An investment fund is a legal entity created to pool money from multiple investors, who are often referred to as limited partners. Each investor purchases an interest in the fund entity, and the adviser uses that money to make investments on behalf of the fund. Investment funds can be structured in various ways, including as limited partnerships (LPs) or limited liability companies (LLCs). In the United States, most investment funds are regulated by the Securities and Exchange Commission (SEC) and must be registered under the Investment Company Act of 1940. However, private investment funds are not considered investment companies and are therefore not subject to the same registration requirements.

What You'll Learn

- Investment funds are not considered corporations

- Investment funds are limited partnerships or LLCs

- Investment funds are regulated by the Securities Act of 1933

- Investment funds are exempt from registration under the Investment Company Act of 1940

- Investment funds require an LEI to report on trade and transactions

Investment funds are not considered corporations

The distinction is important because it affects the taxation of the fund and its investors. By structuring the fund as an LP or LLC, double taxation is avoided. If the fund were structured as a corporation, there would be taxation at both the corporate level and the individual investor level.

Additionally, certain private investment funds are not considered investment companies under federal securities laws and are therefore exempt from registration requirements. These include private investment funds with no more than 100 investors and private investment funds whose investors each have a substantial amount of investment assets.

It is worth noting that investment companies, as broader entities that include investment funds, are regulated by the Securities Act of 1933 and the Investment Company Act of 1940. They must also adhere to the Securities Exchange Act of 1934. These laws set forth various registration, disclosure, and reporting requirements for investment companies.

In summary, investment funds are not considered corporations due to their specific structure as limited partnerships or limited liability companies. This structure has tax advantages and allows for certain exemptions from registration requirements under federal securities laws. However, they operate within the broader context of investment companies, which are subject to specific regulations and requirements.

Invest Wisely: Kotak Select Focus Fund Guide

You may want to see also

Investment funds are limited partnerships or LLCs

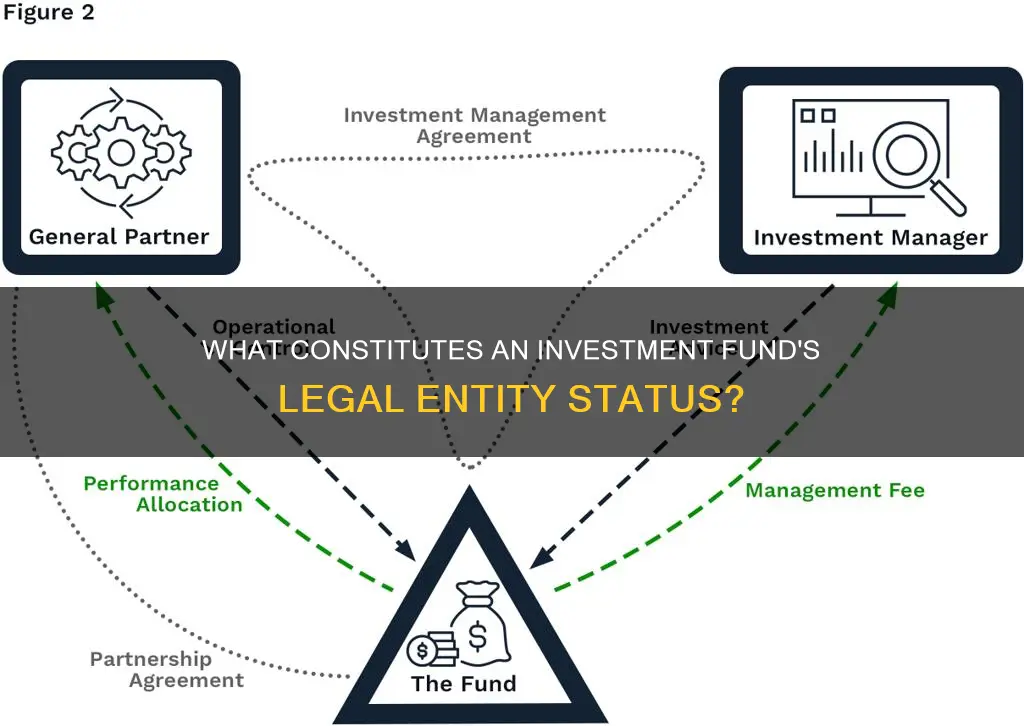

Private investment funds are not structured as corporations. Instead, they are structured as limited partnerships (LPs) or limited liability companies (LLCs). This is because these entities can be taxed as partnerships, allowing them to avoid the double taxation of investors and the corporation itself, which is associated with traditional corporate forms.

A limited partnership is a business entity that requires at least one general partner and one or more limited partners. The general partner has unlimited financial liability and full management control of the business, while the limited partners have liability only up to the amount of their investment and little to no involvement in management. Limited partners are often referred to as "silent partners" or "passive investors" due to their hands-off role.

Limited liability companies, on the other hand, can have as many members as desired, and all members typically have the right to manage the business. LLCs also offer corporation-like protection, where members are generally not held directly liable for the company's debts.

Both limited partnerships and limited liability companies are pass-through tax entities, meaning that each investor is responsible for reporting their share of the entity's profits on their personal tax returns.

In some states, such as Delaware and Florida, investment funds can also register as a limited liability limited partnership (LLLP). Separate entities may be required for related domestic and offshore funds, as well as for the associated management company.

Strategies to Invest Alongside Warren Buffett

You may want to see also

Investment funds are regulated by the Securities Act of 1933

Investment funds are a type of investment company, which is a corporation or trust that pools investors' capital to invest in financial securities. In the US, most investment companies are regulated by the Securities and Exchange Commission (SEC) under the Investment Company Act of 1940. However, they are also subject to the Securities Act of 1933.

The Securities Act of 1933, also known as the 1933 Act, the Securities Act, the Truth in Securities Act, the Federal Securities Act, and the '33 Act, was enacted by the US Congress on 27 May 1933, during the Great Depression and after the 1929 stock market crash. It is an integral part of US securities regulation and was the first major federal legislation to regulate the offer and sale of securities.

The 1933 Act has two main goals: to ensure transparency in financial statements so investors can make informed decisions, and to establish laws against misrepresentation and fraudulent activities in the securities markets. The Act requires companies selling securities to the public to disclose certain information, such as their assets, financial health, executives, and a description of the security being sold. This information must be provided in the form of a prospectus and registration statement, which are made available on the SEC website.

The 1933 Act is based on a philosophy of disclosure, meaning that its goal is to require issuers to fully disclose all material information that a reasonable shareholder would need to make an investment decision. This is in contrast to state blue sky laws, which impose merit reviews and often prevent companies from doing registered offerings in a particular state if they do not meet certain qualitative requirements.

While the 1933 Act applies to most securities offerings, some are exempt, including:

- Intrastate offerings

- Offerings of limited size

- Securities issued by municipal, state, and federal governments

- Private offerings to a limited number of persons or institutions

The 1933 Act is now one of many laws that control securities offerings in the US, but it remains an important piece of legislation that helps to protect investors and maintain their confidence in the stock market.

A Guide to Investing in Birla Sunlife Mutual Funds

You may want to see also

Investment funds are exempt from registration under the Investment Company Act of 1940

Investment funds are a type of investment company, which can be structured as a corporation, trust, limited partnership (LP), or limited liability company (LLC). In the US, most investment funds are subject to the Investment Company Act of 1940, which is enforced and regulated by the Securities and Exchange Commission (SEC). The Act sets standards for the investment fund industry and aims to protect investors by ensuring they are aware of the risks associated with buying and owning securities.

While the Act applies to all investment companies, several types of investment funds are exempt from its coverage. These exemptions are outlined in Sections 3(c)(1) and 3(c)(7) of the Act and include hedge funds, private equity funds, and venture capital funds. Private investment funds that only accept money from investors with substantial assets (accredited investors) are also exempt from registration under the Act.

The Investment Company Act of 1940 was established to protect investors and stabilise the financial markets following the 1929 Wall Street Crash and the subsequent Great Depression. The Act requires investment companies to disclose material details about their financial health, conflicts of interest, and investment objectives. It also places restrictions on certain activities, such as short-selling shares.

By understanding and complying with the Investment Company Act of 1940, investment funds can ensure they are operating within the regulatory framework and providing transparent and secure investment opportunities to their investors.

Hedge Fund Redemption: A Complex Investment Exit Strategy

You may want to see also

Investment funds require an LEI to report on trade and transactions

An investment fund is a business entity that can be privately or publicly owned. They are often set up as limited partnerships (LPs) or limited liability companies (LLCs) to avoid double taxation. Investment funds are not always structured as corporations.

Investment funds that operate within the financial system and carry out financial transactions are considered legal entities. As such, they require a Legal Entity Identifier (LEI) to report on trade and transactions. An LEI is a 20-character, alphanumeric code that is used to identify legal entities and provide key information for financial transactions. It is based on the ISO 17442 standard developed by the International Organization for Standardization (ISO).

The LEI system enhances transparency in the global marketplace by providing publicly available data on legal entities. This data includes the entity's legal name, jurisdiction, registration information, ownership structure, and contact details. Obtaining an LEI is mandatory for entities wishing to participate in certain financial markets, such as the European financial market, and it is required for regulatory reporting under financial regulations.

By having an LEI, investment funds can fulfil their reporting obligations and ensure compliance with financial regulations. The LEI also enables efficient client onboarding and enhances trust and transparency between legal entities globally. It is worth noting that natural persons or private individuals are not required or allowed to obtain an LEI.

Selecting the Right Investment Fund for Your HSA

You may want to see also

Frequently asked questions

An investment fund is an entity created to pool money from multiple investors, who are often referred to as limited partners. The fund then invests this money in financial securities.

An investment fund is typically structured as a limited partnership (LP) or a limited liability company (LLC). In some states, it can also be registered as a limited liability limited partnership (LLLP).

Yes, an investment fund is a separate legal entity. Funds are treated as legal entities under certain regulations, such as the Alternative Investment Fund Managers Directive (AIFM) and the US Dodd-Frank Act Title IV.

Investment funds are primarily regulated by the Investment Company Act of 1940. They are also subject to the Securities Act of 1933 and the Securities Exchange Act of 1934. Private investment funds are not required to register or be regulated as investment companies under federal securities laws.