Buying a gun can be a controversial investment. While some sources suggest that guns can be a good investment, others argue that there is no guarantee that their value will increase. It is important to understand the risks and rewards before investing in firearms.

Demand for guns in the United States is high, and prices for assault rifles and ammunition have risen steadily. Share prices for firearm manufacturers have also increased. Well-maintained, high-quality guns rarely depreciate. However, investing in guns that are currently in high demand may not be a good idea, as it is similar to buying high in the stock market.

Some advantages of investing in guns include the high demand and the fact that they hold their value if well-maintained. Additionally, certain types of weapons, such as English shotguns by makers like London-based Holland & Holland, have been known to increase in value over time.

On the other hand, there is no guarantee that gun values will continue to increase. Price spikes, such as those caused by speculation and potential changes in legislation, tend to be temporary. Other disadvantages include the lack of tax advantages associated with traditional investment vehicles and the cost of proper storage.

Ultimately, the decision to invest in guns depends on various factors, including personal comfort, knowledge of federal gun laws, and patience.

| Characteristics | Values |

|---|---|

| Pros | Plenty of demand |

| They hold their value | |

| Some weapons are a solid bet | |

| Cons | There's no guarantee values will increase |

| Traditional investment vehicles can offer tax deductions | |

| You've got to spend more for proper, safe and secure storage | |

| If the law is changed so that no new guns can be made, but those remaining in circulation are legal, prices will go up. But if a gun you own is entirely outlawed, its legal resale value may drop. |

What You'll Learn

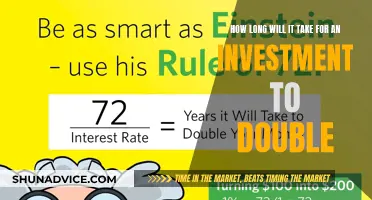

Guns can be a good investment if you buy low and sell high

High Demand and Steady Price Increases

Americans tend to purchase firearms after mass shootings due to concerns about personal defence and potential restrictions on gun sales. This increased demand has led to steady price increases for assault rifles and ammunition. As a result, investing in gun manufacturers like Smith & Wesson Holding Corp. (SWHC) and Sturm Ruger & Co. (RGR) can be lucrative.

Value Retention of High-Quality Guns

Well-maintained, high-quality guns rarely depreciate and can hold their value over time. Antique, unique, or collectible guns, when properly cared for, are unlikely to lose value, making them a stable investment option.

Impact of Legislative Changes

Legislative changes and the potential outlawing of certain types of firearms can significantly impact gun prices. For example, when a ban on assault weapons was enacted in 1994, demand spiked before the ban, leading to substantial price increases. If specific guns are entirely outlawed, their resale value may drop, but if existing weapons are allowed to remain in circulation, their value can increase due to reduced supply.

Collectible Guns

Collectible guns can be a solid long-term investment strategy. Collectors seek old guns made by famous manufacturers that are in like-new condition and have the original box. The history of the gun and its previous owners can also significantly boost its value. For example, a gun previously owned by a famous person or with an interesting backstory can command a much higher price at auction.

Gun Stocks and Ammunition Companies

If you're interested in investing in the gun industry without directly purchasing physical firearms, consider investing in gun stocks. Smith & Wesson Holding Corp. (SWHC) and Sturm, Ruger & Co. (RGR) are publicly traded firearm companies. Additionally, investing in ammunition companies can be a solid strategy due to the consistent high demand for ammunition.

In conclusion, buying and selling guns can be a good investment strategy if you time your purchases right and have a good understanding of the market. However, it's important to remember that investing in guns comes with certain risks and considerations, such as safe storage requirements and the potential impact of legislative changes on gun values.

The S&P 500: A Retirement Investment Strategy for States

You may want to see also

Guns can be collectible and profitable

During the recession, wealthy investors rediscovered high-end collectible guns as an investment opportunity. Guns tend to hold their value, especially if they are well-maintained. For example, a 12-gauge Purdey sold for $52,800, far exceeding its estimated value of $24,000 to $32,000. A pistol that gangster John Dillinger carried in his sock was auctioned for $95,600, more than twice its original estimate.

However, there is no guarantee that gun values will increase. For example, when Congress enacted a ban on the manufacture of assault weapons for civilian use in 1994, demand spiked, and prices rose by hundreds of dollars. But this price spike was temporary, as the supply eventually caught up with the demand.

If you are interested in investing in collectible guns, it is important to do your research and educate yourself about the market. Look for old guns made by famous manufacturers that are in like-new condition and come with the original box. Be prepared to be patient, as investing in collectible guns can take decades to pay off.

Student Debt vs. Stock Market: Where Should Your Money Go?

You may want to see also

Gun stocks are a way to invest in firearms without owning them

Guns can be a profitable investment, but they are also controversial. If you want to invest in the firearms industry without directly purchasing a gun, you can consider investing in gun stocks. Here are some reasons why gun stocks may be a good investment option:

Market Demand

The demand for guns in the United States is high and has been increasing. In 2015, the FBI conducted a record-high 23.1 million firearm background checks, indicating a surge in gun purchases. This demand has resulted in rising prices for assault rifles and ammunition. As a result, share prices for firearm manufacturers, such as Smith & Wesson Holding Corp. (SWHC) and Sturm Ruger & Co. (RGR), have also climbed.

Value Retention

High-quality, well-maintained guns rarely depreciate in value. Antique, unique, or collectible guns can hold their value over time, especially if they are in good condition and have a notable history or previous owner.

Investment Options

There are two publicly traded firearm companies: Smith & Wesson Holding Corp. (SWHC) and Sturm, Ruger & Co. (RGR). These companies have benefited from the increased demand for firearms and have seen their share prices rise. Additionally, you can invest in ammunition companies, such as Ammo Inc. (POWW), which offer a diverse range of ammunition for civilian and law enforcement markets.

Diversification

While investing in gun stocks can be lucrative, it's important to consider the potential risks and volatility associated with the industry. Gun stocks tend to be highly political, and their performance can be influenced by regulatory changes and election outcomes. To mitigate these risks, consider diversifying your investments by including companies that offer outdoor sports and recreation equipment, such as Vista Outdoor Inc. (VSTO), which owns firearm brands like Savage Arms and Federal Premium Ammunition.

Ethical Considerations

It's important to consider the ethical implications of investing in the firearms industry. Some investors may have concerns about the association between guns and violence. Gun stocks are generally not considered ESG-friendly investments. Conduct thorough due diligence on the companies you're considering to ensure their practices and policies align with your values.

The Damaging Effects of Inflation and Taxes on Investment Value

You may want to see also

Gun values can increase depending on their history

While buying a gun can be a controversial topic, it can be a good investment. High-quality, well-maintained guns rarely depreciate. However, it is important to note that the value of a gun can be affected by various factors, including political and economic conditions, as well as supply and demand.

The age of a gun plays a crucial role in its value. Generally, new factory-produced firearms depreciate by about 15% when initially purchased. After this initial drop, their value remains relatively stable for the next 15 years, losing only an additional 1% annually. At the 15-year mark, a gun's value may either retain its current value, decrease due to factory recalls or lack of maintenance, or begin to appreciate. If a gun is well-maintained and reaches the 50-year milestone, its value can start to increase, and proper care will pay off when it comes time to sell.

Custom-made firearms, limited editions, or those with specialty features are more likely to hold their value or appreciate over time. Their uniqueness and limited availability make them more valuable to potential buyers. On the other hand, common mass-produced firearms may not hold their value as well due to their widespread availability and lower demand.

The condition of a gun is another critical factor in determining its value. A gun that is well-maintained, free from scratches, dents, rust, or other signs of neglect will command a higher price. Proper care and maintenance are essential to preserving the value of your investment.

When considering investing in guns, it is important to remember that there are risks involved. While guns can hold their value or appreciate over time, there is no guarantee that their values will increase. Additionally, investing in guns does not offer the same tax advantages as traditional investment vehicles like an IRA or 401(k). Furthermore, it is crucial to prioritize safe and secure storage, which can incur additional costs.

Mortgage Freedom or Investment Gains: Where Should Your Money Go?

You may want to see also

Guns can be a safer investment than gold

Demand for guns in the United States is at or near record levels. The FBI conducted a record-high 23.1 million firearm background checks in 2015, indicating that 2015 was a record-breaking year for actual gun purchases. Americans tend to buy firearms in the wake of mass shootings, both for their own defence and out of concern that such incidents may lead the government to restrict gun sales in the future.

Amid growing demand, prices for assault rifles and ammunition have risen steadily. In the recent surge, share prices for listed firearm manufacturers like Smith & Wesson Holding Corp. (SWHC) and Sturm Ruger & Co. (RGR) have also climbed. During the recession, wealthy investors also began to rediscover high-end collectible guns as a place to put their money.

Well-maintained, high-quality guns rarely depreciate. If you are looking to invest in guns for the long term, then collectible is the way to go. Different collectors look for different things in firearms, but history is the most desired trait. A gun from a popular maker that is in pristine condition (preferably never been shot) and has a history will command the most money.

However, nothing is certain when it comes to investing in guns. In recent years, there has been a lot of talk about tightening gun laws and even banning certain guns altogether. Since you can't predict the future, investing in guns can be a gamble. If a gun you own is entirely outlawed, its legal resale value may drop.

Who Invests in Precious Metals?

You may want to see also