Municipal bonds, or munis, are debt securities issued by states, cities, counties, and other governmental entities to fund day-to-day operations and capital projects such as building schools, highways, or sewer systems. By purchasing municipal bonds, investors are essentially lending money to the bond issuer in exchange for regular interest payments and the return of the original investment. Municipal bonds are often considered a form of investment rather than savings due to their potential for capital appreciation, interest income, and tax advantages.

| Characteristics | Values |

|---|---|

| Tax advantages | Exempt from federal taxes, and some are tax-free at the state and local levels |

| Risk | Low-risk investment with a much lower rate of default than corporate bonds |

| Interest rate | Often quite a bit lower than rates offered on corporate bonds |

| Socially responsible investment | The money raised is used to build infrastructure in your area |

| Type | General obligation bonds and revenue bonds |

| Diversification | Often used alongside Treasurys, corporate bonds and other fixed-income securities |

| Safety | Considered a relatively safe fixed-income investment |

What You'll Learn

- Muni bonds are exempt from federal taxes and have a low risk of default

- They are a good way to preserve capital while generating interest

- They are relatively illiquid and opaque compared to other financial markets

- They are a good investment for people with high incomes

- They are a good way to minimise state and federal tax liability

Muni bonds are exempt from federal taxes and have a low risk of default

Municipal bonds, or "munis", are a distinct asset class that offers investors a way to generate tax-free income. They are often considered a good investment option for people with high incomes, as they are exempt from federal taxes and sometimes from state and local taxes as well.

The interest on municipal bonds is usually exempt from federal income tax. This means that investors can preserve their capital while generating interest, making munis an appealing option in an environment of rising taxes. Additionally, if an investor lives in the same state where the bond is issued, the muni will often be exempt from state and local taxes too. This primarily benefits investors in a higher tax bracket, as the tax exemption enhances the bond's return.

The tax advantages of muni bonds depend on where you live and how much you earn. Some US states have no income tax, so exemption from state taxes may not be advantageous. On the other hand, residents of states with high income taxes, such as California, can benefit significantly from the tax exemptions that municipal bonds offer.

Municipal bonds also have a low risk of default. According to Moody's, the annual municipal bond default rate was about 0.03% between 2009 and 2014, compared to a long-run corporate bond default rate of about 2.5% per year. The low default rate is because municipalities can usually raise taxes if necessary to cover their debt obligations.

However, it's important to note that not all muni bonds are equally safe. Health care, private higher education, and project finance are areas where issuers may be in less good financial health. Additionally, revenue bonds can be "non-recourse", meaning that investors bear the risk if project revenues don't meet expectations.

Overall, municipal bonds are a relatively safe, low-risk investment option that can provide tax advantages, particularly for high-income individuals.

Young Investors: Where to Begin?

You may want to see also

They are a good way to preserve capital while generating interest

Municipal bonds, or "munis", are a good way to preserve capital while generating interest. They are often exempt from federal taxes, and sometimes from state and local taxes too, depending on the state where the bond is issued. This makes them particularly attractive to investors in high tax brackets, as the tax exemption enhances the bond's return.

The interest rate for tax-exempt municipal bonds is usually lower than on taxable fixed-income securities, such as corporate bonds, with similar maturities, credit qualities and other items. However, the tax benefits of municipal bonds can make up for this lower interest rate, and investors can use the tax-equivalent-yield formula to compare the real return on a muni bond with a corporate bond.

Municipal bonds are also considered a relatively safe investment, with a very low rate of default. General obligation bonds, which are issued by states, cities or counties and backed by the "full faith and credit" of the issuer, are considered safer than revenue bonds, which are backed by revenues from a specific project or source.

Municipal bonds can be purchased as stand-alone investments or bundles through an online broker, or through robo-advisors, mutual funds or exchange-traded funds (ETFs).

Investments with Fortnightly Dividends

You may want to see also

They are relatively illiquid and opaque compared to other financial markets

Municipal bonds, or "munis", are debt instruments issued by states, cities, counties, and other government entities to raise funds for public projects such as roads, bridges, and schools. They are often considered a conservative investment option due to their strong credit fundamentals and the opportunity to earn tax-exempt income. However, compared to other financial markets, the municipal bond market has been criticized for its lack of liquidity and transparency.

The municipal bond market is characterized by a large number of unique bond issuances, which can impede trading in the secondary market as investors may struggle to find willing counterparties for their bespoke bonds. Trading in this market occurs in a decentralized, over-the-counter dealer market, rather than on exchanges, further hindering pre-trade price transparency. Investors must buy or sell exclusively through dealers, who have access to inter-dealer brokers and electronic platforms that give them a significant informational advantage. This lack of transparency has led to excessive trading costs for individual investors, who often pay higher prices and markups compared to institutional investors and dealers.

The municipal bond market also exhibits lower liquidity compared to other financial markets. Trading activity drops significantly after the initial distribution period, with a third of municipal bonds trading only once after issuance and 5% trading once every twelve years. The lack of liquidity leads to higher costs for issuers, who must compensate investors for the associated risks. It also makes it difficult for investors to trade municipal bonds and can result in steep losses during periods of market stress, such as interest rate hikes.

To address these issues, regulatory bodies like the Securities and Exchange Commission (SEC) and the Municipal Securities Rulemaking Board (MSRB) have implemented measures to improve transparency and liquidity in the municipal bond market. For example, the MSRB introduced the Electronic Municipal Market Access (EMMA) system, which provides investors with free and instant access to key information about municipal bonds. Additionally, the MSRB and the SEC have proposed rules to enhance price transparency, such as requiring dealers to disclose pricing reference information on retail customer confirmations.

The Workforce Investment Act: Unlocking Tuition Support for Career Seekers

You may want to see also

They are a good investment for people with high incomes

Municipal bonds, or "munis", are a good investment for people with high incomes. This is because they are exempt from federal taxes, and sometimes state and local taxes, too. This tax exemption is more beneficial for those in a higher tax bracket, as it enhances the bond's return.

The tax-free status of municipal bonds means that the interest rate is usually lower than that of corporate bonds. However, when you factor in the tax impact, a completely tax-free municipal bond will usually present a more profitable opportunity.

The tax advantages of muni bonds depend on where you live and how much you make. In US states with no income tax, exemption from state taxes offers no advantage. However, residents of states with high income taxes, such as California, benefit more from the tax exemptions of municipal bonds.

Municipal bonds are also a relatively safe investment. The default rate is very low compared to corporate bonds. Between 2009 and 2014, the annual municipal bond default rate was about 0.03%, while the corporate bond default rate is about 2.5% per year.

Municipal bonds are also a good way to preserve capital while generating interest. They are a low-risk investment, making them a good option for those with high incomes who want to balance out the risks of higher-risk investments.

The Equipment Conundrum: Is Buying Gear Really an Investment?

You may want to see also

They are a good way to minimise state and federal tax liability

Municipal bonds, or "munis", are a great way to minimise state and federal tax liability. They are a type of debt security issued by states, cities, counties, and other government entities to fund day-to-day operations and finance capital projects such as building schools, highways, or sewer systems. By purchasing municipal bonds, investors are essentially lending money to the bond issuer in exchange for regular interest payments and the return of the original investment.

One of the biggest advantages of municipal bonds is their tax-exempt status. The interest on most municipal bonds is exempt from federal income tax, and if the investor lives in the same state where the bond is issued, it may also be exempt from state and local taxes. This tax exemption enhances the bond's return, making it particularly attractive to investors in higher tax brackets.

To compare the return on a municipal bond with that of a taxable bond, investors can use the tax-equivalent yield (TEY) formula:

TEY = Tax-Free Yield / (1 – Tax Rate)

For example, if an investor in the 35% tax bracket buys a tax-free municipal bond with a 4% yield, the calculation would be 4 / (1 - 0.35), resulting in a TEY of 6.15%. This means that to be comparable, a taxable bond would need to yield 6.15%.

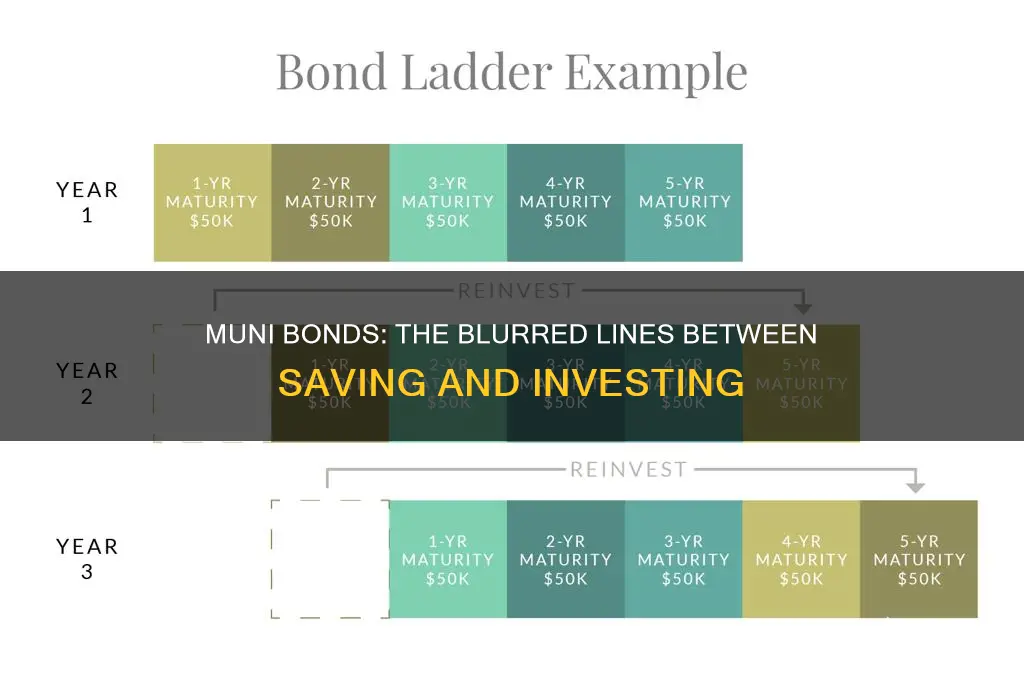

Municipal bonds are also a good diversification strategy. They are generally considered a low-risk investment due to their relatively low default rates and the ability of municipalities to raise taxes to cover debt obligations. Investors often use municipal bonds alongside other fixed-income securities like Treasurys and corporate bonds to balance their portfolios, as municipal bonds carry slightly more risk but offer higher returns than Treasurys, and are less risky with lower yields than corporate bonds.

Additionally, municipal bonds are a socially responsible investment, as the projects they finance often aim to benefit the community. For these reasons, municipal bonds are an excellent option for investors looking to minimise their state and federal tax liability while also generating a steady income stream.

Retirement Investments: Living Off Profits

You may want to see also

Frequently asked questions

Municipal bonds, or "munis", are debt securities issued by states, cities, counties, and other governmental entities to fund day-to-day operations and public projects such as roads, bridges, fire departments, libraries, and schools.

Municipal bonds offer a source of tax-free income, diversification, and resilience in shifting market conditions. They are also considered a relatively safe investment with a low default rate.

Municipal bonds carry interest rate risk, inflation risk, liquidity risk, and credit risk. The demand for municipal bonds can also be unpredictable, making it tricky to enter the market.

Municipal bonds can be purchased as stand-alone investments or bundles through an online broker or robo-advisor. Investors can also buy mutual funds or exchange-traded funds (ETFs) that invest in municipal bonds.

The two most common types of municipal bonds are general obligation bonds and revenue bonds. General obligation bonds are backed by the "full faith and credit" of the issuer, which has the power to tax residents to pay bondholders. Revenue bonds are backed by revenues from a specific project or source, such as highway tolls or lease fees.