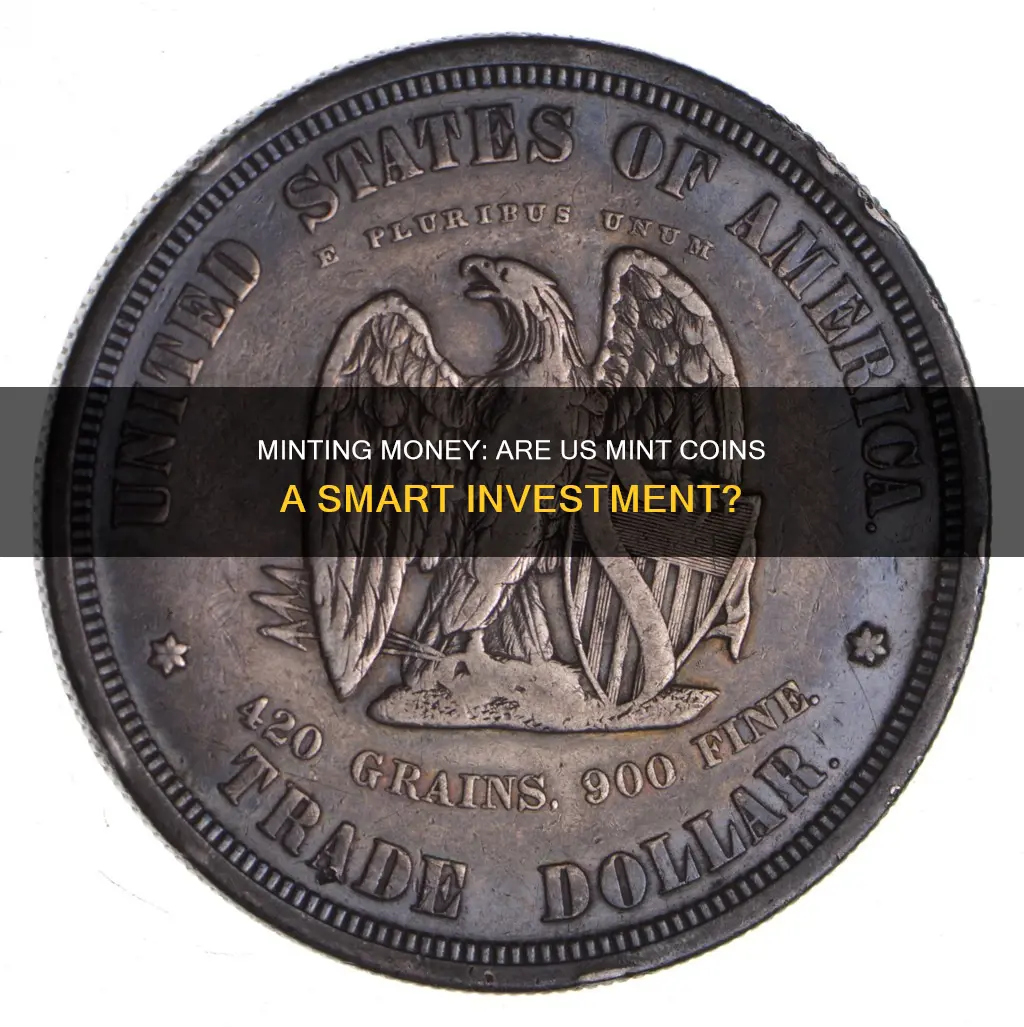

US Mint coins have been in production for over two centuries, providing ample time for the creation of rare, collectible coins. The value of a coin is derived from its bullion value and its collector or numismatic value. The bullion value is calculated based on the weight and fineness of the precious metal contained in the coin. The numismatic value is determined by factors such as rarity, demand, historical significance, and metal content. US Mint coins are known for their aesthetic appeal, with the Eagle design in gold being the most popular coin in the world. The US Mint also produces commemorative coinage that transcends their intrinsic metal value. When considering investing in US Mint coins, it is important to evaluate factors such as preservation quality and grading errors, especially for older coins. Additionally, understanding market trends and performing thorough research can help maximize the potential for profitable investments.

| Characteristics | Values |

|---|---|

| Historical Performance | US Mint coin investments have a long history dating back to 1792 when Congress established the first federal building for minting in Philadelphia. |

| Rarity | Rare coins are more valuable and desirable to collectors and investors. |

| Demand | The demand for US Mint coins is influenced by factors such as economic trends and collector sentiment. |

| Metal Content | The value of a coin is influenced by the type and amount of metal it contains. |

| Historical Significance | Commemorative coins that mark historical events or locations are more valuable and desirable. |

| Grading | The condition of a coin is an important factor in its value, with uncirculated or top-grade coins being the most valuable. |

| Reputation | The US Mint has a reputation for producing high-quality, aesthetically pleasing coins, which can increase their investment value. |

| Price | US Mint coins may be more expensive than other options due to their reputation and aesthetics. |

| Aesthetics | The design of a coin, such as the Eagle design, can increase its popularity and investment value. |

| Limited Edition | Limited edition coins may be more valuable due to their rarity and collector appeal. |

What You'll Learn

US Mint coins' historical performance as an investment

US Mint coins have been around since 1792, providing a long history of performance as an investment. The US Mint has produced a variety of coins, from the original gold and silver coinage to commemorative medals and coins for other countries like the Philippines.

One of the key factors influencing the value of US Mint coins over time is their rarity. With two centuries of production, the US Mint has released many rare coins that are highly sought after by collectors and investors. For example, the 1907 Double-Eagle is highly valuable due to its scarcity and historical significance. The demand for rare coins can be influenced by factors such as economic trends and collector sentiment.

The historical performance of US Mint coin investments is also linked to geo-economic shifts that impact the scarcity of certain coins and their collectability among numismatists. For instance, the establishment of branches in gold-rich regions like Charlotte and Dahlonega, as well as San Francisco during the Gold Rush, led to the production of gold coins that are now valuable to collectors.

The investment potential of US Mint coins is also influenced by factors such as historical significance, metal content, and demand. Numismatic enthusiasts often value certain coins due to their limited supply or unique features. While the precious metals in a coin contribute to its intrinsic worth, collector interest can drive its market price significantly beyond its face value or metal value.

In recent times, even during the pandemic and periods of high inflation, there has been significant growth in coin sales and values. For example, a 1933 Double Eagle gold coin sold for $18.9 million at Sotheby's.

US Mint bullion coins, such as the American Eagle series, are also popular investments. These coins are valued based on the prevailing market price of the metal (gold, silver, platinum, or palladium) plus a small premium for minting and distribution costs.

Overall, US Mint coins have a long history as investments, with their value influenced by factors such as rarity, historical significance, metal content, and collector demand.

Grayscale Bitcoin Trust: What's the Investment Focus?

You may want to see also

Bullion vs numismatic coins

Bullion and numismatic coins are valued differently and for different reasons. Bullion coins are minted using refined precious metals such as silver, gold, platinum, and palladium. The value of bullion is based solely on the weight and fineness of the metal. Bullion coins are often available for much less than numismatic coins and are acquired for their precious metal content.

Numismatic coins, on the other hand, are sought for their rarity and limited supply. They are typically no longer in production and have acquired their status as collectibles after being phased out. The value of numismatic coins is derived from factors such as rarity, historical context, importance, condition, and demand. Numismatic coins often have a huge premium that far exceeds their inherent value.

When deciding between investing in bullion or numismatic coins, it is important to consider your goals. Bullion coins offer a more stable investment as they will always have value due to their gold or silver content. Numismatic coins, however, carry a larger risk due to their reliance on the volatile collectible market. Nonetheless, numismatic coins can be a good investment if you are willing to take on the risk and are knowledgeable about the factors that drive their value.

Ultimately, the decision to invest in bullion or numismatic coins depends on your personal preferences and investment goals. Both options have their advantages and can be a good choice under the right circumstances. Conducting thorough research and due diligence is essential before making any investment decisions.

Bitcoin vs Cardano: Which Crypto is the Better Investment?

You may want to see also

Factors influencing the investment potential of US Mint coins

When considering whether to invest in US Mint coins, several factors come into play. The first rule of investing in coins is that their value is largely driven by their rarity. The US Mint has been producing coins for over two centuries, resulting in a wide variety of rare numismatic coins that are highly sought after by collectors and investors. The historical significance of these coins, such as the 1907 Double-Eagle, can greatly increase their value.

Another factor influencing the investment potential of US Mint coins is their metal content. Precious metals like gold and silver contribute to a coin's intrinsic worth, but the collector interest can significantly amplify its market price beyond the metal prices alone. For example, silver dollars have been considered excellent investments since the establishment of the US Mint in 1791.

The condition and preservation quality of the coins are also important factors. Buyers who value coins for their numismatic appeal tend to pay higher prices for coins that are in uncirculated or mint condition, with minimal wear and tear, and retain their original luster.

The reputation and aesthetics of the US Mint coins also play a role in their investment potential. The Eagle design, especially in gold, is considered the most popular coin in the world, followed by the 1 oz Gold Buffalo design. The US Mint's long-standing reputation and the aesthetic appeal of its coins attract investors and collectors alike.

Additionally, the US Mint produces commemorative coinage that transcend their intrinsic metal value. These coins often sell for much higher prices than bullion coins due to their historical significance and limited mintage.

Lastly, economic trends and collector sentiment can also influence the investment potential of US Mint coins. In times of economic instability, rare coins are often seen as a safe haven for investment, as evidenced by the significant growth in coin sales and values during the pandemic and periods of high inflation.

Bitcoin vs. Stocks: Where Should You Invest?

You may want to see also

The pros and cons of investing in US Mint coins

Investing in US Mint coins can be a lucrative endeavour, but it is essential to understand the potential benefits and drawbacks. Here is an overview of the pros and cons to help you make informed decisions.

Pros:

- Rarity and Historical Significance: US Mint coins have a long history, with some rare pieces dating back to the early days of American coinage. These rare coins, such as the 1907 Double-Eagle, possess immense value due to their scarcity and historical allure.

- Aesthetic Appeal: The US Mint is renowned for its aesthetically pleasing coin designs, such as the iconic Eagle design in gold, which is considered the most popular coin design globally. This aesthetic appeal enhances the desirability and potential profitability of these coins.

- Reputation and Quality: The US Mint has a strong reputation for producing high-quality coins with reliable purity levels of precious metals. This reputation influences coin values, as investors and collectors are willing to pay a premium for coins backed by a trusted mint.

- Diversification and Safe Haven: Investing in rare coins offers portfolio diversification and can be seen as a safe haven during economic instability. US Mint coins, particularly those with historical significance, have the potential to increase in value over time.

- Precious Metal Content: Many US Mint coins contain precious metals like gold, silver, platinum, and palladium. These metals have intrinsic value and can serve as a store of wealth, providing stability to investors.

Cons:

- Subjective Value and Collector Sentiment: The value of US Mint coins can be highly subjective, influenced by factors such as rarity, demand, and collector sentiment. While some coins may have high numismatic value, others may not be in high demand, making it challenging to predict future collector markets.

- Limited Edition Premiums: Limited edition bullion coins from the US Mint often come with a hefty premium price. While these pieces may have aesthetic and reputation advantages, they do not always offer equivalent resale value.

- Challenges in Grading and Authentication: Properly evaluating the worth of US Mint coins requires an understanding of grading factors such as surface preservation, strike quality, errors, and wear and tear. Ensuring the authenticity and proper grading of these coins can be challenging for inexperienced investors.

- Volatility and Market Trends: The value of US Mint coins, especially those containing precious metals, can be subject to market volatility. It is crucial for investors to stay informed about market trends and the movements of precious metals prices to optimize their investments.

- Lack of Direct Public Sales: The US Mint does not sell bullion coins directly to the public. Investors need to go through authorized distributors or local dealers, which may result in higher prices and additional considerations when buying and selling these coins.

US Mint Coins: Global Bullion Investment Strategy?

You may want to see also

Where to buy US Mint coins

The US Mint is the nation's sole manufacturer of legal tender coinage and is responsible for producing circulating coinage for the nation to conduct its trade and commerce. The US Mint also produces numismatic products, including proof, uncirculated, and commemorative coins; Congressional Gold Medals; and silver and gold bullion coins.

The US Mint website (usmint.gov) provides an easy-to-use interface for different purchases. The website's customer service is friendly and professional to ensure all online and offline purchases are made promptly for collectors and investors.

You can also buy US Mint coins from GovMint.com, where you can rest assured that you are buying authentic United States coinage. They offer free shipping on orders of $149 or more and have a 30-day return policy for all non-bullion items.

Additionally, Global Bullion Suppliers offer free shipping on orders over $250. They can be contacted on 1-800-427-4045.

How to Invest in Bitcoin Using TD Ameritrade

You may want to see also

Frequently asked questions

The value of US Mint coins is determined by their rarity, demand, historical significance, and metal content. The fewer coins minted, the higher their collector value. The condition of the coin is also important, with uncirculated coins being more valuable.

Bullion coins are valued by their weight and the fineness of the specific precious metal they contain. Numismatic or commemorative coins, on the other hand, are valued by limited mintage, rarity, condition, and age.

The Silver Eagle, the 1 oz Gold Buffalo, and the American Eagle Gold and Silver Bullion Coins are all popular choices for investors. The Silver Eagle is a hallmark of the US Mint, and in 2016 alone, 37,701,500 were sold. The Gold Buffalo features the original walking liberty design, which is highly sought after by investors and collectors. The American Eagle Gold and Silver Bullion Coins are distributed through a network of official distributors and are a convenient and cost-effective way to add precious metals to investment portfolios.

US Mint coins can be purchased directly from the US Mint website (usmint.gov) or through local dealers and online markets. The US Mint website offers a user-friendly interface and professional customer service to facilitate purchases for collectors and investors.