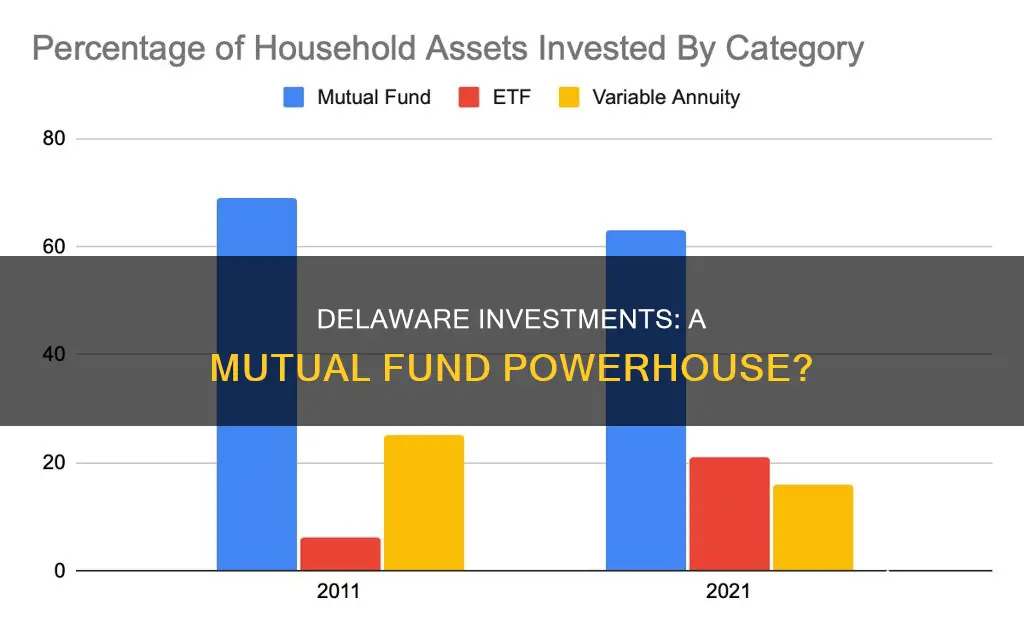

Delaware Investments, now known as Macquarie Investment Management, is a US-based asset management firm that provides mutual funds and institutional investment opportunities. The company was founded in 1929 and introduced its first mutual fund in 1938. Over the years, Delaware Investments expanded its capabilities and services, including the introduction of institutional separate account management in 1972, the establishment of its Taft-Hartley business in 1974, and the launch of its International/Global capabilities in 1990.

In 2010, Delaware Investments was acquired by Macquarie Group, an Australian investment bank, for $452 million. Following the acquisition, the company was rebranded as Macquarie Investment Management in 2017, marking the end of the original entity.

Today, Macquarie Investment Management operates as a wholly-owned subsidiary of Macquarie Group and continues to offer a range of investment products, including mutual funds, under the Delaware Funds by Macquarie brand. The firm has a long-standing presence in the mutual fund industry, with more than 80 years of experience.

Some of the notable Delaware mutual funds include the Delaware Ivy Large Cap Growth Fund, the Delaware Sustainable Equity Income Fund, and the Delaware Floating Rate Fund. These funds aim to provide investors with diversified investment opportunities across different sectors and geographies.

Overall, Delaware Investments, now Macquarie Investment Management, has a long history in the mutual fund industry and offers a range of investment products to its clients.

| Characteristics | Values |

|---|---|

| Type of company | US-based asset management firm |

| Ownership | Wholly owned subsidiary of Macquarie Group, an Australian investment bank |

| Services | Mutual funds and institutional investments |

| History | Commenced business in 1929; introduced its first mutual fund in 1938; rebranded as Macquarie Investment Management in 2017 |

| Acquisition | Macquarie Group acquired Delaware Investments in 2010 for a reported $452 million cash deal |

What You'll Learn

- Macquarie Investment Management (previously Delaware Investments) is a US-based asset management firm that provides mutual funds and institutional investments

- Delaware Investments was acquired by Macquarie Group in 2010 and was rebranded as Macquarie Investment Management in 2017

- Delaware Investments introduced its first mutual fund in 1938 and has been in existence for over 80 years

- Delaware Investments offers a diverse range of products, including securities investment management, infrastructure and real asset management, and fund and equity-based structured products

- Delaware Investments' mutual funds provide a wide range of investment opportunities across the United States, Europe, Asia, and Australia

Macquarie Investment Management (previously Delaware Investments) is a US-based asset management firm that provides mutual funds and institutional investments

Macquarie Investment Management, formerly known as Delaware Investments, is a US-based asset management firm that offers mutual funds and institutional investment services. The company was established in 1929 and introduced its first mutual fund in 1938. Over the years, they expanded their capabilities, including the introduction of institutional separate account management in 1972, the establishment of their Taft-Hartley business in 1974, and the launch of their global capabilities in 1990.

In 2010, Macquarie Group, an Australian investment bank, acquired Delaware Investments for a reported $452 million. This acquisition led to a rebranding in 2017, and the company became known as Macquarie Investment Management.

Macquarie Investment Management has a global presence with offices in the United States, Europe, Asia, and Australia. As active managers, they prioritise autonomy and accountability at the investment team level, always seeking opportunities that benefit their clients. Delaware Funds, one of their notable offerings, has a long history, with over 80 years in existence, making it one of the longest-standing mutual fund families.

The firm provides a diverse range of products and services through its asset management division, Macquarie Asset Management (MAM). This includes securities investment management, infrastructure and real asset management, and fund and equity-based structured products.

Macquarie Investment Management offers a wide range of investment opportunities and has a long-standing reputation in the industry. With their global reach and commitment to their clients' success, they are well-positioned to serve individuals and institutions alike.

Robinhood's S&P 500 Index Fund: A Step-by-Step Investment Guide

You may want to see also

Delaware Investments was acquired by Macquarie Group in 2010 and was rebranded as Macquarie Investment Management in 2017

Delaware Investments, a US-based asset management firm, was acquired by Macquarie Group in 2010 for a reported $452 million cash deal. The firm was then rebranded as Macquarie Investment Management in 2017, ending the original entity.

Macquarie Investment Management is a wholly owned subsidiary of Macquarie Group, an Australian investment bank. The company is a global asset manager with offices in the United States, Europe, Asia, and Australia.

Delaware Investments, which commenced business in 1929, introduced its first mutual fund in 1938. Over the years, the company expanded its capabilities, introducing institutional separate account management in 1972, establishing its Taft-Hartley business in 1974, and launching its International/Global capabilities in 1990.

The acquisition by Macquarie Group in 2010 allowed Delaware Investments to leverage the Group's extensive resources and history of profitability. With Macquarie's support, Delaware Investments, now Macquarie Investment Management, continues to provide a wide range of investment opportunities and asset management services to its clients.

Target Year Fund: Smart IRA Investment Strategy

You may want to see also

Delaware Investments introduced its first mutual fund in 1938 and has been in existence for over 80 years

Delaware Investments, now known as Macquarie Investment Management, introduced its first mutual fund in 1938 and has been in existence for over 80 years. The company commenced business in 1929 and was rebranded as Macquarie Investment Management in 2017.

Macquarie Investment Management is a US-based asset management firm that provides mutual funds and institutional investment services. It is a wholly owned subsidiary of Macquarie Group, an Australian investment bank.

Delaware Investments has a long history of providing investment opportunities and has established itself as one of the longest-standing mutual fund families. The company offers a wide range of investment options across the United States, Europe, Asia, and Australia.

Over the years, Delaware Investments has expanded its capabilities and introduced new services. In 1972, it introduced institutional separate account management, and in 1974, it established its Taft-Hartley business. The company enhanced its fixed-income capabilities in 2000 and launched the Delaware Investments Global Funds plc in 2007.

In 2010, Macquarie Group acquired Delaware Investments for a reported $452 million, and the company became a business unit of Macquarie Group in 2017.

With its long track record, global presence, and commitment to investment innovation, Delaware Investments, now Macquarie Investment Management, has established itself as a trusted name in the mutual fund industry.

Cocolife Fixed Income Fund: A Smart Investment Strategy

You may want to see also

Delaware Investments offers a diverse range of products, including securities investment management, infrastructure and real asset management, and fund and equity-based structured products

Macquarie Investment Management (MAM), a division of the Macquarie Group, offers a diverse range of products and services. MAM's offerings include securities investment management, infrastructure and real asset management, and fund and equity-based structured products.

MAM's securities investment management service offers active management, prioritising autonomy and accountability at the investment team level to pursue opportunities that benefit clients.

MAM's infrastructure and real asset management service covers a wide range of sectors, including but not limited to energy, healthcare, industrials, and information technology.

MAM's fund and equity-based structured products include mutual funds, which have been a part of MAM's offerings since 1938, and institutional investments. MAM has a long history in the mutual fund space, with the Delaware Funds being one of the longest-standing mutual fund families, having existed for over 80 years.

MAM's diverse range of products and services, combined with its global presence and strong track record, make it an attractive choice for investors seeking investment opportunities.

Asia's 1997 Financial Crisis: Why Foreign Investment Poured In

You may want to see also

Delaware Investments' mutual funds provide a wide range of investment opportunities across the United States, Europe, Asia, and Australia

Delaware Investments mutual funds, managed by Macquarie Investment Management, have been in existence since 1969. The funds are known for their independence, global diversification, and commitment to long-term success.

Leveraging Macquarie’s 50-year track record of profitability, Delaware Investments mutual funds provide a wide range of investment opportunities across the United States, Europe, Asia, and Australia. With its conviction-based strategy and support from Macquarie Group's history of profitability, the Delaware mutual fund is an attractive choice for investments.

Delaware Ivy Large Cap Growth Fund (WLGYX)

This fund seeks capital appreciation by investing in a diversified portfolio of common stocks issued by growth-oriented, large to medium-sized US and foreign companies that management believes have appreciation possibilities. WLGYX has a three-year annualized return of 9.6% and a five-year annualized return of 15.8%. Its net expense ratio is 0.95%, which is lower than the category average of 0.99%.

Delaware Sustainable Equity Income Fund (IDAAX)

The Delaware Sustainable Equity Income Fund invests in equity securities of companies that align with its sustainable investment criteria, considering both net assets and any borrowing for investment purposes. IDAAX has a three-year annualized return of 7.2% and a five-year annualized return of 8.9%. Its net expense ratio is 0.74%, lower than the category average of 0.94%.

Delaware Floating Rate Fund (DDFAX)

The Delaware Floating Rate Fund invests most of its assets and any borrowings in floating-rate loans and floating-rate debt securities. DDFAX's advisors assess economic and market conditions to decide how to distribute the fund's assets among various types of securities. This fund has a three-year annualized return of 4.8% and a five-year annualized return of 4.5%. Its net expense ratio is 0.94%, slightly lower than the category average of 1.03%.

Credit Card Mutual Fund Investments: A Smart Guide

You may want to see also

Frequently asked questions

Delaware Investments, now known as Macquarie Investment Management, is a US-based asset management firm that provides mutual funds and institutional investment services. It has been in operation since 1929 and introduced its first mutual fund in 1938.

Some examples of Delaware mutual funds include the Delaware Ivy Large Cap Growth Fund, the Delaware Sustainable Equity Income Fund, and the Delaware Floating Rate Fund.

The top holdings in these funds include Microsoft, Apple, Visa, JPMorgan Chase, Johnson & Johnson, and Hess Corp.

The investment strategy of Delaware mutual funds is focused on long-term capital appreciation. The funds invest in a diversified portfolio of common stocks, fixed-income securities, and floating-rate loans issued by companies that have growth potential or are undervalued.