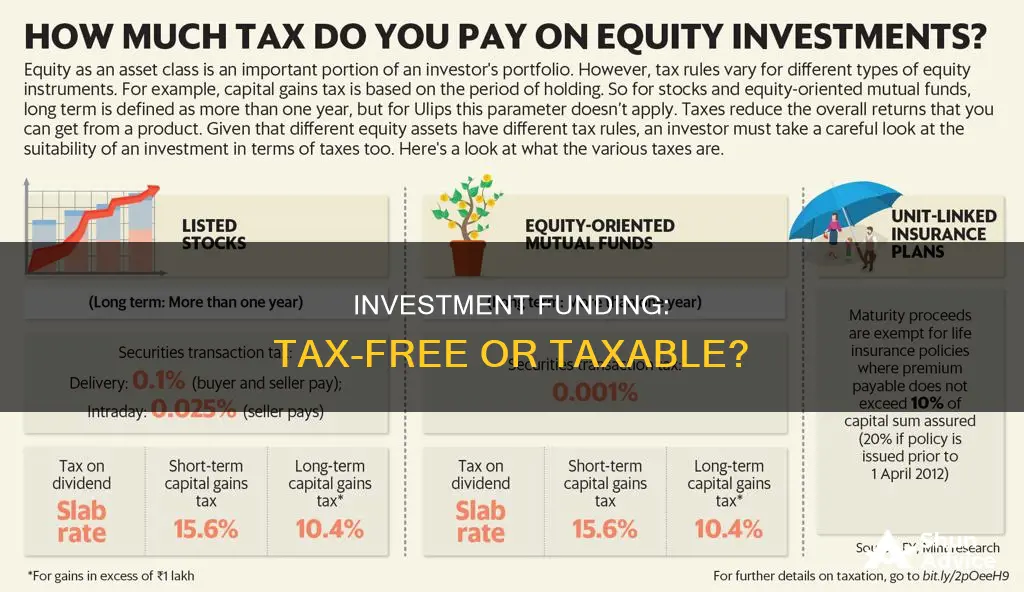

Whether or not investment funding is tax-free depends on the type of investment and a few other factors. The federal government taxes most investment income, including dividends, interest, and rent on real estate, as well as realised capital gains. However, there are some tax-free and tax-efficient investment options available.

For example, contributions to a Roth IRA (individual retirement account) are made with after-tax dollars and allow for tax-free withdrawals in retirement. Similarly, investors do not have to pay federal taxes on municipal bonds, health savings accounts (HSAs), or life insurance policies with a cash value. Treasury bonds issued by US states and municipalities are also usually exempt from federal income tax.

Additionally, tax-deferred investments such as 401(k) retirement plans allow earnings to be taxed only when money is withdrawn. In the case of traditional 401(k) plans, this means that contributions are made pre-tax, reducing current adjusted gross income, while withdrawals in retirement are taxed as regular income. Conversely, Roth 401(k) plans allow investors to contribute after-tax dollars, meaning that qualified withdrawals are then tax-free.

| Characteristics | Values |

|---|---|

| Tax on capital gains | The rate you pay depends on how long you held the asset before selling. The tax rate on capital gains for most assets held for more than a year is 0%, 15% or 20%. Capital gains taxes on most assets held for less than a year correspond to ordinary income tax rates. |

| Tax on dividends | Nonqualified dividends are taxed at the same rate as your regular income tax bracket. Qualified dividends are usually taxed at 0%, 15% or 20%, depending on your taxable income and filing status. |

| Taxes on investments in a 401(k) | Generally, you don’t pay taxes on money you put into a traditional 401(k), and while the money is in the account you pay no taxes on investment gains, interest or dividends. Taxes hit only when you make a withdrawal. With a Roth 401(k), you pay the taxes upfront, but then your qualified distributions in retirement are not taxable. |

| Tax on mutual funds | Mutual fund taxes typically include taxes on dividends and capital gains while you own the fund shares, as well as capital gains taxes when you sell the fund shares. |

| Tax on the sale of a house | If you sell your home for a profit, some of the gain could be taxable. The IRS typically allows you to exclude up to $250,000 of capital gains on your primary residence if you’re single and $500,000 if you’re married and filing jointly. |

| Tax on interest income | Interest income from investments is usually treated like ordinary income for federal tax purposes. |

| Tax on municipal bonds | Interest earnings from municipal bonds are tax-free at the federal level. They can also be tax-free at the state and local government level, depending on the bond, where it is issued and where it was bought. |

What You'll Learn

Capital gains tax

Long-term vs. Short-term Capital Gains

Capital gains are classified as either long-term or short-term, depending on how long the asset was held for before it was sold. If an asset is held for more than one year before being sold, any profit made is usually subject to a lower rate of tax (0%, 15%, or 20%) than an asset held for one year or less, which is subject to regular income tax rates (10-37%).

Capital Losses

If an asset is sold for less than its original value, this is known as a capital loss. Capital losses can be used to offset capital gains, reducing the amount of tax owed. If capital losses exceed capital gains, individuals may be able to deduct up to $3,000 of net capital losses against other taxable income. Any remaining capital losses can be carried forward to future years to offset future capital gains.

Exceptions

There are some exceptions to the standard capital gains tax rates. Collectibles, such as antiques, art, and rare coins, are usually taxed at a rate of 28%, regardless of how long they have been held for. The Net Investment Income Tax (NIIT) is an additional 3.8% tax that may apply to individuals with high incomes and significant capital gains.

Index Funds: Direct Investing Without a Broker

You may want to see also

Dividend tax

Dividends are shares of a company's profits that are distributed to shareholders. Dividends are usually taxable income.

There are two types of dividends: qualified and nonqualified (also known as "ordinary"). Qualified dividends benefit from a lower tax rate. Nonqualified dividends are taxed as income, with a maximum rate of 37%.

The tax rate on qualified dividends is 0%, 15%, or 20%, depending on the taxpayer's income and filing status. For the 2024 tax year, the following rates apply:

- Married filing jointly: 0% up to $44,625; 15% up to $553,850; 20% above $553,850.

- Married filing separately: 0% up to $22,300; 15% up to $276,925; 20% above $276,925.

To be considered a qualified dividend, three conditions must usually be met:

- The dividend is paid by a U.S. corporation or qualifying foreign entity.

- The dividend is recognised as a dividend by the IRS. Some things that don't count as dividends include premiums paid back by an insurance company, annual distributions made by credit unions to members, and "dividends" from co-ops or tax-exempt organisations.

- The underlying security was held for a minimum period. Typically, if the security was owned for more than 60 days during the 121-day period that began 60 days before the ex-dividend date (the day by which the stock must be owned to receive the dividend), the dividend is qualified.

After the end of the tax year, taxpayers will receive a Form 1099-DIV or a Schedule K-1 from their broker or any entity that sent them at least $10 in dividends and other distributions. This form indicates what the taxpayer was paid and whether the dividends were qualified or nonqualified. This information is then used to fill out the tax return.

To control their dividend tax bill, investors can hold their investments for the 61-day minimum to benefit from the lower qualified dividend tax rate. They may also need to pay estimated taxes throughout the year. Additionally, owning dividend-paying investments inside a retirement account could shelter dividends from taxes or defer taxes on them.

Climate Fund Investment: Steps to Take Action

You may want to see also

Taxes on mutual funds

Mutual fund taxes typically include taxes on dividends and capital gains while you own the fund shares, as well as capital gains taxes when you sell the fund shares.

Your mutual fund may generate and distribute dividends, interest or capital gains from the investments inside the fund. Accordingly, you may owe taxes on these investments – even if you haven't sold any of the shares or received any cash from them. The tax rate you pay depends on the type of distribution you get from the mutual fund, as well as other factors. If you sell your mutual fund shares for a profit, you might incur capital gains tax.

How to minimise mutual fund tax

Waiting at least a year to sell your shares could lower your capital gains tax rate. Holding mutual fund shares inside a retirement account could defer the tax on the interest, dividends or gains your mutual fund distributes. Tax-loss harvesting and choosing funds less likely to distribute taxable income are other options.

How mutual fund tax works

If you receive a distribution from a fund that results from the sale of a security the fund held for less than a year, that distribution is taxed at your ordinary income tax rate. If the fund held the security for 12 months or more, then those funds are subject to the capital gains tax instead. When a mutual fund distributes long-term capital gains, it reports the gains on Form 1099-DIV, Dividends and Distributions, and issues the form to you before the annual tax filing date.

The difference between ordinary income and capital gains income can make a huge difference to your tax bill. In short, only investment income you derive from investments held for more than a year is considered capital gains.

This concept is pretty straightforward when it comes to investing in individual stocks. The world of mutual funds, however, is a little more complicated.

Mutual funds are investment companies that invest the collective contributions of their thousands of shareholders in numerous securities called portfolios. When it comes to distributions, the difference between ordinary income and capital gains has nothing to do with how long you have owned shares in a mutual fund but rather how long that fund has held an investment within its portfolio.

If you receive a distribution from a fund that results from the sale of a security the fund held for only six months, that distribution is taxed at your ordinary-income tax rate.

There are typically two times when your taxes are affected by your investments: the first is when you receive income from the investments, and the second is when you sell the investments for a gain or loss.

Mutual Fund Investment: Strategies for Success

You may want to see also

Tax-free investments

While there are no truly tax-free investments, some investment options offer tax advantages. These include:

- Municipal bonds: These are debt instruments used by state and local governments to raise money. Interest earnings from municipal bonds are tax-free at the federal level and may also be tax-free at the state and local levels, depending on the bond and where it was purchased. However, this tax benefit does not extend to capital gains, and you will pay federal and state taxes if you sell your municipal bonds for a profit.

- Treasury bonds: These are debt instruments used by the federal government to raise money. Interest earned on Treasury bonds is exempt from state income taxes.

- Tax-exempt mutual funds and ETFs: These funds invest in municipal bonds and other federal tax-free investments, allowing you to lower your investment tax bill. They also provide the benefit of diversification, reducing your risk by spreading your investments across multiple securities.

- Roth 401(k): This is a variant of the popular employer-sponsored retirement plan, the 401(k). With a Roth 401(k), you can invest after-tax dollars, and any qualified withdrawals when you retire will be tax-free. There are no income limits on Roth 401(k)s, and you can contribute regardless of how much you earn. For the tax year 2024, the contribution limit is $23,000 for those under 50 and $30,500 for those 50 and older.

- Roth IRA: A Roth IRA is an individual retirement account that allows you to invest after-tax dollars, and you can make tax-free withdrawals in retirement. There are contribution limits for Roth IRAs for the tax year 2024: $7,000 for those under 50 and $8,000 for those 50 or older. Additionally, if your modified adjusted gross income is $161,000 or higher ($240,000 for joint filers), you won't be able to contribute.

- Health Savings Accounts (HSAs): HSAs are tax-advantaged accounts for individuals and families with high-deductible health insurance plans. You can contribute pre-tax income to the account, reducing your taxable income. The money in the account grows tax-free, and qualified withdrawals for medical expenses are also tax-free.

- 529 Education Savings Plans: These plans are offered by most states and allow you to save for college education. Contributions are not tax-deductible for federal taxes, but many states offer tax incentives. Your contributions will grow tax-free, and qualified withdrawals for tuition, textbooks, and other educational expenses are tax-free.

- Indexed Universal Life Insurance (IUL): IUL ties your earnings to the performance of a stock index while protecting your principal. The cash value grows tax-free, and withdrawals and death benefits to beneficiaries are also tax-free. There are no contribution limits, and you don't have to wait until a certain age for qualified withdrawals.

- Donor-Advised Funds (DAFs): DAFs are accounts that manage the charitable donations of individuals and organizations. Contributions are tax-deductible, and securities and other assets contributed (including cryptos and private stocks) are excluded from capital gains tax.

- Qualified Opportunity Funds: These funds stimulate investment in economically distressed and low-income communities, known as opportunity zones. Capital gains used to fund these funds are deferred until the fund is sold or until December 31, 2026, whichever is earlier. Additionally, if you hold the fund for more than 10 years, no federal income taxes will be paid on the fund's appreciation when it is sold.

- Community Development Financial Institutions (CDEs): The New Markets Tax Credit (NMTC) program provides tax incentives for private investments in low-income and financially distressed communities. Investments are channelled through CDEs, and investors can claim a tax credit of up to 39% of the amount invested against federal taxes, spread over seven years.

It is important to note that while these investment options offer tax advantages, they may not be suitable for everyone. Before choosing any investment, it is recommended to consult with a financial advisor to determine the most appropriate strategy for your personal and financial situation.

A Beginner's Guide to Index Funds in Hong Kong

You may want to see also

Tax-deferred investments

Tax-deferred status refers to investment earnings that accumulate tax-free until the investor takes constructive receipt of the profits. Interest, dividends, and capital gains are earnings that can be considered tax-deferred.

Types of Tax-Deferred Investment Accounts

There are several types of tax-deferred investment accounts, each with its own benefits and eligibility criteria:

- Retirement plans such as a 401(k) and 403(b): These employer-sponsored savings accounts for retirement often offer an employer match on your contribution and tax advantages.

- Fixed deferred annuities: These insurance-based contracts offer guaranteed interest rates for future retirement income.

- Variable annuities: These annuities are tied to investments, offering potential growth but with market-related risks.

- U.S. savings bonds: These U.S. government savings bonds offer low risk, and owners may elect to have their tax deferred. Series I bonds also offer inflation protection.

- Whole life insurance: This kind of permanent life insurance may offer a tax-free benefit for beneficiaries and a cash-saving component that the policyholder can access or borrow against.

Benefits of Tax-Deferred Investments

- They lower your annual taxable income when you contribute to them. When you add money to a tax-deferred account, it may come out of pre-tax income, reducing your taxable income for the year.

- You won't owe taxes on your investment gains until you begin withdrawing the funds. This allows you to defer tax on enormous gains for years, especially with high-return investments such as stocks and stock funds.

Drawbacks of Tax-Deferred Investments

There are a few rules and restrictions to consider when investing in tax-deferred accounts:

- Contribution caps: The IRS sets limits on how much you can save in tax-deferred accounts each year. For example, the maximum contribution to a 401(k) plan in 2024 is $23,000, while the limit for IRA contributions is $7,000.

- Penalties on early withdrawals: The IRS will impose a 10% penalty if you withdraw funds from your 401(k) or IRA before age 59½. You'll also owe taxes on the amount withdrawn since it hasn't been taxed yet.

- Required minimum distributions (RMDs): Retirement accounts like IRAs and 401(k)s have RMDs starting at age 73. Missing or skipping an RMD can result in significant tax penalties.

Medmen Opportunity Fund: Investing in Cannabis Innovation

You may want to see also