Mutual funds are a popular investment option as they help investors reach their financial goals. They are also tax-efficient investment vehicles, offering tax-efficient returns. However, it is important to understand the taxation rules and regulations to avoid paying unnecessary taxes. The taxation of mutual funds depends on various factors such as the type of fund, dividend income, capital gains, and the holding period. While mutual funds offer tax advantages, it is essential to carefully consider tax implications when investing to minimise overall tax expenses.

| Characteristics | Values |

|---|---|

| Are mutual funds tax-exempt? | No, profits gained from investment in mutual funds are known as 'Capital gains' and are subject to tax. |

| What is taxed? | Dividends and capital gains are both taxable. |

| What is tax on mutual funds determined by? | Fund types, dividend, capital gains, and holding period. |

| What are the tax benefits of mutual funds over fixed deposits? | In fixed deposits, interest is added to your taxable income and taxed at your income tax slab rate. Mutual funds are more tax-efficient. |

| What is taxed more, short-term or long-term capital gains? | Long-term capital gains are taxed less than short-term capital gains. |

| What is the Securities Transaction Tax (STT)? | A separate tax from capital gains and dividend taxes, levied by the government (Ministry of Finance) when you buy or sell mutual fund units of an equity fund or a hybrid equity-oriented fund. |

| Are mutual fund taxes payable every year? | No, you only pay taxes on mutual fund returns/gains when you sell your holdings. |

| Can you avoid paying capital gains tax? | No, but you can plan your investments to be more tax-efficient. |

| Are all mutual funds tax-saving investments? | No, only investments in Equity Linked Savings Schemes (ELSS) qualify for tax exemption under Section 80C of the Income Tax Act, 1961. |

| What are tax-saving mutual funds? | Funds whose investment qualifies for tax exemption under Section 80C of the Income Tax Act, 1961, with a mandatory lock-in period of 3 years. |

| Are mutual funds considered capital assets for taxation purposes? | Yes, for the purpose of taxation, mutual funds are treated as capital assets. |

What You'll Learn

Mutual funds vs fixed deposits

Mutual funds and fixed deposits are both popular investment options in India. However, they differ in several ways. Here is a detailed comparison of the two:

Returns and Risk

Mutual funds returns are linked to the market performance and vary depending on the type of fund and tenure of investment. Equity-based mutual funds can bring returns of 15-20% over 3-5 or more years. On the other hand, fixed deposits (FDs) offer fixed and guaranteed returns at a predefined rate over a specific time period. FDs carry zero risk, while mutual funds carry varying levels of risk influenced by the market.

Charges and Expenses

Mutual funds carry certain charges and expenses, such as fund management charges, which are deducted from the fund. In contrast, FDs do not incur any expenses during initiation or over the tenure of the deposit.

Withdrawal

Mutual funds allow free withdrawals after a certain period without any charges. Premature withdrawals may incur an exit load charge of 1%. With FDs, depositors who wish to withdraw early will have to break their FD and pay a penalty.

Taxation

In India, mutual funds are subject to short-term and long-term capital gains tax. Short-term capital gains are charged at a flat rate of 15%, while long-term capital gains above a certain threshold are taxed at 10-20% of the earnings, depending on the type of mutual fund. FDs, on the other hand, are subject to TDS (tax deducted at source) of 10% on interest earned above a certain limit in a financial year.

Other Benefits

Mutual funds offer benefits such as risk mitigation through diversification, professional fund management, and the option to start with a small investment amount. FDs provide the convenience of low risk, guaranteed returns, and regular monthly payments, making them a popular choice for retired individuals and senior citizens.

In summary, the choice between mutual funds and fixed deposits depends on an individual's financial goals, risk tolerance, and investment horizon. Mutual funds offer higher return potential but carry market-related risks, while FDs provide stable and guaranteed returns with zero risk.

Best Index Funds to Invest in: A NerdWallet Guide

You may want to see also

Dividend distribution tax

Dividends are profits realised by companies and shared with their shareholders. Dividend distribution tax (DDT) is the tax applied to dividends.

Before April 1, 2020, DDT was levied on companies/mutual funds when they decided to distribute profits to their shareholders. The company would pay DDT before distributing the dividend, and the remaining amount would be passed on to the investor tax-free.

However, the Finance Act, 2020 changed the method of dividend taxation. Now, dividends are taxed at the hands of the investor, as per their income tax slab. This means that dividend income is included in the taxable income of the investor under the heading "income from other sources". The standard rate of TDS is 10% on dividend income paid in excess of Rs 5,000 from a company or mutual fund. The Mutual Fund scheme's dividend is also subject to TDS (tax deducted at source). The AMC is now required to deduct 10% TDS under Section 194K from the dividend that the Mutual Fund distributes to its investors.

The removal of DDT has made it a level playing field for both Growth and Dividend options under a scheme. Investors will now have to weigh the benefits of opting for a dividend option in terms of the effective tax rate (including cess and surcharge) applicable to them and the need for dividend income.

Index Funds in Australia: Best Investment Options

You may want to see also

Capital gains tax

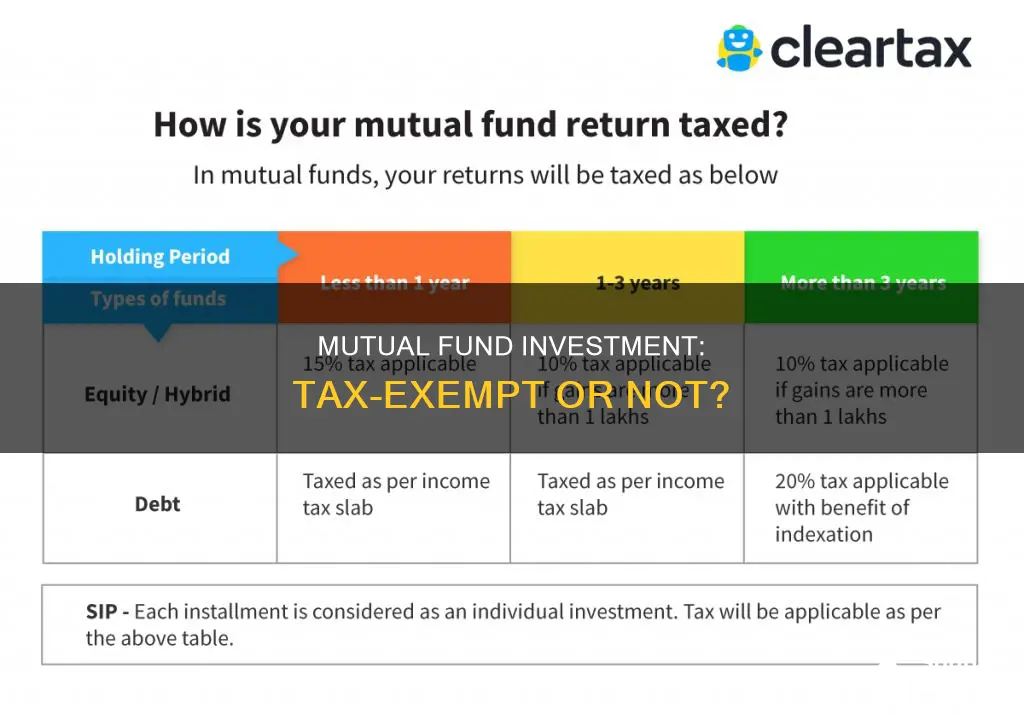

In India, the capital gains tax on mutual funds depends on the scheme and tenure of the investment. There are two types of capital gains tax: short-term capital gains tax (STCG) and long-term capital gains tax (LTCG). The period of holding is a major factor in determining which type of tax is applied.

In the case of equity mutual funds, an investment tenure of less than one year is considered a short-term investment, while any investment over one year is considered long-term. For debt mutual funds, until 31 March 2023, an investment tenure of up to three years was considered short-term, and any investment beyond that was long-term. However, from 1 April 2023, capital gains from debt mutual funds are considered short-term gains, regardless of the holding period.

The tax rate on capital gains for mutual funds also depends on the type of fund. For equity funds, short-term capital gains are taxed at 15% (plus cess), while long-term capital gains of up to Rs 1 lakh per year are tax-exempt. Any gains above Rs 1 lakh are taxed at 10% (plus cess). For debt funds, short-term capital gains are taxed at the investor's income tax slab rate, while long-term capital gains are taxed at 20% with indexation benefits.

It is important to note that capital gains tax is only incurred when the mutual fund units are sold. If you continue to stay invested, you will not have to pay capital gains tax. Additionally, long-term capital gains of up to Rs 1.25 lakh per year from equity-oriented mutual funds are exempt from tax under Section 80C of the Income Tax Act.

To summarise, capital gains tax on mutual funds depends on the type of fund, the holding period, and the amount of gains. By understanding these factors, investors can plan their investments to reduce their overall tax expense.

Smartly Investing 100K in Mutual Funds at 35

You may want to see also

Securities transaction tax

STT is imposed on both the buyer and the seller and is calculated as a percentage of the transaction value. The rate of STT is decided by the government and is subject to change. For example, as of October 1st, 2024, the STT on futures is 0.02%, and the STT on options is 0.1%.

STT is collected by recognised stock exchanges, mutual funds, or merchant bankers, who are responsible for remitting the tax to the government. If they fail to collect the tax, they are still obligated to pay an equivalent amount to the government.

STT is applicable on the sale of units of equity-oriented mutual funds and is calculated based on the sale price of the units. It is important to note that STT is not applicable on the purchase or sale of debt fund units.

STT provides certain benefits to taxpayers. For transactions undertaken until March 31st, 2018, any capital gain on the sale of shares or equity-oriented mutual fund units (EOMF) subject to STT is taxed at a beneficial/nil rate. Long-term capital gains (LTCG) on these securities held for more than 12 months are exempt from tax, while short-term capital gains (STCG) are taxed at a concessional rate.

However, starting July 23rd, 2024, the tax rate on STCG increased to 20%. Additionally, the exemption on LTCG was withdrawn, and LTCG on equity shares and EOMF are now taxed at a concessional rate of 10% for transfers made on or after April 1st, 2018. This tax rate was further increased to 12.5% in the 2024 Budget, effective from July 23rd, 2024.

STT is a separate tax from Capital Gains and Dividend Taxes. It is important for investors to understand the taxation rules for mutual funds to reduce their overall tax expense and make informed investment decisions.

Artemis Vega Fund: A Smart Investment Strategy

You may want to see also

Tax-saving funds

Tax-saving mutual funds, also known as Equity Linked Savings Schemes (ELSS), are a great investment option for those looking for wealth generation, regular returns, and tax savings. ELSS funds have a short lock-in period of three years, the shortest among all tax-saving investments, and provide the potential for high returns.

- They offer tax deductions of up to Rs 1,50,000 per year under Section 80C of the Income Tax Act, 1961. This helps investors save up to Rs 46,800 per year in taxes.

- ELSS funds have a mandatory lock-in period of three years, with no provisions for premature withdrawal.

- There is no upper limit on the amount that can be invested in ELSS funds, while the minimum investable amount varies across fund houses.

- ELSS funds are the only tax-saving investments with the potential to offer inflation-beating returns.

- ELSS funds provide the twin benefits of tax deductions and wealth creation.

- The portfolio of an ELSS fund mostly consists of equities, with some exposure to fixed-income securities.

When considering investing in ELSS funds, it is important to keep in mind certain factors such as investment horizon, returns, and lock-in period. It is advisable to have an investment horizon of more than five years to mitigate market volatility due to the equity exposure of ELSS funds. While ELSS funds do not provide guaranteed returns, a longer investment horizon can potentially result in higher returns compared to other tax-saving options. Additionally, the lock-in period of three years should be considered, as investors cannot redeem their holdings until this period is complete.

In terms of investment mode, investing via a Systematic Investment Plan (SIP) is recommended for those who are not willing to take on higher risk. SIP allows investors to benefit from purchasing fund units across market cycles, resulting in a lower average price per unit. On the other hand, investing a lump sum is generally not advisable unless there is a bearish market trend and the investor has a higher risk tolerance and longer investment horizon.

Overall, ELSS funds are an attractive option for those seeking tax savings and wealth creation, particularly individuals in higher income tax brackets. The short lock-in period and potential for high returns make ELSS funds a popular choice for tax-saving investments.

Best Index Funds: Where to Invest Your Money

You may want to see also

Frequently asked questions

No, mutual funds are not tax-exempt. Profits gained from investment in mutual funds are known as 'Capital gains' and are subject to tax. However, in some cases, you can avail of tax deductions.

Tax-exempt mutual funds are simply composed of investments that generate tax-free interest. Mutual funds invested in government or municipal bonds are often referred to as tax-exempt funds because the interest generated by these bonds is not subject to income tax.

Mutual fund investing allows investors to profit from either Capital Gains or Dividend Income. Capital Gains refer to the profit from selling an asset for more than its cost. Dividend Income refers to the income generated by investors in Mutual Funds through dividends distributed by the Mutual Fund house.