Reliance Industries Limited (RIL) is an Indian company with a focus on hydrocarbon exploration, petroleum refining, petrochemicals, and digital services. With a market capitalization of $150 billion, it is one of the world's most valuable companies. As of July 2023, RIL's stocks have gained 18% for the fiscal year, and analysts predict further growth, with the company's share price potentially reaching Rs 3,000-3,100 by March 2024. This prediction is supported by Vinit Bolinjkar, Head of Research at Ventura Securities, who highlights the potential of upcoming disclosures, such as the Reliance Retail and Jio IPO, to drive stock prices higher. Kranthi Bathini, an Equity Strategist at WealthMills Securities, also foresees a 10-15% return on investment by March 2024. With positive analyst sentiments and a strong performance, now may be a good time to consider investing in Reliance Industries.

What You'll Learn

Reliance Industries' stock performance

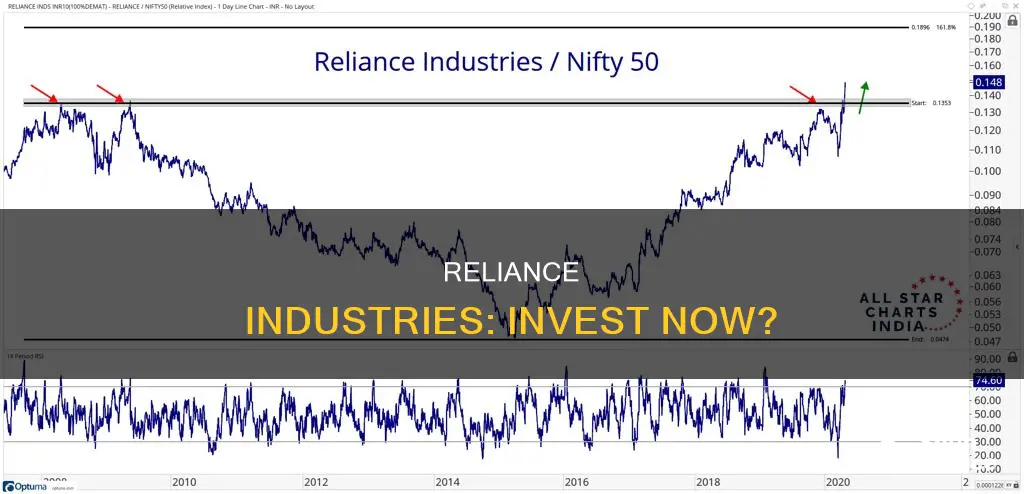

Reliance Industries Ltd. is a Large Cap company operating in the Diversified sector. As of 12 July 2024, the RIL share price was Rs 3,191.15, up 0.95% from its previous close. In the last month, the RIL share price moved up by 9.04%.

RIL's share price has been on an upward trajectory, with a 3-year return of 45.35% compared to the Nifty 100's 52.57%. The company has a market capitalization of Rs 21,50,811 Cr and a PE ratio of 30.72.

RIL's share price has seen strong momentum, with the price above short, medium, and long-term moving averages. However, the company has faced challenges with declining net cash flow and an increasing trend in non-core income.

Analyst recommendations for RIL stock are generally positive, with a majority suggesting a 'Buy' or 'Strong Buy'.

Overall, RIL's stock performance has been strong, with consistent financial performance, quality management, and a positive upward trend in its share price.

NBA: Why Fans Don't Invest

You may want to see also

The company's financial health

Reliance Industries Limited is an Indian multinational conglomerate with a diverse range of businesses, including energy, petrochemicals, natural gas, retail, entertainment, telecommunications, mass media, and textiles. As of 2023, the company had 254 subsidiary companies and 15 associate companies. It is the largest public company in India by market capitalization and revenue and is also the country's largest exporter.

Reliance Industries has a strong financial position, as evidenced by its total shareholder equity of ₹9,257.9 billion and total assets of ₹17,559.9 billion. The company's EBIT (earnings before interest and taxes) stands at ₹1,114.0 billion, resulting in an interest coverage ratio of 4.8. This indicates that the company's operating income can cover its interest payments almost five times over.

Reliance Industries' debt levels are relatively well-managed. Its total debt of ₹3,246.2 billion translates to a debt-to-equity ratio of 35.1%, which has decreased significantly from 72.7% over the past five years. The company's net debt to equity ratio is 13.1%, considered satisfactory. Additionally, Reliance Industries' debt is well covered by its operating cash flow, with a coverage ratio of 48.9%.

The company's short-term assets exceed its short-term liabilities, indicating a positive liquidity position. Similarly, its short-term assets are greater than its long-term liabilities, demonstrating a healthy balance sheet structure.

Reliance Industries has a history of strong financial performance, with consistent revenue growth across its various business segments. The company's revenue streams are diverse, with refining contributing 76%, petrochemicals 19%, oil & gas 2%, and other segments 3% in 2012-13.

In terms of market performance, Reliance Industries has delivered strong returns to its shareholders. The company's market capitalization as of December 2022 stood at Rs.17,59,017.23 crore, reflecting its significant value in the Indian stock market.

Overall, Reliance Industries exhibits a robust financial health profile, with strong earnings, manageable debt levels, positive liquidity, and diverse revenue streams. The company's financial position is a key factor in its ability to maintain its market leadership and continue expanding its business across multiple sectors.

Smartly Choosing Your Investment Portfolio

You may want to see also

The industry Reliance Industries operates in

Reliance Industries Limited is an Indian multinational conglomerate, founded by Dhirubhai Ambani, with its headquarters in Mumbai. It is the largest private sector corporation in India, with consolidated sales of more than $60 billion. It is also the country's largest exporter and private taxpayer.

The company operates in a wide range of industries, including:

- Energy

- Petrochemicals

- Natural gas

- Retail

- Entertainment

- Telecommunications

- Mass media

- Textiles

- Oil refining

- Oil and gas exploration and production

- Aerospace

- Healthcare

- Logistics

- Solar energy

- Financial services

- Special economic zone (SEZ) development

Reliance Industries has a strong presence in the petrochemicals industry, being the largest producer of petrochemicals in India and among the top 10 in the world. The company's refinery in Jamnagar is the world's largest integrated single-location refining complex, which has helped India become a net exporter of petroleum products.

In the telecommunications sector, Reliance's digital services business, Jio, has played a significant role in democratising access to digital services for millions of people in India. Jio also offers broadband services and has partnered with global companies like Facebook, Google, and Intel for strategic investments.

The company has a diverse range of businesses, and its operations span multiple industries, making it a prominent conglomerate in India.

China's Bubble: Global Investment Risk

You may want to see also

Reliance Industries' business segments

Reliance Industries Limited is an Indian multinational conglomerate with a diverse range of business segments. The company operates in various sectors, including energy, petrochemicals, natural gas, retail, entertainment, telecommunications, mass media, and textiles. Here is a detailed overview of its key business segments:

- Refining: This segment involves the production and marketing of petroleum products. Reliance has a significant presence in the refining industry, with a crude refining capacity of 1.4 million barrels per day and the largest single-site refinery complex globally.

- Petrochemicals: The company is engaged in the manufacture and marketing of petrochemical products. This includes a range of products such as transportation fuels, polymers, polyesters, and elastomers.

- Oil and Gas: This segment covers the exploration, development, and production of crude oil and natural gas. Reliance has made significant discoveries in the Krishna Godavari basin and operates the largest refinery in the world at Jamnagar, Gujarat.

- Organised Retail: Reliance Retail, founded in 2006, is a major subsidiary of the company. It is the fastest-growing retailer in the world and India's largest in terms of revenue. Reliance Retail operates in various segments, including grocery, fashion and lifestyle, consumer electronics, and connectivity.

- Digital Services: Reliance provides a range of digital services and has made significant investments in this area. The company's Jio Platforms subsidiary is valued at over $100 billion and offers mobile, broadband, and enterprise connectivity services.

- Others: The company is also involved in media, special economic zone (SEZ) development, and textile businesses. The textile business has been a part of the company since the 1960s, and it continues to be a significant segment.

These business segments have contributed to Reliance Industries' position as the largest public company in India by market capitalisation and revenue. The company has a diverse range of operations, with a strong presence in the energy and petrochemical sectors, as well as a growing focus on retail and digital services.

Retirement Investments: Safe Options for the Elderly

You may want to see also

Analyst recommendations

Analysts on Dalal Street predict another 10% rally in Reliance Industries by March 2024. Vinit Bolinjkar, Head of Research at Ventura Securities, stated that Reliance Industries may hit Rs 3,000-3,100 levels by March 2024. He expects multiple new disclosures from Reliance Industries, such as Reliance Retail, Jio IPO, and news flow on green energy signings. Bolinjkar believes that the corporate action will pick up and drive the stock to seek higher levels.

Kranthi Bathini, an Equity Strategist at WealthMills Securities, shares a similar sentiment, stating that the stock has further headroom and can give a 10-15% return by March 2024. Bathini attributes this potential to the value unlocking and the underlying strength of the business, expecting it to scale new highs over time.

Market Analyst Raghvendra Singh commented on the perfect breakout of RIL stock, anticipating that the momentum will continue for at least a week following the demerger news.

In terms of strengths, weaknesses, opportunities, and threats, Reliance Industries presents a mixed picture. Its strengths include a strong momentum with prices above short, medium, and long-term moving averages. However, one of its weaknesses is a declining net cash flow, indicating that the company is not generating enough net cash.

On the opportunities front, brokers have upgraded their recommendations or target prices in the past three months. The main threat lies in the increasing trend in non-core income.

Overall, the consensus among analysts seems to be positive, with expectations of further growth and upside potential in Reliance Industries stock, making it an attractive investment prospect.

Rich People: The Only Investors?

You may want to see also

Frequently asked questions

Reliance Industries Limited is an India-based company engaged in hydrocarbon exploration and production, petroleum refining and marketing, petrochemicals, advanced materials and composites, renewables (solar and hydrogen), retail and digital services.

Analysts on Dalal Street see another 10% rally in Reliance Industries by March 2024. Kranthi Bathini, Equity Strategist at WealthMills Securities, said, “The stock has further headroom from here. RIL can give a 10-15% return by March 2024. With the value unlocking and underlying strength of business it may scale new highs over a period of time.”

Reliance Industries Limited (RIL) became the first Indian company to enter the exclusive club of $150 billion in market capitalization among the world's most valuable companies, and is now ranked 58 on the list.

As of July 10, 2023, Reliance Industries shares scaled a fresh 52-week high of Rs 2,755 apiece. On July 8, 2024, the share price was Rs 1,759.

As of June 21, 2020, Reliance Industries' dividend yield was 0.37%.