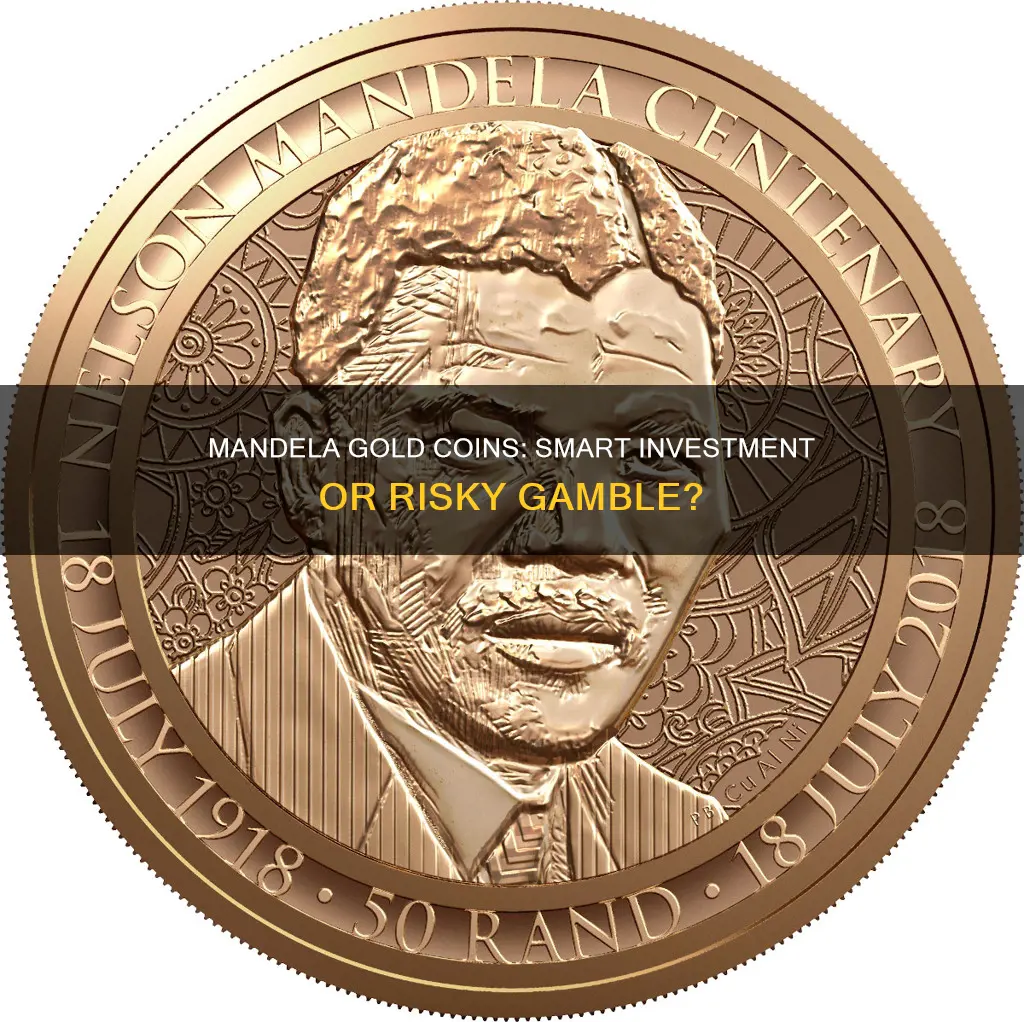

Mandela gold coins are a special edition release by the South African Mint, honouring one of the country's greatest icons, Nelson Mandela. Given Mandela's global recognition and the limited quantities of these coins, they are highly collectible and valuable. The coins are made from 24-carat pure gold and document the greatest successes of Mandela's life. They are considered a good investment, with a recommended holding period of around 4 to 5 years for a satisfying return. However, it is important to note that the circulated Mandela coins are not considered rare due to their high mintages, and their value is primarily based on people's appreciation for Mandela.

| Characteristics | Values |

|---|---|

| Type of coin | Mandela gold coins are medallions or gold bullion coins. |

| Collectability | Mandela coins are collectable due to their low mintage and use of precious metals. |

| Value | Circulated Mandela coins are not considered rare as millions have been minted. Uncirculated Mandela coins, on the other hand, are incredibly hard to source and can fetch high prices. |

| Investment | Mandela coins are not an efficient way to invest in gold as their value is tied to their collectability, which is difficult to predict. Krugerrands are a better investment vehicle for gold. |

| Taxation | Mandela coins are subject to capital gains tax when sold, which can be up to 20% of the sale value. |

| Selling | Mandela coins are harder to sell than Krugerrands as they need to be sold to a collector. Krugerrands can be sold to the South African Reserve Bank (SARB). |

What You'll Learn

Mandela coins are not a collectible item

While uncirculated Mandela coins have been known to fetch high prices, the circulated versions are not considered rare. This is because millions of them have been minted, and there is a high supply of these coins with relatively low demand. Additionally, the mint could always manufacture more, which would further lower the value of the coin and dilute the market.

The value of circulated Mandela coins lies primarily in the appreciation and respect that people have for Nelson Mandela. Over time, his legacy will likely contribute to the coins gaining value. However, for now, the high supply and low demand for these coins mean that they are not considered collectibles.

If you are looking for collectible coins, rare coins such as the ZAR coins might be a better option. These are the first indigenous coins produced for the Republic of South Africa, and they are considered collectibles. As such, they are not subject to capital gains tax when sold, making them a more attractive investment option.

In summary, Mandela coins are not currently considered collectible items due to their high supply and low demand. Their value remains at R5, and they are not expected to increase in value unless there are changes in supply and demand. For collectible coin options, rare coins such as the ZAR coins are a better choice.

Bitcoin in Canada: What's the Legal Status?

You may want to see also

Krugerrands are a better investment

Firstly, Krugerrands are the first modern, investment-grade gold bullion coins. Introduced in 1967, they were the first gold bullion of their kind in the world. They are also legal tender in South Africa and are available in four sizes: 1oz, 1/10oz, 1/4oz, and 1/2oz. The value of a Krugerrand is based on the intrinsic value of the metal it is manufactured from, so its price increases or decreases with the price of gold. This makes it a good hedge against inflation.

Secondly, Krugerrands have a much lower mintage than Mandela coins. The Mandela coin, while incredibly valuable in its uncirculated form, is not considered rare because millions have been minted. Krugerrands, on the other hand, are much harder to source, especially in good condition, making them more attractive to investors.

Thirdly, Krugerrands have a signature reddish-orange glow due to their composition of 8.33% copper. This gives them a unique look that sets them apart from other gold coins, such as the American Gold Eagle, which has a classic yellow-gold hue.

Lastly, Krugerrands have a strong historical significance. At the time of their introduction, South African gold accounted for approximately 70% of the gold distributed worldwide. The Krugerrand was the South African government's way of marketing its gold and selling it at a 5% premium above the spot price. This historical context adds to the Krugerrand's appeal as an investment.

In conclusion, while both Mandela gold coins and Krugerrands are valuable and sought-after, Krugerrands are a better investment due to their status as the first modern gold bullion coins, their lower mintage, their unique composition, and their strong historical significance.

Coinbase: A Guide to Investing in the Company

You may want to see also

Mandela coins are a risky investment

Uncirculated Mandela coins, on the other hand, have been known to fetch high prices due to their low mintage and the fact that they are struck using precious metals. While these coins can be a sound investment, they are also difficult to source and come with the risk of the collector's market, where tastes and fashions are hard to predict.

When investing in Mandela coins, it's important to understand the difference between bullion value and collector's value. The bullion value of a coin is based on the amount of gold it contains, while the collector's value is influenced by factors such as rarity, historical significance, and the interests of collectors. Mandela coins, as collectible coins, do not provide a clear bullion view, making them a less efficient way to invest in gold.

Additionally, selling medallion coins can be challenging. Investors must first find a collector or someone interested in the medallion before they can sell it. This adds another layer of risk to the investment, especially if the investor does not fully understand the collectors' market or the full collector value of the coin. Therefore, it is crucial to conduct thorough research before investing in Mandela coins or any collectible coins.

Trinidad and Tobago's Bitcoin Investment Strategy

You may want to see also

Mandela coins are not rare

The R5 Mandela coins are legal tender in South Africa and bear a value of R5 only. They are commemorative circulation coins and are not considered collectible coins. More than 22 million of these coins were issued by the South African Mint, and they are not bought back by the mint.

While uncirculated Mandela coins have been known to fetch high prices when sold privately or through auctions, these coins are incredibly hard to source. Their low mintage figures and the fact that they are struck using precious metal add to their value.

The Mandela R5 coins are often marketed as rare by clever sellers who convince buyers that certain coins are extremely rare and worth a lot of money. However, this is not an indication of their rarity, as the term "rarity" in coin grading refers to conditional rarities, which means that not many coins have been sent for grading and received a particular grade.

Therefore, it is important for buyers to be cautious and do their research before investing in Mandela coins or any other commemorative coins.

The Future of Digital Coins: Best Investment Options

You may want to see also

Mandela coins are valuable due to their gold content

Gold has been valued for thousands of generations and has preserved wealth over time. In contrast, the value of paper-denominated currencies, such as the US dollar, has been eroded by inflation. For example, in the early 1970s, one ounce of gold was worth $35. Today, one ounce of gold is worth significantly more, while the purchasing power of $35 has decreased due to inflation.

The Mandela gold coin is a sound investment, especially for those who can afford it. Its value is expected to increase over time, making it a good choice for those looking to protect their wealth and diversify their investments. Additionally, the coin's low mintage figures and use of precious metals contribute to its value.

However, it is important to note that circulated Mandela coins are not considered rare because millions of them have been minted. Their value lies primarily in the respect and appreciation people have for Nelson Mandela, and it is expected that his legacy will further increase the coins' value over time.

For those interested in investing in gold, it is essential to conduct thorough research and understand the risks involved. Gold investments come with distinct costs and risks, and there is no guarantee that gold will always appreciate in value. Consulting with a qualified financial advisor is recommended before making any investment decisions.

How Indians Can Invest in Bitcoin

You may want to see also

Frequently asked questions

The Mandela Gold Coin is a special edition coin that immortalises one of South Africa's greatest icons, Nelson Mandela, and his lifelong dedication to the struggle for freedom and democracy in South Africa.

Mandela gold coins are valuable because they are released in extremely low quantities, making them collectible and worth a lot of money.

Mandela gold coins are a rewarding investment, and it is recommended to hold them for around 4 to 5 years to get a satisfying return.

Mandela gold coins are fairly liquid, and investors, collectors, and dealers openly trade them on the market. However, finding a buyer or seller in the market for such rare coins can take some effort.