When considering investments for your Individual Retirement Account (IRA), it's crucial to explore options that offer both security and growth potential. Mutual of Omaha, a well-known financial services company, provides a range of mutual funds that could be suitable for IRA investments. This introduction aims to delve into the safety and advantages of Mutual of Omaha's offerings, helping investors make informed decisions about their retirement savings.

| Characteristics | Values |

|---|---|

| Company Overview | Mutual of Omaha is a well-known insurance and financial services company based in Omaha, Nebraska. It offers a range of products, including life insurance, annuities, and retirement plans. |

| Safety and Stability | The company has a strong financial position and a long history of stability. It has received high ratings from independent agencies like A.M. Best and Standard & Poor's, indicating a low risk of default. |

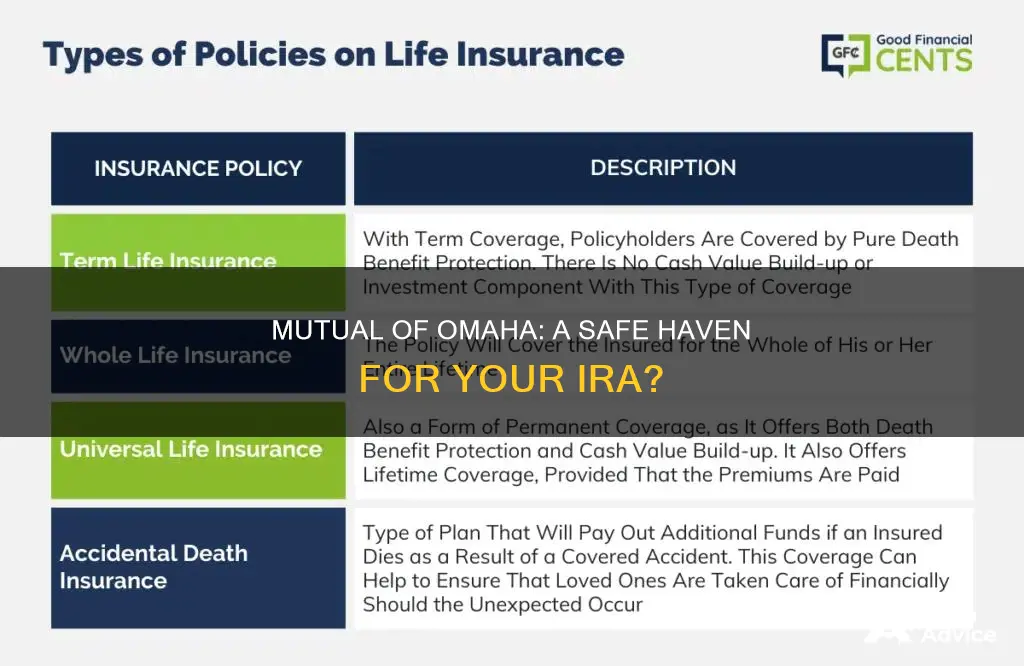

| Investment Options | Mutual of Omaha provides various investment options for IRAs, including mutual funds, stocks, bonds, and fixed-income securities. These investments can be tailored to different risk tolerances and goals. |

| Customer Service | They offer customer support and guidance to help investors make informed decisions. Their representatives can assist with account management, investment advice, and addressing any concerns. |

| Fees and Expenses | The company's fees and expenses for IRA investments may vary depending on the specific products and services chosen. It's important to review the fee structure to understand the potential impact on returns. |

| Market Performance | Past performance is not indicative of future results, but Mutual of Omaha's investment options have historically provided competitive returns. However, market conditions can fluctuate, and investment values can change. |

| Regulatory Compliance | Mutual of Omaha operates under strict regulatory guidelines to ensure the safety and protection of its customers' assets. They adhere to industry standards and laws governing financial institutions. |

| Customer Reviews | Online reviews and testimonials can provide insights into customer experiences. While individual opinions may vary, many customers appreciate the company's services and the security of their investments. |

| Additional Benefits | They may offer additional benefits such as tax-advantaged accounts, retirement planning tools, and educational resources to help investors make the most of their IRA investments. |

| Accessibility | The company provides accessible resources and tools for investors to monitor their IRA accounts and make adjustments as needed. This includes online portals and mobile apps for convenient access. |

What You'll Learn

- Financial Stability: Mutual of Omaha's financial strength and ratings make it a safe choice

- Investment Options: Diversified investment choices cater to various IRA strategies

- Customer Service: Dedicated support and resources ensure a positive investor experience

- Fees and Costs: Transparent fee structure, competitive rates, and no hidden charges

- Regulatory Compliance: Adherence to IRS and SEC regulations ensures investor protection

Financial Stability: Mutual of Omaha's financial strength and ratings make it a safe choice

Mutual of Omaha is a well-established and reputable financial services company, and its financial stability is a significant factor to consider when evaluating it as an IRA investment option. The company's strong financial position and positive ratings from independent agencies provide investors with a sense of security and confidence in their retirement savings.

One of the key indicators of Mutual of Omaha's financial strength is its financial ratings. The company has been consistently rated by major credit rating agencies, such as A.M. Best, Moody's, and Standard & Poor's. These ratings assess Mutual of Omaha's ability to meet its financial obligations and provide a comprehensive overview of its financial health. As of the latest assessments, Mutual of Omaha maintains an 'A' rating from A.M. Best, indicating a high level of financial stability and a strong capacity to fulfill its commitments. This rating is particularly important for IRA investors, as it assures them that their investments are backed by a financially robust entity.

In addition to the ratings, Mutual of Omaha's financial performance and reserves are impressive. The company has a substantial financial cushion, with a significant amount of assets allocated to various investment vehicles. This includes a diverse portfolio of investments, such as fixed-income securities, equity securities, and alternative investments. By diversifying its investments, Mutual of Omaha aims to minimize risk and maximize returns for its policyholders and investors. The company's financial statements and annual reports provide detailed insights into its investment strategies and performance, allowing investors to make informed decisions.

Furthermore, Mutual of Omaha's long-standing presence in the market is a testament to its financial stability. With a history spanning over 90 years, the company has weathered economic downturns and market fluctuations, consistently delivering on its promises. This longevity and track record of success make Mutual of Omaha a trusted name in the financial industry, especially for retirement planning.

For IRA investors, choosing a financially stable and well-rated company like Mutual of Omaha can provide peace of mind. The company's commitment to financial strength and its ability to navigate market challenges ensure that investors' retirement savings are in good hands. When considering IRA investments, it is crucial to assess the financial health of the insurance company, and Mutual of Omaha's ratings and performance metrics make it a safe and reliable choice.

Assessing Investment Risk Appetite: Strategies for Success

You may want to see also

Investment Options: Diversified investment choices cater to various IRA strategies

Mutual of Omaha is a well-known financial services company that offers a range of investment products, including mutual funds, which can be a valuable addition to an Individual Retirement Account (IRA). When considering whether Mutual of Omaha is a safe and suitable investment for your IRA, it's essential to understand the company's reputation, investment strategies, and the potential risks involved.

Diversification is a key strategy in IRA investments, and Mutual of Omaha provides a variety of investment options to cater to different risk tolerances and financial goals. Their mutual funds are professionally managed, offering investors access to a wide range of assets, including stocks, bonds, and alternative investments. This diversification can help mitigate risks and provide a more balanced approach to growing your retirement savings. For instance, they offer funds focused on specific sectors, such as healthcare or technology, allowing investors to align their portfolios with their interests and expertise.

One of the advantages of Mutual of Omaha's mutual funds is the potential for long-term growth. These funds are designed to provide capital appreciation and income over extended periods, which can be particularly beneficial for retirement planning. The company's investment strategies are typically transparent, with detailed reports and disclosures, ensuring investors can make informed decisions about their IRA contributions.

Additionally, Mutual of Omaha's commitment to customer service and financial education is notable. They provide resources and guidance to help investors understand the market and make suitable investment choices. This support can be invaluable for those new to investing or seeking to optimize their IRA portfolios. However, as with any investment, there are risks associated with mutual funds, including market volatility and the potential for losses.

In summary, Mutual of Omaha offers a comprehensive suite of investment options that can be a safe and strategic choice for IRAs. Their diversified mutual funds provide investors with the opportunity to build a well-rounded portfolio, tailored to their risk preferences. By combining Mutual of Omaha's investment choices with a thoughtful diversification strategy, individuals can work towards securing their financial future and achieving their retirement objectives. It is always advisable to consult with a financial advisor to ensure that your IRA investments align with your overall financial plan and risk tolerance.

Chris Gardner's Life Savings Investment: A Fateful Decision

You may want to see also

Customer Service: Dedicated support and resources ensure a positive investor experience

Mutual of Omaha is a well-known financial services company that offers a range of investment products, including Individual Retirement Accounts (IRAs). When considering an IRA investment, investors often prioritize safety and reliability, and Mutual of Omaha understands the importance of providing dedicated customer service to meet these needs.

The company's customer service team is a valuable resource for investors, offering support and guidance throughout the investment journey. This dedicated support system ensures that investors can make informed decisions and feel confident in their IRA choices. Mutual of Omaha's customer service representatives are trained to provide personalized assistance, addressing any concerns or questions investors may have. Whether it's clarifying investment options, explaining account management processes, or providing educational resources, the team is equipped to deliver comprehensive support.

In addition to direct assistance, Mutual of Omaha offers various resources to empower investors. Their website features an extensive knowledge base with articles, guides, and FAQs covering various IRA topics. This self-service option allows investors to explore and understand their investment options at their own pace. Furthermore, the company provides access to financial advisors who can offer tailored advice based on individual circumstances, ensuring investors receive professional guidance when needed.

The availability of dedicated support and resources is a significant advantage for investors, especially those new to the world of IRAs. It allows them to navigate the complexities of retirement planning with confidence. Mutual of Omaha's commitment to customer service ensures that investors can make informed choices, feel supported, and ultimately have a positive experience with their IRA investments. This level of assistance can be a crucial factor in building trust and long-term relationships with investors.

By prioritizing customer service, Mutual of Omaha demonstrates its dedication to investor satisfaction and safety. This approach not only helps investors make suitable IRA choices but also fosters a positive and supportive investment environment, which is essential for long-term success and financial well-being.

Diversifying Your Investment Portfolio: Strategies for Success

You may want to see also

Fees and Costs: Transparent fee structure, competitive rates, and no hidden charges

When considering Mutual of Omaha for your IRA investment, understanding their fee structure is crucial. Mutual of Omaha offers a transparent approach to fees, ensuring investors are well-informed about the costs associated with their retirement accounts. This transparency is a key factor in building trust and confidence in their services.

The company provides a detailed breakdown of fees on their website, making it easy for investors to review and compare. This includes management fees, which are typically a percentage of the assets under management, and these fees can vary depending on the type of IRA and investment strategy. Additionally, there may be transaction fees for certain activities, such as wire transfers or early withdrawals, but these are clearly outlined to ensure investors are aware of potential costs.

One of the advantages of Mutual of Omaha is that they offer competitive rates for their services. These competitive rates can provide investors with cost-effective options for growing their retirement savings. By keeping fees low, Mutual of Omaha aims to maximize returns for investors over the long term. This competitive pricing strategy is particularly appealing to those seeking affordable investment management.

Furthermore, Mutual of Omaha prides itself on having no hidden charges. This means that investors can trust that the fees they see are the fees they will pay, with no unexpected surprises. Transparency in pricing encourages investors to make informed decisions and build a long-term relationship with the company. It also fosters a sense of security, knowing that there are no undisclosed costs that could impact their retirement savings.

In summary, Mutual of Omaha's commitment to a transparent fee structure, competitive rates, and no hidden charges is a significant advantage for investors. This approach allows individuals to make informed choices about their IRA investments, knowing exactly what they are paying for. By providing clear and competitive pricing, Mutual of Omaha aims to build trust and offer a reliable investment option for those planning for their retirement.

Sharks' Investment Strategies: Profitable or Not?

You may want to see also

Regulatory Compliance: Adherence to IRS and SEC regulations ensures investor protection

Mutual of Omaha, a well-known financial services company, operates under strict regulatory frameworks to ensure the safety and protection of its investors, particularly those who invest in Individual Retirement Accounts (IRAs). The adherence to IRS (Internal Revenue Service) and SEC (Securities and Exchange Commission) regulations is a cornerstone of their business model, providing investors with a sense of security and trust.

The IRS sets forth specific guidelines and rules for retirement accounts, including IRAs, to ensure they are utilized for their intended purpose. Mutual of Omaha, as a financial institution, must comply with these regulations to offer IRA services. This includes maintaining accurate records, providing transparent reporting, and ensuring that all contributions and withdrawals adhere to the IRS's tax laws and contribution limits. By following these rules, Mutual of Omaha helps investors avoid potential penalties and ensures their retirement savings are managed according to legal requirements.

SEC regulations, on the other hand, focus on protecting investors and ensuring the fair and transparent operation of the financial markets. Mutual of Omaha, as a registered investment company, is subject to these regulations, which include disclosing relevant information to investors. This transparency allows investors to make informed decisions about their IRA investments. For instance, Mutual of Omaha must provide detailed information about fund performance, fees, and potential risks associated with their investment products. This level of disclosure empowers investors to assess the safety and suitability of their IRA investments.

Furthermore, SEC regulations mandate that investment companies like Mutual of Omaha maintain a certain level of financial stability and liquidity. This ensures that investors' funds are protected and can be withdrawn or redeemed when needed. The company must also adhere to rules regarding the diversification of investments, which further safeguards investors by reducing the risk associated with individual securities.

In summary, Mutual of Omaha's commitment to regulatory compliance is essential for maintaining the trust of its investors. By adhering to IRS and SEC regulations, the company ensures that IRA investments are managed according to legal requirements, providing investors with a safe and secure environment for their retirement savings. This level of regulatory oversight is a key factor in establishing Mutual of Omaha as a reliable and trustworthy financial partner for investors.

Consumption, Savings, and Investment: Understanding Aggregate Behavior

You may want to see also

Frequently asked questions

Yes, Mutual of Omaha is a well-established and reputable financial services company. It has been in the business for over 100 years and is known for its mutual funds and insurance products. The company is regulated by the Securities and Exchange Commission (SEC) and has a strong financial standing, making it a safe choice for IRA investments.

Mutual of Omaha employs various strategies to safeguard your IRA investments. They offer a range of investment options, including mutual funds, which are professionally managed and diversified. The company also provides risk management tools and regularly reviews and rebalances portfolios to ensure they align with your investment goals and risk tolerance. Additionally, Mutual of Omaha's insurance products can provide an extra layer of security for your retirement savings.

Absolutely! Mutual of Omaha welcomes the transfer of existing IRAs. The process is straightforward and involves working with their dedicated team to facilitate the transfer. They provide guidance and support throughout the process, ensuring a smooth transition of your retirement savings to their platform. It's a convenient way to consolidate your investments and potentially benefit from Mutual of Omaha's investment expertise.