Risk is an inherent part of investing, and understanding the level of risk associated with an investment is crucial for making informed decisions. While some investments carry a higher level of risk, such as stocks, others are considered lower-risk options, like fixed deposits. The choice between low-risk and high-risk investments depends on various factors, including an individual's financial goals, risk tolerance, and time horizon. Low-risk investments typically have lower potential returns, while high-risk investments offer the possibility of higher returns. However, it's important to note that the risk of an asset is subjective and depends on the investor's capacity to take on risk. Diversification and a balanced portfolio approach can help investors manage risk and achieve their investment goals.

| Characteristics | Values |

|---|---|

| Risk | Exposure of an investment vehicle to loss |

| Probability of Loss | Depends on the investment |

| Impact of Loss | Depends on the investment |

| Returns | Low-risk investments have lower returns |

| Volatility | Low-risk investments have lower volatility |

| Investor Profile | Risk-averse investors prefer low-risk investments |

| Investment Instruments | Fixed deposits, public provident funds, life insurance, treasury bonds, etc. |

| Peace of Mind | Low-risk investments offer more peace of mind |

What You'll Learn

- Low-risk investments offer stability and peace of mind

- High-risk investments can lead to major financial rewards

- Low-risk investments are great for long-term planning

- High-risk investments should only be made if you are comfortable with the risk

- Diversification and a balanced portfolio can help manage risk

Low-risk investments offer stability and peace of mind

Low-risk investments are a great way to ensure financial stability and peace of mind. They are especially important during uncertain economic times, as they provide a safeguard against the unpredictable swings of the stock market. This stability is crucial for long-term financial planning, helping individuals meet their financial goals without taking on excessive risk. While they may not provide the high returns of riskier assets, they play a crucial role in a diversified portfolio.

- Government Bonds: These are considered one of the safest low-risk investment options. They are essentially loans that investors give to the government, which promises to pay back the principal amount with interest over a predetermined period. The risk of default is minimal because these bonds are backed by the government's ability to tax its citizens. Government bonds offer reliability and a steady income stream, making them attractive for those focused on capital preservation and consistent returns.

- Dividend-Paying Stocks: Investing in mature and well-established companies that have a consistent track record of profitability can provide stability to your investment portfolio. These companies often operate in industries that are less susceptible to economic downturns, such as utilities or consumer staples. Dividend-paying stocks typically experience less price fluctuation and provide regular income in the form of dividends.

- Certificates of Deposit (CDs): CDs are reliable, fixed-rate investments offered by banks or credit unions. They provide a predetermined interest rate over a specified duration, usually ranging from a few months to several years. CDs are insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Association (NCUA), safeguarding your investment up to specified limits. They offer higher interest rates than regular savings accounts and are suitable for those who don't need immediate access to their funds.

- Money Market Funds: These are specialized mutual funds that invest in short-term, high-quality debt securities, such as treasury bills and certificates of deposit. Money market funds strive to maintain a stable net asset value, typically aiming for a value of $1 per share. They are attractive for investors looking for safe places to park their funds, especially during volatile market conditions.

- Treasury Securities: Backed by the US government, treasury securities come in the form of bills, notes, and bonds. Bills mature in one year or less, notes span up to 10 years, and bonds typically mature in 20 to 30 years. When you purchase these securities, you are lending money to the US government. Treasury securities are considered low-risk due to the government's backing, and they provide stable returns.

By incorporating these low-risk investments into your portfolio, you can enjoy stable returns, reduce volatility, and maintain peace of mind. Remember, it's important to diversify your investments and consider your financial goals, risk tolerance, and investment horizon when creating your investment strategy.

Venture Capitalists: Strategies Behind Investment Choices

You may want to see also

High-risk investments can lead to major financial rewards

Risk is an inherent part of investing, and while it may not be well-defined or quantifiable, it is fundamental to any discussion of returns and performance. High-risk investments, while potentially dangerous, can also lead to substantial financial gains.

Understanding Risk

Risk can be understood as the possibility or probability of an asset experiencing a permanent loss in value or underperforming expectations. It is important to note that volatility, or the range of potential outcomes, is not necessarily a good measure of risk, as it does not affect the likelihood of outcomes.

High-Risk Investments

A high-risk investment has a large chance of loss of capital or underperformance, or a relatively high chance of a significant loss. These investments are often characterised by significant volatility, meaning their prices can fluctuate dramatically over a short period. Examples include:

- Penny stocks: shares of small companies that trade for less than $5 per share, prone to manipulation and fraud.

- Junk bonds: issued by companies with poor credit ratings, offering higher interest rates but a higher chance of default.

- Leveraged exchange-traded funds (ETFs): aiming to amplify returns of an underlying index, often using derivatives, but highly volatile and unsuitable for long-term investing.

- Binary options: a wager that can result in a fixed amount or a loss of the entire investment, akin to gambling.

- Venture capital in startups: investing in early-stage companies with high growth potential, but a high failure rate.

Weighing the Risks and Rewards

When considering high-risk investments, it is crucial to assess your risk tolerance and capacity. Your risk tolerance is your comfort level with taking on risk, while your risk capacity is the amount of financial risk you can take given your financial situation.

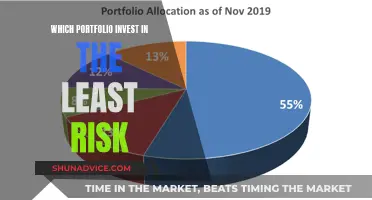

The investment risk pyramid is a useful framework for allocating assets based on risk and potential returns. At the base of the pyramid are low-risk assets like cash and treasuries, followed by medium-risk investments like corporate bonds, and topped by high-risk investments.

High-risk investments are placed at the summit of the pyramid, representing a small portion of your portfolio. This portion should consist of money you can afford to lose without serious repercussions and that is fairly disposable, so you are not forced to sell prematurely in case of losses.

Final Thoughts

While high-risk investments carry the possibility of significant financial losses, they also offer the potential for major financial rewards. It is important to approach these investments with caution and to diversify your portfolio to mitigate potential downsides. Understanding your own risk tolerance and financial situation is key to making informed investment decisions.

Investing My Daughter's Savings: Strategies for Long-Term Growth

You may want to see also

Low-risk investments are great for long-term planning

- Capital Preservation and Steady Returns: Low-risk investments prioritize capital preservation, making them ideal for investors who want to protect their principal while still generating modest returns. This is especially beneficial for those nearing retirement or seeking to balance out higher-risk investments.

- Diversification and Risk Management: By including low-risk investments in your portfolio, you can diversify your assets and manage risk effectively. This helps to reduce the overall volatility of your investments and provides a safety net during market downturns.

- Long-Term Growth Potential: While low-risk investments may not offer high returns in the short term, they can still provide attractive long-term growth potential. This is because they often involve less risk of significant losses, allowing your investments to compound over time.

- Peace of Mind: Low-risk investments offer a sense of security and stability. Knowing that your investments are relatively safe can provide peace of mind, especially during uncertain economic times.

- Suitability for Various Financial Goals: Low-risk investments are versatile and can help you save for a variety of financial goals, such as retirement, a home down payment, or an emergency fund. They are particularly well-suited for long-term goals, as they provide steady growth without exposing you to excessive risk.

- Protection Against Inflation: Some low-risk investments, such as Treasury Inflation-Protected Securities (TIPS) or Series I Savings Bonds, offer protection against inflation. These investments adjust their principal or interest payments based on the inflation rate, ensuring that your returns keep up with rising prices.

In conclusion, low-risk investments are a great choice for long-term planning due to their ability to preserve capital, generate steady returns, provide diversification, and offer peace of mind. They are well-suited for investors seeking a more conservative approach to achieve their financial goals without taking on excessive risk.

Should You Register a Managed Investment Scheme?

You may want to see also

High-risk investments should only be made if you are comfortable with the risk

Risk is an inherent part of investing. The more risk you take on, the greater the potential for higher returns. However, it is crucial to understand that high-risk investments are not suitable for everyone. Before considering such investments, you should be comfortable with the potential for significant financial loss and have a clear understanding of what constitutes "risk" in the investment world.

Firstly, it's important to note that there is no universally agreed-upon definition of "risk" in the context of investments. Academics often use volatility as a proxy for risk, but this is flawed as it does not accurately reflect the likelihood of negative outcomes. A better way to think about risk is as the possibility of an asset experiencing a permanent loss of value or underperforming expectations.

High-risk investments typically fall into two categories. The first is where there is a large chance of losing capital or underperformance. The second, and often overlooked aspect, is the potential for a devastating loss, even if the chances are relatively low. For example, investing in options or foreign emerging markets can offer high rewards but also carry significant risks.

When considering high-risk investments, it's essential to assess your risk tolerance and financial goals. While some high-risk investments may be enticing, it's crucial to do your research and understand the specific risks involved. For instance, investing in initial public offerings (IPOs) can be risky due to the uncertainty surrounding a company's management and future performance. Similarly, venture capital investments in startups carry a high degree of uncertainty as many startups fail, even with desirable products.

High-yield bonds, real estate investment trusts (REITs), and cryptocurrency are also considered high-risk investments. While they offer the potential for lucrative returns, they are prone to significant losses. For instance, REITs are highly susceptible to swings in the real estate market, interest rates, and the overall economy.

Ultimately, high-risk investments should only be made if you are comfortable with the potential for substantial financial losses and have a clear understanding of the specific risks involved. It is essential to assess your risk tolerance and financial goals before considering such investments. By building knowledge about the risks and how they can impact you financially, you may be able to include some higher-risk investments in your portfolio alongside lower-risk options.

Angel Investing in India: A Beginner's Guide

You may want to see also

Diversification and a balanced portfolio can help manage risk

Diversification is a key strategy to help manage risk and balance your portfolio. It is based on the principle of "not putting all your eggs in one basket", and involves investing in a variety of financial assets to reduce exposure to any specific type of risk.

By spreading your investments across different asset classes, industries, and geographies, you can lower the impact of any one investment's poor performance on your overall portfolio. This strategy can improve your chances of achieving more stable and consistent returns over time and reduce the risk of loss.

- Spread your investments: Avoid concentrating all your investments in one stock or sector. Maintain a broad mix of investments across various asset classes, such as stocks, bonds, cash or cash-like investments, real estate, mutual funds, and ETFs.

- Geographic diversification: Invest in international markets to protect your portfolio against specific economic or political risks that may affect a particular country or region.

- Industry diversification: Invest in different economic sectors, such as technology, healthcare, consumer goods, energy, and finance. Each industry reacts uniquely to market conditions.

- Maturity diversification: Include a mix of short-term and long-term investments. Short-term investments provide liquidity, while longer-term investments typically offer higher yields.

- Reassessment and adjustment: Diversification requires regular attention. Periodically re-evaluate your portfolio and make adjustments to ensure your investments remain aligned with your financial goals and risk tolerance.

- Consult a financial expert: Collaborate with financial experts to ensure your diversification strategy is properly implemented and suits your specific needs and goals.

While diversification can help manage risk, it is important to remember that it does not guarantee a profit or completely eliminate the possibility of loss. It is just one tool in your investment strategy, and it should be used alongside other techniques such as buy-and-hold and dollar-cost averaging to build a resilient portfolio.

Risk Tolerance: When is Your Appetite for Risk Highest?

You may want to see also

Frequently asked questions

High-risk investments include stocks, real estate, venture capital, and hedge funds. These types of investments are characterized by higher returns but also higher volatility, making them well-suited for investors with a long-term investment horizon and a higher risk tolerance.

Low-risk investments include bonds, savings accounts, fixed deposits, money market funds, and treasury securities. These investments tend to have lower returns but also lower volatility when compared to high-risk investments.

Diversifying your portfolio by including a mix of both low-risk and high-risk investments is key to balancing risk and reward. This will help you achieve your investment goals while minimizing the risk of major losses.

Low-risk investments tend to have lower returns but also lower volatility. High-risk investments, on the other hand, tend to have higher returns but come with greater potential for loss. The level of risk associated with an investment depends on factors such as an individual's financial goals, risk tolerance, and time horizon.