When considering whether QYLD is a safe investment, it's important to understand the nature of the fund and its historical performance. QYLD, or the Invesco QQQ Trust, is an exchange-traded fund (ETF) that tracks the performance of the NASDAQ-100 Index. This ETF primarily invests in large-cap technology stocks, which are known for their high growth potential but also carry significant market risk. The fund's strategy involves leveraging the power of the NASDAQ-100 Index, which includes some of the most innovative and influential companies in the technology sector. However, like any investment, QYLD is not without its risks. Investors should carefully evaluate their risk tolerance and consider the potential volatility of the technology sector before making a decision.

What You'll Learn

- Risk Assessment: Evaluate QYLD's volatility and historical performance to determine its safety

- Market Analysis: Study QYLD's market position and competitors to gauge its stability

- Financial Health: Examine QYLD's financial statements for signs of financial distress or stability

- Regulatory Compliance: Ensure QYLD adheres to industry regulations to avoid legal risks

- Investor Sentiment: Monitor investor confidence and news to predict QYLD's future performance and safety

Risk Assessment: Evaluate QYLD's volatility and historical performance to determine its safety

When considering whether QYLD (Quicksilver Growth and Income Trust) is a safe investment, it's crucial to delve into its volatility and historical performance. This assessment is vital as it provides insights into the potential risks and rewards associated with this investment.

Volatility is a key indicator of risk. QYLD, as a closed-end fund, has experienced fluctuations in its share price over time. Analyzing its historical volatility can help investors understand the potential for price swings. A higher volatility suggests a more volatile investment, which may appeal to some but could also be a cause for concern for risk-averse investors. It's important to note that volatility is not the same as risk; volatility measures price changes, while risk encompasses the potential for financial loss.

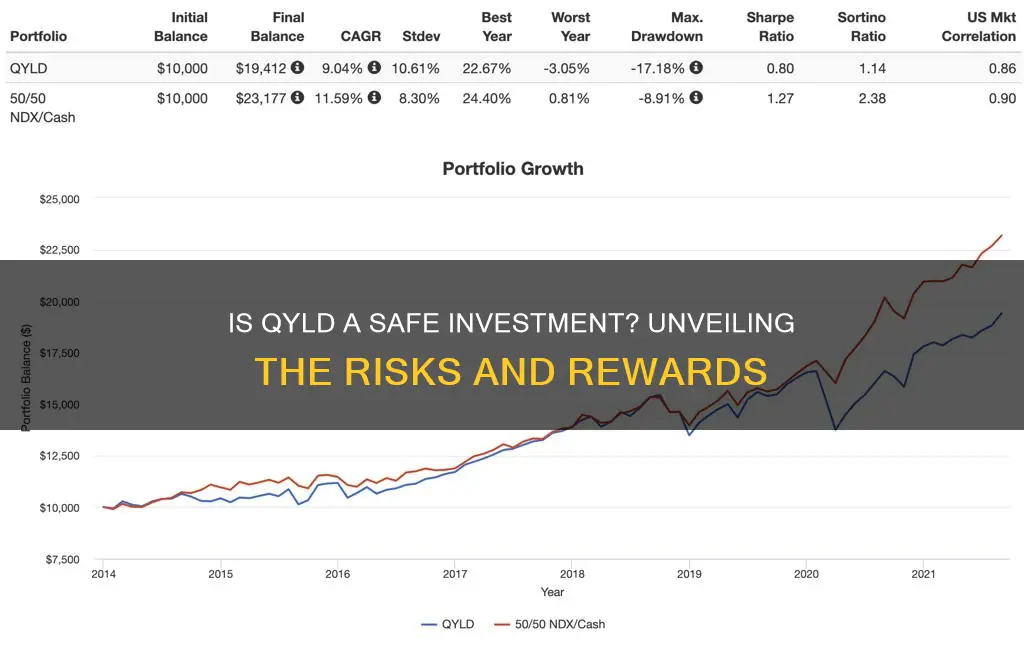

Historical performance is another critical factor. Examining QYLD's past returns and trends can offer valuable insights. Investors should look at both short-term and long-term performance to get a comprehensive view. A consistent track record of positive returns could indicate a stable and reliable investment, while significant dips or consistent losses might raise red flags. It's also beneficial to compare QYLD's performance against relevant benchmarks or industry standards to gauge its relative performance.

Additionally, understanding the underlying assets or sectors that QYLD invests in is essential. The fund's focus and diversification across different industries or asset classes can impact its overall risk profile. For instance, if QYLD primarily invests in a single sector, any downturn in that sector could have a more significant impact on the fund's performance and, consequently, its safety as an investment.

In summary, assessing the safety of QYLD involves a thorough examination of its volatility and historical performance. Investors should also consider the fund's investment strategy and the sectors it targets. By analyzing these factors, investors can make informed decisions about the suitability of QYLD for their investment portfolios, ensuring that they align with their risk tolerance and financial goals.

Investment Bankers: Strategies for Decision-Making Success

You may want to see also

Market Analysis: Study QYLD's market position and competitors to gauge its stability

When considering whether QYLD (Qualitative Yield) is a safe investment, a thorough market analysis is essential. This analysis should focus on understanding QYLD's market position, its competitors, and the overall stability of the investment. Here's a step-by-step guide to conducting this analysis:

Market Position:

- Identify Target Market: Clearly define the target market for QYLD. This could be investors seeking stable income, those looking for alternative investments, or specific demographic groups. Understanding the target market is crucial for assessing demand and potential growth.

- Analyze Market Share: Determine QYLD's market share within its target sector. Is it a leading player, a niche competitor, or a relatively unknown brand? A strong market position often indicates stability and a larger customer base.

- Competitive Advantage: What sets QYLD apart from its competitors? Is it superior product quality, innovative features, lower costs, or a unique value proposition? Identifying a competitive advantage can contribute to long-term stability and investor confidence.

Competitor Analysis:

- Identify Key Competitors: Research and list QYLD's main competitors in the same industry. Analyze their strengths, weaknesses, market share, and unique selling points. Understanding the competitive landscape is vital for assessing QYLD's position and potential threats.

- SWOT Analysis: Conduct a SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis for both QYLD and its competitors. This will help identify internal strengths and weaknesses, as well as external opportunities and threats. A comprehensive SWOT analysis provides valuable insights into the overall stability and risk profile of the investment.

- Competitive Pricing: Examine the pricing strategies of competitors. Is QYLD positioned as a premium, mid-range, or budget option? Understanding pricing dynamics can help investors gauge the perceived value and affordability of QYLD.

Industry Trends and Stability:

- Market Trends: Research industry trends and growth prospects. Is the sector experiencing expansion or contraction? Are there any disruptive technologies or economic factors that could impact QYLD's performance? Understanding industry dynamics is crucial for assessing long-term stability.

- Regulatory Environment: Analyze the regulatory environment within which QYLD operates. Are there any favorable or unfavorable regulations that could affect its operations and profitability? A stable regulatory environment is essential for investor confidence.

Financial Analysis:

- Financial Performance: Examine QYLD's financial statements (income statements, balance sheets, cash flow statements) for the past few years. Look for consistent growth, profitability, and financial stability. Strong financial performance often indicates a robust and safe investment.

- Risk Assessment: Conduct a risk assessment to identify potential financial risks associated with QYLD. This may include market risk, credit risk, liquidity risk, and operational risk. Understanding and mitigating these risks is crucial for making an informed investment decision.

By conducting a comprehensive market analysis, investors can gain valuable insights into QYLD's market position, competitors, industry trends, and financial stability. This analysis will help determine whether QYLD is a safe investment, considering its potential risks and rewards. Remember, a well-informed decision based on thorough research is essential for successful investing.

Esports Investing: Risks, Rewards, and What You Need to Know

You may want to see also

Financial Health: Examine QYLD's financial statements for signs of financial distress or stability

When considering whether QYLD is a safe investment, a thorough examination of its financial health is essential. This involves delving into the company's financial statements, which provide a comprehensive view of its financial position and performance. Here's a step-by-step guide to evaluating QYLD's financial health:

- Balance Sheet Analysis: Start by scrutinizing QYLD's balance sheet, which offers a snapshot of its assets, liabilities, and shareholders' equity. Look for any red flags, such as a significant increase in short-term liabilities or a decrease in long-term assets. A healthy balance sheet should demonstrate a strong equity position and manageable debt levels. Assess the company's ability to meet its short-term obligations and its long-term financial commitments.

- Profitability and Revenue Trends: Financial statements provide insights into QYLD's profitability and revenue generation. Examine the income statement to identify trends in revenue growth, profit margins, and overall profitability. Consistent revenue growth and stable profit margins indicate a healthy and expanding business. However, be cautious if there are sudden drops in revenue or increasing costs, as these could signal financial distress.

- Cash Flow Management: Assess QYLD's cash flow statements to understand its liquidity and ability to generate cash. Positive cash flow from operations is crucial for the company's sustainability. Analyze the sources and uses of cash, including investments, financing activities, and operating cash flow. A consistent positive cash flow suggests that QYLD can fund its operations and investments, making it a more financially stable investment.

- Financial Ratios and Metrics: Financial ratios provide a quantitative assessment of QYLD's financial health. Calculate and analyze key ratios such as the debt-to-equity ratio, return on assets, and current ratio. These metrics help compare QYLD's performance against industry peers and identify potential financial vulnerabilities. For instance, a high debt-to-equity ratio might indicate a reliance on debt, which could be a risk factor.

- Industry and Market Position: Consider QYLD's position within its industry and market. Is the company a market leader or a niche player? Understanding its market share and competitive landscape can provide context for its financial performance. A strong market position often correlates with better financial health, as it allows for pricing power and a more stable revenue stream.

By thoroughly examining QYLD's financial statements and employing these analytical techniques, investors can make informed decisions about the safety and viability of their investment in QYLD. It is crucial to stay updated with the company's financial disclosures and seek professional advice when needed to ensure a well-rounded investment strategy.

Alternative Investments: High Risk or Worthwhile?

You may want to see also

Regulatory Compliance: Ensure QYLD adheres to industry regulations to avoid legal risks

When considering QYLD as an investment, it's crucial to delve into the regulatory landscape to ensure compliance and mitigate potential legal risks. The financial industry is heavily regulated to protect investors and maintain market integrity. Here's a breakdown of how to navigate this aspect:

Understand Industry Regulations: Start by familiarizing yourself with the regulatory framework governing the investment industry. This includes laws and regulations set by financial authorities such as the Securities and Exchange Commission (SEC) in the United States or similar bodies in other countries. These regulations often cover areas like disclosure requirements, investor protection, and anti-fraud measures. For instance, the SEC's Regulation D provides guidelines for private placements, which might be relevant if QYLD involves offering securities to accredited investors.

Compliance with Investment Advisers Act: If QYLD involves providing investment advice, the Investment Advisers Act of 1940 is a critical consideration. This act requires investment advisers to register with the SEC and adhere to specific standards of conduct. Ensure that any advice related to QYLD is provided in compliance with this legislation, including accurate and timely disclosure of fees, conflicts of interest, and performance information.

Know Your Customer (KYC) and Anti-Money Laundering (AML) Checks: Financial institutions and investment firms are mandated to perform thorough KYC and AML procedures. These checks help verify the identity of investors and ensure that funds are not being used for illegal activities. Implement robust KYC processes for QYLD to ensure that all investors meet the required eligibility criteria and that their activities comply with anti-money laundering regulations.

Disclosure and Transparency: Regulatory compliance heavily emphasizes transparency and disclosure. Ensure that all relevant information about QYLD is disclosed to investors, including risks, fees, and potential conflicts of interest. Provide clear and concise documentation, such as offering memoranda or prospectuses, to ensure investors have all the necessary details to make informed decisions.

Stay Updated on Regulatory Changes: The regulatory environment is dynamic, with frequent updates and amendments. Stay informed about any changes in regulations that might impact QYLD. Subscribe to relevant newsletters, follow industry publications, and engage with legal experts to ensure that your investment practices remain compliant as regulations evolve.

By diligently addressing these regulatory compliance aspects, you can significantly reduce legal risks associated with QYLD. It demonstrates a commitment to ethical practices and helps build trust with investors, which is essential for long-term success in the investment industry.

Is Stash Investment App Secure? Unveiling the Truth

You may want to see also

Investor Sentiment: Monitor investor confidence and news to predict QYLD's future performance and safety

When considering the safety of an investment like QYLD, monitoring investor sentiment and staying abreast of relevant news is crucial. This approach allows you to gauge the market's perception and potential future performance of QYLD. Here's a detailed breakdown of how to approach this:

Understanding Investor Confidence:

Investor confidence plays a pivotal role in shaping the trajectory of QYLD's performance. High investor confidence often indicates a positive outlook, suggesting that more investors are optimistic about QYLD's prospects. This optimism can lead to increased demand for QYLD, potentially driving up its price. Conversely, low investor confidence might signal concerns or uncertainties about QYLD, potentially causing a decline in its value.

News Monitoring:

Staying informed about news related to QYLD is essential. This includes keeping an eye on company-specific announcements, industry developments, and broader economic trends that could impact QYLD. For instance, positive news about QYLD's performance, new product launches, or strategic partnerships can boost investor confidence and drive up the stock price. On the other hand, negative news, such as financial setbacks, regulatory changes, or competitor advancements, might erode investor trust and lead to a decrease in QYLD's value.

Analyzing Market Trends:

Beyond individual news items, it's important to analyze broader market trends to understand the overall sentiment towards QYLD. This involves tracking QYLD's performance relative to its peers and the broader market. If QYLD consistently outperforms its competitors and the market, it may indicate strong investor confidence and a positive outlook. Conversely, underperformance could suggest that investors are becoming increasingly cautious or that there are underlying issues with QYLD that need to be addressed.

Risk Assessment and Diversification:

While monitoring investor sentiment and news is crucial, it's equally important to conduct a comprehensive risk assessment of QYLD. This includes evaluating the company's financial health, management team, competitive landscape, and industry trends. Diversification is also key to managing risk. Consider allocating your investments across different asset classes and sectors to mitigate the impact of any single investment's performance.

By actively monitoring investor confidence and relevant news, you can gain valuable insights into the potential future performance and safety of QYLD. This approach empowers you to make informed investment decisions, adapt to changing market conditions, and potentially capitalize on opportunities that arise in the dynamic world of finance. Remember, staying informed and proactive is essential for successful long-term investing.

Axie Infinity: A Safe Investment Haven or a Crypto Pitfall?

You may want to see also

Frequently asked questions

QYLD, or the Invesco QQQ Trust, is an exchange-traded fund (ETF) that tracks the performance of the Nasdaq-100 Index. While it is generally considered a safe investment, it is important to understand the risks associated with it. QYLD primarily invests in large-cap technology and other growth-oriented companies, which can be volatile, especially during market downturns. However, its focus on a diversified portfolio of large, well-established companies can provide a level of stability.

The primary risk of investing in QYLD is market volatility. As an ETF that tracks the Nasdaq-100, it is susceptible to the performance of the underlying technology and growth sectors. During economic downturns or market corrections, these sectors can experience significant declines, impacting the value of QYLD. Additionally, like any investment, there are risks associated with the fund's management and operational expenses, which can affect long-term performance.

QYLD's safety profile can be compared to other large-cap index funds or ETFs that track the S&P 500 or other broad market indices. These funds generally offer more stability and diversification, reducing the impact of individual stock volatility. However, it's important to note that no investment is entirely risk-free. Diversification within a portfolio and a long-term investment horizon can help mitigate risks and provide a more stable investment experience.