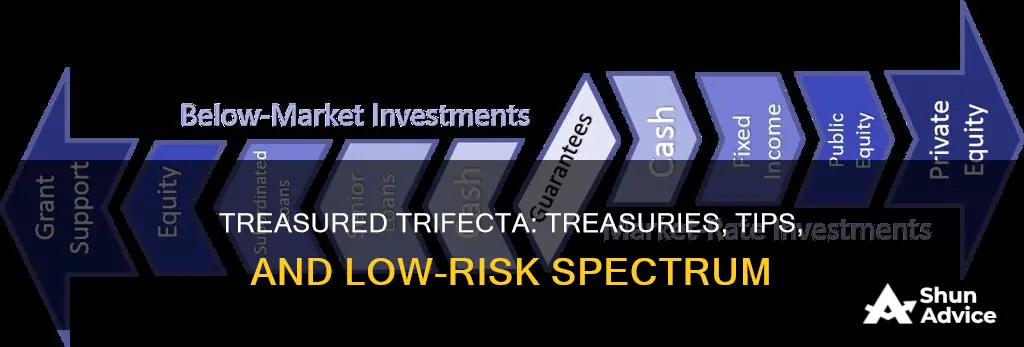

The risk-return spectrum is a way to visualise the relationship between the amount of return on an investment and the amount of risk undertaken. The more return sought, the more risk that must be taken on. Different types of investments carry different levels of risk and potential return, and investors need to balance these factors according to their goals, preferences, and tolerance. Generally, higher-risk investments offer higher potential returns, while lower-risk investments offer lower potential returns.

The risk-return spectrum can be divided into four main categories: cash equivalents, fixed income, equities, and alternative investments. Cash equivalents, such as money market funds and treasury bills, are traditionally the lowest-risk and lowest-return investments. Fixed income investments, like bonds, are slightly higher-risk and offer higher returns. Equities, or stocks, represent ownership in a company and are considered higher-risk and higher-return. Finally, alternative investments, including hedge funds, private equity, and real estate, are the highest-risk and highest-return options, offering the possibility of exceptional returns but also involving high fees and low liquidity.

While the risk-return spectrum is a useful guide, it is not a fixed concept. The spectrum can vary depending on market conditions and the specific characteristics of each investment. For example, some equities may be riskier than certain alternative investments, and fixed-income investments may occasionally offer lower returns than cash equivalents. Therefore, investors should consider other factors in addition to the spectrum when making investment decisions.

| Characteristics | Values |

|---|---|

| Risk | Average compared to funds in the same category |

| Volatility Measurements | Reflect the uncertainty or risk of change in a security's value |

| Investment Objective | A high level of current income with moderate share price fluctuation |

| Underlying Holdings | Potential for a high level of current income and the potential for attractive long-term returns with moderate risk |

| Yield and Share Price | Vary with interest rate changes |

| Investment in Other Funds | The fund bears the risk that its underlying funds will fail to successfully employ their investment strategies |

| Interest Rates | A rise in interest rates causes the price of a fixed-rate debt instrument to fall and its yield to rise |

| Junk Investing | Investments in bonds that are rated below investment grade expose an underlying fund to greater volatility and credit risk |

| International Investing | Non-U.S. securities tend to be more volatile and have lower overall liquidity than U.S. securities |

| Emerging Markets | Investments in emerging market countries are subject to greater risk and overall volatility than investments in the U.S. and other developed markets |

What You'll Learn

Low-risk investments

- Money market accounts: These are savings accounts that allow you to spend directly from the account, with higher interest rates than traditional savings accounts. They are FDIC-insured up to $250,000 per institution per investor.

- High-yield savings accounts: These accounts offer higher interest rates than traditional savings accounts and can be found at online banks. They are also FDIC-insured.

- Cash management accounts: These accounts combine the features of checking and investment accounts, allowing you to access funds while your money is invested in high-liquidity, low-yield investments. They are FDIC-insured or protected by similar insurance.

- Certificates of deposit (CDs): CDs are timed deposit accounts with a fixed interest rate and maturity date. They are FDIC-insured and can be purchased from your bank.

- Treasury bills, notes, and bonds: These are considered among the safest investments as they are backed by the US government. You are essentially giving a loan to the government, which pays you interest at regular intervals.

- Government bond funds: These are packages of debt securities issued by the US government. Investing in a fund diversifies your investment across multiple assets, and your interest may be exempt from federal income taxes.

- Municipal bond funds: These work similarly to government bond funds but invest in local and state governments. The income generated may be exempt from federal, state, and local taxes.

- Corporate bond funds: These are packages of bonds issued by corporations, with yields varying based on the credit rating of the companies. They have higher yields than government and municipal bonds but are subject to credit risk.

- Index funds: These are bundles of stocks that aim to replicate the performance of a specific index, like the S&P 500. Diversification across many stocks mitigates the risk, and there is potential for better returns depending on market conditions.

While not completely risk-free, these investment options are considered low-risk due to their stable nature, insurance, or government backing. They are suitable for investors seeking to preserve their capital and generate consistent, albeit modest, returns.

Building an Investment Portfolio: Excel Essentials

You may want to see also

High-risk investments

- Options investing: Options offer high rewards for investors who try to time the market. They allow investors to purchase a stock or commodity equity at a specified price within a future date range. However, if the security price turns out to be less desirable than predicted, the investor is not obligated to purchase or sell the option security. This form of investment is precarious because it places time requirements on the purchase or sale of securities, and professional investors often discourage timing the market.

- Initial Public Offerings (IPOs): IPOs are when a company first offers its shares for sale to the public. Some IPOs attract a lot of attention that can skew valuations and short-term returns. Others are less high-profile and offer investors the chance to buy shares while a company is undervalued, leading to high short- and long-term returns. However, most IPOs fail to generate significant returns or any returns at all.

- Venture capital: Investing in startups or early-stage companies can offer high returns if the company succeeds, but it is also a risky venture as many startups fail. There is low transparency in the ability of management to carry out the necessary functions to support the business, and venture capital investments usually have very high minimums.

- Foreign emerging markets: Investing in countries experiencing high economic growth can provide opportunities for high returns. However, the period of extreme growth may be shorter than expected, and political changes can suddenly modify the economy.

- Real Estate Investment Trusts (REITs): REITs offer investors high dividends in exchange for tax breaks from the government. They invest in pools of commercial or residential real estate. However, REITs are subject to swings based on developments in the overall economy, interest rates, and the state of the real estate market, which can flourish or experience depression.

- High-yield bonds: These instruments, issued by foreign governments or high-debt companies, offer investors high returns but also carry the potential for total loss.

- Currency trading: Quick-paced changes in exchange rates offer a high-risk, high-reward environment for traders and investors.

- Penny stocks: Penny stocks are typically sold for $5 or less per share and have a lack of liquidity or ready buyers due to the nature of the company and the small size of the shares. They are speculative and can result in a total loss of investment if overvalued.

It is important to note that high-risk investments are not suitable for everyone, and it is recommended to do thorough research before investing.

Understanding the Cost of Managed Investments: Average Expense Percentage Rates

You may want to see also

Risk-return spectrum

The T. Rowe Price Spectrum Income Fund (RPSIX) is a mutual fund that seeks to provide a high level of current income with moderate share price fluctuation. The fund achieves this through broad diversification, investing in a variety of U.S. and international bond funds, including emerging market bond funds, a money market fund, and an income-oriented stock fund.

When considering the risk-return spectrum of this fund, it is important to understand the underlying risks and potential returns. According to Morningstar, the fund has an average risk compared to other funds in the same category. This indicates that it is not a low-risk investment option, but it also doesn't carry significantly higher risk.

One of the key risks associated with the fund is the potential for underlying funds to fail to successfully employ their investment strategies. This could cause the fund to underperform compared to similar funds. Additionally, interest rate changes can impact the yield and share price of the fund, and investments in non-U.S. securities and emerging markets may introduce higher volatility and overall risk.

In terms of returns, the fund has a history of providing moderate returns. Over the past year, it returned 3.05%, while over the past three and five years, it returned -1.05% and 1.64% respectively. It is important to note that past performance does not guarantee future results, and the fund's returns may fluctuate over time.

Overall, the T. Rowe Price Spectrum Income Fund aims to balance risk and return by diversifying its investments across various market segments. While it may not be considered a low-risk investment, it seeks to provide moderate share price fluctuation and the potential for attractive long-term returns.

Roth Accounts: Savings or Investment?

You may want to see also

Risk tolerance

The fund's primary objective is to achieve a high level of current income, and it aims to do this through a highly diversified approach. By investing in a broad range of T. Rowe Price mutual funds representing specific market segments, the fund seeks to reduce the impact of declining markets and benefit from strong performance in particular market segments over time. This diversification strategy helps to moderate risk and volatility, as the fund is not overly reliant on the performance of any single market or sector.

According to Morningstar, the fund's risk is average compared to others in the same category. It has a volatility measurement that reflects the uncertainty or risk of change in the security's value. The fund's underlying holdings, which include a range of U.S. and international bond funds, an income-oriented stock fund, and a money market fund, contribute to its overall risk profile. These holdings provide the potential for attractive long-term returns with moderate risk.

However, it is important to remember that all investments carry some degree of risk. The fund's prospectus outlines various risks associated with investing in the T. Rowe Price Spectrum Income Fund, including interest rate risk, credit risk, and the risk of losing the principal amount invested. Additionally, investments in non-U.S. securities and emerging markets may introduce greater volatility and credit risk due to adverse economic, political, or social developments.

Ultimately, an investor's decision to choose the T. Rowe Price Spectrum Income Fund should consider their own risk tolerance and investment objectives. The fund's moderate risk profile makes it suitable for those seeking a balanced approach, but individual investors should carefully evaluate their financial goals, time horizon, and capacity for risk before making any investment decisions.

Creating Investment Portfolio Projections: A Comprehensive Guide

You may want to see also

Risk capacity

When considering the T. Rowe Price Spectrum Income Fund, it is important to understand the concept of risk capacity, which is a crucial aspect of investment planning. Risk capacity refers to an investor's ability to take on investment risks without jeopardising their financial goals. It involves assessing the potential for losses within an investment portfolio and determining how much risk an investor can comfortably handle.

The T. Rowe Price Spectrum Income Fund (RPSIX) is designed to offer a high level of current income with moderate share price fluctuation. The fund achieves this through broad diversification, investing in a variety of U.S. and international bond funds, including emerging market bond funds, a money market fund, and an income-oriented stock fund. By diversifying across multiple market segments, the fund aims to reduce the impact of declining markets and take advantage of strong performance in specific segments over time.

According to Morningstar, the risk associated with the T. Rowe Price Spectrum Income Fund is average when compared to other funds in the same category. This assessment takes into account volatility measurements, which reflect the uncertainty or risk of change in the value of securities held by the fund. However, it is important to remember that all investments are subject to market risk, including the possible loss of principal.

When evaluating your risk capacity for the T. Rowe Price Spectrum Income Fund, it is essential to consider your investment goals, time horizon, and risk tolerance. Ask yourself how long you plan to invest and whether you can tolerate price fluctuations in the short and long term. Additionally, assess your financial situation and determine if you can withstand potential losses without compromising your financial objectives.

By understanding your risk capacity, you can make informed decisions about investing in the T. Rowe Price Spectrum Income Fund. Remember, investing always carries some level of risk, and it is crucial to carefully consider your own financial circumstances before making any investment choices.

Buffett's India Investment: Has He Taken the Plunge?

You may want to see also

Frequently asked questions

The fund seeks a high level of current income with moderate share price fluctuation. It broadly diversifies its assets among a set of T. Rowe Price mutual funds representing specific market segments.

The fund has an average risk level compared to other funds in the same category, according to Morningstar. It has moderate volatility and a medium/moderate credit quality.

The fund has below-average fees compared to other funds in its category. The expense ratio is 0.62%, while the distribution fee is low.

The minimum initial investment required is $2,500.