Target-date funds are a popular choice for investors saving for retirement. They are designed to help manage investment risk and are based on an investor's anticipated retirement year. These funds are a set it and forget it investment option, where investors choose a fund with a target year closest to their anticipated retirement year. The fund then automatically rebalances and reallocates assets, typically shifting from riskier investments to more conservative investments as the target date approaches. While target-date funds offer a convenient and diversified investment option, they may also be too conservative and have high fees. Therefore, it is important for investors to carefully consider the advantages and disadvantages of target-date funds before deciding whether to invest in them for retirement.

| Characteristics | Values |

|---|---|

| Investment Type | Retirement funds are a type of investment account designed to help individuals save for their retirement years. Target funds, or target-date funds, are a type of mutual fund or exchange-traded fund (ETF) that focuses on a specific retirement date. |

| Investment Objective | Retirement funds aim to provide income and capital growth over the long term, taking into account an individual's risk tolerance, time horizon, and financial goals for retirement. Target funds have a specific target date in mind, and the investment strategy is tailored towards that date, gradually shifting from riskier to more conservative investments. |

| Investment Strategy | Retirement funds can be invested in a variety of assets, including stocks, bonds, mutual funds, ETFs, and other securities. Target funds typically follow a "glide path," gradually rebalancing the portfolio from higher-risk, higher-reward assets to more conservative investments as the target date approaches. |

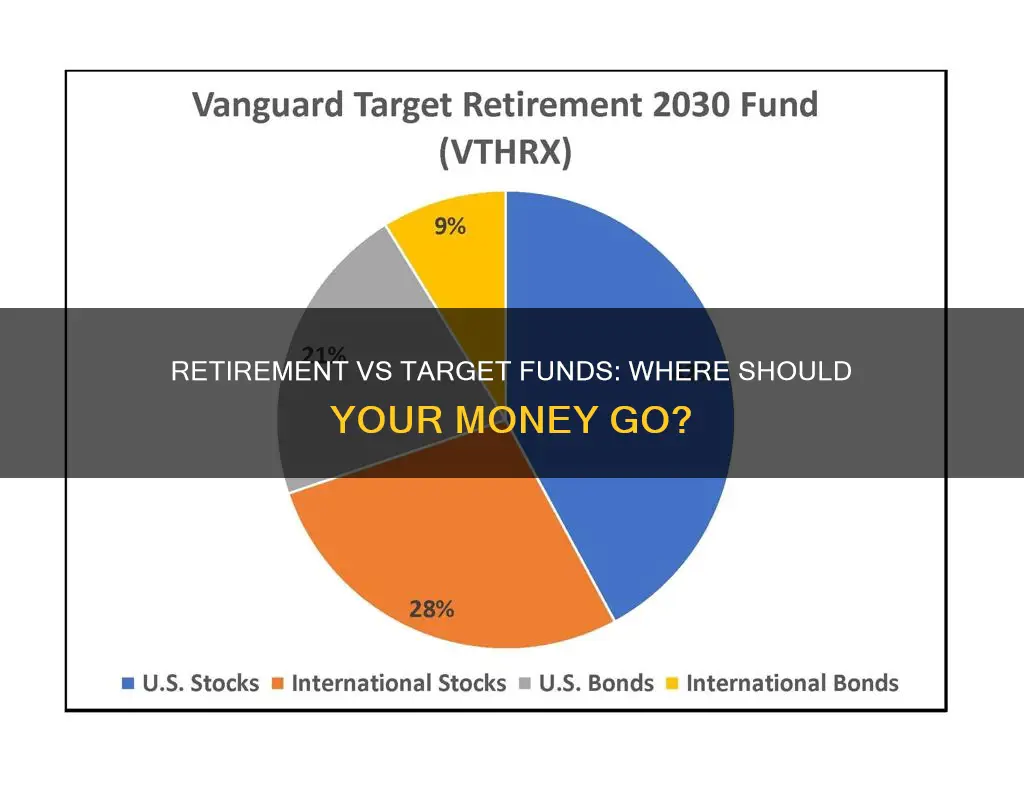

| Risk Profile | Retirement funds can vary in their risk profile depending on the individual's risk tolerance and financial goals. Target funds generally start with a higher-risk profile, investing heavily in stocks and equities, and gradually shift towards more conservative investments like bonds, fixed-income securities, and cash as the target date nears. |

| Diversification | Retirement funds can provide diversification across different asset classes, sectors, and geographic regions. Target funds also offer diversification by investing in a range of underlying mutual funds or ETFs, providing exposure to a wide variety of stocks and bonds. |

| Fees and Expenses | Retirement funds may have various fees and expenses associated with them, such as management fees, transaction fees, and expense ratios. Target funds typically have expense ratios that vary across different funds and fund providers. |

| Investor Involvement | Retirement funds may require ongoing monitoring and adjustments by the investor to ensure the portfolio aligns with their financial goals and risk tolerance. Target funds are often considered a "set it and forget it" investment, as the fund automatically rebalances and adjusts the asset allocation over time without requiring active involvement from the investor. |

| Suitability | Retirement funds are suitable for individuals who are saving for their retirement and want a comprehensive investment solution. Target funds are particularly attractive to investors who want a simple, hands-off approach to retirement investing, as the fund manages the asset allocation and rebalancing based on the target date. |

What You'll Learn

Target-date funds are a set it and forget it investment option

Target-date funds are a "set it and forget it" investment option. They are designed to be a simple, convenient, and low-maintenance way to save for retirement. Here's how they work and why they might be a good choice for you:

How Target-Date Funds Work

Target-date funds are mutual funds or exchange-traded funds that adjust their asset allocation over time to meet your retirement goals. You pick a fund with a target retirement year, such as 2040 or 2050, and the fund managers handle the rest. As you get closer to retirement, the fund gradually shifts its focus from riskier investments, like stocks, to more conservative ones, like bonds and cash, to preserve your wealth. This adjustment of the asset mix over time is known as a "glide path."

Advantages of Target-Date Funds

Autopilot Investing:

Target-date funds allow you to put your investing activities on autopilot. You don't need to constantly monitor and adjust your portfolio, reducing the stress associated with financial planning as you approach retirement. The fund has a defined trajectory, and as you get closer to your target retirement date, it automatically adjusts to make your portfolio more conservative, helping to ensure your money is there when you need it.

Flexibility:

Target-date funds offer flexibility. If your retirement plans change and you decide to work for a few more years, you can easily switch to a fund with a later target date.

Lower Fees:

Due to their increasing popularity, target-date funds have become more competitive, and their fees have come down significantly. As of the end of 2022, the asset-weighted average expense ratio was 0.32%, which means you'd pay $32 annually for every $10,000 invested.

Disadvantages of Target-Date Funds

Fund Expenses:

While fees have been decreasing, you may still be able to find cheaper funds and manage your portfolio yourself. It's important to compare expense ratios before selecting a target-date fund to keep expenses as low as possible and maximize your potential earnings.

No Guaranteed Earnings:

Like any investment, target-date funds come with risks. There is no guarantee of earnings, and the potential for loss is always present. For example, during times of rising interest rates, even conservative funds can experience declines as both bond and stock prices may be affected.

Potential for Over-Conservatism:

As you approach your target retirement date, target-date funds may shift too much of your portfolio into conservative investments too quickly. This could lower your overall potential returns and impact your retirement income. To mitigate this, some advisors suggest choosing a target-date fund with a date that is 5-10 years later than your actual planned retirement, as these funds will have a higher allocation to stocks, providing more potential for growth.

Who Are Target-Date Funds Good For?

Target-date funds are an excellent option for those who want a hands-off, stress-free approach to retirement investing. They are particularly beneficial for young investors just starting their investment journey, as they provide instant diversification and remove the need for constant rebalancing. Additionally, target-date funds can help investors avoid making emotionally driven investment decisions during market volatility, which often leads to buying high and selling low.

While target-date funds offer a simple solution, remember that they are not perfect for everyone. Over time, as your investment knowledge grows and your asset accumulation increases, you may want to reconsider your options and work with a financial advisor to create a more customized retirement plan that aligns with your specific goals.

Maharlika Investment Fund: Approved or Not?

You may want to see also

Target-date funds are designed to manage investment risk

Target-date funds are designed to help manage investment risk. They do this by shifting the risk profile of their investments as the investor gets closer to retirement age. This shift across asset classes is known as a "glide path", and it is designed to reduce investment risk over time.

When investors choose a target-date fund, they select a fund with a target year that is closest to the year they anticipate retiring. For example, an investor who is 30 years old and wishes to retire at 65 might choose a target-date fund with a target date of 2050. The closer the fund gets to its target date, the more it focuses on assets that traditionally have a lower risk profile, such as fixed income, cash, and cash equivalents.

Target-date funds are typically structured as mutual funds, and most are structured as a "fund of funds", meaning that they invest in other mutual funds rather than in individual securities. These funds are designed to be a "set it and forget it" investment option, with the fund's asset mix automatically adjusting over time to become less focused on potential growth and more focused on producing income.

While target-date funds aim to reduce risk over time, they are not risk-free, even when the target date has been reached. Target-date funds do not provide guaranteed income in retirement and can lose money if the stocks and bonds owned by the fund drop in value. It is also important to note that funds with identical target dates may have very different investment strategies and asset allocations, which can affect how risky they are.

Target-date funds can be a good option for investors who want to take a hands-off approach to their retirement planning, or for those who are inclined to frequently change their fund allocation. They provide a well-balanced mix of stocks and bonds, with an asset allocation that rebalances towards more conservative investments as the investor ages. However, it is important to keep in mind that target-date funds may not be suitable for everyone, and there may be cheaper and more flexible alternatives available.

Blackstone Energy Fund: A Guide to Investing in Their Success

You may want to see also

Target-date funds are a default option for many employer-sponsored 401(k) plans

A target-date fund is a mutual fund or exchange-traded fund that rebalances and reallocates assets as you get closer to retirement. The fund is designed as a one-stop investment shop with a diversified set of asset classes. With a target-date fund, investors pick the year they think they'll need to access the funds, and the fund management company takes care of the rest.

Target-date funds are often structured as a "fund of funds," meaning they invest in other mutual funds rather than individual securities. The fund's managers gradually shift the asset allocation to fewer stocks and more bonds so that the fund becomes more conservative as the investor gets closer to retirement. This is known as a glide path.

The Pension Protection Act of 2006 helped employers develop retirement plans and set up automatic enrolment, making target-date funds an easy option for retirement plans with their low fees and diversified portfolios. According to Vanguard, 64% of retirement contributions in 2023 were invested in target-date funds, up from 59% in 2022.

The chief appeal of target-date funds is their simplicity. They offer a well-balanced mix of stocks and bonds, with an asset allocation that rebalances towards more conservative investments as the investor ages. This makes them a good default option for new investors, especially those who want to take a hands-off approach to their retirement investments.

However, it's important to note that target-date funds may not be suitable for everyone. They may be too conservative for some investors, and the one-size-fits-all strategy may not meet the needs of all individuals. Additionally, while target-date funds have become more affordable, they may still carry higher fees than index funds.

Hedge Fund Investment Strategies: Where and How They Invest

You may want to see also

Target-date funds may be too conservative

Target-date funds are designed to become more conservative as the investor gets closer to retirement age. This is done to preserve wealth. However, this can be a problem if the fund becomes too conservative, as some research suggests. According to research by academics at the University of Illinois at Urbana-Champaign and MIT, target-date funds start becoming too conservative for most people around the age of 50.

The researchers found that a typical upper-middle-class couple without access to family wealth should put 80% of their portfolio in stocks at age 45, declining to a steady 60% at and during retirement. While target-date funds do a good job of stock ownership initially, they become too conservative after the age of 50, according to the report. At retirement age, these funds typically have 50% stock holdings, declining to between 30% and 40% in later years.

As people are living longer, retirees may need the extra growth provided by stocks. One solution to this problem is to buy a target-date fund with a retirement date five or ten years later than you actually intend to retire. This later-dated fund will have a higher allocation to stocks, providing more growth potential.

Another issue with target-date funds becoming too conservative is that they may not provide enough income for retirees. For example, the Vanguard Target Retirement 2025 Fund (VTTVX) fell more than 15% in 2022, despite being close to its target date. This shows that even conservative funds can lose money, and that a more aggressive approach may be needed to generate sufficient income.

In summary, while target-date funds are designed to become more conservative over time to preserve wealth, they may become too conservative too quickly, reducing potential returns and income for retirees. This is an important consideration when deciding whether to invest in a retirement or target fund.

Angel Fund Investments: Dollars, Income, and Corporations

You may want to see also

Target-date funds can be too broad

Target-date funds are designed to be a one-size-fits-all investment option. However, this means that they may not be tailored to an individual's specific needs and circumstances.

According to Morningstar research, roughly 60% of target-date funds are off-the-shelf, and 80% of target-date fund assets are managed by just five companies: American Funds, BlackRock, Fidelity, T. Rowe Price, and Vanguard. This means that workers across different income brackets are offered the same plan, despite their income. For example, a Gap sales clerk and an insurance salesman trader will have a similar percentage of their target-date fund invested in equities at 65, despite their different salaries.

Target-date funds are also designed to become more conservative over time, which may not be suitable for all investors. Research by academics at the University of Illinois at Urbana-Champaign and MIT found that target-date funds start becoming too conservative for most people around the age of 50. The study found that a typical upper-middle-class couple without access to family wealth should put 80% of their portfolio in stocks at age 45 and then decline to a steady 60% at and during retirement. In contrast, target-date funds tend to decrease their stock allocation to around 50% by the time the investor reaches retirement age.

Furthermore, while target-date funds are designed to reduce investment risk over time, they are not risk-free. Like any investment, there is the potential for target-date funds to lose money if the stocks and bonds owned by the fund drop in value. For example, the Vanguard Target Retirement 2025 Fund (VTTVX) fell more than 15% in 2022, despite being close to its target date.

Finally, target-date funds may not be suitable for investors who want to be actively involved in their investment choices. These funds limit investment choices and decisions and are designed for those who want to take a hands-off approach to their retirement planning.

Franklin Templeton Mutual Funds: Safe Investment Haven?

You may want to see also

Frequently asked questions

A target-date fund is a mutual fund or exchange-traded fund that automatically rebalances and reallocates assets as you get closer to retirement. The fund is designed as a one-stop investment shop with a diversified set of asset classes. The target date in the fund's name refers to the approximate year an investor will retire and leave the workforce.

Target-date funds offer a simple, convenient, and diversified investment option for those saving for retirement. They are a "set it and forget it" investment, automatically adjusting the asset mix to become more conservative as investors get older. They also handle the challenging task of optimising asset allocation and rebalancing investment holdings.

Target-date funds have some drawbacks, including potentially high fees and the possibility of becoming too conservative too quickly, which could reduce overall returns. They may also be too broad and not tailored to an individual's specific needs and income.

When choosing a target-date fund, consider the fund's fees, investment strategy, and asset allocation to ensure it aligns with your risk tolerance and investment goals. Compare different funds with similar target dates to find the one that best matches your circumstances and needs.