When considering whether to invest in euros or dollars, it's important to understand the factors that influence the value of these currencies and how they might impact your investment strategy. Both the euro and the US dollar are major global currencies, but their exchange rates and economic conditions can vary significantly. Factors such as interest rates, inflation, and economic growth can all play a role in determining which currency might be a better investment choice. Additionally, the stability and political climate of the countries issuing these currencies can also affect their value. Understanding these dynamics can help investors make informed decisions about where to allocate their funds.

What You'll Learn

- Exchange Rates: Fluctuations impact investment returns; monitor trends for informed decisions

- Inflation: Eurozone inflation rates affect purchasing power; compare with US inflation

- Economic Indicators: GDP, unemployment, and interest rates influence investment appeal

- Political Stability: Political risks and economic policies impact currency value and investment safety

- Diversification: Consider euro-denominated assets for portfolio diversification and risk management

Exchange Rates: Fluctuations impact investment returns; monitor trends for informed decisions

When considering whether to invest in euros or dollars, understanding the dynamics of exchange rates is crucial. Exchange rates fluctuate constantly, and these movements can significantly impact the returns on your investments. Here's a detailed look at how exchange rate fluctuations can influence your investment decisions:

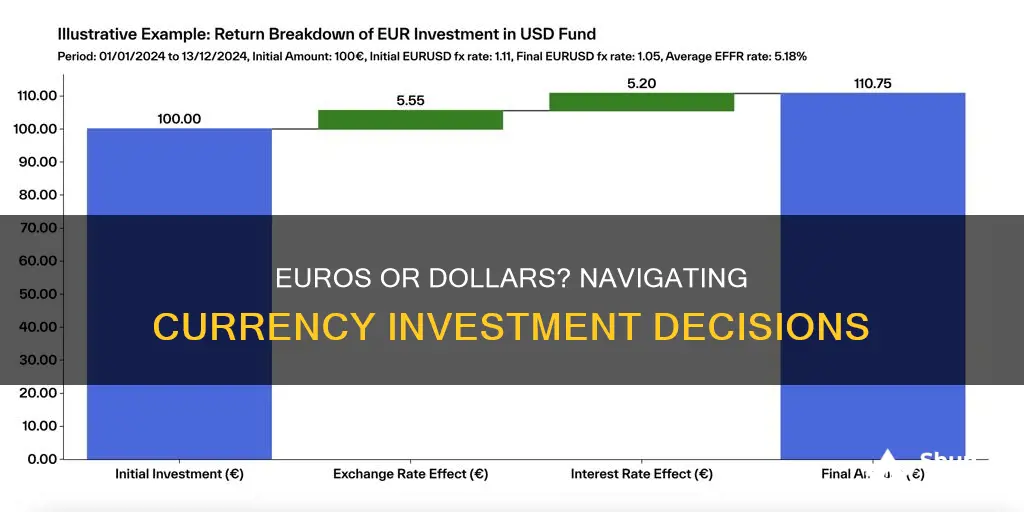

Impact on Investment Returns: Exchange rates play a pivotal role in determining the value of your investments denominated in foreign currencies. If you invest in European assets denominated in euros, the strength of the euro against the dollar will directly affect your investment's value in dollars. A stronger euro means your investment will be worth more in dollars, while a weaker euro will result in a lower value. Similarly, for investments in US assets denominated in dollars, the value of the dollar against other currencies, including the euro, is essential.

Monitoring Exchange Rate Trends: To make informed investment decisions, it's imperative to monitor exchange rate trends. Economic indicators, geopolitical events, and central bank policies are key drivers of exchange rate fluctuations. For instance, if the European Central Bank (ECB) decides to raise interest rates, it could strengthen the euro. Conversely, a significant economic downturn in the Eurozone might lead to a depreciation of the euro. Keeping an eye on these factors can help you anticipate exchange rate movements and their potential impact on your investments.

Diversification and Risk Management: Exchange rate fluctuations can introduce volatility into your investment portfolio. To mitigate this risk, consider diversifying your investments across multiple currencies. This strategy ensures that the impact of exchange rate movements on any single investment is minimized. For example, if you have a portfolio with a mix of euro-denominated and dollar-denominated assets, the gains or losses from exchange rate fluctuations will offset each other to some extent.

Long-Term vs. Short-Term Investments: The impact of exchange rates on investments can vary depending on their duration. For long-term investments, exchange rate fluctuations may have a less significant effect over an extended period. However, for short-term trades or highly speculative investments, exchange rate movements can be more pronounced and influential. Understanding the time horizon of your investments is crucial in deciding whether to focus on short-term exchange rate trends or long-term economic fundamentals.

Stay Informed and Adapt: Exchange rates are dynamic and ever-changing, so staying informed is essential. Utilize financial news sources, economic calendars, and currency conversion tools to keep track of exchange rate trends. Additionally, consider consulting financial advisors who can provide personalized guidance based on your investment goals and risk tolerance. Being proactive in monitoring exchange rates will enable you to make timely adjustments to your investment strategy.

Whole Life: Smart Investment?

You may want to see also

Inflation: Eurozone inflation rates affect purchasing power; compare with US inflation

The Eurozone's inflation rates have a significant impact on the purchasing power of its residents, and this is an essential factor to consider when deciding whether to invest in the Euro or the US Dollar. The Eurozone's inflation rate has been relatively stable over the past few years, but it has shown some fluctuations, which can directly affect the value of the currency and, consequently, the returns on investment.

In the Eurozone, the European Central Bank (ECB) plays a crucial role in managing inflation. The ECB's primary goal is to maintain price stability, which is defined as a year-on-year increase in the Harmonized Index of Consumer Prices (HICP) of below 2%. When the inflation rate exceeds this target, the ECB may take measures to curb spending and borrowing, which could potentially lead to a decrease in the Euro's value. On the other hand, if the inflation rate is too low, the ECB might implement expansionary policies to stimulate the economy, which could result in a stronger Euro.

Comparing this with the US, the Federal Reserve (Fed) also aims to maintain price stability, but their target is a 2% inflation rate over the longer term. Historically, the US has experienced higher inflation rates than the Eurozone, and this can have a substantial impact on purchasing power. For instance, if the US inflation rate is 3% and the Eurozone's is 1%, the purchasing power of the Euro will decrease relative to the US Dollar. This means that the same amount of money in Euros will buy fewer goods and services in the US compared to the Eurozone.

Investors should also consider the impact of inflation on interest rates. When inflation is high, central banks often raise interest rates to control spending and borrowing. Higher interest rates can attract foreign investment, strengthening the currency. For example, if the Eurozone's inflation rate is high, the ECB might increase interest rates, making the Euro more attractive to investors. In contrast, if the US inflation rate is lower, the Fed may keep interest rates stable or even cut them, potentially leading to a weaker Dollar.

In summary, when deciding between investing in Euros or Dollars, understanding the inflation dynamics in both regions is crucial. The Eurozone's stable inflation rate, managed by the ECB, can provide a relatively predictable environment for investors. Meanwhile, the US, with its higher historical inflation, may offer different opportunities and challenges. Investors should also keep an eye on central bank policies and their potential impact on currency values and interest rates.

The Future of Wealth: Unlocking the Power of Investments

You may want to see also

Economic Indicators: GDP, unemployment, and interest rates influence investment appeal

When considering whether to invest in the Euro or the US Dollar, understanding the economic indicators that drive their appeal is crucial. These indicators provide insights into the health and potential of these currencies, which in turn can impact your investment decisions. Here's a breakdown of how GDP, unemployment, and interest rates play a role in this context:

GDP Growth: Gross Domestic Product (GDP) is a key indicator of a country's economic health. A strong GDP growth rate suggests a robust economy with increasing production, higher demand, and potentially rising export levels. For investors, a country with a consistently growing GDP can be attractive as it often indicates a stable and improving economic environment. For instance, the Eurozone has shown mixed GDP growth rates in recent years, with some countries experiencing recessions while others have demonstrated resilience. In contrast, the US has generally maintained a positive GDP growth trajectory, making it an appealing investment destination for those seeking economic stability.

Unemployment Rates: The unemployment rate is a critical factor as it reflects the labor market's health and can impact a country's economic outlook. Low unemployment rates indicate a strong job market, higher consumer spending power, and increased economic activity. Investors often view low unemployment as a positive sign for the economy and the currency. For example, the US has consistently low unemployment rates, which have been a significant factor in attracting investors. In the Eurozone, while some countries have made progress in reducing unemployment, others still face significant challenges, which can impact the overall investment appeal of the region.

Interest Rates and Monetary Policy: Central banks' decisions on interest rates have a profound effect on currency investment. Higher interest rates can make a currency more attractive to investors seeking higher returns on their investments. For instance, the US Federal Reserve's interest rate hikes in recent years have made the US Dollar more appealing to investors seeking yield. Conversely, lower interest rates might discourage investors from holding a particular currency. The European Central Bank's (ECB) interest rate policies have also been a critical factor in the Euro's performance. When the ECB lowers rates, it can impact the Euro's value relative to other currencies, affecting investment decisions.

Additionally, the relationship between a country's interest rates and its GDP growth is essential. Higher interest rates can stimulate economic activity, leading to increased GDP growth, which further enhances the investment appeal of a currency. Investors often look for countries with a combination of strong GDP growth and favorable interest rate policies to maximize their returns.

In summary, GDP, unemployment, and interest rates are critical economic indicators that investors should consider when deciding between the Euro and the US Dollar. These factors provide insights into the economic strength and potential of each currency, helping investors make informed decisions based on their investment goals and risk tolerance. Staying informed about these indicators is essential for anyone looking to navigate the currency investment landscape effectively.

Maximize Your Million: Strategies for Post-Retirement Wealth Growth

You may want to see also

Political Stability: Political risks and economic policies impact currency value and investment safety

When considering whether to invest in euros or dollars, political stability and the associated economic policies play a crucial role in determining the safety and potential returns of your investment. Political risks can significantly influence currency values and, consequently, the attractiveness of a particular currency for investment.

In regions with stable political environments, investors often find greater confidence in the local currency. This stability is a result of consistent economic policies, rule of law, and a lower likelihood of sudden policy changes that could negatively impact investments. For instance, countries with strong democratic institutions and a history of economic management are likely to attract more foreign investment due to the perceived lower risk. In contrast, politically unstable regions may experience currency fluctuations and reduced investor confidence, making investments in the local currency more speculative.

Economic policies are another critical factor. Governments' fiscal and monetary policies can directly affect the value of their currencies. Central banks' decisions on interest rates, quantitative easing, and other monetary tools can influence the attractiveness of a currency for investors. Lower interest rates might make a currency less appealing for those seeking high returns, while higher rates could attract investors seeking stable returns. Additionally, fiscal policies, such as tax incentives, subsidies, or trade regulations, can impact the competitiveness of a country's exports and imports, thereby affecting the demand for its currency.

For investors, understanding the political landscape and economic policies of the countries involved is essential. A comprehensive analysis should consider the current political climate, historical trends, and potential future scenarios. This includes assessing the stability of the government, the likelihood of policy changes, and the overall economic management capabilities of the country. By evaluating these factors, investors can make more informed decisions about whether to invest in a particular currency and the potential risks and rewards associated with their choice.

In summary, political stability and economic policies are key determinants of currency value and investment safety. Investors should carefully consider the political environment and economic strategies of the countries in which they wish to invest, as these factors can significantly influence the performance of their investments in euros or dollars.

Planning for Prosperity: Strategies for Investing Close to Retirement

You may want to see also

Diversification: Consider euro-denominated assets for portfolio diversification and risk management

When it comes to building a well-rounded investment portfolio, diversification is key. One effective strategy is to consider euro-denominated assets as part of your investment mix. This approach can offer several benefits for investors seeking to manage risk and optimize returns.

The eurozone, comprising 19 European countries, represents a significant global economy. Investing in euro-denominated assets provides exposure to this robust market, allowing investors to tap into the economic growth and stability of these nations. By diversifying your portfolio across different currencies, you can reduce the impact of currency fluctuations and potentially benefit from the euro's strength. For instance, if the euro appreciates against the US dollar, your euro-denominated investments could yield higher returns in dollar terms, thus enhancing your overall portfolio performance.

In addition to currency exposure, euro-denominated assets can also provide access to a variety of investment opportunities. These include government bonds, corporate bonds, and stocks issued by European companies. Diversifying across different asset classes and sectors within the eurozone can help spread risk and potentially uncover undervalued gems. For example, investing in high-quality European government bonds can offer a stable income stream, while carefully selected European stocks might provide long-term capital appreciation.

Furthermore, considering euro-denominated assets can be a strategic move for risk management. The eurozone has demonstrated resilience during economic downturns, and its diverse economy can provide a hedge against potential risks associated with other major currencies. By allocating a portion of your portfolio to euro-denominated investments, you can balance out the volatility of other markets and potentially protect your capital. This is particularly relevant in today's complex and interconnected global economy, where currency and market movements can be highly correlated.

In summary, incorporating euro-denominated assets into your investment strategy can be a powerful tool for diversification and risk management. It allows you to tap into the economic strength of the eurozone, access a range of investment opportunities, and potentially benefit from currency fluctuations. By carefully selecting euro-denominated investments, investors can build a robust portfolio that is well-positioned to navigate various market conditions and achieve their financial goals.

Who Manages Your Money?

You may want to see also

Frequently asked questions

The choice between investing in Euros or US Dollars depends on various factors, including your investment goals, risk tolerance, and the current economic landscape. Both currencies have their own advantages and potential risks. It's essential to research and understand the factors influencing their value and how they align with your financial objectives.

Investing in Euros can offer several advantages. The Eurozone is a large economic bloc with a diverse range of countries, providing a stable and robust market. Euros are widely accepted and used as a global currency, making international transactions more accessible. Additionally, the Euro has a long history and is considered a safe-haven currency, often sought during times of economic uncertainty.

US Dollars are the official currency of the United States and are widely recognized worldwide. Investing in Dollars can provide access to the US market, which is one of the largest and most influential economies globally. Dollars are often seen as a safe-haven currency, attracting investors during periods of market volatility. However, the value of the Dollar can be influenced by various economic factors, including interest rates and inflation.