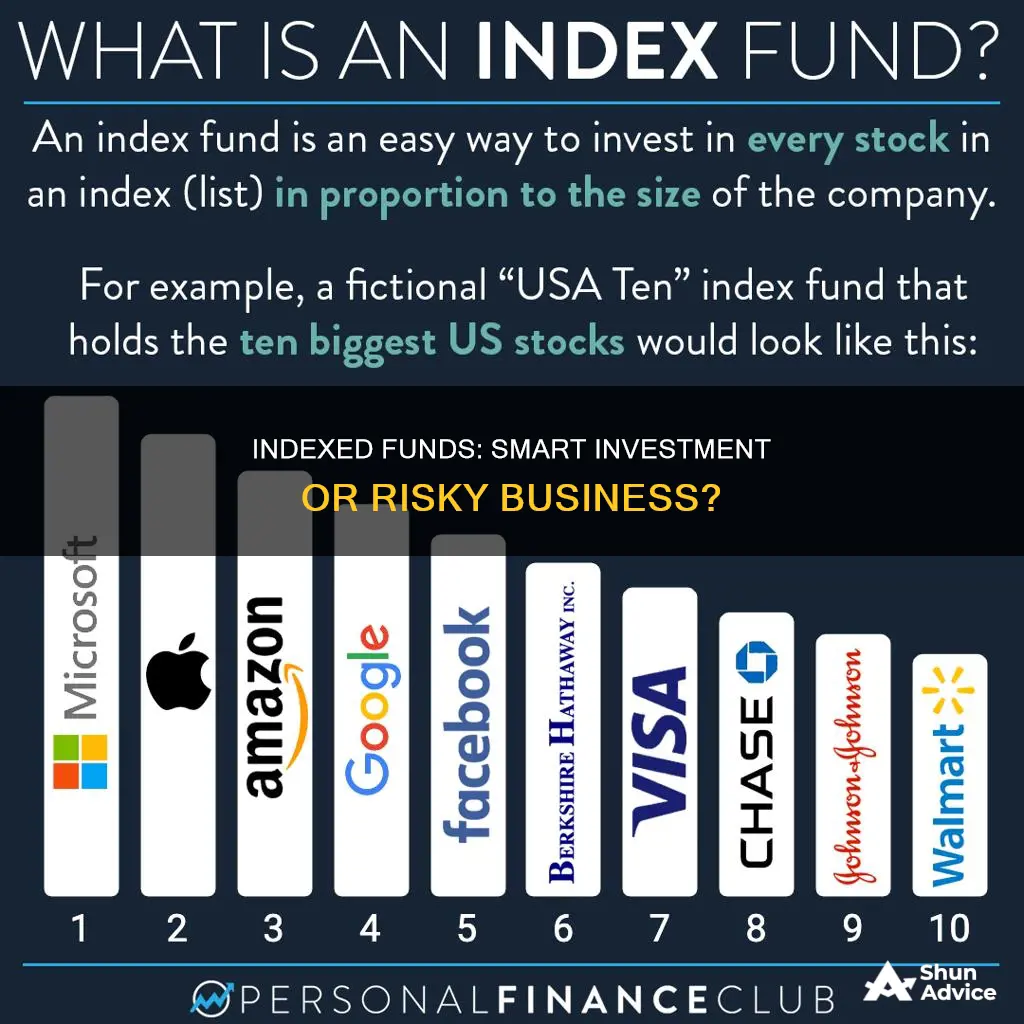

Index funds are a type of mutual fund or exchange-traded fund (ETF) that holds a bundle of securities, typically stocks or bonds, that track the performance of a market index, such as the S&P 500. They are considered one of the smartest investment moves due to their affordability, diversification, and attractive returns over time. However, there are also drawbacks to investing in index funds, including lack of downside protection and the inability to react to market changes. With the popularity of index funds growing, it is important for investors to understand the benefits and risks before deciding whether to invest in them.

| Characteristics | Values |

|---|---|

| Management fees | Low |

| Tax advantages | Generate less taxable income |

| Risk | Low |

| Returns | Attractive |

| Diversification | High |

| Performance | Outperform other types of funds |

| Cost | Low |

| Turnover ratio | Low |

| Capital gains | Low |

What You'll Learn

Index funds vs actively managed funds

Index funds and actively managed funds are two types of mutual funds or exchange-traded funds (ETFs) with different investment strategies.

Index funds are passively managed, aiming to mirror the performance of a specific market index or benchmark, such as the S&P 500. They buy and hold a diverse range of securities, such as stocks or bonds, in the same proportion as the index they track. This strategy provides broad diversification, low costs, and attractive long-term returns. Index funds are considered a smart investment move as they enable instant diversification, have low management fees, and tend to generate competitive returns over time.

On the other hand, actively managed funds are actively managed by professional money managers who hand-pick investments with the goal of outperforming the market. These funds try to beat market returns by selecting stocks or bonds based on the manager's research and expertise. While this approach may provide the potential for higher returns, it also comes with higher fees and the risk of underperforming the market.

When comparing the two, it's important to consider the level of risk and potential returns. Index funds are generally seen as less risky due to their diversification and lower fees, while actively managed funds offer the possibility of higher performance but with higher costs and the risk of underperforming the market.

Additionally, index funds provide less flexibility and choice, as investors have no control over the individual holdings in the portfolio. In contrast, actively managed funds offer more investment choices and the ability to react to market changes, such as selling overvalued stocks.

In summary, the choice between index funds and actively managed funds depends on an investor's risk tolerance, investment goals, and preferences. Index funds are suitable for those seeking a more passive approach with broad diversification and lower fees. Actively managed funds, on the other hand, may appeal to investors who want more control and the potential for higher returns, despite the higher costs and risk of underperformance.

Warren Buffett's Stance on Index Funds Explained

You may want to see also

Pros of investing in index funds

Index funds are considered one of the smartest types of investments. Here are some of the pros of investing in index funds:

Broad Diversification

Index funds enable broad diversification, minimising the likelihood of losing some or all of your money. An index fund that tracks the S&P 500, for example, would hold about 500 different stocks. Investing in a fund that holds all of them matches your portfolio's performance to that of the index itself. Diversifying your portfolio among so many companies ensures that the value of your portfolio is not overly correlated with the fortunes of any one company listed in the index.

Low Costs

Index funds have much lower management fees than other funds because they are passively managed. Instead of having a manager actively trading, the index fund’s portfolio just duplicates that of its designated index. Index funds also have lower transaction costs, as they hold investments until the index itself changes (which doesn’t happen very often). These lower costs can make a big difference in your returns, especially over the long haul.

Attractive Returns

Even the smartest and most diligent portfolio managers can rarely steer actively managed funds to beat index funds. Only about 23% of actively managed mutual funds outperform the S&P 500 over five years, according to research by Standard & Poor's. Other studies support this number as well.

Easy to Invest In

Index funds are easy to invest in, have low fees, and often perform very well. They are also nearly as automatic and hands-off as using a robo-advisor, which is another option for those looking for low-cost investing.

Best ELSS Funds to Invest in India: Smart Picks

You may want to see also

Cons of investing in index funds

Index funds are a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a market index. While they are considered one of the smartest types of investments, there are some cons to investing in index funds. Here are some of the most common disadvantages:

- Lack of Downside Protection: Index funds provide no protection from market corrections and crashes. If the market drops, your index fund will drop with it. In contrast, an actively managed fund might be able to sense a market correction and adjust or liquidate positions to buffer the drop.

- Lack of Reactive Ability: Index funds do not allow for advantageous behaviour. If a stock becomes overvalued, it carries more weight in the index. However, this is when investors would want to lower their portfolios' exposure to that stock.

- No Control Over Holdings: Index funds are set portfolios, meaning investors have no control over the individual holdings. This can be frustrating if there are specific companies you want to invest in or if you have ill feelings towards certain companies for moral or personal reasons.

- Limited Exposure to Different Strategies: Index funds may not give you access to successful investing strategies. You may be able to find better-value stocks or combine different strategies to provide better risk-adjusted returns.

- Dampened Personal Satisfaction: Investing in index funds can still be stressful, as you may find yourself constantly checking the market's performance. You also lose the satisfaction of making good investments and being successful with your money.

- Encouraging Investor Passivity: Relying solely on index funds may cause investors to miss out on opportunities offered by growth stocks. While index funds provide a diversified selection of stocks, they may not provide the level of diversification that includes bonds, real estate, or other non-equities.

- Potential for Disappointing Returns: While index funds have historically outperformed actively managed funds, there is no guarantee that this will continue. The high market valuation of index funds could indicate that forward returns may be poor.

High Net Worth Investors: Hedge Funds for Long-Term Growth

You may want to see also

Who should invest in index funds?

Index funds are considered one of the smartest types of investments. They are affordable, enable diversification, and tend to generate attractive returns over time.

Index funds are a good investment option for those who are looking for a low-cost, low-maintenance, and diversified investment option. They are also a good choice for those who want to mirror the performance of a specific index, such as the S&P 500 or the Dow Jones Industrial Average.

Index funds are suitable for investors who want to take a passive approach to investing and are comfortable with the risks and potential downsides associated with index investing. These include lack of downside protection, lack of reactive ability, no control over holdings, limited exposure to different strategies, and dampened personal satisfaction.

Additionally, index funds may be a good choice for those who are investing for the long term, as they have historically outperformed other types of funds over longer periods.

However, it is important to note that past performance does not guarantee future results, and there may be periods of flat or negative returns. Therefore, investors should carefully consider their risk tolerance, investment goals, and time horizon before deciding to invest in index funds.

Invest in SBI Magnum Midcap: A Guide to Get Started

You may want to see also

How to invest in index funds

Index funds are a great investment for building wealth over time, which is why they are popular with retirement investors. They are a type of investment fund, either a mutual fund or an exchange-traded fund (ETF), that is based on an index. An index is a preset collection of stocks or bonds, and an index fund mimics the composition of the index rather than trying to pick which stocks will outperform.

- Have a goal for your index funds: Index funds are ideal if you are looking to let your money grow slowly over time, especially if you are saving for retirement.

- Research index funds: There are several types of index funds to choose from, depending on your investment goals. These include company size and capitalization (small-, mid- or large-cap indexes), geography (international or specific exchanges), business sector or industry (consumer goods, technology, health), asset type (bonds, commodities, cash), and market opportunities (emerging markets or other growing sectors).

- Pick your index funds: When choosing an index fund, consider the costs. Index funds are cheap to run because they are automated, but don't assume that all index funds are equally cheap. Two funds with the same investment goal may have very different management costs, and these fees can affect your long-term returns.

- Decide where to buy your index funds: You can purchase an index fund directly from a mutual fund company or a brokerage, or you can buy ETFs, which are like mini mutual funds that trade like stocks throughout the day. When deciding where to buy, consider fund selection, convenience, trading costs, impact investing, and commission-free options.

- Open an investment account: To purchase shares of an index fund, you'll need an investment account. A brokerage account, individual retirement account (IRA), or Roth IRA will all work.

- Buy the index fund: Go to your broker's website and set up the trade. Input the fund's ticker symbol and the number of shares you want to buy, based on how much money you have put into your account. Many brokers allow you to set up an investing schedule to buy an index fund on a recurring basis, which can help you reduce risk and increase returns.

- Keep an eye on your index funds: Index funds are passive investments, but you should still monitor their performance. Check that the index fund is mirroring the performance of the underlying index, and be aware of any fees that may be stacking up over time.

Index funds are a low-cost, passive investment strategy that can help you build wealth over time. By following these steps, you can get started on investing in index funds and working towards your financial goals.

Chanakya Opportunities Fund: A Smart Investment Strategy

You may want to see also

Frequently asked questions

Index funds are considered one of the smartest types of investments. They are affordable, enable diversification, and tend to generate attractive returns over time. They are also easy to invest in, have low fees, and often perform very well.

Index funds can encourage investor passivity, preventing investors from seizing opportunities elsewhere. They also do not provide protection from market corrections and crashes, and investors have no control over the individual holdings in the portfolio.

You can purchase index funds through a brokerage firm or a mutual fund company such as Fidelity Investments or Vanguard. You can also buy them directly from an index fund provider.