The SPDR S&P 500 ETF Trust (SPY) is an exchange-traded fund that tracks the S&P 500 Index. Launched in 1993, it was the first ETF listed in the United States and is now the largest ETF by assets under management. SPY provides instant exposure to the entire U.S. market and the S&P 500 at a very low cost. With a rock-bottom expense ratio of 0.09%, SPY is an excellent option for investors seeking broad exposure to the Large Cap Blend segment of the U.S. equity market. The ETF has a diverse range of holdings, with its top three sectors being Information Technology, Financials, and Healthcare. SPY has added roughly 18.97% so far this year and is up about 28.43% in the last year, making it a solid choice for long-term investors.

| Characteristics | Values |

|---|---|

| Launch Date | 29 January 1993 |

| Sponsor | State Street Global Advisors |

| Assets | $566.52 billion |

| Type of Companies | Large Cap Blend |

| Management Style | Passively Managed |

| Annual Operating Expenses | 0.09% |

| 12-Month Trailing Dividend Yield | 1.22% |

| Sector Exposure | Information Technology, Financials, Healthcare |

| Top Holdings | Apple Inc, Microsoft Corp, Nvidia Corp |

| Holdings | 504 |

| Beta | 1 |

| Standard Deviation | 17.45% |

| Zacks ETF Rank | 2 (Buy) |

What You'll Learn

SPDR S&P 500 ETF's performance and risk

The SPDR S&P 500 ETF Trust is one of the most popular exchange-traded funds (ETFs). It aims to track the Standard & Poor's (S&P) 500 Index, which comprises 500 large-cap U.S. stocks. The S&P 500 is widely seen as the definitive measure of the U.S. stock market among most investors.

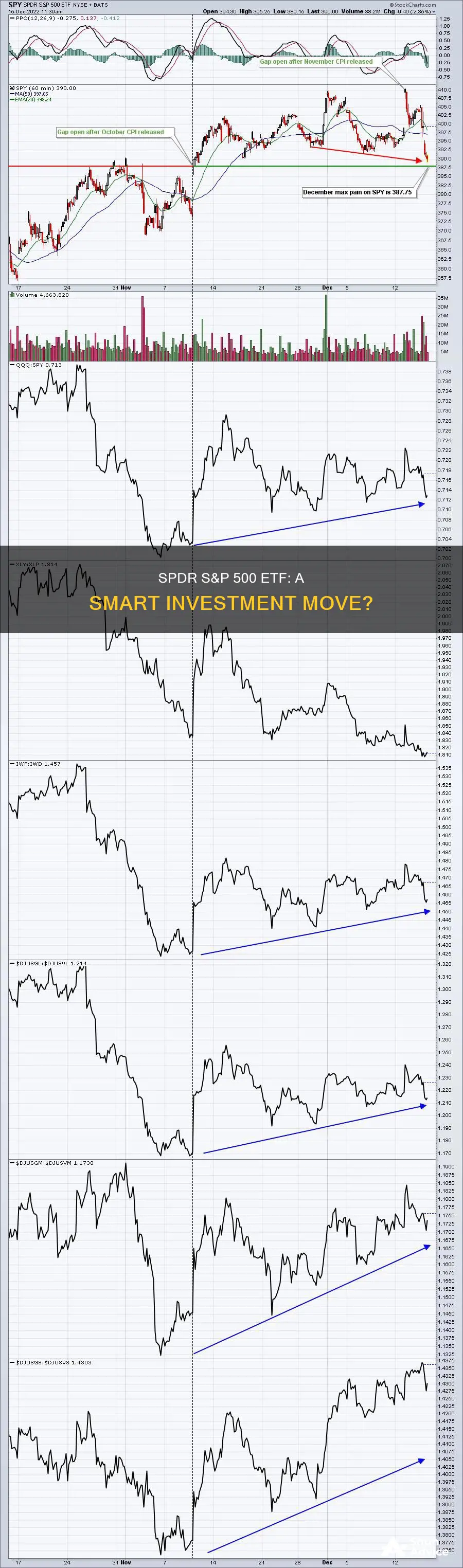

Performance:

- The SPDR S&P 500 ETF Trust has generated an average annual return of just over 10% since its inception in January 1993.

- As of September 25, 2024, the fund generated average annual returns of 12.84% based on trailing 10-year data.

- The fund's average three-year return as of September 25, 2024, was 9.25%.

- The 12-month distribution yield for SPY was 1.23% as of September 25, 2024.

- The dividend yield on the SPY is roughly 1.6%.

Risk:

- SPDR S&P 500 ETF is subject to market risk, country risk, currency risk, economic risk, and interest rate risk.

- The fund's investments are subject to changes in general economic conditions, general market fluctuations, and the risks inherent in investment in securities markets.

- Investment markets can be volatile and prices of investments can change substantially due to various factors, including economic growth or recession, changes in interest rates, and changes in the actual or perceived creditworthiness of issuers.

- The fund is subject to the risk that geopolitical events, war, acts of terrorism, the spread of infectious illness or other public health issues, or other events could have a significant impact on the fund and its investments.

- SPY shares may not readily trade in all market conditions and may trade at significant discounts in periods of market stress.

- SPY is subject to investment risk and may trade at prices above or below the ETF's net asset value. Brokerage commissions and ETF expenses will reduce returns.

Lithium ETF: A Smart Investment Strategy for Beginners

You may want to see also

The fund's sector exposure and top holdings

The SPDR S&P 500 ETF Trust is a well-diversified fund that spreads investment across all 11 sectors. The fund's top holdings, as of 2 December 2024, are:

- META Platforms Inc Class A

- Berkshire Hathaway Inc Class B

- Microsoft Corporation

- Meta Platforms Inc Class A

- Alphabet Inc. Class A

- Alphabet Inc. Class C

The fund's sector breakdown is as follows:

- Information Technology: 31.55%

- Consumer Discretionary: 10.22%

- Communication Services: 8.77%

- Consumer Cyclical: 6.33%

- Health Care: 5.22%

- Financial Services: 4.65%

- Industrials: 3.46%

- Consumer Defensive: 2.85%

- Basic Materials: 2.46%

- Utilities: 2.34%

- Energy: 2.06%

- Real Estate: 1.64%

The SPDR S&P 500 ETF Trust is designed to expose investors to all 11 sectors. However, investors can also choose to buy into just one sector of the SPY stock.

Nasdaq 100 ETF: Motilal Oswal's Investment Prospects

You may want to see also

The benefits of investing in S&P 500 index funds

The S&P 500 is a well-known stock market index, and while you can't invest directly in the index itself, you can invest in an index fund or exchange-traded fund (ETF) that tracks it. Here are some benefits of investing in S&P 500 index funds:

Instant Diversification

Investing in an S&P 500 index fund means you're investing in 500 different stocks across 11 sectors at once. This level of diversification reduces your risk because even if a few stocks don't perform well, it won't significantly impact your entire portfolio.

Affordable Investment Option

Index funds are one of the most affordable investment options, making them ideal for those with limited funds. With index funds, you can start investing with just a few dollars, making them a good choice if you're focused on paying bills or building an emergency fund while also investing for retirement.

Exposure to Top Companies

The S&P 500 includes some of the world's most dynamic and important companies, such as Apple, Microsoft, Amazon, and Walmart. These companies represent about 80% of the total U.S. stock market's value, so investing in an S&P 500 index fund gives you access to a wide range of large-cap U.S. stocks.

Long-Term Performance

The S&P 500 has consistently performed well over the long term. Since its creation in 1926, it has returned about 9.9% per year on average, including dividends. This makes it a good option for long-term investors who can ride out any short-term market downturns.

Less Time-Intensive

Investing in an S&P 500 index fund can save you time and effort as you don't need to research and analyse individual stocks or decide when to buy or sell. This makes it a good choice for those who prefer a more hands-off, passive approach to investing.

ETFs: Smart Single Investment or Risky Business?

You may want to see also

The best SPDR ETFs of 2024

SPDR Portfolio S&P 500 ETF Trust (SPLG)

The SPDR Portfolio S&P 500 ETF Trust is a great option for investors looking to gain exposure to the entire U.S. stock market. With an average annualized return of around 10% over the past 100 years, the S&P 500 has been a solid investment choice. SPLG, with its rock-bottom expense ratio of 0.02%, is a more cost-effective alternative to the popular SPY ETF, charging less than one-fourth of its expense ratio.

SPDR Dow Jones REIT ETF (RWR)

REITs are a great way to gain exposure to the real estate market and benefit from dependable cash flows. The SPDR Dow Jones REIT ETF seeks to provide returns that correspond to the Dow Jones U.S. Select REIT index, which focuses on real estate investment trusts and real estate operating companies. With rising inflation and interest rates, REITs can be a solid choice for investors.

SPDR SSGA US Sector Rotation ETF (XLSR)

The SPDR SSGA US Sector Rotation ETF is an actively managed fund that aims to identify sectors poised to outperform the market. While it has lagged the S&P 500 in the past year, it offers the potential to benefit from a shift in investor-favored sectors. XLSR has shown less volatility than its peers over the past three and five years.

SPDR S&P Kensho New Economies Composite ETF (KOMP)

This thematic ETF focuses on companies driving innovation across various sectors, including artificial intelligence, robotics, and cybersecurity. With a growth potential spiced by an OK dividend yield, KOMP is a great choice for long-term investors comfortable with investment volatility.

SPDR S&P 500 Fossil Fuel Reserves Free ETF (SPYX)

The SPDR S&P 500 Fossil Fuel Reserves Free ETF is a sustainable investing option, excluding companies that own fossil fuel reserves. With holdings in mega-caps like Apple, Microsoft, and Amazon, it can be a suitable replacement for an S&P 500 index fund in a sustainable portfolio.

SPDR Portfolio Short Term Treasury ETF (SPTS)

In the current environment of rising interest rates, the SPDR Portfolio Short Term Treasury ETF offers a way to reduce portfolio volatility. With a focus on short-term Treasury bonds, SPTS provides a relative safe haven and has maintained elevated yields amid the Fed's uncertain rate decisions.

SPDR Portfolio Developed World Ex-U.S. ETF (SPDW)

The SPDR Portfolio Developed World Ex-U.S. ETF provides exposure to international stocks from 24 markets, helping investors avoid "home-country bias." With an ultra-low-cost expense ratio and a respectable dividend yield, it offers broad diversification and reduced country-specific risk.

Invest in Ethiopia ETF: A Guide to Opportunities and Risks

You may want to see also

How to invest in SPDR ETFs

SPDR ETFs, or Standard & Poor's Depositary Receipts, are a type of exchange-traded fund (ETF) that offers diverse investment opportunities. Here is a guide on how to invest in SPDR ETFs:

Understanding SPDR ETFs

SPDR ETFs are issued by State Street Global Advisors and are designed to track specific indexes or benchmarks. The most well-known SPDR ETF is the S&P 500 ETF Trust (SPY), which seeks to replicate the performance of the S&P 500 Index. SPDR ETFs can also focus on specific market sectors, such as technology or financials, or market capitalization, such as small, mid, or large-cap companies.

Buying and Selling SPDR ETFs

Investors can buy and sell SPDR ETFs like stocks through any brokerage account. Traditional stock trading techniques, such as stop orders, limit orders, margin purchases, and short sales, can be used with SPDR ETFs. It's important to note that SPDR ETFs are subject to similar risks as stocks, including those related to short-selling and margin account maintenance. Ordinary brokerage commissions apply to SPDR ETF trades.

SPDR ETF Options, Futures, and Hedging

Since SPDR ETFs trade like stocks, they can be sold short or used with options to hedge a portfolio. When an investor has a long position in the S&P 500 SPDR ETF, they will make money if the index increases. However, if the index decreases, they will lose money. By shorting the SPDR or buying put options, investors can hedge their bets and mitigate some risks.

SPDR ETF Performance and Fees

The performance of SPDR ETFs is tied to the underlying index they track. For example, the SPDR 500 Trust (SPY) is designed to trade at approximately one-tenth of the level of the S&P 500. If the S&P 500 is at 1,800, the SPY shares will trade around $180. It's important to note that this relationship is not exact and can fluctuate.

SPDR ETFs typically have low fees compared to mutual funds. For example, the SPY ETF has an annual fee of only 0.095%. This means that for a $25,000 investment, you would pay just $23.75 per year in fees.

SPDR ETF Options

When considering which SPDR ETF to invest in, it's important to look at the different options available. Some popular choices include the Financial Select Sector SPDR ETF (XLF), which focuses on financial stocks, and the SPDR S&P 1500 Value Tilt ETF (VLU), which focuses on value stocks. There are also global and sector-specific SPDR ETFs, such as the SPDR Portfolio Developed World ex-US ETF (SPDW) and the SPDR Dow Jones Global Real Estate ETF (RWO).

In conclusion, investing in SPDR ETFs offers individuals a wide range of investment opportunities. By understanding the basics of how SPDR ETFs work, the different options available, and the benefits and risks involved, investors can make informed decisions about including SPDR ETFs in their investment portfolios.

A Guide to Investing in Bharat 22 ETF

You may want to see also

Frequently asked questions

The SPDR S&P 500 ETF (SPY) is an exchange-traded fund that tracks the S&P 500 Index. It was the first ETF launched in 1993 and is now the largest ETF by assets under management. The fund aims to duplicate the composition of the S&P 500 index, with the same weighting of each stock, and maintain a share price that's approximately 10% of the S&P 500's price.

The SPDR S&P 500 ETF offers broad exposure to the large-cap blend segment of the US equity market at a very low cost. It has a five-star rating from Morningstar and is one of the least expensive products in its space, with an expense ratio of 0.09%. The fund has a diverse range of holdings, with its top 10 holdings accounting for about a third of its value.

The ETF has added roughly 18.97% so far this year and is up about 28.43% in the last year. It has a beta of 1 and a standard deviation of 17.45% for the trailing three-year period, making it a medium-risk choice.

You can invest in the SPDR S&P 500 ETF by purchasing shares through any brokerage account, as ETFs trade like stocks. However, it's important to note that ETF shares are not individually redeemable from the fund, and investors can only acquire or tender them in Creation Unit Aggregations.