Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. Index funds are defined as investments that mirror the performance of benchmarks like the S&P 500 by mimicking their makeup. Index funds are a low-cost, easy way to build wealth and are popular with retirement investors. They are also considered a passive management strategy as they don't need to actively decide which investments to buy or sell.

| Characteristics | Values |

|---|---|

| Type | Mutual fund or exchange-traded fund (ETF) |

| Investment strategy | Passive |

| Investment objective | To track the performance of a market index, e.g. S&P 500 |

| Management | Fund managers ensure the fund performs the same as its target index |

| Risk | Low due to diversification |

| Performance | Historically, index funds have outperformed actively managed funds |

| Fees | Low fees due to passive management and low transaction costs |

| Tax | Tax-efficient due to lower turnover rates |

| Suitability | Suitable for beginners due to simplicity and low cost |

What You'll Learn

What are index funds?

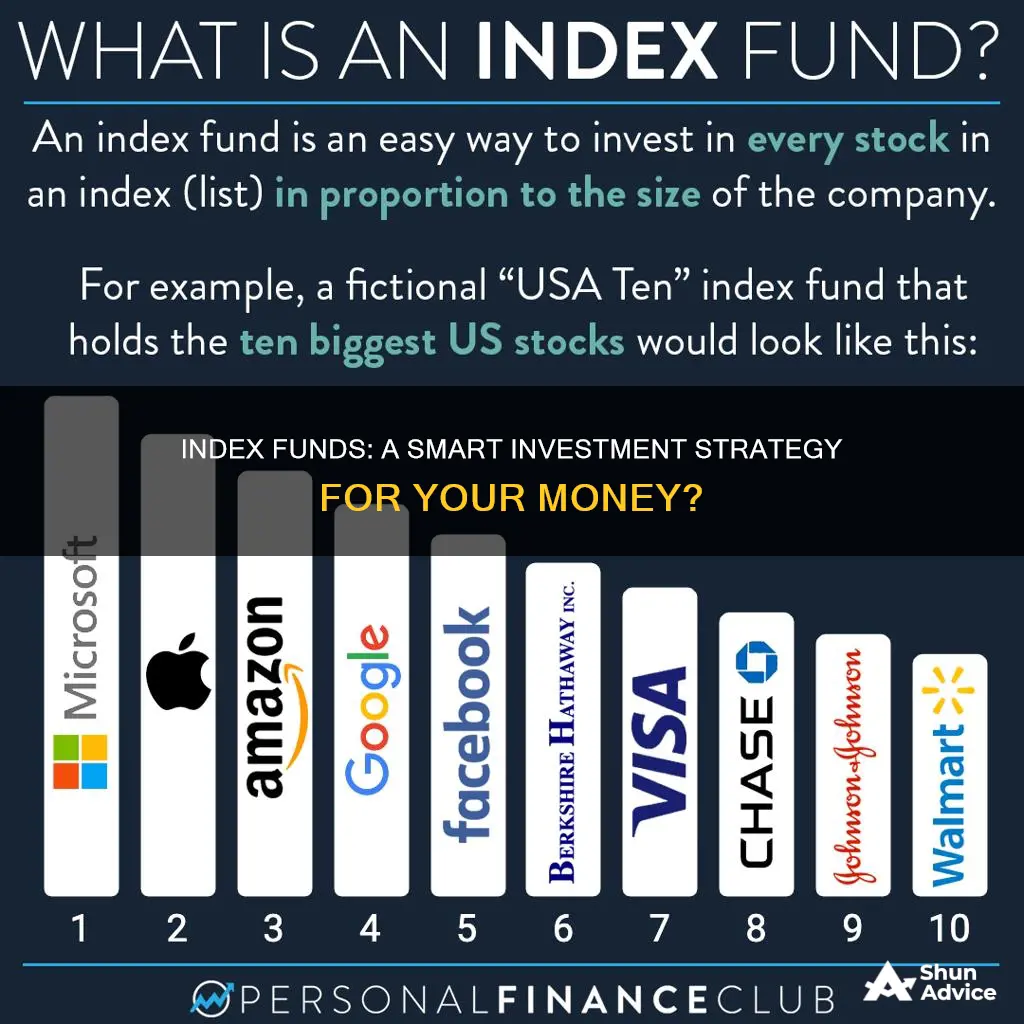

Index funds are a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500. They are designed to replicate the performance of financial market indexes and are ideal for long-term investing, such as retirement accounts.

Index funds are passively managed, meaning they don't have a team of analysts and portfolio managers actively trying to beat the market. Instead, they aim to match the performance of their chosen index by holding the same stocks or bonds or a representative sample of them. This passive management strategy means they are a low-cost investment option, with lower fees than actively managed funds.

Index funds are highly diversified, holding a preselected collection of hundreds or thousands of stocks or bonds. This lowers the risk of investing, as if a single stock or bond performs poorly, there is a good chance that another is performing well to balance out the losses.

Index funds are also tax-efficient. They don't change their holdings as often as actively managed funds, resulting in fewer taxable capital gains distributions. They also have the flexibility to choose from hundreds of lots when selling a particular security, allowing them to sell the lots with the lowest capital gains and reduce the tax bill.

Overall, index funds are a popular investment choice due to their broad diversification, low costs, tax efficiency, and long-term solid returns. They are a straightforward and low-risk way to gain exposure to a wide range of stocks or bonds, making them suitable for beginners as well as expert investors.

A Guide to Investing in Vanguard Funds from South Africa

You may want to see also

How do they work?

Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. They are defined as investments that mirror the performance of benchmarks like the S&P 500 by mimicking their makeup.

Index funds are passively managed, meaning they don't require a fund manager to actively pick and choose investments. Instead, they are designed to replicate the performance of a specific market index. This passive management strategy means that index funds don't need to decide which investments to buy or sell and are therefore considered lower-risk.

Index funds are often used to help balance the risk in an investor's portfolio, as market swings tend to be less volatile across an index compared to individual stocks. They are also a low-cost way to invest, as they have lower fees than actively managed funds. This is because they require less work and don't need to pay for a fund manager's time and expertise.

Index funds can be purchased directly from a mutual fund company or a brokerage, or through a brokerage account, an individual retirement account (IRA), or a Roth IRA. When choosing a platform to invest in index funds, it's important to consider the number of index funds available, the fees, and how user-friendly the platform is.

Overall, index funds are a popular investment choice due to their low fees, passive management, and diversification across various sectors and asset classes.

Choosing a Fund: Key Factors for Investment Success

You may want to see also

Are they good for beginners?

Index funds are a great option for beginners looking to invest their money. They are a simple, cost-effective way to hold a broad range of stocks or bonds that mimic a specific benchmark index, meaning they are diversified.

Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. They are passively managed, meaning they don't require a lot of research and analysis on the part of the investor. The fund's portfolio is designed to mirror the performance of a specific index, so the investor doesn't need to actively select stocks or time the market.

Index funds also have lower fees than actively managed funds. Because they are passively managed, index funds don't require a team of analysts and portfolio managers, which keeps costs low. These lower fees can make a big difference in your returns, especially over time.

Index funds are also good for beginners because they offer diversification. By investing in an index fund, you are investing in a broad range of stocks or bonds, which reduces the risk of losing money. If one stock in the fund performs poorly, it will have less impact on the overall performance of the fund.

Additionally, index funds are transparent and easy to understand. The holdings of an index fund are well-known and available on most investing platforms, so you can easily see what you're investing in.

Overall, index funds are a good option for beginners because they are simple, cost-effective, diversified, and transparent. They offer a low-risk way to invest in the stock market without requiring a lot of research or analysis.

Target Retirement Funds: Vanguard IRA Investment Strategy

You may want to see also

How much does it cost?

Index funds are a low-cost investment option, with low fees and often strong performance. The costs of investing in index funds vary depending on the fund and your broker's policies, but there are generally two types of fees associated with them:

- Sales load: This is a commission charged when buying or selling the fund, or over time. This can sometimes be avoided by choosing investor-friendly fund companies such as Vanguard, Charles Schwab, or Fidelity.

- Expense ratio: This is an ongoing fee paid to the fund company, based on the assets you have invested in the fund. It is usually charged daily and seamlessly deducted from your account.

Index funds that are mutual funds may charge both types of fees, while ETFs usually only charge an expense ratio. According to data from the Investment Company Institute in 2024, the average fee for an index fund is 0.05%, with some funds offering even lower expense ratios.

When choosing an index fund, it is important to compare costs, as these can vary widely even between funds tracking the same index. For example, two funds tracking the S&P 500 might have very different management costs, and these fees can impact your long-term investment returns. Typically, larger funds have lower fees.

It is also worth noting that some brokers may charge extra for buying index fund shares, so it may be cheaper to go directly through the index fund company. On the other hand, many investors prefer the convenience of having all their investments held in a single brokerage account.

When investing in index funds, you also need to consider trading costs. Mutual fund commissions tend to be higher than stock trading commissions, and some brokers may charge a transaction fee for buying or selling the fund. However, many brokers now allow trading without a commission, especially for ETFs.

Additionally, some mutual funds have a minimum investment amount, which can be several thousand dollars, while ETFs usually do not have this requirement.

Overall, index funds are a low-cost investment option, but it is important to carefully consider the fees and costs associated with the specific fund and broker you choose.

Growth Funds: Why You Should Invest Now

You may want to see also

Are they safer than stocks?

Index funds are generally considered safer than stocks because they are diversified and low-cost. By investing in an index fund, you are investing in a group of stocks that aim to mirror the performance of an existing stock market index, providing a level of diversification that individual stocks cannot offer.

For example, the Vanguard S&P 500 ETF (VOO) invests in all 500 companies that make up the S&P 500 large-cap benchmark index. This means that if one stock in the index underperforms, there are 499 other stocks that can make up for those losses. Additionally, index funds have lower fees because they are passively managed, meaning they don't require a fund manager to actively buy and sell stocks. These lower fees can add up to significant savings over time.

However, it's important to note that index funds are not completely risk-free. They are still subject to market volatility and can lose value during a market downturn. Additionally, some index funds may have higher fees than others, so it's important to do your research before investing.

Overall, index funds offer a safer and more hands-off approach to investing compared to individual stocks, making them a popular choice for those seeking long-term wealth accumulation with less active involvement.

A Step-by-Step Guide to Mutual Fund Investing on Ameritrade

You may want to see also

Frequently asked questions

An index fund is a type of investment fund, often a mutual fund or an exchange-traded fund (ETF), that tracks the performance of a specific market index, such as the S&P 500. Index funds aim to mirror the composition and performance of the index by holding the same stocks, bonds, or a representative sample.

Index funds offer broad market exposure and diversification across sectors and asset classes. They are also associated with lower fees and costs compared to actively managed funds, as they are passively managed and do not require active decision-making, stock picking, or market timing. Index funds are simple, low-cost, and suitable for beginners.

Index funds lack flexibility as they are designed to mirror a specific market index. They decline in value when the market does and cannot pivot to take advantage of new opportunities. Index funds may also include overvalued or weak companies, and their performance is tied to the largest companies in the index.

When choosing an index fund, consider factors such as the fund's expenses, taxes, investment minimums, performance history, and the index it tracks. Compare similar funds that track the same index, as these should have similar returns, and opt for the one with lower fees.

You can invest in index funds by opening an online brokerage account or using a robo-advisor. Research and analyze different index funds, decide which one suits your goals and risk tolerance, and then purchase shares through your chosen platform.