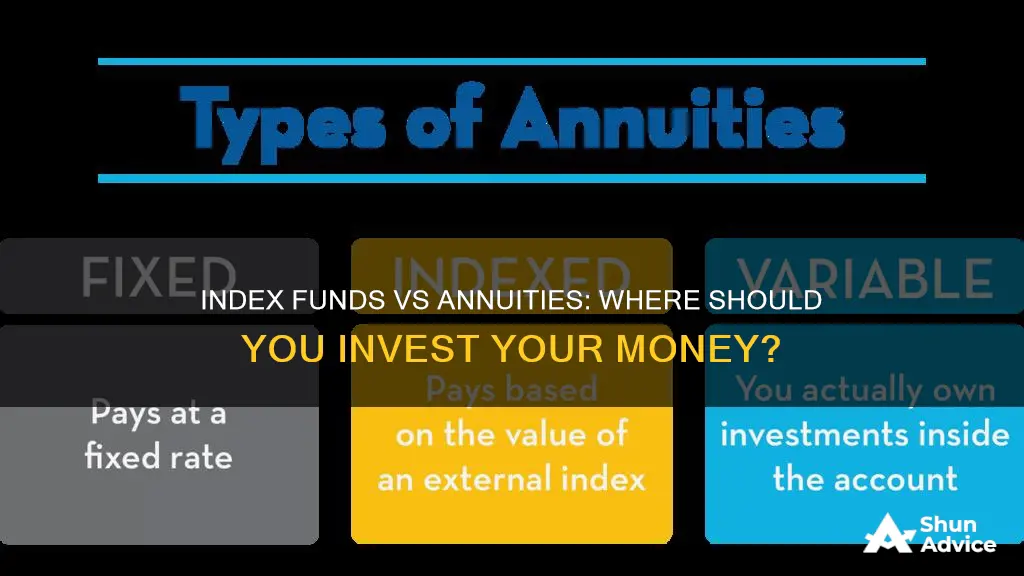

Index funds and annuities are both investment vehicles, but they work very differently. Index funds are a type of mutual fund that tracks a specific stock market index, like the S&P 500. The value of an index fund rises and falls with the index it tracks, so investors can benefit from the gains of the stock market. Annuities, on the other hand, are contracts sold by insurance companies that promise to make periodic payments to the annuitant over a set period. There are different types of annuities, including fixed annuities, variable annuities, and indexed annuities. Fixed annuities offer a guaranteed rate of return, while variable annuities offer the potential for higher returns but also come with higher risk. Indexed annuities are a middle ground between the two, offering a guaranteed return plus a return that is based on the performance of a market index. So, which is the better investment option?

| Characteristics | Values |

|---|---|

| Type of investment | Insurance product |

| Risk | Less risky than investing directly in the market |

| Returns | Limited upside, not as high as direct investment in the market |

| Tax | Tax-deferred |

| Complexity | Complicated, difficult to understand |

| Fees | High fees |

| Access to funds | Not easily accessible |

What You'll Learn

Index funds vs annuities: pros and cons

Index funds and annuities are both investment vehicles, but they work very differently. Here are the pros and cons of each:

Index Funds

Index funds are a type of investment fund that tracks a particular stock market index, such as the S&P 500. They are designed to mirror the performance of that index, so if the index goes up by 10%, the value of the index fund should also increase by 10%. Investing in index funds is a passive investment strategy as the fund manager simply tries to replicate the performance of the chosen index.

Pros of Index Funds:

- Index funds are a relatively hands-off investment, making them ideal for investors who don't want to be actively involved in picking and choosing stocks.

- They offer diversification, as they are made up of a basket of stocks that make up the index. This diversification can help reduce risk.

- Historically, the stock market has tended to increase in value over time, and index funds allow investors to benefit from this growth.

Cons of Index Funds:

- Index funds will not outperform the market, as they are designed to match the market's performance.

- They may be more volatile than other types of investments, as they are directly tied to the performance of the stock market.

- There may be fees associated with index funds, such as management fees, which can eat into returns.

Annuities

Annuities are insurance products that provide a guaranteed stream of income, often during retirement. There are different types of annuities, including fixed annuities, variable annuities, and indexed annuities. Fixed annuities offer a guaranteed rate of return, while variable annuities offer the potential for higher returns but also come with higher risk. Indexed annuities, as the name suggests, are linked to the performance of a particular market index but usually have caps and floors on returns.

Pros of Annuities:

- Annuities provide a guaranteed income stream, which can be attractive for retirees who want a stable source of income.

- They can offer tax advantages, as taxes on gains are often deferred until the money is withdrawn.

- Indexed annuities, in particular, can provide a middle ground between the security of a fixed annuity and the potential upside of a variable annuity.

Cons of Annuities:

- Annuities often have high fees and complex structures, which can make them difficult to understand and expensive to own.

- Withdrawing money from an annuity early can result in stiff penalties, so they are not a good option for those who may need access to their money.

- The returns on annuities may not keep up with inflation, which can erode the purchasing power of the principal over time.

Lump-Sum Mutual Fund Investment Guide for Indians

You may want to see also

What is an index fund?

An index fund is a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500. Index funds are defined as investments that mirror the performance of benchmarks like the S&P 500 by holding the same stocks or bonds or a representative sample of them.

Index funds are passive investments, meaning they do not involve actively picking securities or timing the market. Instead, they aim to replicate the performance of a specific market index. This makes them a low-cost way to track a specific group of investments and are more broadly diversified than individual stocks.

Index funds are often considered a good choice for beginner investors as they are a simple, cost-effective way to hold a broad range of stocks or bonds. They are also generally safer than individual stocks due to their inherent diversification.

There are two main types of index funds: index mutual funds and ETFs. Index mutual funds pool money to buy a portfolio of stocks or bonds, while ETFs are traded on exchanges like individual stocks, allowing for more trading strategies.

When investing in an index fund, it is important to consider factors such as the fund's expenses, taxes, investment minimums, and long-run performance. It is also crucial to remember that index funds are subject to market swings and may underperform in prolonged downtrends.

Overall, index funds offer investors a way to gain exposure to a broad range of stocks or bonds at a low cost while providing the benefits of diversification and lower risk.

All-in-One Funds: Worthy Investment or Risky Gamble?

You may want to see also

What is an annuity?

An annuity is a contract between a buyer and an insurance company that provides the buyer with a regular series of payments in return for a lump-sum payment. An annuity is most commonly used to establish a steady stream of income in retirement.

Annuities are insurance contracts that provide regular income, either immediately or in the future, in return for a lump-sum payment. They can be a useful investment for those who want a steady, guaranteed retirement income and are willing to trade a large lump sum for a regular cash flow.

There are three main types of annuities: fixed, variable, and indexed. Fixed annuities offer a guaranteed, predictable income with a modest annual return, usually higher than the interest on a bank certificate of deposit (CD). Variable annuities offer a potentially higher return but carry greater risk. Indexed annuities fall somewhere in between fixed and variable annuities in terms of risk and payout potential. The buyer receives a guaranteed minimum payout, but a portion of the return is tied to the performance of a market index, such as the S&P 500.

Annuities can be a good option for those seeking a stable income in retirement, particularly in the current economic climate, where volatile markets, inflation, and rising interest rates are a concern. They can also help manage the risk of outliving your savings and protect against inflation eating away at your retirement funds.

However, annuities have been criticised for their complexity, high fees, and sales tactics that result in high commissions for salespeople. It's important to carefully consider the fees involved and consult a financial advisor before purchasing an annuity to ensure it aligns with your financial goals and needs.

American Century Investments: A Leading Mutual Fund Company?

You may want to see also

How do I choose between the two?

When deciding between investing in index funds or annuities, there are several factors to consider. Here are some key points to help you make an informed decision:

- Risk and Return: Index funds offer direct exposure to the stock market, providing the potential for higher returns but also carrying the risk of losses. Annuities, on the other hand, are considered less risky and offer a guaranteed return. However, they may have lower upside potential compared to index funds.

- Tax Implications: Both options have different tax treatments. Index funds held in taxable accounts will incur taxes on capital gains and dividends each year. Annuities, on the other hand, offer tax-deferral on gains, similar to retirement accounts like IRAs and 401(k)s. You don't pay taxes on annuity gains until you start withdrawing the money.

- Liquidity: Index funds offer higher liquidity as you can buy and sell them daily. Annuities, especially fixed annuities, lock up your money for a specific term, and early withdrawals may result in significant fees and penalties.

- Fees: Index funds typically have lower fees compared to annuities. Annuities often come with various fees, such as mortality and expense fees, administrative expenses, rider fees, and surrender charges. These fees can eat into your returns over time.

- Investment Horizon: If you are investing for the long term, both options can be suitable. However, consider your risk tolerance and financial goals. Index funds may be more suitable if you are comfortable with market volatility and are seeking higher returns. Annuities may be a better choice if you prioritize capital preservation and a steady income stream, especially in retirement.

- Complexity: Annuities, especially indexed annuities, can be complex financial products with intricate structures and fine print. It is crucial to thoroughly understand the terms and conditions before investing in an annuity. Index funds, on the other hand, are generally more straightforward and transparent.

- Financial Goals: Consider your overall financial goals and risk tolerance. If you are seeking capital appreciation and higher returns to meet long-term goals, such as retirement or funding your child's education, index funds may be more suitable. If you are primarily focused on generating a stable income stream, especially in retirement, annuities may be a better option.

- Diversification: Index funds offer exposure to a diverse range of stocks or bonds, providing instant diversification to your portfolio. Annuities may be used as part of a broader investment portfolio that includes stocks, bonds, and other assets.

- Advice from Professionals: Consult with a trusted financial advisor or planner who can provide personalized advice based on your financial situation, goals, and risk tolerance. They can help you assess the pros and cons of each option and create a comprehensive investment plan tailored to your needs.

Remember, there is no one-size-fits-all solution when it comes to investing. Carefully consider your financial goals, risk tolerance, time horizon, and tax situation before making any investment decisions. Diversification and a long-term perspective are key to building a robust investment portfolio.

Retirement Fund Investment: Choosing the Right Option

You may want to see also

How do interest rates affect fixed and index annuities?

Interest rates play a significant role in determining the returns on fixed and index annuities. Fixed annuities offer a guaranteed, fixed interest rate over the course of the annuity, typically starting at around three years. The interest rate is set based on current market trends and remains steady throughout the term. On the other hand, index annuities, also known as fixed index annuities or equity-indexed annuities, offer a variable rate of return that is linked to the performance of a specific market index. The rate for index annuities is initially set based on prevailing market conditions and then fluctuates depending on market performance and economic trends.

For fixed annuities, the interest rate is locked in at the time of purchase, providing investors with predictable and guaranteed returns. In contrast, index annuities provide a minimum guaranteed interest rate, typically ranging from 1% to 3%, while the remaining return is linked to the performance of the underlying index. This means that the returns for index annuities can be higher or lower than the guaranteed rate of fixed annuities, depending on market conditions.

When interest rates are high, as they were in 2024, fixed annuities become more attractive as they offer higher guaranteed rates. Fixed index annuities also benefit from higher interest rates, as insurers may offer higher possible caps for returns, providing the opportunity for greater gains. However, it is important to remember that insurance companies will also benefit from higher interest rates by taking a slice of the returns, which may reduce the overall growth potential of index annuities.

While interest rates can impact the returns of fixed and index annuities, it is crucial to consider other factors as well. Index annuities have complex structures with various fees, caps, and participation rates that can affect returns. Additionally, the performance of the underlying market index plays a significant role in determining the returns for index annuities. Fixed annuities, on the other hand, offer more predictable returns as they are not directly linked to market performance.

A Guide to Investing in Mutual Funds via Zerodha

You may want to see also

Frequently asked questions

An index annuity is a contract sold and backed by insurance companies that promise to provide you with a steady stream of income in retirement. The rate of return is based on a stock market index, such as the S&P 500.

The pros of investing in index annuities are that they provide a steady stream of income in retirement, protect against market losses, and have tax-deferred status. The cons are that they have high fees, are complex and difficult to understand, and may result in lower returns than expected.

An index fund is a type of investment fund that tracks a specific stock market index, such as the S&P 500. Index funds are designed to provide investors with a diversified portfolio that mirrors the performance of the index it tracks.

The pros of investing in index funds are that they provide diversification, have low fees, and historically have provided strong returns. The cons are that they may be more volatile than other types of investments and may not perform as well as actively managed funds.