Investing in mutual funds for a year requires a balance between capital safety and liquidity. While you may not earn as much as you would with longer-term investment plans, you can still make stable returns with less risk.

There are several types of mutual funds to choose from, each with its own advantages and considerations. For example, liquid funds are ideal for short-term investments of up to a year, while ultra-short-duration funds invest in debt securities that mature in 3-6 months. Low-duration funds focus on securities with a duration of 6-12 months, and money market funds provide high liquidity and low risk.

Before investing, it's important to assess your financial goals, risk tolerance, and the fund's expense ratio, liquidity, and exit loads. Diversifying your investments and understanding the tax implications can also help you make informed decisions.

| Characteristics | Values |

|---|---|

| Investment type | Mutual funds |

| Investment period | 1 year |

| Risk | Low to medium |

| Returns | 4% to 141.66% |

| Investment options | Liquid funds, ultra-short-term funds, low-duration funds, money market funds, floater funds, arbitrage funds |

| Liquidity | High |

| Diversification | Available |

| Management | Professional fund management |

| Minimum investment | Low |

| Pricing | Transparent |

| Flexibility | High |

What You'll Learn

Liquidity and capital safety

When investing in a one-year fund, it is important to balance liquidity and capital safety. Here are some factors to consider:

Money Market Funds:

Money market funds are a popular option for short-term investments. These funds typically invest in low-risk, highly liquid money market instruments with maturities of up to one year. They provide stable returns and are ideal for investors seeking capital safety.

Ultra-Short Duration Funds:

Ultra-short duration funds invest in debt securities with maturities of 3-6 months. They are well-suited for investors who want to match the duration of their investments with their financial goals. These funds offer relatively higher liquidity compared to longer-term investments.

Low Duration Funds:

Low duration funds invest in securities with durations of 6-12 months. They are designed for investors who are willing to accept slightly higher risks than those offered by money market funds but still prioritize capital safety and liquidity.

Risk Assessment:

When considering a one-year fund, it is crucial to assess the liquidity risk. This includes funding liquidity risk, which focuses on the ability to fund liabilities, and market liquidity risk, which pertains to the ability to exit a position without significant losses. Understanding these risks can help you make informed investment decisions.

Diversification:

Diversifying your investments across different asset classes and fund types can help manage liquidity and capital safety concerns. By spreading your investments, you reduce the impact of market fluctuations and lower the overall risk of your portfolio.

Contingency Planning:

It is important to have a contingency plan in place to manage unexpected events. This includes maintaining sufficient liquid assets, accessing borrowing lines, and having stable funding sources to meet liquidity demands. A well-prepared contingency plan can help protect your capital and ensure liquidity when faced with unforeseen circumstances.

In conclusion, when considering a one-year fund investment, it is vital to assess liquidity and capital safety. By understanding the different investment options, managing risks, and diversifying your portfolio, you can make informed decisions that align with your financial goals and risk tolerance.

A Safe Mutual Fund Investment: Strategies for Beginners

You may want to see also

Risk tolerance

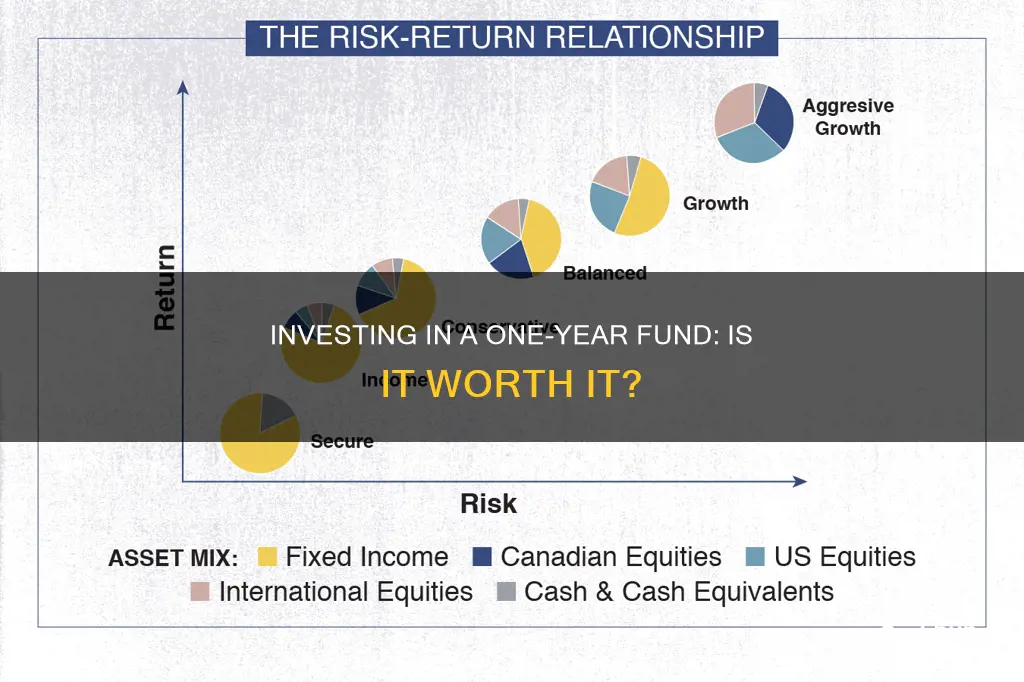

Investing in a 1-year fund, or any fund, always involves some level of risk. The level of risk will depend on the type of fund and the underlying assets or instruments. Generally, funds with higher potential returns come with higher risk.

For example, high-risk investments include volatile stocks, cryptocurrency, and growth-focused stocks. On the other hand, traditionally safer investments with lower returns include treasury bonds, money market funds, and "blue-chip" stocks.

When considering a 1-year fund, it is important to note that these funds typically invest in low-risk, short-term assets such as fixed-income securities, treasury bills, short-term bonds, and money market instruments. These funds aim to balance capital safety and liquidity, providing stable returns, even if they are lower than those of longer-term funds.

To assess your risk tolerance, you should consider your financial goals, investment horizon, and comfort with potential losses. You can also take an online risk assessment test or consult an investment advisor to better understand your risk profile.

It is crucial to remember that market volatility can significantly impact short-term investments. Therefore, investors should carefully evaluate their risk tolerance and ensure that their investment strategy aligns with their financial objectives and risk tolerance.

Investing in CDs or Index Funds: Which is Better?

You may want to see also

Investment goals

Setting clear investment goals can help you determine if you’re investing the right amount, at the right time, and in the right mix of assets. It can help you set a timeline and give you a starting point for how much you need to start investing, and what that will translate to for your monthly or yearly budget.

What you’re investing for

Perhaps you’re investing for retirement, or maybe your end goal is to purchase a home or fund your child’s education. Deciding what your end goal is can help you set a realistic timeline for reaching your goal and make it easier to land on how aggressively you should be investing to make those goals a reality.

What your timeline looks like

Your timeline will look different depending on what your goal is. If your end goal is retirement, depending on when you start investing, you could have decades to invest and grow your retirement fund. You have the flexibility to start small and gradually increase those contributions over time as your income increases. This timeline could look different if you’re investing for a shorter-term goal like purchasing a home or retiring early.

Your risk tolerance

Investing will always involve some level of risk, regardless of the kind of asset you’re investing in. Ask yourself how comfortable you feel with assuming that risk. “Beginner investors should think carefully through the mix of investments they’d like to have in their portfolio, as it’s good to have diversity,” says Michael Wang, CEO and founder at Prometheus Alternative Investments.

Types of 1-year investment funds

- Liquid funds

- Ultra-short-term funds

- Low-duration funds

- Money market funds

- Floater funds

- Arbitrage funds

How to choose the best 1-year investment plan

When choosing the best 1-year investment plan, consider the following:

- Assess your risk tolerance

- Evaluate the expense ratio

- Prioritise liquidity

- Consider any exit loads or fees

Large-Cap Growth Fund: A Smart Investment Strategy

You may want to see also

Investment types

When considering a 1-year investment, it's important to assess your financial goals, risk tolerance, and the investment options available to you. Here are some types of investments to consider for a 1-year horizon:

Liquid Funds

Liquid funds are ideal for short-term investments, typically up to one year. These funds invest in money market instruments with a maturity period of around 90 days. Due to the short holding period, there is minimal price risk involved. Liquid funds are a popular choice for investors looking to park their money for a short duration.

Ultra-Short Duration Funds

These funds have gained popularity for their focus on duration rather than maturity. They invest in debt securities with maturities ranging from 3 to 6 months, making them suitable for maturity matching. Ultra-short duration funds offer flexibility and are often chosen for short-term investment goals.

Low-Duration Funds

Low-duration funds invest in securities with durations of 6 to 12 months. They are well-suited for investors who want to park their funds for up to one year. These funds aim to balance risk and return effectively.

Money Market Funds

Money market funds invest in money market instruments with maturities of up to one year. They are known for their high liquidity and low risk. Unlike duration funds, money market funds do not carry credit risk. This makes them attractive to investors seeking stable and relatively safe short-term investments.

Floater Funds

Floater funds are a type of debt fund that invests primarily in floating-rate bonds. The interest rates on these bonds adjust with changes in the market, making them suitable for short-term investments, especially in a rising interest rate environment.

Arbitrage Funds

Arbitrage funds leverage price differences between the cash and derivatives markets to generate returns. While classified as hybrid funds, they function similarly to debt funds. Arbitrage funds are a popular choice for short-term investments of up to one year, with returns linked to the volatility of the underlying assets.

When considering these investment options, it's important to remember that each comes with its own set of risks and potential rewards. Conduct thorough research, assess your financial goals and risk tolerance, and consider seeking advice from a financial advisor before making any investment decisions.

Opening an Investment Fund: A UK Guide

You may want to see also

Returns and expenses

Returns

When considering a 1-year fund, it's important to understand the potential returns on your investment. Short-term investments typically have lower yields compared to long-term investments. The focus is on capital preservation and liquidity rather than high returns. However, there are still options available that can provide stable returns.

For a 1-year investment horizon, you may consider the following options:

- Ultra-short-duration funds: These funds invest in debt securities with maturities of 3-6 months, providing stable returns with low interest rate risk.

- Low-duration funds: These funds invest in securities with durations of 6-12 months, making them suitable for a 1-year investment timeframe.

- Money market funds: These funds invest in money market instruments with maturities of up to 1 year and are very liquid and low-risk.

- Floating-rate funds: These are debt funds that invest in floating-rate bonds, which can be advantageous in a rising interest rate environment.

- Arbitrage funds: These funds leverage the price differential between the cash and derivatives markets to generate returns and are suitable for short-term investments.

Expenses

When investing in a 1-year fund, it's important to consider the expenses associated with the investment. Here are some key expense-related factors to keep in mind:

- Fees and charges: Be mindful of any fees or charges associated with the fund, such as maintenance fees or transaction costs. These can eat into your returns.

- Interest rates: Keep an eye on interest rates, as they can impact the returns on certain types of investments, especially fixed-income securities.

- Inflation: Consider the impact of inflation on your returns, especially if you're holding cash in a checking account or low-interest savings account. Inflation can erode the purchasing power of your money over time.

- Tax implications: Understand the tax implications of your investment, as certain types of investments may have tax advantages, such as exemptions from state and local taxes.

Teachers' Retirement: Mutual Funds, IRAs, or 403(b)s?

You may want to see also

Frequently asked questions

Short-term funds offer many advantages, such as reduced volatility and lower risk, stable returns in a short time frame, and diversification opportunities.

There are several risks to consider, including market volatility, liquidity risk, interest rate fluctuations, and currency risk for international funds.

There are several types of 1-year funds to choose from, including liquid funds, ultra-short-duration funds, low-duration funds, money market funds, floater funds, and arbitrage funds.

When choosing a 1-year fund, it is important to assess your risk tolerance, evaluate the fund's expense ratio, prioritise liquidity, and consider any exit loads or fees.

The returns on 1-year funds can vary depending on market conditions and the specific investment chosen. It is important to research and select a fund that aligns with your financial goals and risk tolerance.