Investing in bonds or mutual funds is a common dilemma for investors. While both options have their pros and cons, the decision ultimately depends on the investor's financial goals, risk tolerance, and behavioural preferences.

Bonds are typically considered a more conservative and safer investment option compared to stocks or mutual funds. They offer fixed interest rates and promise a certain return, making them less volatile than stocks. However, this lower risk also results in a lower return on investment.

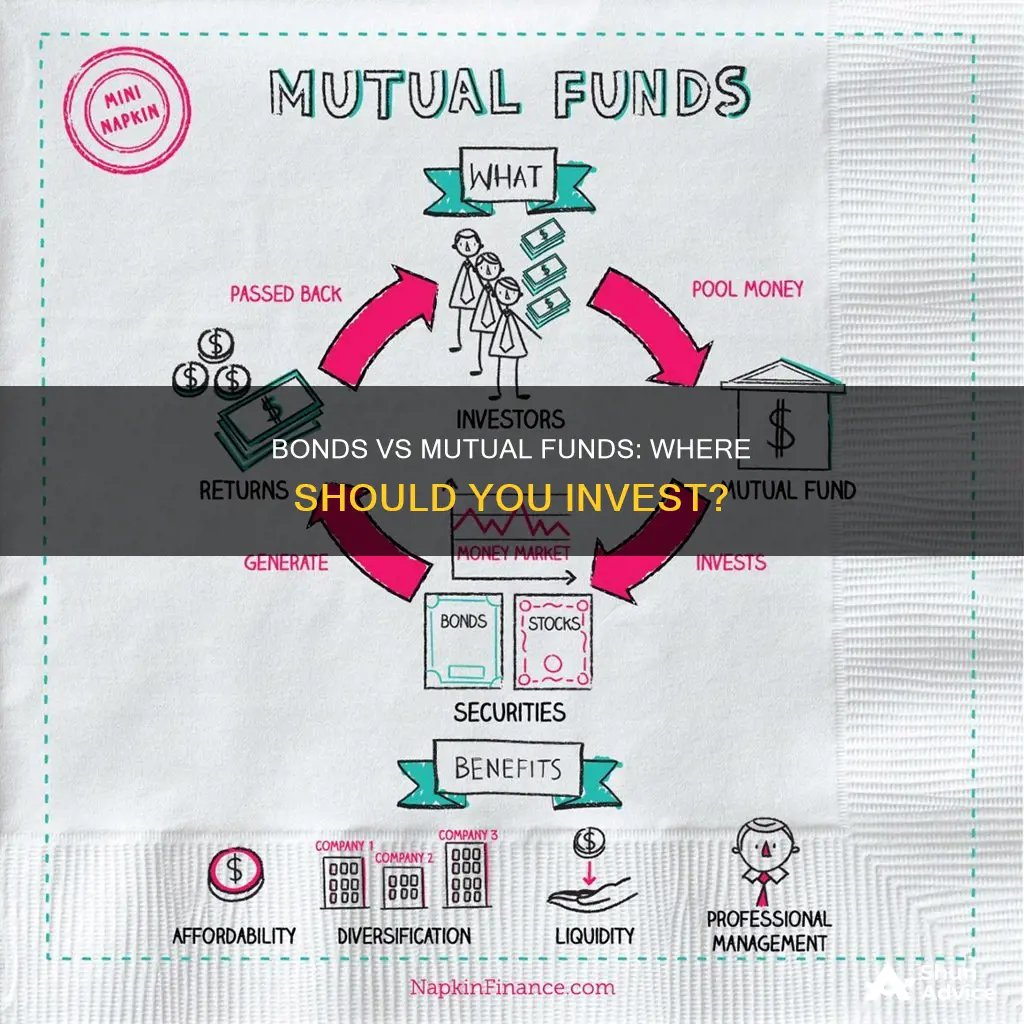

Mutual funds, on the other hand, offer instant diversification by pooling money from multiple investors to invest in different securities. They are a good option for those who want to build wealth through investing but don't want to be involved in the complicated decision-making process. Mutual funds also provide access to professional management, which can be beneficial for those who prefer to leave the research and decision-making to experts.

When deciding between bonds and mutual funds, it's essential to consider factors such as the amount of money available for investment, financial goals, and the level of control desired over the investment portfolio. Understanding these personal investment goals and circumstances is key to making the right choice.

What You'll Learn

- Bonds vs. Bond Mutual Funds: The Pros and Cons

- Mutual Funds: Diversification, Convenience, and Lower Costs

- Bond Mutual Funds: Greater Diversification, Access to Institutional Pricing, and Professional Management

- Bond Funds: Management Fees, Fluctuating Net Asset Value, and Different Cost Basis and Tax Consequences

- Bonds: Fixed Income, Safety, and Credit Ratings

Bonds vs. Bond Mutual Funds: The Pros and Cons

Bonds

Bonds are a type of investment designed to help governments or corporations raise money for projects. They are considered a safer investment option than stocks because corporations are required to pay back bond investors before stock investors in the event of bankruptcy. Bonds also come with fixed interest rates, promising a certain return.

The benefits of bonds include:

- A reliable income stream, which is great for planning.

- A predictable value at maturity.

- Your own cost basis, which is useful for tax-planning purposes.

However, there are also downsides to investing in bonds:

- A significant amount of bonds is needed to achieve diversification.

- Pricing is generally less attractive than the pricing institutional investors receive.

- It takes a lot of time to research individual bonds and manage a strategy.

Bond Mutual Funds

Mutual funds pool money from a group of investors and invest that capital into different securities. They are a good option for investors looking to diversify their portfolios and reduce investment risk.

The benefits of bond mutual funds include:

- Greater diversification per dollar invested.

- Access to institutional pricing.

- Professional management.

However, there are also downsides to investing in bond mutual funds:

- Management fees for actively traded bond funds can be higher, leading to lower returns.

- The net asset value (NAV) will fluctuate with the market, making them less attractive for planning future liabilities.

- Different cost basis and tax consequences.

The right choice between bonds and bond mutual funds depends on your personal investment goals, time horizon, and risk tolerance.

If you are looking for predictable value and certainty, individual bonds may be a better fit. On the other hand, if you seek professional management and greater diversification, bond mutual funds may be more suitable.

Additionally, consider the amount of assets you have available for your bond portfolio. Individual bonds can be cost-prohibitive for some investors, making bond funds a more accessible option.

ICICI Prudential Bluechip Fund: Is It Worth Your Investment?

You may want to see also

Mutual Funds: Diversification, Convenience, and Lower Costs

Mutual funds are a great way to achieve diversification, convenience, and lower costs when investing.

Diversification

Mutual funds offer investors a diverse pool of investment options. They are comprised of dozens of different securities, across many different sectors and industries. This means that with a small amount of money, an investor can access a wide range of investments, which helps to minimise potential losses.

Experts recommend that a portfolio should hold stock in at least 20 different companies to realise the benefits of diversification. This can be difficult and costly for an individual investor to achieve, but mutual funds provide an easy way to do this.

Convenience

Mutual funds are convenient because they allow investors to defer the decision-making to an expert. Investors can rely on the expertise of a money manager to help determine their portfolio's asset allocation, rather than having to research and select individual stocks themselves.

Lower Costs

The cost of trading in a mutual fund is spread over all investors in the fund, which often results in a lower cost per individual. This is because mutual funds benefit from economies of scale, and the cost of a trade is the same whether an investor buys one share or 5,000.

Additionally, mutual funds can be purchased without generating a transaction fee, and they charge an ongoing management fee to cover the cost of maintaining the fund, rather than charging fees every time money is invested into the fund.

SBI Blue Chip Fund: A Smart Investment Strategy

You may want to see also

Bond Mutual Funds: Greater Diversification, Access to Institutional Pricing, and Professional Management

Greater Diversification

One of the main advantages of investing in bond mutual funds is the greater diversification they offer compared to individual bonds. With a bond mutual fund, you obtain exposure to a basket of bonds with a variety of issuers, maturity dates, coupon rates, and credit ratings. This diversification can be more challenging to achieve when investing in individual bonds, especially for investors with a limited amount of capital.

Access to Institutional Pricing

Bond mutual funds generally receive better pricing on individual bonds than individual investors. Bond funds often purchase large quantities of bonds at once, similar to institutional investors, and thus benefit from more attractive pricing. This means that for the same investment amount, you may be able to buy a greater number of bonds through a bond mutual fund compared to investing directly in individual bonds.

Professional Management

Bond mutual funds are actively managed by fund managers who buy and sell bonds based on the economic and interest rate environment. This professional management can be particularly valuable when investing in riskier segments of the fixed-income market, such as high-yield bonds, bank loans, or preferred securities. The fund manager's expertise can help navigate the nuances and credit analysis required to succeed in these markets.

Other Considerations

While bond mutual funds offer these benefits, there are also some downsides to consider. Bond mutual funds typically charge management fees, which can be higher for more actively traded funds, potentially leading to lower returns. Additionally, the net asset value (NAV) of bond mutual funds will fluctuate with changes in interest rates, so there is no guarantee of recovering your principal at a specific time.

The decision to invest in bond mutual funds or individual bonds depends on various factors, including your investment goals, risk tolerance, and time horizon. Bond mutual funds provide greater diversification, access to institutional pricing, and professional management, but they also come with management fees and potential fluctuations in NAV. Individual bonds, on the other hand, offer more control and predictability but require significant time and resources for research and management.

Bond Funds: Best Time to Invest and Why

You may want to see also

Bond Funds: Management Fees, Fluctuating Net Asset Value, and Different Cost Basis and Tax Consequences

When deciding whether to invest in bonds or mutual funds, it is important to consider the management fees, net asset value fluctuations, cost basis, and tax consequences associated with bond funds.

Management Fees

Bond funds typically charge management fees, which can impact their performance relative to the market. The success of actively managed bond funds in outperforming their benchmarks is often diminished once management fees are factored in. In contrast, passive investment options, such as index funds, tend to have lower fees and can sometimes offer better returns. Therefore, it is crucial to consider the impact of fees when evaluating the potential returns of a bond fund.

Fluctuating Net Asset Value

The net asset value (NAV) of a bond fund can fluctuate due to changes in interest rates and other market factors. When interest rates rise, the value of a bond fund tends to decline, and when interest rates fall, the value of the fund increases. This volatility in NAV can affect investors' returns, especially if they choose to redeem their shares during a period of fluctuating interest rates. Unlike individual bonds, bond funds do not have a defined maturity date, so investors are exposed to the risk of losing principal if they sell their shares during unfavourable market conditions.

Different Cost Basis and Tax Consequences

Understanding the cost basis of bond investments is crucial for accurate tax reporting and informed investment decisions. The cost basis represents the total amount paid for the bond, including any associated costs such as broker fees. When bonds are bought at a discount or premium, adjustments must be made to the cost basis depending on whether they are held to maturity or sold early.

Tax-exempt bonds, such as municipal bonds, offer federal income tax relief on interest income, but calculating the cost basis is still essential for reporting capital gains or losses. On the other hand, taxable bonds, like corporate bonds, incur federal, state, and sometimes local income taxes on the interest earned. The tax treatment of bond investments can significantly impact the yield and attractiveness of the investment, especially for investors in higher tax brackets.

Small-Cap Funds: Worth the Investment Risk?

You may want to see also

Bonds: Fixed Income, Safety, and Credit Ratings

Bonds are a type of investment that governments or corporations use to raise money for projects. They are considered "fixed income" assets because they pay interest at regular intervals until they reach maturity. The interest payments are fixed in advance, hence the name. When you buy a bond, you are essentially loaning money to the issuer.

Bonds are typically safer than stocks because corporations are legally required to pay back bond investors before stock investors in the event of bankruptcy. However, this does not make bonds risk-free. To help investors gauge their risk, bonds are rated for credit quality by credit rating agencies such as Moody's or Standard and Poor's. Investment-grade bonds typically have ratings of A, AA, or AAA.

When investing in bonds, you have the option to buy individual bonds or invest in a bond fund, which is a type of mutual fund. A bond fund pools capital from investors and allocates it to various fixed-income securities. Here are some key things to know about bonds:

Fixed Income

Bonds pay interest at regular intervals, usually semi-annually. This provides a reliable income stream that is great for planning. For example, if you have periodic expenses like college tuition, the fixed income from bonds can help cover those costs.

Safety

Bonds are generally considered safer than stocks because, in the event of bankruptcy, corporations must pay back bond investors before stock investors. Additionally, the predictable value of bonds at maturity adds to their safety. Unless the bond is callable (meaning it can be called back by the issuer before the maturity date), you will receive the par value of the bond at maturity, barring default.

Credit Ratings

To help investors assess the risk of a bond, credit rating agencies such as Moody's or Standard and Poor's assign a credit quality grade to each bond. Investment-grade bonds typically have ratings of A, AA, or AAA. These ratings are based on the financial viability of the issuer and the likelihood of default.

A Guide to Investing in the Baillie Gifford American Fund

You may want to see also

Frequently asked questions

Bonds are a safer, more conservative investment option than stocks. They come with fixed interest rates that promise a certain return. Bonds are also less volatile than stocks and can help stabilise a diversified investment portfolio.

Mutual funds offer instant diversification across many different industries or types of securities. They are also more convenient as they make investment decisions for you and are managed by professionals. Mutual funds are also more cost-efficient as the cost of trading is spread over all investors in the fund.

One of the downsides of investing in bonds is that you need a significant amount of bonds to achieve diversification, which may be cost-prohibitive for some investors. Bond prices can also fluctuate in the secondary market depending on the direction of interest rates.