Target-date funds are a popular choice for investors saving for retirement. They are designed to be a set it and forget it investment option, automatically rebalancing a portfolio from growth investments to more conservative ones as retirement nears. While target-date funds are typically standalone investments, some investors choose to hold multiple target-date funds with different retirement dates. This strategy is known as laddering and can be used to afford more flexibility in retirement. However, critics of this strategy argue that it goes against the principle of keeping investments simple and that it may not provide any additional benefits.

| Characteristics | Values |

|---|---|

| Purpose | Retirement savings |

| Main advantage | Simplicity |

| Other advantages | Easy diversification, automatic rebalancing, low fees |

| Disadvantages | May be too conservative, indifferent to individual needs, high fees |

| Best for | Young workers, hands-off investors |

What You'll Learn

Target-date funds are a set it and forget it retirement savings option

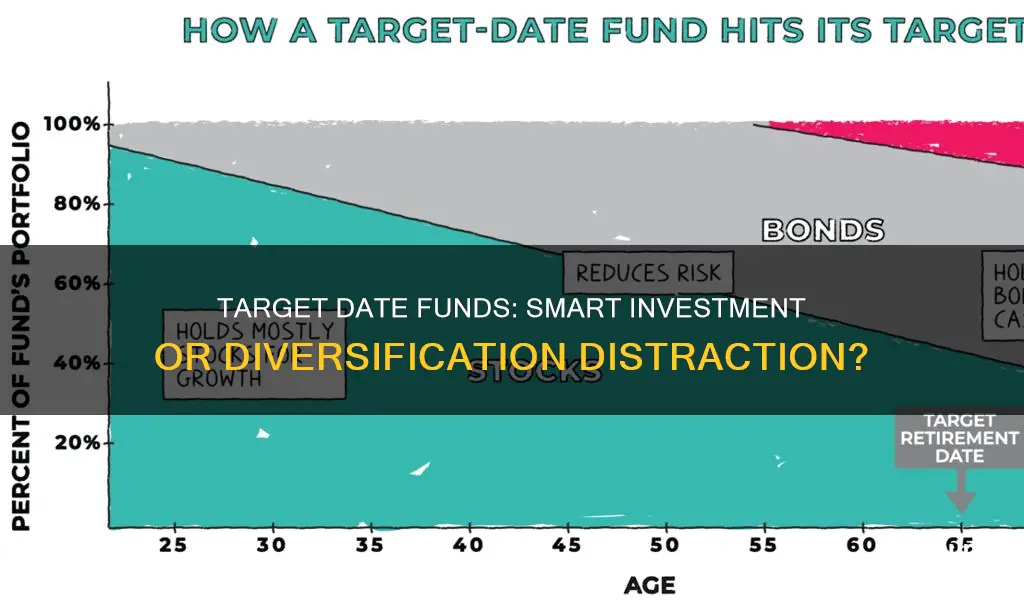

Target-date funds, also known as life-cycle funds or target-retirement funds, aim to continually strike the right balance between the risk necessary to build wealth and safer bets to protect a growing nest egg. The fund automatically rebalances your portfolio with the right mix of stocks, bonds, and money market accounts as you age. While you set and forget, the fund updates your asset allocation through the years.

Early in your working life, a target-date fund is generally set for growth by having a much larger slice of your portfolio in stocks rather than fixed-income investments like bonds, which are safer but provide smaller returns. As your retirement year approaches, the fund gradually shifts toward more bonds, money market accounts, and other lower-risk investments.

Your retirement year is the "target date" of most of these funds, and the funds are conveniently named to correspond with your planned retirement year. For example, if you are 40 years old and plan to work until you are 65, you would choose the provider with a fund named with the year nearest your planned retirement date.

The chief appeal of target-date funds is their simplicity. “If you think about putting together funds as you would cook a good meal, asset allocation is the choice of ingredients that goes in,” says Laura Scharr, principal at Laura Scharr Coaching, a financial coaching firm in Columbia, South Carolina. With target-date funds, “it’s an instant meal — they’ve put all the ingredients together for you.”

Another advantage of target-date funds is that they keep investors from being their own worst enemy by being too reactive to the market's twists and turns, which often results in buying high and selling low.

While the set-and-forget nature of target-date funds is a key feature, experts advise looking at your fund's performance once a year to ensure it still works for you. Also, look at other investments you hold. How do those assets and your target-date fund fit together? If you don’t know, you run the risk of double-dip in asset classes, even buying the same fund twice, experts warn. An annual checkup of your total portfolio could spot such problems.

International vs Domestic Funds: Where Should You Invest?

You may want to see also

Target-date funds are designed to age with you

Target-date funds are designed to be a ""set it and forget it" investment option for those saving for retirement. They are built to be standalone funds, comprising a broadly diversified portfolio in just one investment. They are also designed to age with you by automatically rebalancing your portfolio from growth investments toward more conservative ones as retirement nears.

The target date in a target-date fund is the investor's anticipated year of retirement. The fund's portfolio of assets aims for growth while reducing risk as individuals get closer to retirement age. This is done by automatically adjusting the mix of stocks and bonds in the fund so that investors have less risk as they near retirement. This is known as the fund's glide path.

Target-date funds are popular because they are simple. Investors don't need to worry about rebalancing their portfolio—the fund managers take care of that. All investors need to understand is the year they want to retire.

However, target-date funds are not suitable for everyone. They limit investment choices and decisions, and they may be too conservative for some investors, especially as they approach retirement age.

Maximizing HSA Investment: Fidelity's Smart Strategies for Tax-Free Growth

You may want to see also

Target-date funds are a popular choice among investors saving for retirement

Target-date funds are also popular due to their low fees and ease of enrollment. According to Vanguard, in 2023, 64% of retirement contributions were invested in target-date funds, up from 59% in 2022. They have become the default option for many employer-sponsored 401(k) plans, and the Pension Protection Act of 2006 further encouraged their use by allowing employers to set up automatic enrollment. Additionally, target-date funds handle the challenging task of optimising asset allocation and rebalancing investment holdings, making them a convenient choice for investors who want a hands-off approach to retirement planning.

However, it's important to note that target-date funds have some drawbacks. They limit investment choices and decisions, and their one-size-fits-all strategy may not suit everyone's needs. Some research suggests that target-date funds may become too conservative too early, around the age of 50, which could impact long-term investors' asset mix. Additionally, fees for target-date funds can vary, and investors may be able to achieve similar levels of diversification at a lower cost by owning separate index funds.

While target-date funds are a popular choice, investors should carefully consider the pros and cons before deciding if they are the right option for their retirement savings.

Setting Up a Property Investment Fund: A Comprehensive Guide

You may want to see also

Target-date funds limit investment choices and decisions

Target-date funds are designed to be a ""set it and forget it" investment option. They are a passively indexed portfolio that automatically rebalances based on an investor's time until retirement. This means that the investor does not need to make any active decisions about their portfolio, and their investment choices are limited.

The main appeal of target-date funds is their simplicity. An investor simply needs to choose the year closest to their expected retirement date, and the fund will automatically adjust the mix of stocks and bonds to reduce risk as they near retirement. This is known as a "glide path". The fund's asset allocation will periodically adjust to reflect the investor's risk tolerance over time.

Target-date funds are usually a one-size-fits-all strategy, and investors are not actively involved in investment choices. This means that investors give up a certain level of control and customisation over their portfolio. While target-date funds are designed to be standalone investments, some investors choose to add non-target-date funds to their portfolio to make it more aggressive or conservative.

Target-date funds are also often the default option for many employer-sponsored 401(k) plans, and they may not be suitable for everyone. For example, research has shown that they may become too conservative for most people around the age of 50. They may also charge high fees, and investors could achieve a similar level of diversification by owning multiple index funds at a lower cost.

Invest Your 401k: Index Funds for Secure Retirement

You may want to see also

Target-date funds are subject to risks

Target-date funds are a popular choice for investors saving for retirement. They are designed to be a standalone investment, comprising a broadly diversified portfolio in just one investment. However, they are not without risk.

Firstly, target-date funds are subject to the risks of their underlying funds. While they are designed to become more conservative as the target date approaches, they are not guaranteed at any time, including on or after the target date. This means that even as the fund nears maturity, it is still possible to lose money.

Secondly, all investing is subject to market risk, and diversification does not ensure a profit or protect against loss in a declining market. Investments in bond funds carry interest rate, credit, and inflation risk.

Thirdly, target-date funds are inflexible and do not take into account changes in market conditions, which can lead to increased risk or loss of potential gains. For example, during the 2008 financial crash, many investors with target-date funds close to retirement saw their assets plummet in value.

Fourthly, target-date funds are not tailored to individual investors' unique financial situations. They do not take into account an individual's years until retirement, inheritance income, or lifestyle changes over time. As a result, some investors may find that their target-date fund does not provide them with the expected and necessary amount to sustain their lifestyle in retirement.

Lastly, target-date funds can be relatively expensive in terms of fees, as they are funds of funds that invest in other mutual funds or exchange-traded funds, resulting in a double layer of fees. It is important for investors to understand the risks and fees associated with target-date funds and consider all their options before investing.

CEF Funds: Where the Rich Invest Their Money

You may want to see also

Frequently asked questions

A target-date fund is an investment fund designed to help people save for retirement. The "target date" in the fund's name refers to the year the investor plans to retire. These funds automatically adjust their mix of stocks, bonds, and other investments over time to strike a balance between growth and conservation of wealth.

Target-date funds offer a "set it and forget it" approach to retirement savings. They are simple to use and provide a well-diversified portfolio that automatically rebalances based on the investor's time until retirement. They also remove the need for investors to actively choose a mix of assets and manually rebalance their portfolio over time.

Yes, target-date funds may become too conservative too early, limiting investment choices and returns. They also limit investor involvement in decision-making and may charge high fees compared to alternative investment strategies. Additionally, they may not always provide an asset mix that aligns with an individual's specific needs and goals.

While it is possible to invest in multiple target-date funds, financial experts generally advise against it. The primary advantage of target-date funds is their simplicity, and investing in multiple funds can complicate your portfolio without providing additional benefits. It is more important to choose the right fund for your risk tolerance and retirement goals.

When choosing a target-date fund, consider the fund's investing philosophy, fees, and asset allocation strategy. Ensure that the fund's glide path, or the way it shifts from riskier to more conservative investments over time, aligns with your retirement goals. Compare different funds to find one that best matches your desired asset allocation and overall financial plan.