The 2008 financial crisis was the most severe economic crisis since the Great Depression. It was caused by a combination of factors, including predatory lending, excessive risk-taking by financial institutions, and the bursting of the US housing bubble. While the role of hedge funds in the crisis is still debated, some argue that they did contribute to the turmoil.

Hedge funds are private investment pools that cater to high-net-worth individuals and institutions. They employ aggressive investment strategies and are known for taking on significant risk. In the lead up to the 2008 crisis, hedge funds were actively involved in the market for mortgage-backed securities (MBS) and collateralized debt obligations (CDOs), which were backed by subprime mortgages. As the housing market started to decline, hedge funds found themselves exposed to these toxic assets.

Some experts argue that hedge funds, along with investment banks and other financial institutions, contributed to the crisis by promoting and investing in risky mortgage-backed securities. The complex and opaque nature of these securities made it difficult for investors to assess the underlying risks. When the housing market collapsed, hedge funds were left with significant losses, and their withdrawal of billions of dollars from prime brokers further destabilized the financial system.

However, others contend that hedge funds were not a primary cause of the crisis. According to a study by the RAND Corporation, hedge funds did not play a pivotal role compared to other agents, such as credit rating agencies and mortgage lenders. The study found that hedge funds actually bet against the housing market and called attention to the growing bubble.

While the exact role of hedge funds in the 2008 financial crisis remains a subject of debate, it is clear that their activities and investment strategies contributed to the overall turmoil and uncertainty in the financial system during that time.

What You'll Learn

Hedge funds' role in the 2008 financial crisis

The 2007–2008 financial crisis was the most severe worldwide economic crisis since the Great Depression. It was caused by a combination of factors, including predatory lending in the form of subprime mortgages targeting low-income homebuyers, excessive risk-taking by global financial institutions, and the bursting of the United States housing bubble. While the causes of the crisis are complex and multifaceted, hedge funds played a significant role in the lead-up to and impact of the crisis.

Hedge funds are alternative investment vehicles that pool capital from accredited investors to make aggressive bets on various assets, including stocks, bonds, commodities, and derivatives. They often employ highly leveraged strategies, which can amplify gains but also lead to significant losses. In the years leading up to the 2008 financial crisis, hedge funds were among the most active participants in the market for mortgage-backed securities (MBS) and collateralized debt obligations (CDOs). These complex financial products were backed by bundles of subprime mortgages, which were sold to investors as relatively safe and low-risk investments.

As the housing market began to cool and home prices started to fall, many subprime borrowers struggled to make their mortgage payments. This led to a wave of defaults and foreclosures, causing the value of MBS and CDOs to plummet. Hedge funds that had invested heavily in these securities suffered significant losses, and some were even forced to shut down. The crisis also led to a liquidity crunch, as banks and other financial institutions became reluctant to lend to each other, further exacerbating the problems in the financial system.

While the role of hedge funds in the crisis is still debated, some experts argue that they contributed to the crisis by promoting and investing in risky mortgage-backed securities. Others contend that hedge funds were simply responding to the demands of investors for higher returns and were not solely responsible for the crisis. However, it is clear that the industry was significantly impacted by the fallout, with many hedge funds struggling to recover and facing increased regulatory scrutiny in the aftermath.

In conclusion, while the exact role of hedge funds in the 2008 financial crisis remains a matter of debate, it is clear that they played a significant part in the lead-up to and impact of the crisis. The aggressive investment strategies employed by hedge funds, combined with their involvement in risky mortgage-backed securities, left them vulnerable to the collapse of the housing market. The fallout from the crisis led to changes in the industry, including reduced fee structures and increased transparency.

Military Fund Investment: Pros and Cons

You may want to see also

Regulatory changes after the crisis

The 2008 financial crisis led to a raft of regulatory changes, with the most significant being the Dodd-Frank Wall Street Reform and Consumer Protection Act. This act was designed to regulate the activities of the financial sector and protect consumers. It introduced the Consumer Financial Protection Bureau (CFPB) and the Financial Stability Oversight Council (FSOC), which monitor and protect the financial interests of American consumers and designated systemically important financial institutions (SIFIs), respectively. The Volcker Rule, a provision of the Dodd-Frank Act, limits speculative investments by depository institutions and proprietary traders at large financial institutions.

The Dodd-Frank Act also enhanced existing regulations, including the Securities Act of 1933, the Securities Exchange Act of 1934, the Investment Company Act of 1940, the Investment Advisers Act of 1940, and the Sarbanes-Oxley Act of 2002.

Another key piece of legislation was the Emergency Economic Stabilization Act, which provided $475 billion in bailout relief through the Troubled Asset Relief Program (TARP). This program spent $426.4 billion bailing out institutions, including American International Group Inc. (AIG), Bank of America (BAC), Citigroup (C), JPMorgan (JPM), and General Motors (GM).

In addition to these US-focused regulatory changes, the G20 committed to fundamental reform of the global financial system. The G20 called on the Financial Stability Board (FSB) to develop and coordinate a comprehensive framework for global regulation and oversight. The FSB's priority reform areas included building resilient financial institutions, ending "too big to fail", implementing effective resolution regimes, enhancing supervision, making derivatives markets safer, and improving risk disclosures.

Strategies for Investing in Average Mutual Funds Wisely

You may want to see also

Hedge funds' contribution to systemic risk

While hedge funds were not the primary cause of the 2007-2008 financial crisis, they did contribute to systemic risk.

Hedge funds are a dynamic part of the global financial system. Their managers engage in innovative and aggressive investment strategies that can improve the performance of financial markets and facilitate the flow of capital from savers to users. However, there is concern that they can contribute to financial instability.

The collapse of Long-Term Capital Management (LTCM) in 1998 raised awareness that hedge funds could be a source of risk to the entire financial system. Hedge funds also invested heavily in many of the financial instruments at the heart of the 2007-2008 financial crisis, such as mortgage-backed securities.

The failure of hedge funds during the crisis can be attributed to their investment in illiquid assets, their involvement in short selling, and the buildup of highly leveraged and illiquid portfolios. Hedge fund withdrawals also weakened prime brokers and their parent organizations.

To address the potential systemic risks posed by hedge funds, the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 was enacted. This legislation addressed gaps in the information available to regulators on hedge fund operations, investment strategies, and investment positions. It also gave regulators the authority to impose margin and other requirements to cover the risk of default.

While hedge funds did not play a pivotal role in the 2007-2008 financial crisis, their contribution to systemic risk underscores the importance of effective regulation and oversight to mitigate potential risks to the financial system.

A Guide to Investing in Sundaram Mid Cap Fund

You may want to see also

The impact of the crisis on the hedge fund industry

The 2007-2008 financial crisis had a profound impact on the hedge fund industry. The crisis, which was the most severe worldwide economic crisis since the Great Depression, was precipitated by a combination of factors, including predatory lending practices, excessive risk-taking by financial institutions, and the bursting of the US housing bubble. This "perfect storm" led to the Great Recession, causing significant disruptions and losses across the global economy.

Hedge funds, which had previously been regarded as darlings of Wall Street, were not spared from the fallout of the crisis. Here are some key ways in which the crisis affected the hedge fund industry:

Decline in Returns and Performance:

Hedge funds experienced a significant decline in returns following the financial crisis. The crisis and the ensuing Great Recession put a damper on hedge fund returns, and the industry struggled to recover. Even with the help of government stimulus measures, many hedge funds were unable to produce returns comparable to pre-crisis levels.

Closure and Liquidation:

The crisis led to a significant number of hedge fund closures and liquidations. During the first three quarters of 2008, approximately 7% of hedge funds shuttered their doors, and more than three-quarters of the industry either liquidated their holdings or imposed restrictions on redemptions. The crisis exposed the vulnerabilities of hedge funds, and many were unable to withstand the market turmoil.

Changes in Fee Structures:

The crisis prompted a shift in fee structures within the hedge fund industry. Historically, hedge funds adhered to the "two-and-twenty" model, charging 2% of their total assets and 20% of their gains. However, the lacklustre returns after the crisis made it challenging to justify these high fees. As a result, some funds started moving towards a lower management fee of 1% and a performance fee of 15%.

Regulatory Changes and Increased Scrutiny:

The financial crisis triggered regulatory changes and increased scrutiny of the hedge fund industry. Legislators introduced measures such as the Dodd-Frank Wall Street Reform and Consumer Protection Act in the US, which aimed to increase accountability and transparency. Portions of this legislation restricted speculative investments by banks and prohibited their involvement with hedge funds under the Volcker Rule.

Shift in Investor Sentiment:

The crisis led to a shift in investor sentiment towards hedge funds. While hedge funds had previously attracted investors with their record-beating returns, the aggressive and risky strategies employed by some funds during the crisis led to significant losses. This prompted investors to withdraw their money, and hedge funds struggled to regain their previous levels of investment.

Impact on Prime Brokerage Relationships:

The crisis had a significant impact on the relationship between hedge funds and prime brokers. The prime brokerage model, which allowed re-hypothecation and provided low costs, came under scrutiny. Hedge funds became more cautious and sought greater protection for their assets, leading to changes in the industry.

Industry Consolidation and Attrition:

The financial crisis led to a period of consolidation and attrition within the hedge fund industry. There was a Darwinian process of survival, where funds that could consistently deliver reliable returns attracted business, while those with volatile performance struggled. The industry witnessed a significant level of fund closures and a reshuffling of the remaining players.

Increased Focus on Risk Management and Liquidity:

Hedge funds became more focused on risk management and liquidity in the aftermath of the crisis. The crisis exposed the vulnerabilities of funds with over-leveraged balance sheets and inadequate liquidity provisions. As a result, funds started paying closer attention to their balance sheet management and ensuring they had sufficient cash holdings to navigate turbulent market conditions.

Shift in Investment Strategies:

The crisis prompted hedge funds to reevaluate their investment strategies. Strategies such as global macro, CTA, volatility arbitrage, and distressed investing gained favour due to their ability to generate returns in various market conditions. Funds recognised the importance of diversifying their portfolios and reducing exposure to illiquid assets.

Greater Emphasis on Transparency and Regulation:

There were calls for greater transparency and regulation in the hedge fund industry following the crisis. While the industry had traditionally operated with less regulatory oversight, the fallout from the crisis highlighted the need for smarter and more effective regulation. This included addressing issues such as re-hypothecation and improving the overall risk management framework.

Emergency Fund Investment: Is It Worth the Risk?

You may want to see also

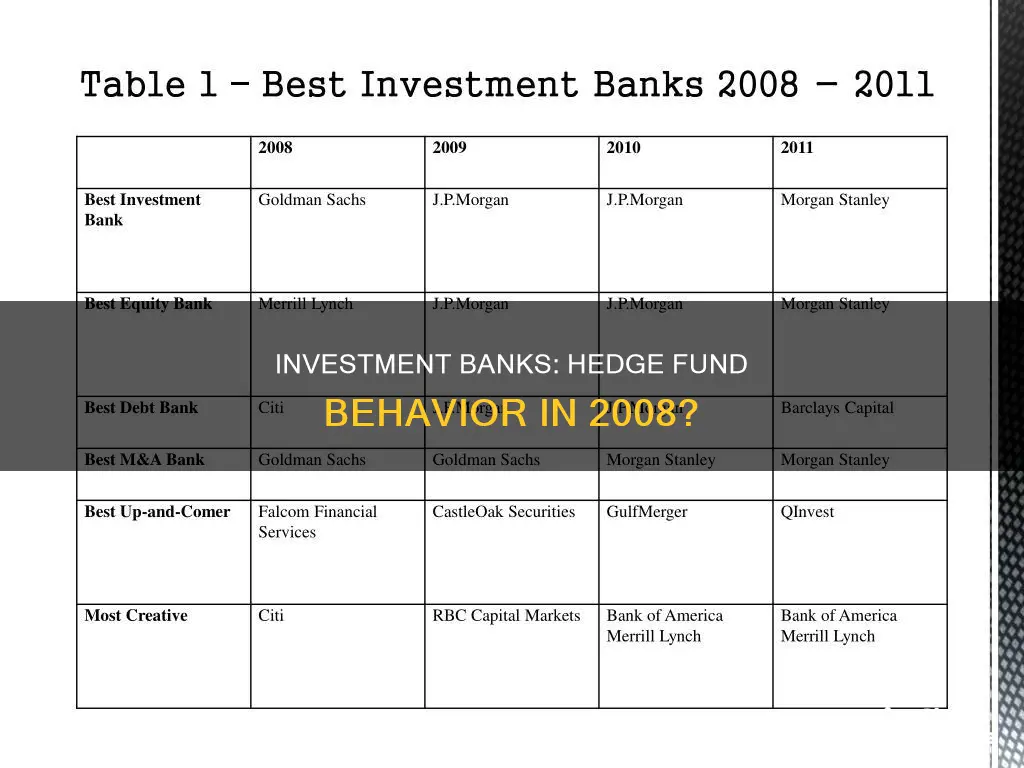

The role of investment banks

Investment banks played a significant role in the 2008 financial crisis, with some arguing that their actions were a primary cause.

In the years leading up to 2008, investment banks and other financial institutions engaged in risky lending practices, including the bundling and selling of subprime mortgages as mortgage-backed securities (MBS). These practices were fuelled by low-interest rates, loose lending standards, and the demand for higher returns following the dot-com bubble burst.

As a result, when home prices began to fall in 2006, it triggered a wave of subprime loan defaults and bankruptcies. This led to a panic in the global lending system as financial institutions were left holding trillions of dollars in worthless mortgages and related securities.

The collapse of the investment bank Lehman Brothers in September 2008 marked a pivotal moment in the crisis. It sparked a fire sale of assets, a freeze in the credit markets, and a loss of confidence in the financial system.

In the aftermath of the crisis, regulatory changes were implemented, including the Dodd-Frank Wall Street Reform and Consumer Protection Act, which imposed stricter rules on banks and sought to increase accountability and transparency.

Maximizing Your SEP IRA: Smart Investing with Fidelity

You may want to see also

Frequently asked questions

A hedge fund is a limited partnership of private investors whose money is pooled and managed by professional fund managers. These managers use a wide range of strategies, including leverage and the trading of non-traditional assets, to earn above-average investment returns.

Investment banks and hedge funds both contributed to the financial crisis of 2007-2008. However, the crisis was years in the making and was caused by a combination of factors, including cheap credit, loose lending standards, and risky ventures by investment managers and investors.

Hedge funds contributed to the financial crisis by withdrawing billions of dollars from prime brokers and their parent investment banks out of fear that those assets could be frozen. This action was essentially a run on the bank and further destabilized the financial markets.

No, hedge funds were not the primary cause of the financial crisis. Other agents, such as credit rating agencies, mortgage lenders, and issuers of credit default swaps, played a more pivotal role.