The savings and investment schedules are essential components of personal finance and macroeconomic theories. Saving refers to setting aside money for future use, often in low-risk accounts like savings accounts or certificates of deposit (CDs). On the other hand, investing involves taking on some risk by putting money into financial instruments like stocks, bonds, or real estate, with the potential for higher returns. While saving is crucial for short-term goals and emergencies, investing is geared towards achieving long-term financial objectives.

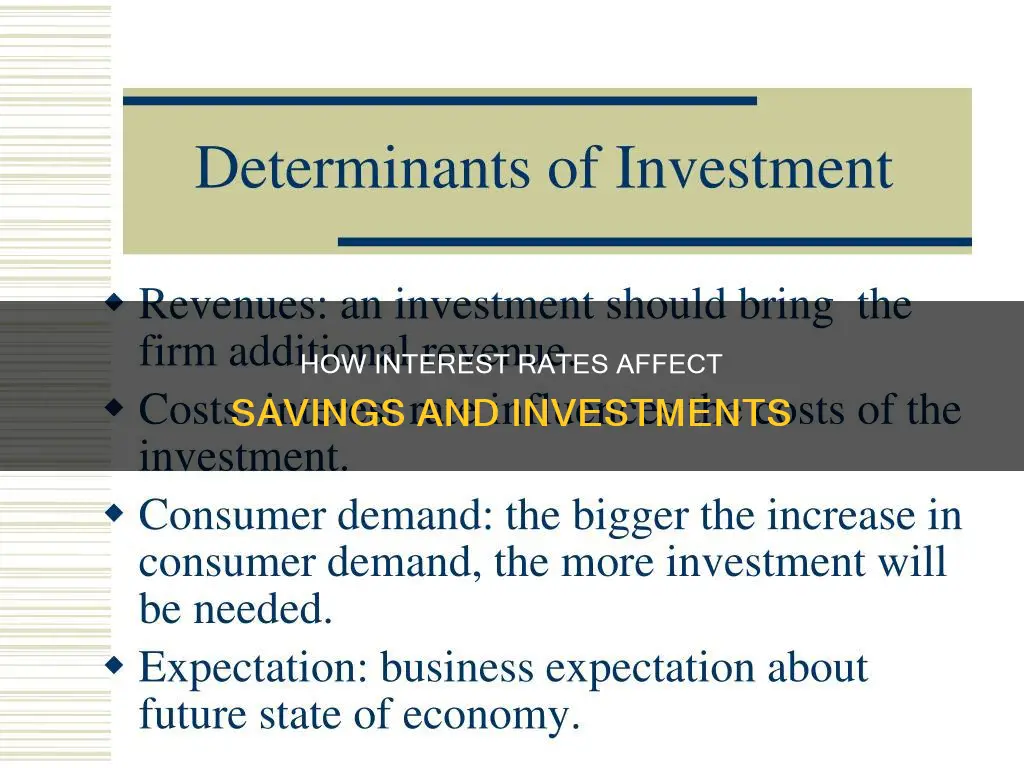

Various factors influence the savings and investment schedules. For instance, interest rates play a pivotal role, with higher interest rates prompting a shift towards non-traditional, higher-yield accounts and safer investments. Additionally, government policies, credit liquidity, global events, and investor sentiment can impact interest rates and, consequently, savings and investment decisions. Expectations about future sales and profitability also come into play, affecting investment choices. Other determinants include the level of economic activity, the stock of capital, capacity utilization, the cost of capital goods, technological advancements, and public policy.

Understanding the dynamics of savings and investment schedules is essential for individuals to make informed financial choices and for economists to analyse macroeconomic trends and theories.

What You'll Learn

Interest rates

The relationship between interest rates and investment is equally significant. Higher interest rates tend to make investors shift towards safer investments, moving away from higher-risk options. This shift can indirectly affect certain sectors, including technology stocks and digital asset investments. Moreover, rising interest rates can impact mortgage rates, making homebuying less affordable and discouraging investment in new homes.

The impact of interest rates on savings and investment decisions is complex. Individuals need to adapt their strategies and consider various financial options to make the most of their money in a high-interest-rate environment.

The interest rate also influences the opportunity cost of investing in a solar energy system versus purchasing a bond. If the return on investment from the solar energy system is lower than the interest rate on the bond, individuals may opt for the bond instead. As a result, higher interest rates can reduce the number of potential investments that make sense.

Purchasing a Condominium: Saving or Investing?

You may want to see also

Investor sentiment

Additionally, high-interest rates can also impact investment strategies. Investors tend to shift towards safer investments, moving away from higher-risk options. In such cases, bonds and treasuries become attractive alternatives, as they offer more stability.

However, it is important to note that investor sentiment is not the only factor influencing interest rates. Government policy changes, credit liquidity, and global events can also play a significant role in determining interest rates.

ETFs: Smart Short-Term Investment Strategy for Savings?

You may want to see also

Public policy

For example, the Kennedy administration introduced two strategies to stimulate investment: accelerated depreciation and the investment tax credit. Accelerated depreciation allowed firms to depreciate capital assets over a short period, reducing tax payments during the early years of an asset's life. The investment tax credit allowed firms to subtract a fraction of their investment cost from their tax liability, essentially a government subsidy.

A third strategy to encourage investment would be a reduction in taxes on corporate profits. Greater after-tax profits mean firms can retain more of the returns on their investments. A lower capital gains tax rate can also increase the demand for capital by making assets subject to the tax more attractive.

Investing vs Saving: Understanding the Key Differences

You may want to see also

Expectations

For example, consider a firm's expectations of future sales or a student's expectations of different occupations and their required educational levels. These expectations will influence their investment decisions. If a firm anticipates higher future sales, it may invest in expanding its production capacity. Similarly, a student who expects higher earnings from a particular career may invest in obtaining the necessary education and training.

Moreover, expectations about future economic activity can impact investment choices. An increase in GDP, indicating a rise in economic activity, is likely to shift the investment demand curve to the right, leading to greater investment. This, in turn, enhances the multiplier effect of changes in aggregate demand, as higher investment further boosts household incomes and consumption.

Labor-Saving Equipment: Worth the Investment for Automotive Division?

You may want to see also

The level of economic activity

For instance, an increase in GDP will likely lead to a higher demand for capital, resulting in increased investment. This will further enhance the multiplier effect of any initial change in the components of aggregate demand. As household incomes rise with an increase in production, consumption will also increase, leading to a further increase in aggregate demand. If this rise in production and income also encourages firms to increase their investment, the multiplier effect will be even stronger.

Therefore, the level of economic activity is closely linked to investment decisions. A higher level of economic activity can induce additional capital spending for two main reasons. Firstly, investment is linked to profit, and profits tend to rise with an increase in GDP. Secondly, at low levels of income and output, excess capacity and idle machinery and equipment discourage further capital investment. Thus, a higher level of economic activity can stimulate investment demand.

Maximizing Savings: Strategies to Double Your Money

You may want to see also

Frequently asked questions

Saving is setting aside money for future use, often for short-term goals or emergencies. It typically involves low-risk options such as savings accounts or certificates of deposit (CDs). On the other hand, investing involves taking on some risk by putting money into financial instruments like stocks, bonds, or mutual funds, with the potential for higher returns over the long term.

Higher interest rates tend to reduce the quantity of investment, as they increase the opportunity cost of investing. People may shift their savings to non-traditional, higher-yield accounts or focus on short-term goals like certificates of deposit (CDs) or money market accounts.

Investment schedules can be influenced by expectations, the level of economic activity, the stock of capital, capacity utilization, the cost of capital goods, other factor costs, technological changes, and public policy. For example, during expansions or when capacity utilization is high, firms are more likely to increase investment.

According to economists, saving means consuming less now so that more can be consumed in the future. This adds to the stock of capital, which can be invested to produce more goods and services, leading to economic growth.