Saving and investing are essential skills for financial literacy, and it is never too early to start teaching children about money. The earlier young people begin to understand the basics of personal finance, the better their chances of achieving financial security and independence as adults. Teaching children about money can start with simple concepts like budgeting and saving, and gradually build to more complex topics like investing in stocks, bonds, and mutual funds.

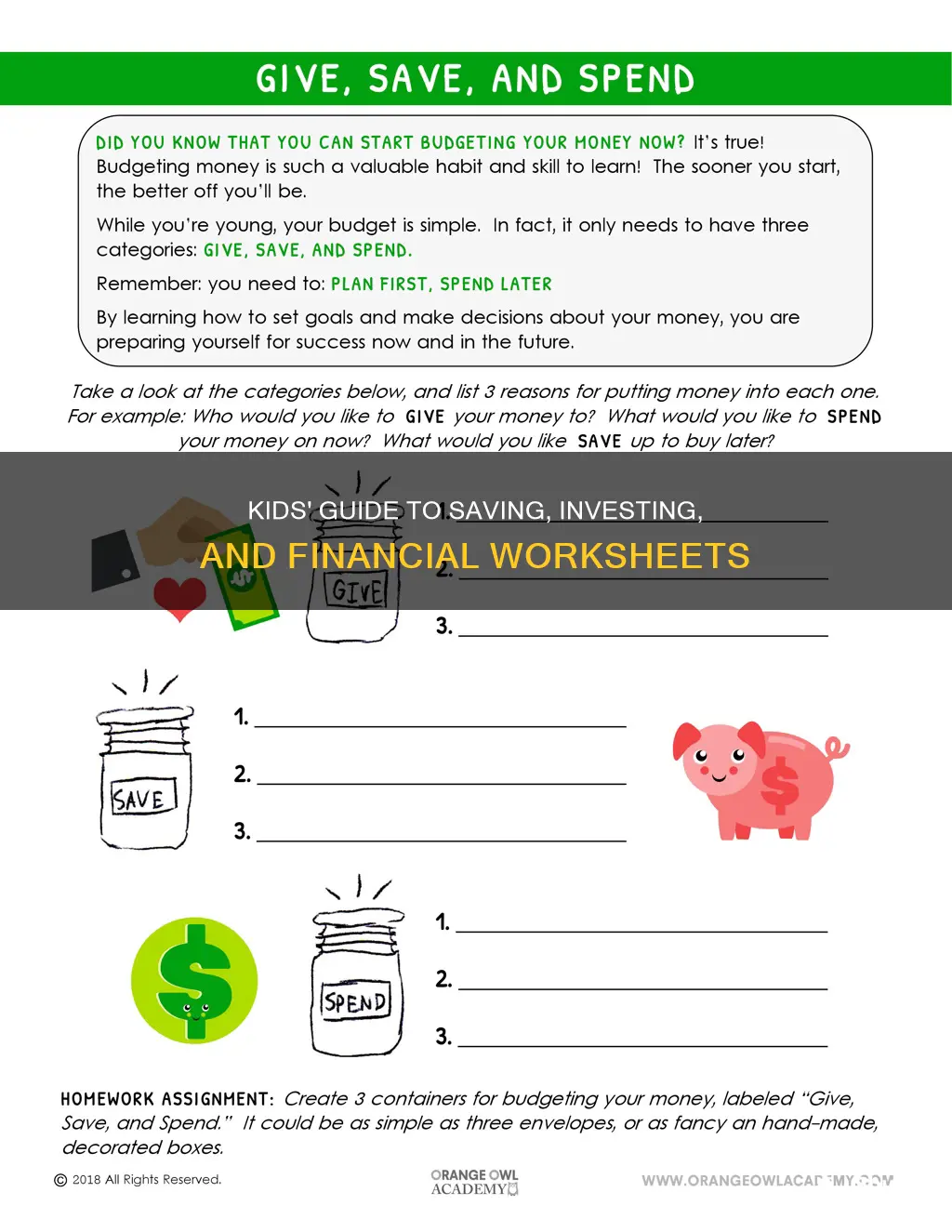

Worksheets and lesson plans on saving and investing can help parents and educators impart these important skills to children of all ages. These resources can cover a range of topics, from basic money management and banking to more nuanced subjects like compound interest, supply and demand, and inflation.

By familiarising themselves with these concepts, children can develop a strong foundation in financial literacy, setting them up for a more secure and prosperous future.

| Characteristics | Values |

|---|---|

| Age appropriateness | 3rd to 12th graders |

| Topics covered | Check writing, checkbooks, checking accounts, banking and savings accounts, basic economic concepts, budgeting, earning and spending, investing basics, stocks, bonds, mutual funds, financial planning, risk tolerance, compound interest, supply and demand, inflation, types of investment accounts, financial goals, investment terminology, investment strategies, investment opportunities, economic theories, market conditions |

| Learning objectives | Provide examples of financial choices that have opportunity costs; explain why it is often harder to save than to spend money; map out a savings plan; brainstorm ways to improve earning potential; identify similarities and differences between saving and investing; identify long-term financial goals; compare rates of return on different investments and order them by risk; list the potential benefits of investing; define common types of financial assets; understand the benefits of compounding for building wealth; explain the importance of having access to full and accurate information about potential investments; understand what drives markets and how it relates to investing |

| Teaching methods | Worksheets, lessons, exercises, games, songs, group work, visual aids, online resources, simulations, real-life examples, conversations, competitions, research activities |

What You'll Learn

The importance of saving and how to save

Saving is an important skill to learn from a young age. It can help you to achieve your financial goals and make sure you have money put aside for the future. Saving is all about putting money away for a later date, rather than spending it now. This means that when you need or want something in the future, you'll have the money available to get it.

There are many reasons why people save. You might be saving for something specific, like a new toy, a car, or a house. You might also be saving for the future, for example, for retirement or for your children's education. It's important to start saving early because it means your money has more time to grow. The longer you save, the more money you will have.

To start saving, the first step is to set a goal. This could be something short-term, like saving for a new bike, or long-term, like saving for retirement. Once you know what you're saving for, you can work out how much money you need and how long it will take you to save it. You can then work out how much money you can put aside each week or month to reach your goal.

It's important to remember that saving doesn't have to mean putting aside large amounts of money. Even small amounts can add up over time. You can also save by spending less money. This might mean cutting down on unnecessary purchases, or finding cheaper alternatives to the things you usually buy.

Another important part of saving is to make sure your money is in a safe place. This could be a savings account at a bank, or somewhere secure at home, like a money box.

Investing is another way to make your money grow. It's about putting your money into something that will hopefully make a profit or increase in value. There are lots of different types of investments, like stocks, bonds, or starting a business. Investing can be risky because you might lose money, but it can also result in big gains. It's important to do your research and only invest money you can afford to lose.

Some other ways to invest your money include:

- Buying bonds, which means lending money to a government or business.

- Buying stocks or shares, which means buying ownership in a company.

- Exchange-Traded Funds (ETFs), which are low-cost and low-risk investments.

- Certificate of Deposits (CDs), where you lend your money to a bank for a set period and earn interest.

- Mutual funds, where lots of people pool their money together to invest in a variety of securities.

Saving and investing are important skills for everyone to learn. They can help you to achieve your financial goals and make sure you have money for the future. It's never too early to start saving and investing, and the earlier you begin, the more your money will grow.

Reviving Nature: Planting vs. Preservation, Where Should We Invest?

You may want to see also

The basics of investing

Investing is about securing and growing wealth by allocating resources with the expectation of gaining profit or a positive return. This can be done by buying assets that will increase in value over time or by using money to start a business.

People who invest early can achieve their long-term financial goals and live comfortably. Investments have higher returns than savings and can help you generate wealth over time. They can also help with retirement plans and save on taxes.

There are various forms of investments besides money. Here are some common types:

- Bonds: When you buy bonds, you lend money to a government or business entity.

- Stocks: Also known as shares or equities, these are considered one of the simplest and most popular investments. If you buy stocks from a publicly-traded company, you also buy ownership in it.

- ETF (Exchange-Traded Funds): These are low-cost and low-risk investments.

- Certificate of Deposits (CDs): This is a low-risk investment where you allow a bank to borrow your money for a set period, and when this period is over, you gain back the principal and the interest.

- Commodities: Investors secure the price of commodities (such as metal, agriculture, oil, etc.) in advance in case a natural disaster is likely to happen.

- Insurance: This is a well-known investment for employees and businessmen, assuring financial security and growth.

Time in the market is more important than timing the market. It is better to invest regularly and keep your money in the market as long as possible, rather than waiting for the "right moment".

Before investing, assess your financial capacity, goals, and risk tolerance. Identify your long-term and short-term financial goals, do your research, and choose the type of investment you want to make.

S-Corp Savings: Investing for Growth and Security

You may want to see also

The different types of investments

There are several types of investments that can help children build a secure financial future. Here are some of the most common ones:

Custodial Accounts:

- These are investment accounts opened and managed by a parent or guardian on behalf of a minor. The age at which the child takes control of the account varies by state but is typically between 18 and 21.

- There are two types of custodial accounts: UGMA (Uniform Gift to Minors Act) and UTMA (Uniform Transfer to Minors Act) accounts. UGMA accounts can hold financial assets, while UTMA accounts can hold financial assets and other property, such as real estate or cars.

- Custodial accounts can be in the form of brokerage accounts, IRAs, or 529 plans.

Savings Accounts:

- These are a great way to teach children about budgeting, saving, and short-term money management.

- High-yield savings accounts offered by online banks and credit unions often provide higher interest rates than traditional brick-and-mortar banks.

Stocks:

- Stocks offer higher rates of return compared to other asset classes and can be held in various types of investment accounts.

- Stocks from companies that children are familiar with or interact with can be a good way to teach them about investing.

- Dividend-paying stocks provide additional returns over time.

- Stocks can be held individually or through mutual funds or exchange-traded funds (ETFs).

Mutual Funds:

- Mutual funds are a way to invest in a diversified portfolio of stocks, bonds, or both, reducing the risk associated with individual stocks.

- Actively managed mutual funds are run by human investors who aim to outperform a benchmark, while passively managed funds, or index funds, aim to replicate the performance of a specific index.

- Mutual funds can be held in IRAs, 529 plans, or education savings accounts (ESAs).

Exchange-Traded Funds (ETFs):

- ETFs are similar to mutual funds but trade on stock exchanges during regular trading hours, offering more flexibility in buying and selling.

- ETFs typically have lower fees than mutual funds and provide certain tax advantages.

Savings Bonds:

- Savings bonds are low-risk investments that grow tax-free.

- Series EE savings bonds are guaranteed to double in value if held for 20 years.

529 Plans:

- 529 plans are tax-advantaged investment accounts specifically for education expenses.

- There are two types: college savings plans, which function similarly to Roth IRAs or 401(k)s, and prepaid tuition plans, which allow you to pay for future college tuition at today's rates.

Coverdell Education Savings Accounts (ESAs):

- Similar to 529 plans, Coverdell ESAs are tax-advantaged investment accounts for education expenses, including elementary and secondary school.

- Coverdell accounts have strict contribution limits and are not available to higher-income households.

Brokerage Accounts:

- Some brokers offer accounts specifically designed for teens, giving them ownership of their investment decisions.

- Brokerage accounts typically offer a wide range of investment options, including stocks, bonds, mutual funds, and ETFs.

Investing Life Savings: Strategies for Long-Term Financial Growth

You may want to see also

How to manage money

Saving and budgeting

Saving is an important habit to develop from a young age. It is a way to keep money safe while also earning something known as interest. Interest is like a reward for saving money. The more money you save, the more interest you will earn. It is also important to understand budgeting, which means planning how to spend your money. For example, if you want to buy something expensive, you will need to save up for it over time.

Banking and accounts

Banks are places where you can save your money and earn interest. There are different types of accounts, such as checking accounts and savings accounts. A checking account is useful for everyday spending, and you can easily take money out of it. A savings account is better for keeping your money safe and earning interest. You can also invest your money in stocks, bonds, or other assets.

Earning and spending

Money is earned through work, and it is important to understand the value of money and how it is needed for necessities such as food and housing. It is also important to understand the different ways to earn more money, such as through a part-time job or by selling things. When spending money, it is good to understand the different options available, such as using cash, a debit card, or a credit card.

Investing

Investing is a way to make your money grow by buying assets that increase in value over time. It is important to understand the different types of investments, such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs). It is also crucial to know about the risks involved in investing, as you could lose money as well as gain it.

Financial goals

It is important to set financial goals, such as saving for a large purchase or investing for the long term. This will help you stay focused and make better decisions about your money. It is also useful to understand how to track your investments and the different apps and websites available for this purpose.

Compound interest

Compound interest is a powerful tool that can help your money grow faster over time. It means earning interest on the interest you have already earned, and it can lead to significant wealth over a long period.

Investing vs. Saving: What's the Real Difference?

You may want to see also

The risks and benefits of investing

Benefits

Teaching children about investing and allowing them to invest can have major benefits for them in the future. Firstly, it helps them develop good saving habits. Teaching them about the importance of saving can be done by giving them an allowance that they can choose to spend or save up. This will help them understand that money is earned through work and is needed for essentials.

Another benefit of investing early is that children have more time to recover from losses. They have potentially decades to invest and gain back any short-term losses that may occur due to market selloffs or economic difficulties. This long-term mindset is an important part of being a good investor.

Additionally, investing can help children reach financial security sooner. Compound interest grows over time, so if they start saving and investing early, they may retire early or at least be in a strong financial position when it's time to retire.

Risks

Investing always comes with risks. One of the main risks is losing money. Even the safest investments can sometimes result in losses. For example, stocks are generally considered high-risk investments. Their value can go up and down, and it's not always possible to predict the effects of associated risks. Negative news can send a stock's value tumbling, and while these events are rare, they do happen.

Another risk is investing in trendy companies that don't have staying power. It can be easy to get caught up in the hype of a new product or company, but these investments may not always pay off.

Finally, there are tax implications to consider when investing for children. Different types of accounts have different tax advantages and disadvantages, and these can impact a child's financial aid eligibility when they apply for college. It's important to consult a tax advisor before setting up an account to discuss the tax implications for your specific situation.

How to Make Your Savings Work for You

You may want to see also

Frequently asked questions

Investments have higher returns than savings, helping individuals achieve their financial goals and plan for retirement. They also contribute to the economy and can be a source of additional income.

- Use songs, games, and activities with investing themes.

- Teach them about different coins and the concept of opportunity cost.

- Let them dream about specific large purchases they may want in the future.

For kindergarteners, teach them about how money is limited and that saving is key. For first graders, help them map out a savings plan to achieve a future purchase. For second graders, teach them about earning more money and how they can invest it.

Time spent studying something to improve at it, bonds, shares, equities, exchange-traded funds (ETFs), and certificate of deposits (CDs).