Mutual funds are a popular investment tool for both individual and professional investors. They are a type of investment vehicle that pools money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. This provides individual investors with access to a professionally-managed portfolio and the potential to benefit from economies of scale, while also spreading risk across multiple investments.

There are several types of mutual funds, including stock, money market, bond, and target-date funds. Each type has its own investment focus and strategy, with some focusing on specific sectors, regions, or themes. Mutual funds also come with fees and expenses, such as annual fees, expense ratios, and commissions, which can impact overall returns.

When choosing a mutual fund, it is important to consider factors such as risk tolerance, time horizon, and investment objectives. Additionally, it is crucial to understand the fees associated with the fund, as these can significantly affect investment returns over time.

| Characteristics | Values |

|---|---|

| Initial Investment | A few thousand dollars |

| Diversification | Yes |

| Management | Yes |

| Reinvestment | Yes |

| Risk | High, Low |

| Returns | High, Low, Moderate |

| Fees | Management fees, Sales load, 12b-1 fees, Redemption fees, Exchange fees, Purchase fees |

What You'll Learn

Mutual funds vs. stocks and bonds

Mutual funds, stocks, and bonds are all well-known components of a diversified portfolio. However, they differ in several ways, including risk, diversification, and management.

When an investor buys a stock, they are purchasing partial ownership of a company in the form of shares. Stocks are usually riskier than bonds as there is no guarantee that the stock will perform well. However, stocks offer the potential for higher returns. If a company performs well, the value of its shares increases, and the investor can sell them at a profit. On the other hand, if the company performs poorly, the share value declines, and the investor may lose some or all of their investment.

Bonds, on the other hand, are a type of investment designed to help governments and corporations raise money. They can be viewed as loans to investors, who do not receive stock ownership but instead receive interest payments at regular intervals. Bonds are considered safer than stocks because, in the event of bankruptcy, corporations are required by law to pay back bond investors before stock investors. However, bonds are not risk-free, and their ratings by credit agencies like Moody's and Standard and Poor's can help investors gauge their risk.

Mutual funds are pooled investment vehicles where money is collected from various investors to purchase a variety of securities. When an investor buys into a mutual fund, they do not own shares of the individual stocks invested in but rather own a piece of the fund itself. Mutual funds are typically managed by fund managers who decide which assets to buy and sell based on the fund's objectives. Mutual funds offer instant diversification across different sectors and asset classes, such as stocks, bonds, commodities, and real estate. They can be actively or passively managed, with the former aiming to beat the market and the latter seeking to replicate the performance of an underlying index.

One of the key advantages of mutual funds over stocks is diversification. Mutual funds provide exposure to a multitude of stocks, reducing the risk associated with investing in just one company or industry. The fees associated with mutual funds can also be lower than trading individual stocks, as the cost of trading is spread across all investors in the fund. Additionally, mutual funds offer convenience, as investors can defer asset allocation decisions to investing experts rather than researching and selecting individual stocks themselves.

However, mutual funds also have some disadvantages. They take control away from the investor, as they are limited to the investments chosen by the fund manager. Mutual funds also typically have ongoing management fees, which may be more expensive than low-cost or no-cost individual stock trades offered by brokerage companies.

Ultimately, there is no single investment channel that is best for every investor. The decision to invest in mutual funds, stocks, or bonds depends on various factors, including age, income generation, risk tolerance, and investment goals.

Index Funds: Monthly vs. Annual Investments — Which is Better?

You may want to see also

Mutual funds for beginners

Mutual funds are a great way to get started with investing. They are a simple, affordable, and diversified investment option. Here are the basics of mutual funds for beginners:

Mutual funds are a type of investment fund that pools money from many investors to purchase a diversified portfolio of stocks, bonds, and other securities. By investing in a mutual fund, you can gain exposure to hundreds of different securities, providing instant diversification for your investment portfolio.

Mutual funds offer several benefits for beginners:

- Diversification: Mutual funds provide instant diversification, reducing risk by spreading your investments across a wide range of companies and industries.

- Affordability: Mutual funds typically have low minimum investment requirements and reasonable annual fees, making them accessible to a wide range of investors.

- Professional Management: Mutual funds are managed by professional fund managers who have the knowledge and expertise to choose and manage the fund's investments.

- Liquidity: Mutual fund shares can be easily bought or sold at any time, providing flexibility for investors.

How to Choose Mutual Funds:

When choosing mutual funds to invest in, consider the following:

- Investment Goals: Determine your financial goals and risk tolerance. Are you investing for retirement, capital gains, or income generation? Are you willing to take on more risk for potentially higher returns?

- Fund Performance: Evaluate the long-term performance of the mutual fund to get an idea of its potential future returns. Keep in mind that past performance does not guarantee future results.

- Fees: Consider the expense ratio and other fees associated with the fund. Higher fees can eat into your investment returns over time. Look for funds with low expense ratios and no-load structures to minimize fees.

- Brokerage Account: Choose a brokerage account that offers a wide range of mutual funds, affordable fees, and research and educational tools to help you make informed investment decisions.

Examples of Top-Performing Mutual Funds:

- Fidelity International Index Fund (FSPSX)

- Fidelity U.S. Sustainability Index Fund (FITLX)

- Schwab S&P 500 Index Fund (SWPPX)

- Shelton Nasdaq-100 Index Fund Investor (NASDX)

- Vanguard Long-Term Investment-Grade Fund Investor Shares (VWESX)

- Fidelity Select Semiconductors

- Vanguard Total Stock Market Index Fund

- Fidelity 500 Index Fund

Remember, investing in mutual funds involves risk, and past performance does not guarantee future results. Always do your own research and consider your investment goals and risk tolerance before investing.

Retirement Fund: Invest Now for a Comfortable Future

You may want to see also

Mutual fund fees

Annual fund operating expenses

Annual fund operating expenses are ongoing fees charged towards the cost of paying managers, accountants, legal fees, marketing, etc. These fees, also known as mutual fund expense ratios or advisory fees, typically range from 0.25% to 1% of your investment in the fund per year. Actively managed funds tend to be more expensive than passively managed funds.

The total annual fund operating expenses are expressed as a percentage of the fund's net average assets and can be found in a mutual fund's prospectus under "Annual Fund Operating Expenses".

Some of the fees included in this category are:

- Management fees: The cost to pay fund managers and investment advisors.

- 12b-1 fees: Fees capped at 1% to cover marketing and selling the fund and other shareholder services.

- Other expenses: Custodial, legal, accounting, transfer agent expenses, and other administrative costs.

Shareholder fees

Shareholder fees are sales commissions and other one-time costs incurred when buying or selling mutual fund shares. These fees are outlined in the "Shareholder Fees" section of a mutual fund's prospectus.

Shareholder fees include:

- Sales loads: Commissions paid to third-party brokers when buying or selling shares. These can be front-end loads, paid at the time of purchase, or back-end loads, paid when selling shares.

- Redemption fee: Charged when an investor sells shares within a short period after purchasing them.

- Exchange fee: Charged by some funds when shareholders transfer their shares to another fund within the same group.

- Account fee: Charged for maintaining an account, often when the balance falls below a specified minimum.

- Purchase fee: Charged when purchasing shares, paid to the fund to defray costs associated with the purchase.

Impact of fees on returns

Even small differences in fees can significantly impact investment returns over time. For example, a 1% increase in fees on a $10,000 investment earning 10% annually can result in a loss of over $10,000 over 20 years.

Therefore, it is crucial to carefully review and compare the fees associated with different mutual funds to make informed investment decisions.

Pimco Funds: Are They Worthy Investment Opportunities?

You may want to see also

Mutual fund diversification

Mutual funds are a great way to diversify your investment portfolio. They are a collection of stocks, bonds, and other securities, and they offer investors exposure to a wide range of companies and industries. This diversification is beneficial as it helps to lower risk and boost returns.

When investing in mutual funds, it is important to keep your investment goals in mind. For example, if you are investing for retirement, you may want to consider funds with long-term capital gains potential. On the other hand, if you are looking for more immediate returns, you might opt for funds with higher dividend yields.

Additionally, fees and expenses can eat into your returns over time, so it is crucial to consider the expense ratio and other associated costs when selecting a mutual fund. Some funds may also have minimum investment requirements, so be sure to review these before making a decision.

- Fidelity International Index Fund (FSPSX): This fund invests in mid- and large-cap companies from 21 international markets, offering exposure to developed markets outside the U.S. and Canada.

- Fidelity U.S. Sustainability Index Fund (FITLX): This fund focuses on companies that meet environmental, social, and governance (ESG) criteria, offering a low-cost way to invest in sustainable businesses.

- Schwab S&P 500 Index Fund (SWPPX): This fund provides exposure to 500 of the largest U.S. companies, offering wide diversification and performance that typically mirrors the broad market.

- Vanguard Total Stock Market Index Fund: This fund offers exposure to the total U.S. stock market, including small, medium, and large companies across all sectors.

- Fidelity Intermediate Municipal Income Fund (FLTMX): This fund focuses on high-quality, investment-grade municipal bonds with maturities between three and ten years, offering tax-exempt income for investors.

- Vanguard Long-Term Investment-Grade Fund Investor Shares (VWESX): This fund primarily invests in long-term corporate bonds, as well as some government and municipal issues, promising both income and capital appreciation.

Remember, when investing in mutual funds, it is essential to consider your financial goals, risk tolerance, and the overall diversification of your portfolio. Conduct thorough research and understand the fees associated with each fund before making any investment decisions.

Fidelity vs. Vanguard: Which Mutual Fund Investment is Better?

You may want to see also

Mutual fund performance

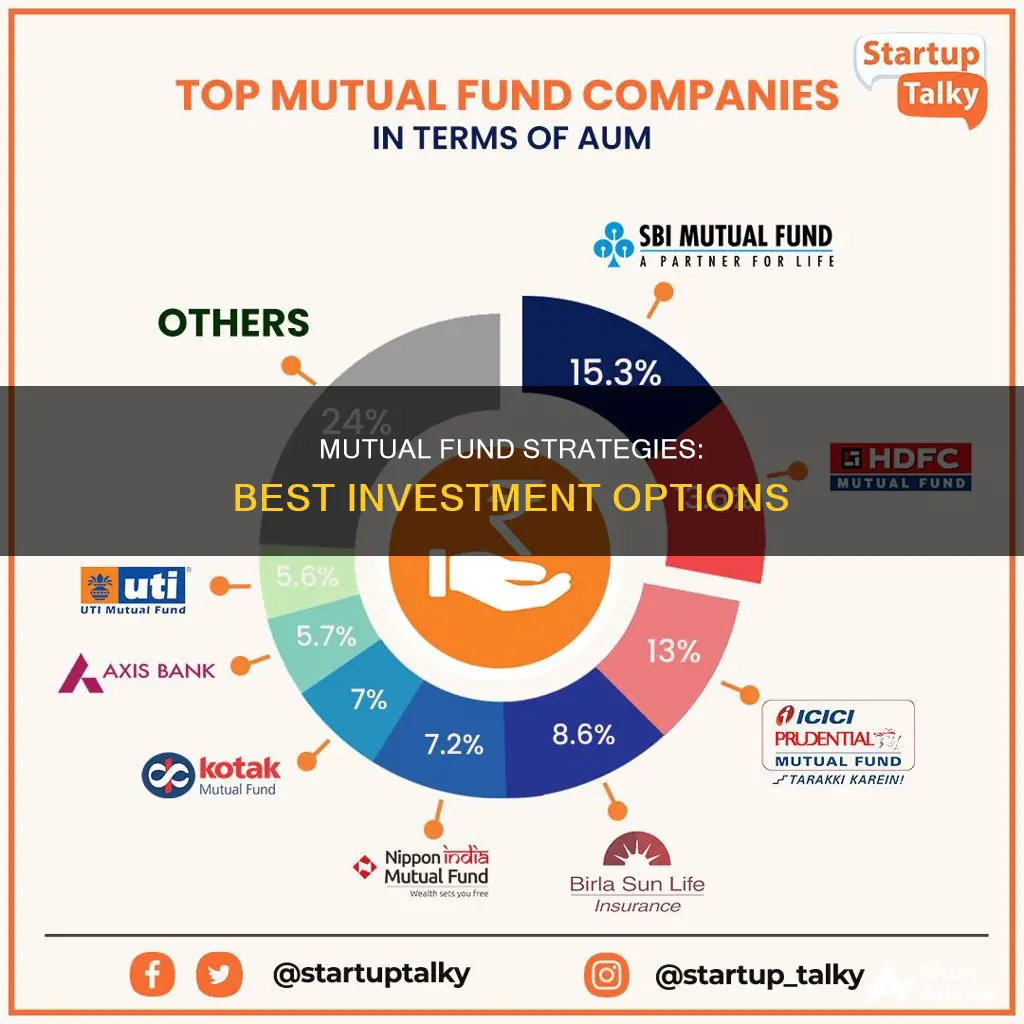

Mutual funds are a popular investment vehicle, with $16 trillion in assets under management in the US as of July 2024. When assessing the performance of a mutual fund, it is important to consider various factors, including fees, historical returns, and the underlying investments.

Fees

Mutual funds typically charge fees such as expense ratios, sales loads, 12b-1 fees, redemption fees, exchange fees, and purchase fees. These fees can eat into investment returns, so it is important to consider them when evaluating a fund's performance. For example, a 1% increase in fees on a $10,000 investment earning 10% annually can result in a loss of over $10,000 over 20 years.

Historical Returns

Historical returns can provide insight into a mutual fund's performance over time. It is important to look at returns over a longer period, such as 5 or 10 years, to gauge consistency. However, past performance does not guarantee future results, and it is essential to consider other factors as well.

Underlying Investments

The underlying investments of a mutual fund can impact its performance. Mutual funds typically invest in a diverse range of stocks, bonds, or other securities. The performance of these investments will affect the overall return of the fund. It is important to review the fund's prospectus and analyse the specific investments to understand the risk and return potential.

Diversification

Mutual funds offer instant diversification by pooling money from many investors to purchase a wide range of securities. This diversification can help reduce risk and potentially boost returns. Well-diversified mutual funds can provide a more stable rate of return and lower the likelihood of significant losses.

Risk and Return

Different types of mutual funds carry different levels of risk and return potential. For example, stock mutual funds have higher potential rewards but also higher risks. In contrast, bond mutual funds provide more stable returns but with lower potential returns. Money market mutual funds have the lowest returns and risks compared to bond and stock funds.

Fund Management

The fund management strategy can also impact performance. Actively managed funds, where professionals actively research and select investments, aim to beat the market but often come with higher fees. On the other hand, passive investing, such as index funds or ETFs, aims to mimic the performance of a specific market index and usually entails lower fees.

Best-Performing Mutual Funds

As of October 2024, some of the best-performing US equity mutual funds with low expense ratios and minimum investment requirements include:

- Fidelity Select Semiconductors

- Fidelity Series Growth Company

- Fidelity Growth Company Fund

- Fidelity Select Technology

- Fidelity Series Blue Chip Growth

- Fidelity Blue Chip Growth

- Columbia Seligman Tech & Info Adv

Additionally, some of the best index funds as of October 2024, based on performance, cost, and popularity, include:

- Fidelity ZERO Large Cap Index

- Vanguard S&P 500 ETF

- SPDR S&P 500 ETF Trust

- IShares Core S&P 500 ETF

- Schwab S&P 500 Index Fund

- Shelton NASDAQ-100 Index Direct

- Invesco QQQ Trust ETF

- Vanguard Russell 2000 ETF

- Vanguard Total Stock Market ETF

- SPDR Dow Jones Industrial Average ETF Trust

Strategies for Investing Your Six-Month Emergency Fund Wisely

You may want to see also

Frequently asked questions

Mutual funds pool money from many participants to buy a portfolio of stocks, bonds and other securities. Mutual funds offer investors an excellent source of diversification for their portfolios. These funds typically own hundreds or even thousands of different securities.

Passive investing is a more hands-off approach and is rising in popularity. Passive investors often choose index funds or ETFs, which are similar to mutual funds but aren't professionally managed. This often means they carry lower fees.

Stock mutual funds, also known as equity mutual funds, carry the highest potential rewards, but also higher inherent risks. For investors looking for a lower-risk option, bond mutual funds invest in a range of bonds and provide a more stable rate of return than stock funds.

Money market mutual funds are considered one of the safest investments. They are used by investors who want to protect their retirement savings but still earn some interest.

To choose a mutual fund, you'll want to decide what type of fund matches your goals, choose a brokerage account and research your options, being careful to consider fees.