Investment management fees are charges levied by investment managers for their services. These services include asset management, financial planning, and custody. The fees are typically charged as a percentage of the total assets under management (usually between 0.20% and 2.00%) and can be paid monthly, quarterly, or annually. The fee structure can vary, with flat, asset-based, and wrap fees being the most common. Investment management fees provide investors with access to the expertise and resources of investment professionals, who can help with portfolio rebalancing, risk allocation, and personalised investment advice.

| Characteristics | Values |

|---|---|

| Definition | A charge assessed by an investment manager for services like asset management, financial planning, and custody. |

| Purpose | To compensate managers for their time and expertise in selecting stocks and managing the portfolio. |

| Factors | Management style, investment size, and whether the fund is actively or passively managed. |

| Range | From 0.10% to more than 2% of assets under management (AUM). |

| Average | 1% of AUM is considered standard for smaller accounts, while flat fees are recommended for accounts over $1 million. |

| Payment Frequency | Monthly, quarterly, or annually. |

| Fee Structures | Flat, asset-based, and wrap fees. |

| Included Costs | Investor relations (IR) expenses, administration costs, trading fees, and commissions. |

| Additional Fees | Trading fees, commissions, wrap fees, penalty fees, inactivity fees, and maintenance fees. |

What You'll Learn

Flat management fees

Investment management fees are the norm in the investment management industry. These fees are charged by investment managers in exchange for providing services like asset management, financial planning, and custody.

Flat-fee financial advisors will typically outline exactly what is included in their planning service, with different tiers for more comprehensive planning. For example, the flat fee may include creating a detailed financial plan for your debt, goals, and investments. The flat fee might also include ongoing investment management and financial planning.

The flat fee may be a fixed annual fee, or it could be a one-time fee for a time-limited project or engagement, such as a retirement projection or a one-time meeting with an advisor. The fee is usually based on the services provided and the advisor's expertise, and it is often in the range of $1,000 to $10,000 per year, although it can be higher or lower.

Flat fees can be beneficial because they provide a more direct link between the fee being charged and the services provided. They can also reduce some problems related to asset-based charges, as the fee does not increase when the market goes up or when the client adds to their investment account. Flat fees can also reduce conflicts of interest, as the advisor's compensation is not tied to the specific investments or the size of the client's assets.

When considering a flat-fee financial advisor, it is important to understand what services are offered and how the fee is calculated. It is also important to research the advisor's background and credentials to ensure they are qualified and reputable.

Viewing Your Acorns Investment Portfolio: A Simple Guide

You may want to see also

Fees assessed by asset class

Management fees are the norm in the investment management industry. They are charged by investment managers in exchange for services like asset management, financial planning, and custody. The fees are usually based on a percentage of the total assets under management (AUM) and can be paid monthly, quarterly, or annually.

The fees can vary depending on the management style and the size of the investment. Generally, investment firms that are more passive with their investments charge lower fees than those that actively manage their investments.

Flat Management Fees

Flat management fees are a common fee structure where the advisor charges a single rate regardless of the client's asset or investment selection. The fee may decrease as the client's portfolio increases. For example, a client with less than $1 million under management may be charged a higher fee than someone with a portfolio between $5 million and $10 million.

Management Fees Assessed by Asset Class on Investment Balance

With this fee structure, clients are charged based on the assets within their account. This means that a client may pay low or no fees on cash reserves in their portfolio. Value investors often choose this type of fee structure as they can build up cash reserves to execute their investment strategy. For instance, an advisor may charge 1.50% for invested equity, 0.75% for fixed-income securities like bonds, and 0.00% for cash or cash reserves.

Tiered Management Fees

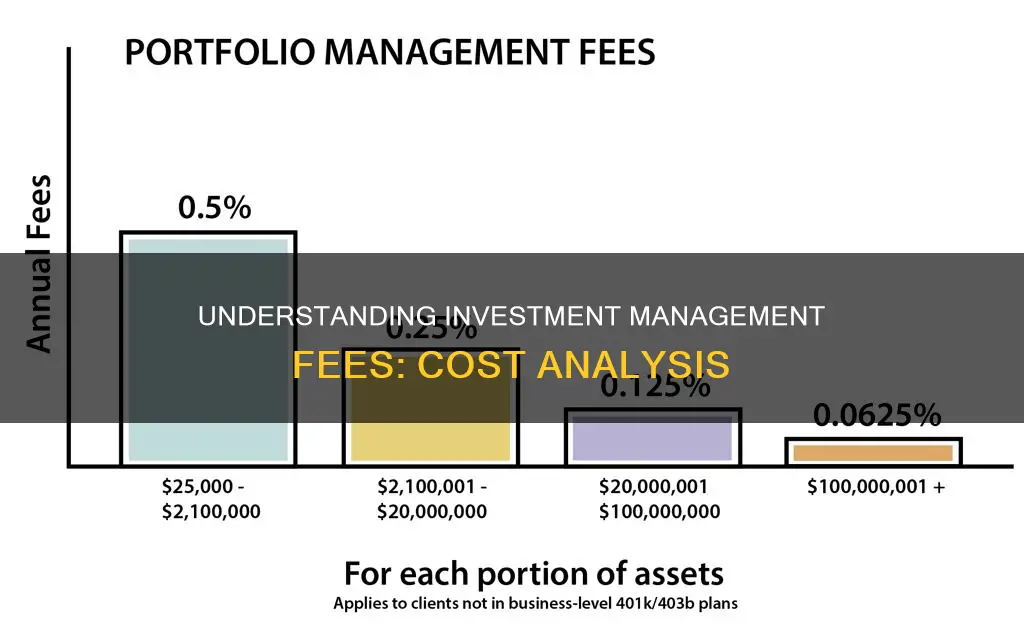

Tiered management fees are charged based on the value of assets in the client's account. This fee structure is a hybrid between a flat rate and an asset-based fee. Regardless of account size, all clients pay the same rate at the deposit level. For example, an investment manager may charge 1.75% on the first $250,000 and 1.50% on the next $750,000.

Flat Fees and Annual Management Fees

Annual management fees are typically charged as a percentage of assets and are paid yearly. This type of fee is common for retirement accounts like 401(k)s and IRAs. The client pays a single rate regardless of trade frequency, earnings, or losses. Wrap fees are another type of flat fee that covers investment management, financial planning, and custody services. These fees are typically charged as a percentage of assets and can be paid monthly, quarterly, or annually. Investment managers usually charge wrap fees of 1% to 3% for the assets they manage.

Becoming a Certified Investment Management Analyst: Steps to Success

You may want to see also

Tiered management fees

Under a tiered fee structure, all clients pay the same rate at the deposit level, regardless of the account size. For example, an investment manager may charge 1.75% on the first $250,000, then 1.50% on the next $750,000, and so on. This means that as the value of assets in an account increases, the management fee percentage decreases.

The tiered fee model has been recommended by the investment body CFA UK as the fairest way of charging investors. They argue that it offers "simplicity, transparency, and an alignment of interests between fund managers and investors". Tiered fees also allow investors to benefit from economies of scale as a fund's assets grow, and they reduce the incentive for managers to increase the size of their fund at the detriment of performance.

Additionally, tiered fees can protect a larger share of revenues for fund managers during a bear market, as the first loss of assets under management (AUM) will be at the lowest fee rate. They also indirectly encourage and reward customer loyalty.

One example of a fund using a tiered fee structure is the Bronze-Rated Monks Investment Trust (MNKS), managed by Charles Plowdon. This trust charges 0.45% on the first £750 million of assets and 0.33% on assets above this level.

Savings and Investments: Your Guide to Financial Freedom

You may want to see also

Annual management fees

The fee compensates money managers for their time and expertise in selecting stocks and managing a portfolio. It can also cover other charges, such as investor relations expenses and the administration costs of the fund.

Management fees are present in almost all investment management and advisory services, but the actual rate can vary significantly. They are paid to investment professionals in return for their services, which can include advice, expertise, and a high return on investment.

Credit Union and Investment Management: What's the Link?

You may want to see also

Wrap fees

The benefit of wrap fees is that they simplify investing costs and make them more predictable. Investors who opt for wrap fees know in advance what their costs will be for the year, regardless of how much or how little they utilise their investment advisor's services. This predictability can be advantageous for those who actively engage with their investments and regularly require the full range of services offered by an investment manager.

However, it's important to note that wrap fees may not cover all possible fees. For example, investors may still need to pay additional charges levied by third-party providers or mutual fund providers. Therefore, it is essential to carefully review the wrap fee brochure provided by investment firms, detailing the services and costs included in the wrap fee.

When considering a wrap fee program, investors should ask their investment advisor several questions to ensure they understand the program's specifics. These questions may include:

- What services are included in the wrap fee program?

- Why does the wrap fee program make sense for me compared to other account types?

- Will my account be actively traded, or will it follow a buy-and-hold strategy?

- Are there any other managers or service providers associated with the wrap fee program, and what fees might I incur for their services?

Wrap fee programs can go by various names, such as asset allocation programs, investment management programs, or separately managed accounts. Regardless of the name, these programs offer bundled investment management and brokerage services for a single fee, providing investors with a convenient way to cover all their investment services in one bundled payment.

Vanguard Value Index Portfolio: What's Inside?

You may want to see also

Frequently asked questions

Investment management fees are the fees charged by investment managers for their services. These services include asset management, financial planning, and custody. The fee is usually charged as a percentage of the assets under management (AUM) and can be paid monthly, quarterly, or annually.

Investment management fees can differ depending on the manager and the financial firm. They are typically based on a percentage of the total assets under management, ranging from 0.10% to 2% of AUM. The fee may also depend on the management style and investment size. More actively managed funds tend to have higher management fees compared to passively managed funds.

There are several types of investment management fee structures, including flat management fees, fees assessed by asset class on the investment balance, tiered management fees, and wrap fees. Flat management fees charge a single rate regardless of the asset or investment selection. Fees assessed by asset class charge clients based on the specific assets within their accounts. Tiered management fees are a hybrid of flat and asset-based fees, where the fee rate changes at different tiers of account size. Wrap fees are all-inclusive, covering investment management, financial planning, and custody services.