Investment management fees can vary significantly depending on the type of investment and the financial professional involved. Fees can be internal or external, with external fees occurring outside the financial product and internal fees incurred as operating expenses within the product. Management fees are typically charged as a percentage of assets under management (AUM) and can range from 0.10% to over 2%. For example, a mutual fund might charge 0.5% of AUM as a management fee. These fees are intended to compensate investment managers for their time and expertise in selecting and managing investments on behalf of their clients.

| Characteristics | Values |

|---|---|

| Management Fee Range | 0.10% to more than 2% of AUM |

| Average Management Fee | 1% of AUM |

| Flat Fee Range | $2,000 to $7,500 per year |

| Hourly Fee Range | $200 to $400 |

| One-time Financial Plan Fee Range | $1,000 to $3,000 |

| Commission Range | 3% to 6% of investment |

What You'll Learn

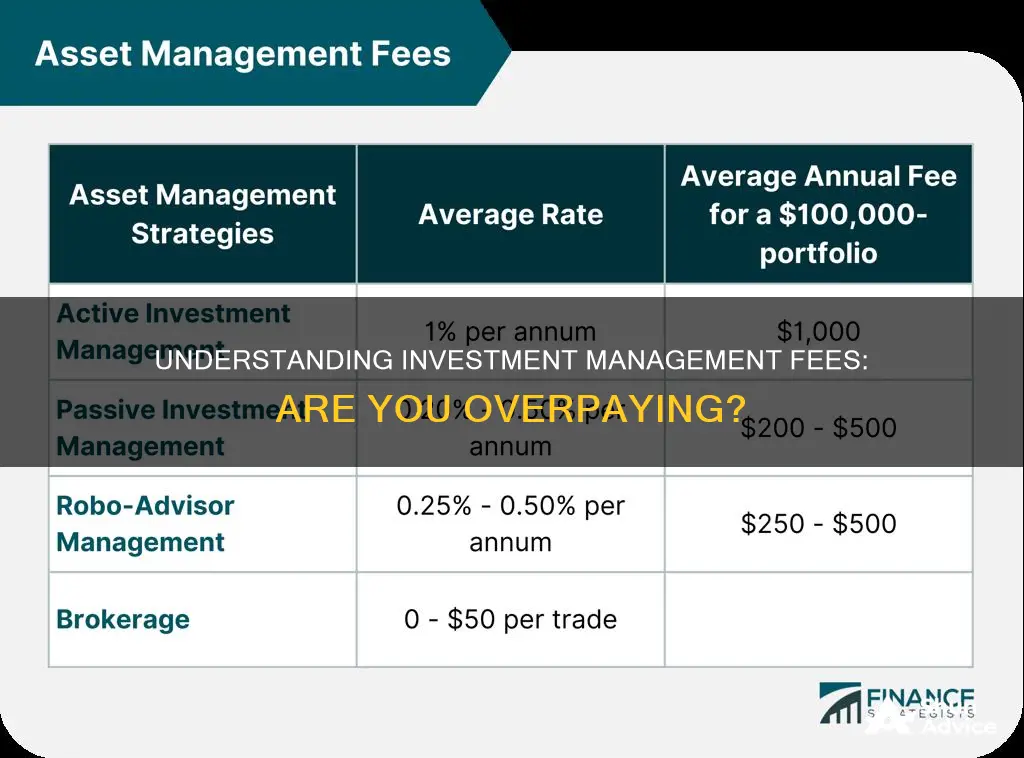

Management fees for investment funds

Management fees are typically based on a percentage of assets under management (AUM). These fees can range from 0.10% to more than 2% of AUM, with the average being between 1-2% of assets. In recent years, due to technological advancements and higher overall awareness, these fees have been closer to an average of 1%.

The disparity in management fees is generally attributed to the investment method used by the fund's manager. Actively-managed funds, which involve the fund manager actively selecting stocks and managing the portfolio, tend to have higher management fees than passively-managed funds, such as index funds that hold a basket of stocks with minimal trading. Actively-managed funds may turn over their portfolio several times a year in search of profit opportunities, resulting in higher costs. However, it is important to note that actively-managed funds do not necessarily yield better returns than passively-managed funds and may sometimes perform worse.

When considering management fees, it is crucial to understand the different cost structures offered by financial advisors. Some advisors charge a flat fee, which is typically between $2,000 and $7,500 per year, while others use a percentage-based fee structure, such as the AUM fee. Additionally, some advisors charge an hourly rate, which can range from $200 to $400 per hour, or a one-time fee for a complete financial plan.

It is also important to be aware of potential additional fees and charges. For example, investors might have to pay penalty fees for not maintaining a minimum balance, inactivity fees, and various maintenance fees. Understanding these fees and their potential impact on your investments is essential for making informed decisions.

Building a Portfolio: Investing Strategies for Beginners

You may want to see also

Flat fees vs. percentage fees

When it comes to investment management fees, there are two main types: flat fees and percentage fees. So, which is the better option for you? Let's take a closer look at the advantages and disadvantages of each.

Flat fees offer simplicity and predictability. With a flat fee, you pay a set amount for investment advice and financial planning services, regardless of the size of your investment portfolio. This can be beneficial if you have a large investment portfolio, as it could end up being more cost-effective than paying a percentage of your assets. For example, let's say you have a $3 million investment and hire a financial advisor who charges the standard fee of 0.8% to 1%. This could cost you $25,000 to $30,000 per year. However, with a flat fee, you might pay around $10,000 per year, resulting in significant savings. Additionally, flat fees can be more equitable, as clients with larger portfolios won't pay significantly more for the same service.

On the other hand, flat fees may not always be the best option for those with smaller investment portfolios. If you have less than $1 million in investable assets, a flat fee could end up being a large percentage of your account, which might not be financially prudent. In such cases, a percentage-based fee structure may be more suitable.

Percentage fees, or assets under management (AUM) fees, are typically charged as a percentage of your investment portfolio's value. The average financial advisor fee falls between about 0.5% and 2% per year but can vary. One advantage of percentage fees is that they scale up and down as your wealth changes, making them a flexible option. Additionally, firms that charge AUM fees often provide ongoing services such as tax planning, investment advice, and retirement planning, which can have a long-term impact on your wealth.

However, one of the drawbacks of percentage fees is that they can become quite costly for larger investment portfolios. For example, if you have a $1 million portfolio and pay a 1% AUM fee, you would be charged $10,000 per year. But if your portfolio value increases to $1.5 million, you would then be paying $15,000 per year, a 50% increase in fees just for adding more funds to your account.

So, which type of fee structure is the most reasonable for investment management? The answer depends on your individual circumstances. If you have a large investment portfolio, a flat fee may be more reasonable, as it could save you a significant amount of money. On the other hand, if you have a smaller portfolio, a percentage-based fee might be more suitable, as flat fees could consume a large percentage of your account. Ultimately, it's important to carefully consider your options, compare different advisors and platforms, and choose the fee structure that aligns with your financial goals and situation.

Saving and Investing: Key Factors for Decision-Making

You may want to see also

Robo-advisors vs. traditional advisors

Investment management fees can vary significantly depending on what is being bought or sold and by whom. Fees typically fall into two categories: external fees that occur outside the financial product and internal fees that occur inside the financial product as an operating expense. External fees include trading costs, which are custodial fees for buying or selling a security trade, and internal fees include expense ratios, which are annual fees that all funds charge.

One of the most common fees is the advisor or management fee, which is typically between 1-2% of assets but has fallen closer to an average of 1% in recent years. This fee is usually negotiable and, according to some sources, you should not be paying more than 1% on investments unless you are receiving personalised financial planning services.

Robo-advisors are online investing platforms that use software algorithms to create and manage investment portfolios based on user goals and risk tolerance. They are a low-cost alternative to traditional financial advisors, with annual fees typically ranging from 0 to 0.65%. Robo-advisors are best suited for those who want a managed portfolio at a low cost and don't require advice on topics such as debt payoff, college savings, or estate planning.

| Robo-advisors | Traditional advisors |

|---|---|

| Low fees, typically ranging from 0 to 0.65% | Higher fees, typically around 1% of assets |

| No minimum balance requirements or low minimums, typically ranging from $0 to $1,000 | Substantial account balance requirements |

| Limited human interaction | In-person interaction |

| Quick and easy account setup | Lengthy account setup |

| Standardised advice | Personalised advice |

| Best for those who want a cheap, managed portfolio | Best for those who want advice on a range of financial topics |

Overall, robo-advisors are a good option for those who want a low-cost, automated investment service. Traditional advisors are better suited for those who want personalised advice and are willing to pay higher fees.

The Future of Investment Management: 2030 Vision

You may want to see also

Negotiating fees with advisors

When it comes to negotiating fees with investment advisors, there are a few key things to keep in mind. Firstly, it's important to understand the different types of fee structures that advisors may use. These can include annual Assets Under Management (AUM) fees, flat annual or monthly fees, hourly rates, one-time financial plan fees, or commissions.

Understanding AUM Fees

AUM fees are typically charged as a percentage of the total assets under the management of the advisor. This fee structure is common among traditional in-person financial advisors, as well as some online financial planning services. The percentage charged can vary but is usually between 0.25% and 1% per year. For example, a client with $100,000 invested with an advisor charging a 1% fee will pay $1,000 per year.

Flat Fees

Some advisors, particularly those offering more comprehensive financial planning services, may charge a flat annual or monthly fee. This fee is usually not linked to the amount of money you have invested but may be higher for more complex situations. Flat fees typically range from $2,000 to $7,500 per year.

Hourly Rates and One-Time Financial Plans

Some advisors charge by the hour, typically between $200 and $400, regardless of the size of your investment portfolio. This can be a good option if you only need advice on a specific issue or want to check in with an advisor a few times a year. Alternatively, you can opt for a one-time financial plan, where you pay a flat fee (usually between $1,000 and $3,000) for a comprehensive financial plan that you then implement and manage on your own.

Commissions

Commission-based advisors are paid through commissions on the investments they recommend, and these commissions come out of your pocket. Mutual fund sales loads generally fall between 3% and 6% of your investment. While some commission-based advisors may offer valuable advice, it's important to be aware that they may be swayed by the potential for higher commissions on certain products.

Negotiation Strategies

Now that you understand the different fee structures, you can use this knowledge to negotiate with potential advisors. Here are some strategies to keep in mind:

- Shop around: Don't be afraid to compare fees and services offered by multiple advisors. This will give you a sense of the market rate for the specific services you require and help you identify advisors who may be charging more than their competitors.

- Understand your needs: Before negotiating, take the time to clearly define your financial goals and the specific services you require. This will help you determine which fee structure is most suitable for your situation.

- Ask for transparency: Always request full disclosure of an advisor's fee structure, including any additional costs or commissions. A reputable advisor should be transparent about their fees and not pressure you into making a decision.

- Discuss fee breakpoints: Many advisors offer reduced fees for clients who reach certain breakpoints in terms of the overall AUM. Ask about these breakpoints and whether your situation qualifies for a reduced fee.

- Consider a flat fee: If you have a significant amount of assets under management (over $1 million, for example), consider negotiating a flat fee instead of a percentage-based fee. Flat fees can often be more affordable for larger portfolios and ensure you're not overpaying for the services you receive.

- Review and reassess: Don't be afraid to review and reassess your advisor's fees periodically. Market conditions and your financial situation can change, and you may find that you're able to negotiate a better rate or that another advisor is offering more competitive pricing for similar services.

Remember, it's important to consider not only the cost but also the value you're receiving from your advisor's services. While negotiating a lower fee can be beneficial, ensure that you're not compromising the quality of advice and level of service you require to achieve your financial goals.

Charities and VAT: Investment Management Fees Explained

You may want to see also

Additional fees and charges

Investment management fees can vary depending on the type of investment, the advisor, and the level of service provided. Here are some additional fees and charges that you may encounter:

External Fees

These occur outside the financial product and can include trading costs and expense ratios. Trading costs are custodial fees incurred when buying or selling a security trade, typically costing less than $10 per trade with low-cost custodians. Expense ratios are annual fees deducted from the investor's balance, ranging from 0.05% to 2% of the investment.

Sales Fees (Commission-Based)

These fees are associated with agents or brokers who sell financial products and receive a commission. Load fees are a type of sales fee where the agent receives a large commission upfront, ranging from 3-8% of the investment. On-going sales fees are reduced commissions paid annually for the duration of the investment, typically between 1-3%.

Insurance Product Costs

These costs are associated with insurance-based investment products, such as annuities or investments within a life insurance policy. They can include insurance-related charges, surrender charges, rider charges, and investment management fees. These fees can add up, with variable deferred annuities often having all-in costs of 2.5% to 4% per year, excluding sales commissions.

Penalty Fees

Penalty fees may be charged for not maintaining a minimum balance in your account. Inactivity fees and various maintenance fees may also be applicable.

12b-1 Fees

These fees are commonly charged to mutual funds to cover marketing, shareholder services, and employee bonuses. They are typically limited to no more than 1% of the assets held.

K) Plan Fees

These plans often have fees that are paid by the participants, estimated at around $30 billion annually across 60 million participants holding $3 trillion in assets.

It is important to understand the fee structure and potential additional charges before committing to any investment product or advisor. Shopping around and inquiring about fees upfront can help investors make informed decisions and avoid unnecessary costs.

How to Grow Your Investment Portfolio Wisely

You may want to see also

Frequently asked questions

Investment management fees are fees charged by financial advisors for overseeing an investment fund. These fees are intended to compensate advisors for their time and expertise in selecting stocks and managing the portfolio.

Investment management fees typically range from 0.25% to 1% per year, depending on the amount of money being managed and the specific services provided. Some financial advisors may charge a flat fee, an hourly rate, or a one-time fee for a complete financial plan.

Yes, there are two main types of investment management fees: external fees and internal fees. External fees occur outside of the financial product, while internal fees occur inside the financial product as an operating expense. External fees include trading costs and expense ratios, while internal fees include insurance product costs and trading costs incurred by investment managers.

It is important to understand the different cost structures and incentives associated with each type of financial advisor. Commission-based advisors, for example, may be under pressure to generate commissions and may not always give advice that is in the best interest of the client. It is also worth noting that the average cost of investment management services has been decreasing in recent years due to technological advancements and higher overall awareness. If you are being charged more than 1% on your investments, you should be receiving personalized financial planning services.