Schedule D is a form that investors with capital gains or losses from investments, business ventures, or partnerships during the tax year use to report them to the Internal Revenue Service (IRS). It is used for reporting short-term and long-term gains or losses, and the calculations from Schedule D impact a taxpayer's adjusted gross income when they are added to Form 1040.

| Characteristics | Values |

|---|---|

| Purpose | To report capital gains or losses from investments, business ventures, or partnerships during the tax year |

| Used by | Investors with capital gains or losses from investments, business ventures, or partnerships |

| Form | Schedule D (Form 1040) |

| Reported gains/losses | Short-term and long-term gains or losses |

| Calculations | Impact a taxpayer's adjusted gross income when added to Form 1040 |

| Required additional forms | Form 8949, Form 4797, Form 6252, Form 4684, Form 8824 |

| Taxed at | Ordinary tax rate for short-term capital gains; IRS capital gains rate for long-term capital gains |

What You'll Learn

Schedule D: Capital Gains and Losses

Short-term capital gains or losses are those from investments held for less than a year, while long-term capital gains or losses are those held for more than a year. Taxpayers must report the sales price of their investment or ownership interest, its cost or other basis, and any adjustments to the gain or loss on Schedule D. This information is typically obtained from Form 1099-B, which the payer must file with the IRS for reporting purposes and provide a copy to the payee.

Schedule D categorises transactions as short-term or long-term since they are taxed at different rates, with long-term capital gains taxed at a lower rate. Additionally, taxpayers with capital loss carryovers from previous years must use Schedule D to report this information. It is important to note that only short-term losses can offset short-term gains, and long-term losses can offset long-term gains. Losses that exceed gains may be eligible to be carried forward and applied to the following year's taxes.

Along with Schedule D, taxpayers may need to prepare and include information from other tax forms, such as Form 8949 for selling investments or a home, Form 4797 for selling business property, Form 6252 for taxpayers with instalment sale income, Form 4684 for taxpayers who claimed a casualty or theft loss, and Form 8824 for taxpayers who made a like-kind exchange.

Who Manages Their Own Investments?

You may want to see also

Non-retirement investment accounts

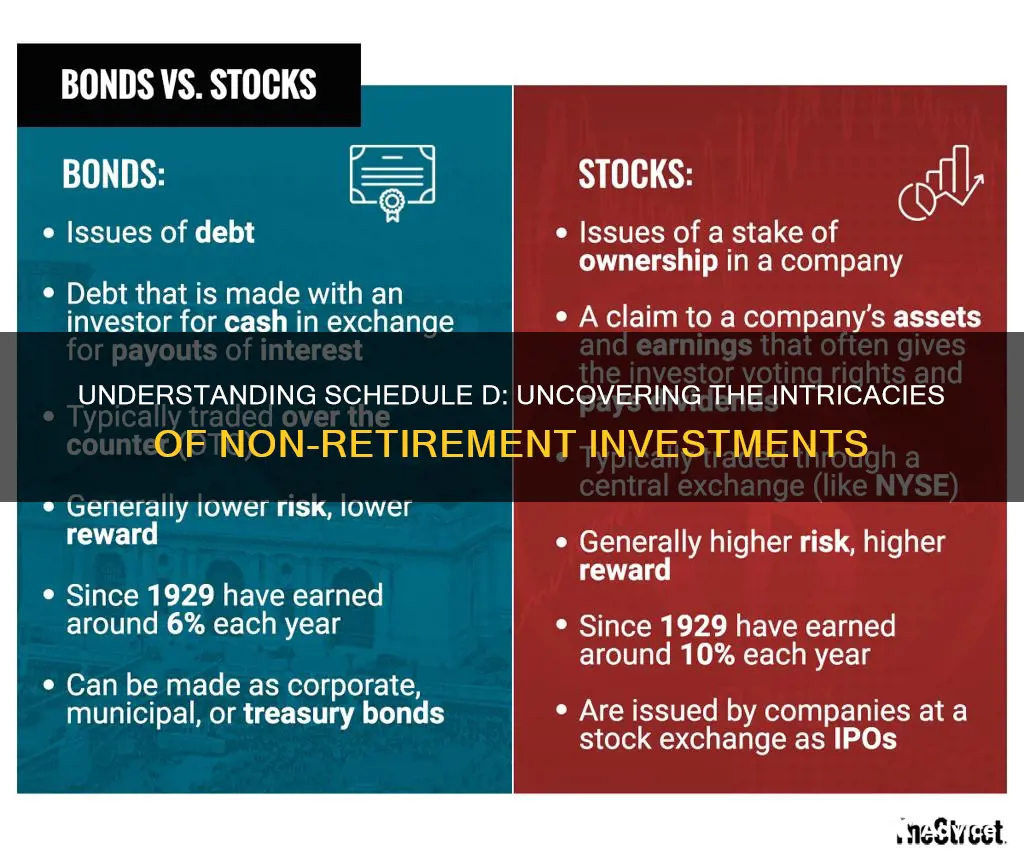

The most common type of non-retirement investment account is a brokerage account. These are non-qualified, taxable investment accounts that can include vehicles like stocks, bonds, mutual funds, and exchange-traded funds (ETFs). With a brokerage account, you have more control over your investments and are not limited by the options available in an employer plan. There are also no limits on how much money you can contribute each year. However, you will pay taxes on the income you earn from yearly dividends or interest, as well as capital gains when you sell stocks.

Another type of non-retirement investment account is a health savings account (HSA). HSAs offer tax benefits, as contributions are made pre-tax and any interest or investment income grows tax-free. Withdrawals for qualified medical expenses are also tax-free. It's important to note that HSAs have contribution limits and are only available to those with a high-deductible health plan.

When considering a non-retirement investment account, it's important to evaluate your financial goals, risk tolerance, and time horizon. Fees, tax implications, and the level of risk involved should all be carefully considered before making any investment decisions.

Theft of Investments: A Growing Concern

You may want to see also

Brokerage accounts

A brokerage account is opened through a licensed broker, on your own (referred to as a self-directed brokerage account), or using an automated investing platform. There is no contribution limit and you can withdraw your money at any time for any reason. However, brokerage accounts are often not tax-advantaged—you may have to pay taxes on any earnings you receive.

A brokerage account is considered "non-qualified", meaning you're investing with after-tax dollars. If you're maxing out your 401(k) contribution and want to keep investing, a non-qualified account may be a good option.

One benefit of non-qualified investments is the amount of control you have over them. With employer plans, you may be limited by what investments are available. A brokerage account, on the other hand, allows you to choose your own investments.

Another benefit is tax diversification. Non-qualified accounts allow you to be more strategic about how and when you access your money. Retirement accounts have rules and penalties for withdrawing money before reaching a specific age, generally 59 ½. With non-qualified accounts, you can withdraw money at any time, although earnings are typically subject to capital gains tax.

There are no limits on how much money you can contribute each year to a brokerage account. Brokerage accounts are taxable, as they're funded with after-tax money. You'll pay taxes on the income you earn from yearly dividends or interest, as well as capital gains when you sell stocks.

Before investing in a brokerage account, it's important to ask yourself the following questions:

- Do I have at least three to six months' worth of emergency funds set aside in a savings account?

- Am I taking full advantage of company matches in my retirement account?

- Have I invested enough in my retirement accounts to meet my post-retirement goals?

- Do I want to fund a 529 plan to save for my children or grandchildren's education?

- Do I have access to and the ability to fund a Health Savings Account (HSA)?

Madoff Victims: Lives Destroyed

You may want to see also

Taxable brokerage accounts

A taxable brokerage account is a versatile investment option. It is a non-retirement investment account, which means it does not receive favourable tax treatment like IRAs or 401(k)s. With a taxable brokerage account, you can build a portfolio and use gains to improve your income and losses to offset your tax bill.

There are several benefits to taxable brokerage accounts. They offer greater flexibility than retirement accounts, and more investment options than a savings account. You can trade stocks, bonds, exchange-traded funds (ETFs), or any other security. There are also no contribution limits or income restrictions on how much you can put into a taxable brokerage account each year.

Another benefit is that you can withdraw money at any time without penalty, although earnings are typically subject to capital gains tax. This makes taxable brokerage accounts a good option if you need access to your money in the short term, for example, if you are saving for a down payment on a house.

Despite these benefits, taxable brokerage accounts do have some downsides. One is that you don't get to take a tax deduction for the money you put into the account. Another is that there is no legal protection for the assets in the account—they can be claimed by creditors. Additionally, you must pay taxes on investment earnings and capital gains in the year in which they are received.

Overall, taxable brokerage accounts can be a useful tool for investors, offering flexibility and control. However, it is important to carefully consider the pros and cons before choosing what type of account to open and to seek advice from a financial advisor.

Investments: The Thrill of the Hunt

You may want to see also

Tax-deferred accounts

There are several types of tax-deferred investment accounts, each with its own benefits and eligibility criteria. Examples include retirement plans such as 401(k) and 403(b) plans, fixed deferred annuities, variable annuities, US savings bonds, and whole life insurance policies. These accounts offer investors the opportunity to accumulate wealth over time while taking advantage of the tax benefits provided by these accounts.

One of the main advantages of tax-deferred accounts is the ability to lower your annual taxable income. Contributions to these accounts may be made with pre-tax income, reducing your taxable income for the year. Additionally, investors can benefit from tax-deferred accounts by not owing taxes on investment gains until they start withdrawing funds. This allows investors to defer taxes on enormous gains for years.

Another benefit of tax-deferred accounts is the potential for tax-free growth. Investments held within these accounts can grow without being subject to immediate taxation. This allows for compound interest to occur, where the gains made are reinvested and generate even more gains. Over time, this can result in significant wealth accumulation.

However, there are also drawbacks to investing in tax-deferred accounts. These accounts come with rules and restrictions, such as contribution caps and penalties for early withdrawals. For example, the IRS sets limits on how much can be saved in tax-deferred accounts annually, and withdrawing funds before the age of 59½ typically results in a 10% penalty. Additionally, even though taxes are deferred, they will eventually need to be paid, and required minimum distributions from these accounts typically begin at the age of 73.

It is important to note that tax-deferred accounts are just one type of investment account available to investors. Other types of accounts include taxable accounts, such as brokerage accounts, and tax-exempt accounts, such as Roth IRAs and Health Savings Accounts (HSAs). Each type of account has its own tax treatment, and investors should consider their financial goals, risk tolerance, and time horizon when deciding where to allocate their investments.

The Looming Question: When Can I Retire in South Carolina?

You may want to see also