Investing in mutual funds involves a range of fees and charges that can impact your overall investment returns. These fees can be broadly categorised into two types: annual fund operating expenses and shareholder fees. Annual fund operating expenses cover the cost of paying managers, accountants, legal fees, marketing, and other administrative costs. Shareholder fees, on the other hand, are sales commissions and other one-time costs incurred when buying or selling mutual fund shares. Understanding these fees is crucial, as they can help you make informed investment decisions and reduce your overall investment costs.

| Characteristics | Values |

|---|---|

| Annual fund operating expenses | Management fees, 12b-1 fees, custodial, legal, accounting, transfer agent and other administrative costs |

| Shareholder fees | Sales loads, redemption fee, exchange fee, account fee, purchase fee |

| Expense ratio | Annual fee, expressed as a percentage of a fund's daily net assets |

| Entry load | Fee levied on investors when they invest in a mutual fund scheme for the first time |

| Exit load | Fee levied on investors who exit a mutual fund scheme within a specific period from the date of purchase |

| Transaction fee | Rs. 100 to Rs. 150 for investments worth Rs. 10,000 and above |

What You'll Learn

Annual fund operating expenses

The specific expenses that make up the annual fund operating expenses include:

- Management fees: The cost of paying fund managers and investment advisors.

- 12b-1 fees: Fees that cover the cost of marketing and selling the fund, as well as other shareholder services, are capped at 1%.

- Other expenses: These may include custodial, legal, accounting, transfer agent expenses, and other administrative costs.

These expenses are listed in the fund's prospectus, a legal document that each mutual fund is required to file with the SEC. The total annual fund operating expenses are expressed as a percentage of the fund's net average assets.

It's important to note that actively managed funds tend to have higher annual fund operating expenses than passively managed funds, such as index funds, as they aim to beat average stock market returns and require more active management.

When considering investing in mutual funds, it is crucial to carefully review the annual fund operating expenses, as they can significantly impact your investment returns over time. Even small differences in fees can lead to substantial differences in returns.

Credit Opportunity Funds: Worth Your Investment?

You may want to see also

Shareholder fees

Sales loads can be charged upfront when you purchase a mutual fund, known as a "front-end load", or when you sell your position in a mutual fund, known as a "back-end load" or "deferred sales load". A fund may also charge both a front-end and a back-end load. For example, a fund might charge 2% upon purchase and 1% upon sale.

Some funds also have "level loads" or "low loads", which are similar to back-end loads but are charged if shares are sold within a shorter time frame.

Front-end loads reduce the amount of your investment. For example, if you have $1,000 to invest in a mutual fund with a 5% front-end load, the $50 sales load comes off the top, and the remaining $950 is invested in the fund.

Back-end loads are often imposed to prevent investors from short-term trading of their funds. The charge may be waived if you hold the fund for a certain minimum amount of time, such as one year.

Many mutual funds today have no loads and are known as "no-load funds".

Redemption fees are another type of shareholder fee. These are charged by some investment brokers when you sell a mutual fund. For example, Charles Schwab charges a $49.95 short-term redemption fee on funds purchased through its Mutual Fund OneSource if a position is held for 90 days or less.

Account fees are another type of shareholder fee. These are charged in connection with the maintenance of your account. A broker or fund may charge an account fee on all account sizes and types, or only on those accounts with balances below a certain threshold.

Purchase fees are charged by some funds upon the purchase of a fund and are separate from load fees. They are more typically charged when there is no load fee.

Exchange fees are imposed by some funds if you exchange your investment in one fund for a position in another fund within the same fund group.

Finally, if you purchase mutual funds through a broker, you will typically be charged a commission or transaction fee. This can range from $10 to $75 per trade, regardless of the dollar amount of the mutual fund purchased or sold. However, an increasing number of brokers are offering no-transaction-fee mutual funds.

Venture Fund 10100: A Guide to Investing in the Future

You may want to see also

Management fees

Actively managed funds tend to have higher management fees due to the comprehensive management involved. These funds involve a more hands-on approach, with fund managers and research teams making buying and selling decisions to outperform the market. On the other hand, passively managed funds, such as index funds and ETFs, generally have lower management fees since they aim to mirror the performance of a specific stock index and involve less manual intervention.

When evaluating mutual funds, it's crucial to consider the management fees, as even small differences can lead to significant disparities in investment returns over time.

SBI Mutual Funds: Safe Investment Option?

You may want to see also

Sales loads

Front-end sales loads are deducted from the investment upfront before the funds are allocated. For example, if an investor writes a $10,000 check to a fund with a 5% front-end sales load, the total amount of the sales load will be $500. The $500 sales load is first deducted from the $10,000 check, and the remaining $9,500 is used to purchase fund shares for the investor.

Back-end sales loads, also known as deferred sales charges, are deducted when an investor redeems their shares (i.e., sells their shares back to the fund). When an investor purchases shares that are subject to a back-end sales load, no sales load is deducted at the time of purchase, and all of the investor's money is immediately used to purchase fund shares. For example, if an investor invests $10,000 in a fund with a 5% back-end sales load, the entire $10,000 will be used to purchase fund shares, and the 5% sales load is not deducted until the investor redeems their shares.

The most common type of back-end sales load is the "contingent deferred sales load" (CDSL or CDSC). The amount of this type of load depends on how long the investor holds their shares and typically decreases to zero if the investor holds their shares long enough. For example, a contingent deferred sales load might be 5% if an investor holds their shares for one year, 4% if they hold their shares for two years, and so on until the load goes away completely.

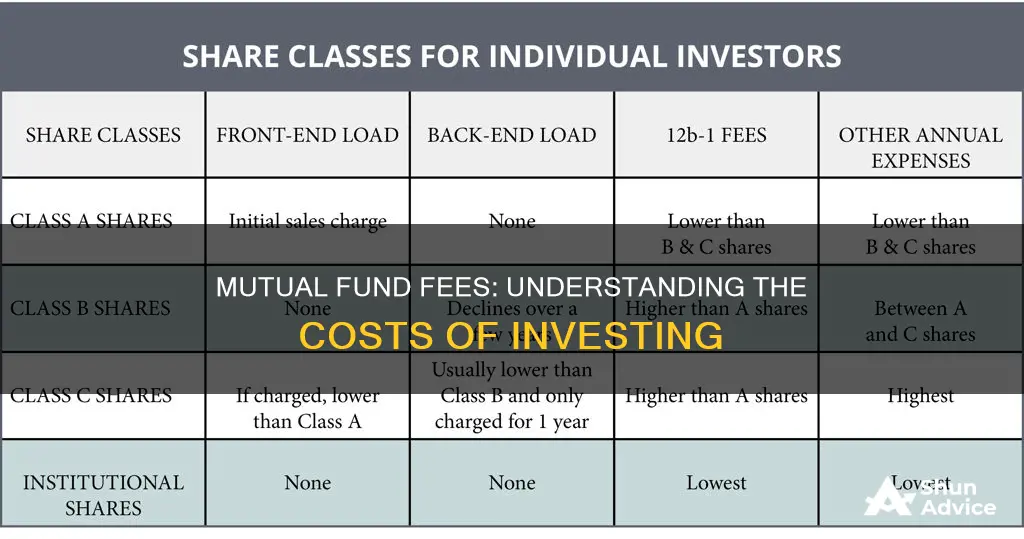

- A-class shares have a front-end sales load, typically between 2% and 5% of the total investment.

- B-class shares have a back-end sales load, which you don't pay unless you sell your shares before a specified time period, usually up to seven years after the original purchase. B-class share funds typically charge higher ongoing annual fees than A-class share funds.

- C-class shares may carry commissions charged every year you own the fund, or they may have a back-end sales load similar to B-class shares.

Index Funds vs Real Estate: Where Should You Invest?

You may want to see also

Redemption fees

In the US, the Securities and Exchange Commission (SEC) limits redemption fees to 2%. Funds may charge a redemption fee if investors sell their shares within a short period of time after purchasing them, which could be anywhere from a few days to over a year, depending on the fund. This fee is intended to discourage investors from opting out of a mutual fund scheme prematurely and to reduce the volume of withdrawals.

In India, the Securities and Exchange Board of India (SEBI) regulates mutual fund fees. While entry loads are no longer permitted, fund houses commonly charge an exit load of around 1% on the redemption value if investors redeem their units within a year of purchase. This exit load is not charged after one year of investment in the same scheme.

A Guide to Investing in Nifty 50 Index Funds with Zerodha

You may want to see also

Frequently asked questions

There are two main types of fees associated with investing in mutual funds: annual fund operating expenses and shareholder fees. Annual fund operating expenses are ongoing fees that cover the cost of paying managers, accountants, legal fees, marketing, etc. Shareholder fees, on the other hand, are sales commissions and other one-time costs incurred when buying or selling mutual fund shares.

Shareholder fees include sales loads, redemption fees, exchange fees, and account fees. Sales loads are commissions paid to third-party brokers when buying or selling shares, while redemption fees are charged when shareholders redeem their shares within a specific period. Exchange fees are imposed when transferring to another fund within the same fund group, and account fees are charged for maintaining investor accounts, often linked to a minimum account balance requirement.

You can find information about the fees associated with a mutual fund in its prospectus, a legal document that each mutual fund is required to file with the SEC. Look for the fee table, which can typically be found near the front of the prospectus. The fees will be listed under the headings "Shareholder Fees" and "Annual Fund Operating Expenses."