Investment funds are a supply of capital from multiple investors, which is used to collectively purchase securities. There are several types of investment funds, including mutual funds, exchange-traded funds (ETFs), money market funds, and hedge funds. These funds have different life spans, investment strategies, and risk levels. For example, private equity funds have an average term of ten years, while hedge funds usually last for about six to seven years.

Investment funds are managed by professionals and provide investors with access to a wide range of assets. They are known for their diversification benefits, as they allow investors to gain exposure to various securities, industries, and asset classes. Funds also provide greater management expertise and lower investment fees than investors could obtain on their own.

When investing in funds, individuals should consider their risk tolerance, investment goals, fees, and the fund's track record. It is important to note that fees and expenses can significantly impact overall returns, so investors should be mindful of these costs.

What You'll Learn

- Mutual funds: Pooled investments managed by professionals, offering diversification and lower fees

- Hedge funds: Actively managed funds with less regulation, investing in various asset classes

- Target-date funds: Asset allocation adjusts over time, becoming more conservative as the target date approaches

- Fund life cycle: Funds go through stages, including formation, fundraising, investment, and divestment/liquidation

- Fees and expenses: Various fees are associated with mutual funds, such as annual fees, expense ratios, and commissions

Mutual funds: Pooled investments managed by professionals, offering diversification and lower fees

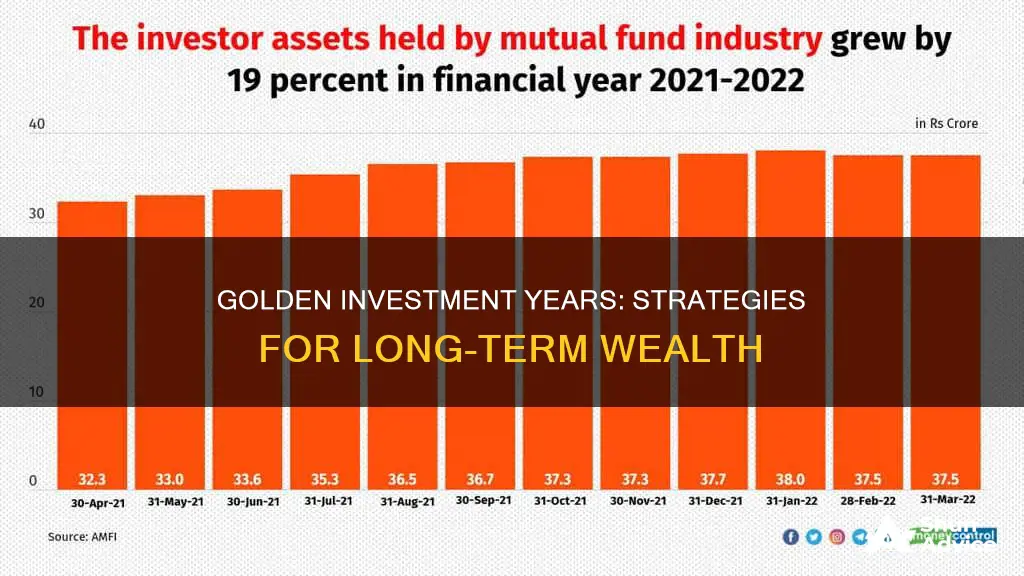

Mutual funds are a type of investment fund, which are portfolios of stocks, bonds, or other securities purchased with the pooled capital of investors. They are defined as pooled investments, managed by professional money managers, and are an accessible way for investors to access a wide mix of assets.

Mutual funds are a popular investment vehicle, with over half of American households investing in them. They are an attractive option for investors as they offer diversification, professional management, and a variety of investment options.

- Pooled Investments and Professional Management: Mutual funds pool money from multiple investors, allowing individual investors to gain exposure to a professionally managed and diversified portfolio. The fund's performance depends on the collective performance of its underlying assets. Professional fund managers oversee the portfolio, deciding how to allocate money based on the fund's strategy.

- Diversification and Risk Reduction: Mutual funds provide diversification by investing in securities with different capitalizations, industries, maturities, and issuers. This diversification helps to reduce investment risk, as the impact of any single underperforming security is minimised.

- Economies of Scale: Mutual funds benefit from economies of scale, allowing investors to take advantage of lower transaction costs. The large amount of capital pooled together enables investors to buy more shares collectively and often at discounted prices.

- Accessibility and Low Minimum Investments: Mutual funds offer accessibility to a wide range of investments, including stocks, bonds, real estate, derivatives, and other securities. They typically have minimal investment requirements, making them an attractive option for investors seeking to build a diversified portfolio with a relatively small amount of capital.

- Variety of Investment Options: Mutual funds are known for the types of securities they invest in, their investment objectives, and the returns they seek. There are various types of mutual funds, including stock funds, bond funds, money market funds, index funds, and target-date funds, each with its own investment strategy and focus.

- Lower Fees: Mutual funds can provide lower investment fees compared to individual investors trading on their own. The large amount of capital in a mutual fund leads to economies of scale, resulting in reduced transaction costs per investor.

While mutual funds offer many benefits, it is important to consider potential drawbacks, such as fees, commissions, and the lack of control over investment decisions. Additionally, the diversification offered by mutual funds may limit the potential for very high returns.

Manulife Financial: A Regulated Mutual Fund Company?

You may want to see also

Hedge funds: Actively managed funds with less regulation, investing in various asset classes

Hedge funds are actively managed funds that face less regulation than other investment vehicles, such as mutual funds. They are considered alternative investments and are generally more aggressive, exclusive, and risky. Hedge funds are also known for their higher fees, with a standard management fee of 2% and a performance fee of 20%.

Hedge funds are distinct from mutual funds or ETFs in that they have more freedom to invest in a variety of asset classes using diverse strategies. They are not subject to the many restrictions that apply to regulated funds, allowing them to employ complex trading and risk management techniques. Hedge fund managers can invest in non-traditional and illiquid assets, such as derivatives, futures, options, and leverage. They can also take short positions and employ distressed debt investment strategies.

Hedge funds are typically offered privately and are only available to accredited investors, who are deemed to have advanced knowledge of financial market investing and a higher risk tolerance. The private nature of hedge funds allows them greater flexibility in their investment provisions and investor terms.

Hedge funds are often managed much more aggressively than mutual funds, seeking to achieve returns in falling markets and taking globally cyclical positions. They are structured differently, usually as limited partnerships with a tiered structure that includes a general partner and limited partners.

The first hedge fund was created in 1949 by Alfred Winslow Jones, who is known as the "father of the hedge fund." He raised $100,000 and combined long-term stock positions with short-selling to minimize risk, a strategy now known as the classic long/short equities model. Jones also implemented the popular "2-and-20" fee structure, with a 2% management fee and a 20% performance fee.

Hedge funds have grown significantly in recent years, with the industry managing over $3 trillion as of 2021 and offering more than 29,000 funds globally as of 2023.

Short-Term Liquid Funds: A Smart Investment Strategy

You may want to see also

Target-date funds: Asset allocation adjusts over time, becoming more conservative as the target date approaches

Target-date funds are a type of mutual fund that is designed to help investors manage their investment risk over time. They are often used in 401(k) plans and other retirement savings accounts. When investing in a target-date fund, an investor chooses a fund with a target year that is closest to the year they anticipate retiring. The fund then rebalances and shifts its asset allocation over time, becoming more conservative as the target date approaches.

The asset allocation of a target-date fund typically starts with a higher weighting towards stocks and other riskier growth stocks, with the aim of maximising gains while the investor has a long time horizon and is better able to recover from any short-term losses. As the target date approaches, the fund's asset allocation gradually shifts towards more conservative investments, such as bonds, cash, and cash equivalents, in order to preserve gains and avoid untimely losses. This shift in asset allocation over time is known as a "glide path".

For example, a 2060 target-date fund will initially be heavily weighted towards stocks and other high-risk, high-reward assets. As the target date of 2060 gets closer, the fund will adjust its asset allocation to include more conservative investments, such as fixed-income investments. By the time the target date arrives, the fund will have a much more conservative asset allocation to match the investor's reduced risk tolerance closer to retirement.

Target-date funds offer a "set it and forget it" investment option for investors who want a simple, automated way to manage their investments over time. The funds are managed by professionals who adjust the asset allocation based on the investor's time horizon and risk tolerance. However, it's important to note that target-date funds do not guarantee a certain level of income or gains, and there is still a risk of losing money if the stocks and bonds owned by the fund drop in value.

A Guide to Investing Money in Pag-Ibig Fund

You may want to see also

Fund life cycle: Funds go through stages, including formation, fundraising, investment, and divestment/liquidation

Investment funds are a supply of capital from multiple investors, used to collectively purchase securities. They are managed by professionals and provide access to a diversified portfolio of stocks, bonds, or other securities.

Funds go through several stages in their life cycle, including formation, fundraising, investment, and divestment/liquidation.

Formation

The fund formation stage involves creating the foundation for the various elements of a fund. This includes determining the fund strategy, navigating the regulatory environment, drafting offering documents, and preparing and reviewing necessary documents. The fund's investment structure is also set up at this stage.

Fundraising

During the fundraising stage, fund operators market and raise capital from investors in accordance with relevant regulations and the fund's offering documents. Investor due diligence, onboarding, and coordination with other service providers are crucial aspects of this stage. The fundraising period ends with the final closing when the last investors commit their capital.

Investment

The investment period is typically the most active stage in a fund's life cycle. Fund managers execute portfolio management strategies, seek new investment opportunities, and call upon committed capital from investors. This stage involves recording and monitoring investment activities, preparing financial statements, providing regulatory and tax reports, and distributing investor statements.

Divestment/Liquidation

In the divestment stage, the fund can no longer acquire additional capital and can only continue to operate its existing investments. The fund manager may sell some funds or assets that have grown to a point where they have achieved a satisfactory rate of return or are no longer core to their portfolio. Following the sale of these investments, returns and profits are distributed to investors. The divestment period transitions into the liquidation stage, where all investments are sold off, and proceeds are distributed.

Wide Moat Fund: Investing in Quality Businesses

You may want to see also

Fees and expenses: Various fees are associated with mutual funds, such as annual fees, expense ratios, and commissions

Mutual funds charge various fees and expenses that investors should be aware of, as they will impact overall returns. These fees can be broadly categorized into annual fund operating expenses and shareholder fees.

Annual Fund Operating Expenses

These are ongoing fees that cover the cost of paying fund managers, accountants, legal fees, marketing, and other administrative costs. They are typically between 0.25% and 1% of your investment in the fund per year and are detailed in the fund's prospectus under "total annual operating expenses."

- Management fees: The cost of paying fund managers and investment advisors.

- 12b-1 fees: Fees capped at 1% used for marketing, selling the fund, and shareholder services.

- Other expenses: May include custodial, legal, accounting, transfer agent expenses, and other administrative costs.

Shareholder Fees

Shareholder fees are sales commissions and other one-time costs incurred when buying or selling mutual fund shares. These are outlined in the fund's prospectus under "shareholder fees."

- Sales loads: Commissions paid when buying or selling mutual fund shares, typically ranging from 2% to 5% of the total investment.

- Redemption fee: Charged when selling shares within a short period after purchasing them, usually within 30 to 180 days.

- Exchange fee: Charged by some funds when shareholders transfer their shares to another fund within the same fund group.

- Account fee: A fee for maintaining your account, often applied if the balance falls below a specified minimum.

- Purchase fee: A fee paid to the fund at the time of purchase, distinct from a front-end sales load paid to the broker.

It's important to carefully review the prospectus and fee structure of a mutual fund before investing, as these fees can significantly impact your investment returns over time.

Mutual Funds: Lump Sum Investing Strategies for Success

You may want to see also

Frequently asked questions

A fund's life cycle refers to the different stages it goes through, from the initial formation stage to the divestment and liquidation stages. The investment period is typically the most active phase, where capital is deployed and fund and governance activities are carried out.

There are various types of investment funds, including hedge funds, fund of funds, real estate funds, private equity funds, venture capital funds, and managed accounts. Each type of fund has its own risk profile, investment objectives, and life span.

A fund of funds is an investment vehicle that holds a portfolio of other investment funds, such as mutual funds, exchange-traded funds (ETFs), or hedge funds. It offers broad exposure to multiple asset classes and is managed by a professional fund manager.

Investing in a fund of funds provides a set-it-and-forget-it approach, professional fund selection and risk management, and diversification into alternative investments. It is suitable for those who want a hands-off approach to investing and prefer to have their portfolio managed by experts.

The main disadvantages of investing in a fund of funds are the stacking of fees, reduced transparency, potential illiquidity, and watered-down returns due to over-diversification. It is important to carefully consider and review all associated fees and expenses before investing.