When it comes to investing, there are a multitude of criteria to consider. From personal financial goals to risk tolerance, there are several factors that influence investment decisions. A widely accepted set of criteria is the INVEST checklist, which assesses the quality of a user story. The acronym stands for Independent, Negotiable, Valuable, Estimable, Small, and Testable. Each of these criteria plays a crucial role in guiding investment choices. Additionally, investment criteria can be further categorized into publicly disclosed parameters and those for internal review, with the former aiming to gather deal flow and the latter enabling buyers to swiftly determine the viability of an acquisition.

| Characteristics | Values |

|---|---|

| Independent | Not dependent on other stories |

| Negotiable | Not a specific contract for features |

| Valuable | Bring value to the customer or stakeholder |

| Estimable | Smaller stories are clear and easy to estimate |

| Small | Fit within an iteration |

| Testable | Can be tested in principle |

| Publicly disclosed criteria | Geography, size of the investment, industry |

| Internal review criteria | Strength of the management team, estimated IRR on the investment, customer diversification |

What You'll Learn

Financial roadmap

A financial roadmap is an important step towards successful investing. It involves taking an honest look at your entire financial situation, especially if you're new to financial planning. It is the first step to achieving financial security and reaping the benefits of managing your money. Here are some key considerations for your financial roadmap:

- Goals and risk tolerance: Understand your financial goals and how much risk you are comfortable taking on. Investing always carries some degree of risk, and you could lose some or all of your money. Carefully consider this risk and whether you are financially prepared for potential losses.

- Diversification: Diversifying your investments is crucial to reducing risk. Avoid putting all your eggs in one basket. Spread your investments across different asset categories, such as stocks, bonds, and cash. This helps protect against significant losses, as different asset categories tend to move up and down under different market conditions.

- Emergency fund: Build an emergency fund to cover unexpected expenses, such as sudden unemployment. Aim to save enough to cover at least a few months' worth of living expenses. This will provide financial security and peace of mind.

- Debt management: Prioritize paying off high-interest debt, such as credit card balances. Clearing high-interest debt is often a wiser financial decision than investing, as it guarantees a return on your money and reduces financial risk.

- Consistency: Consider "dollar cost averaging," a strategy that involves investing a fixed amount regularly, regardless of the market conditions. This approach helps to reduce the risk of investing a large sum at the wrong time and can lead to better long-term returns.

- Employer benefits: Take advantage of any employer-sponsored retirement plans or matching contributions. Many employers will match your retirement contributions up to a certain amount, which is essentially "free money" for your retirement savings.

- Regular rebalancing: Periodically rebalance your investment portfolio to maintain your desired level of risk and ensure it aligns with your financial goals. This typically involves buying or selling assets to return your portfolio to its target asset allocation.

Cash App Investing: Are There Any Fees Involved?

You may want to see also

Risk tolerance

When assessing risk tolerance, it is important to evaluate your comfort level with taking on risk. All investments carry some degree of risk, and it is essential to recognise that you could lose some or all of your money. The potential for higher returns comes with greater risk. For long-term financial goals, investing in asset categories with higher risk, such as stocks or bonds, may lead to more substantial gains. On the other hand, for short-term goals, investing solely in cash or cash equivalents may be more appropriate.

Inflation risk is another factor to consider when evaluating risk tolerance. This refers to the possibility that inflation will erode the returns on cash investments over time. By diversifying your investments across different asset classes, you can help protect against significant losses. Historically, stocks, bonds, and cash have not moved in the same direction simultaneously. Therefore, investing in multiple asset categories can reduce the overall risk and smoothen the investment returns of your portfolio.

Additionally, it is important to consider your financial situation and emergency funds when determining your risk tolerance. Before investing, ensure you have sufficient savings to cover unexpected expenses and that any high-interest debt is paid off. This will provide a more stable foundation for your investments and help you avoid potential financial strain.

Understanding Net Cash Flow: Does It Include Investments?

You may want to see also

Investment mix

Historically, the returns of the three major asset categories—stocks, bonds, and cash—have not moved up and down simultaneously. When one asset category performs well, another often experiences average or poor returns. By investing in multiple categories, you reduce the risk of losing money and smoothen your portfolio's overall investment returns.

For instance, if you invest solely in stocks and the stock market experiences a downturn, you may incur substantial losses. However, if you also invest in bonds and cash, you can potentially offset those losses with better returns in those asset categories.

It's important to note that asset allocation has a significant impact on achieving your financial goals. If your portfolio doesn't include enough risk, your investments may not earn a large enough return to meet your goals. On the other hand, investing in asset categories with greater risk, like stocks, can lead to higher returns over the long term.

To further enhance your investment mix, consider lifecycle funds. These are diversified mutual funds that automatically shift towards a more conservative mix of investments as they approach a specific target date in the future. This can be a convenient way to ensure your portfolio remains well-balanced without requiring constant adjustments.

In conclusion, a well-thought-out investment mix is essential for any investor. By diversifying your investments across different asset categories and regularly reevaluating your portfolio, you can reduce risk, smoothen returns, and increase your chances of achieving your financial goals.

Cash Investments: Now or Later?

You may want to see also

Customer value

When it comes to investing, customer value is paramount. It is important to understand what brings value to the customer or user, and the best way to do this is to involve the customer in the process.

In the context of software development, the INVEST criteria is a widely accepted set of criteria used to assess the quality of a user story. A user story is a description of functionality, written in simple language, that helps the development team understand what the end-user values.

The 'V' in the INVEST acronym stands for 'Valuable', and it is considered the most important priority. A good user story should be valuable, bringing actual project-related value to the stakeholder. If a user story is not valued by the user, it violates one of the Agile Principles, which is to continuously deliver valuable software.

To ensure that each story is valuable, it is recommended to have the customer write the stories. This can make customers uncomfortable, as they may feel that everything they write will be held against them. However, once customers understand that these stories are not formal commitments but rather reminders to have further conversations, they can become more comfortable with the process.

In the context of investing in financial securities, customer value is also important. Before making any investment decisions, it is crucial to evaluate your financial situation, goals, and risk tolerance. This involves understanding the level of risk you are comfortable with and the potential for investment returns. By investing in asset categories with greater risk, such as stocks or bonds, you increase the potential for higher investment returns over time.

Additionally, diversifying your investments is a way to ensure customer value. By investing in a range of asset categories, you can protect against significant losses. Different asset categories, such as stocks, bonds, and cash, tend to perform differently under various market conditions. By including a mix of these investments in your portfolio, you reduce the overall risk and increase the potential for long-term gains.

In both software development and financial investing, customer value is a critical consideration. Involving the customer in the process, understanding their needs and preferences, and tailoring your investments or user stories accordingly can help ensure that the final product or investment strategy aligns with their values and goals.

Direct Investing: Strategies for Personal Finance Success

You may want to see also

Management team strength

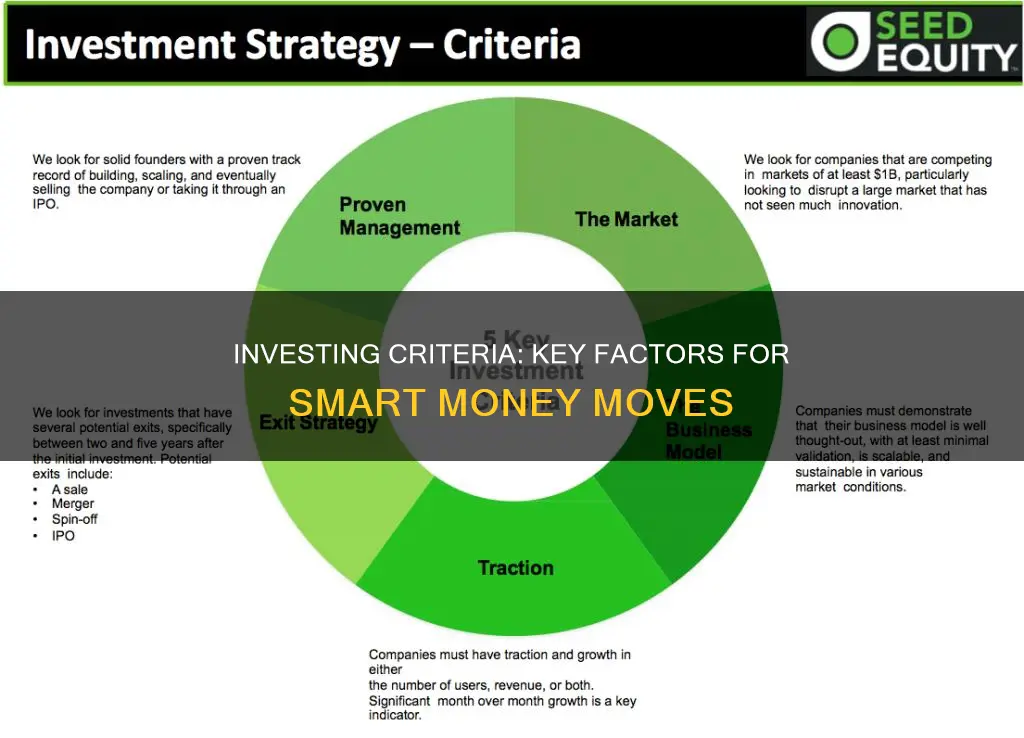

When assessing whether to invest in a company, it is important to evaluate the strength of the management team. This is a common criterion used by financial and strategic buyers when considering an acquisition target.

The management team of a company plays a crucial role in its success and growth. They are responsible for setting the strategic direction, making key decisions, and overseeing day-to-day operations. A strong management team can drive innovation, motivate employees, and navigate the company through challenges and market changes.

When evaluating the strength of a management team, investors may consider factors such as the team's experience and track record, their industry knowledge and expertise, and their ability to execute strategies and make effective decisions.

Additionally, investors may assess the stability and cohesion of the management team. A team with a history of frequent changes or internal conflicts may indicate higher risk. Investors may also look for a diverse range of skills and perspectives within the team, as this can contribute to more robust decision-making and problem-solving.

By evaluating the management team's strength, investors can gain insight into the company's potential for long-term success and stability, which is crucial when making investment decisions.

It is worth noting that the management team's strength is just one of several criteria that investors consider. Other factors, such as financial health, market position, and growth potential, also play a significant role in investment decisions.

Under Armour's Investment Strategy: Equity Method Insights

You may want to see also

Frequently asked questions

INVEST is an acronym used to define a set of criteria for assessing the quality of a user story. It stands for: Independent, Negotiable, Valuable, Estimable, Small, and Testable.

Some common internal investment criteria include the strength of the management team, the estimated IRR (Internal Rate of Return) on the investment, and customer diversification.

Geography, size of the investment or company targeted, and industry are some of the most common publicly disclosed investment criteria. Buyers may also disclose criteria regarding the investment type, such as management buyouts (MBO), distressed opportunities, or succession situations.

It is crucial to evaluate your risk tolerance and create a personal financial roadmap. Diversifying your investments and maintaining an emergency fund are also important considerations.

Internal investment criteria are developed for internal review by the buyer, allowing them to quickly determine if an acquisition should be pursued further. On the other hand, external investment criteria are publicly disclosed to intermediaries such as investment bankers, helping them source deals that align with the buyer's interests.