An ideal investment portfolio is one that is tailored to an individual's financial goals, risk tolerance, and time horizon. It is important to diversify one's portfolio by investing in different types of securities, such as stocks, bonds, mutual funds, and real estate, to balance risk and potential returns. The mix of investments should be regularly reviewed and adjusted to ensure they remain aligned with the investor's financial needs, goals, and risk tolerance. An individual's risk tolerance and investment horizon will inform how assets are allocated within their portfolio. For example, a young investor with a long investment horizon may have a higher risk tolerance and invest a larger portion of their portfolio in equity investments, while an older investor may opt for more conservative investments such as bonds.

| Characteristics | Values |

|---|---|

| Risk tolerance | The ideal investment portfolio should match your risk tolerance. Young investors at the start of their careers may have a higher risk tolerance and invest a significant portion of their portfolio in equity investments. Older investors may prefer lower-risk investments like bonds. |

| Financial goals | The type of financial goal will determine how much risk an investor is willing to take on. For example, investors approaching retirement may prefer low-risk investments, while those saving for retirement may opt for higher-risk assets. |

| Time horizon | The ideal investment portfolio depends on the time horizon, i.e., the period of time over which an investor plans to invest. This can range from short-term (one to two years) to long-term (five to ten years). |

| Diversification | The portfolio should include a mix of asset types, such as stocks, bonds, mutual funds, exchange-traded funds (ETFs), real estate, gold, and cash. Diversification helps reduce the risk of losing money. |

| Regular review | Investors should regularly review and adjust their portfolios to ensure they align with their changing financial needs and goals. |

What You'll Learn

Risk tolerance

An investor's risk tolerance will dictate the types of assets they hold in their portfolio. Those with a higher risk tolerance may allocate more funds to stocks or equity shares, while those with a lower risk tolerance may favour bonds, debt funds and other fixed-income instruments.

For example, a young investor is likely to have a higher risk tolerance, as they have more time to recover from potential losses and a higher earning capacity. They may be more comfortable with volatile securities that offer the potential for higher returns. Conversely, a retired investor may have a lower risk tolerance, as their savings may be their only source of income. They may prefer safer investments that protect their principal value, such as fixed-income securities or money market instruments.

It's important to note that risk tolerance can change over time as an investor's financial situation and life stage evolve. Therefore, it's crucial to regularly review and adjust one's investment portfolio to ensure it aligns with their current risk tolerance and financial goals.

Additionally, it's worth mentioning that risk tolerance is just one aspect of an investor's risk profile. Another factor to consider is their risk capacity, which relates to their financial ability to tolerate losses. Even if an investor has a high-risk tolerance, their risk capacity may be limited by their financial situation. Thus, it's essential to consider both aspects when defining an ideal investment portfolio.

Managing Multiple Investment Portfolios: Strategies for Success

You may want to see also

Financial goals

When it comes to financial goals, an ideal investment portfolio is one that is tailored to your specific objectives. It should be need-based and well-organised, with a clear understanding of the purpose behind each investment.

Firstly, it is important to identify your financial goals and quantify them. For example, if you are planning for retirement, you may want to consider low-risk investments such as bonds or stocks that offer steady returns. On the other hand, if you are saving for retirement and are willing to take on more risk, you might opt for higher-risk assets like stocks. Other financial goals could include saving for a down payment on a house, funding a child's education, or even preparing for medical emergencies.

Secondly, your investment horizon, or the period of time over which you plan to invest, will also influence your portfolio. This could range from short-term goals, such as early retirement, to long-term goals like saving for college tuition. If you have a high tolerance for risk, you may want to invest more aggressively, whereas if you are risk-averse, you might prefer the safety of lower-return investments like bonds.

Additionally, it is crucial to assess your risk appetite and risk capacity. Your risk appetite refers to your psychological comfort with market fluctuations and potential losses. In contrast, risk capacity relates to your financial ability to withstand investment losses. For instance, a young investor at the beginning of their career may have a higher risk tolerance and allocate a larger portion of their portfolio to equity investments, whereas an older investor might prefer less risky options.

By considering these factors and tailoring your portfolio accordingly, you can create an investment strategy that effectively balances risk and reward to help you achieve your financial goals.

CDs: Investment or Saving?

You may want to see also

Investment horizon

When building an investment portfolio, it's important to consider your investment horizon, or the length of time you plan to hold onto your assets. This can range from short-term, such as one or two years, to long-term, such as five or ten years. Your investment horizon will impact the types of investments that make sense for your portfolio.

If you're planning for the long term, you may be more comfortable taking on higher-risk investments, as you'll have more time to recover from any potential losses. For example, a young investor with a long-term investment account can generally tolerate more risk than a couple nearing retirement. In this case, a higher proportion of your portfolio can be allocated to stocks, which tend to have higher returns but also carry more risk.

On the other hand, if you're nearing retirement or have short-term goals, you may prefer to allocate more of your portfolio to lower-risk, lower-return investments such as bonds. This is because you have less time to recover from potential losses, and preserving your capital becomes a higher priority.

It's also important to consider your risk tolerance when determining your investment horizon. If you have a high tolerance for risk, you may be comfortable with a more aggressive investment strategy, even over the short term. Conversely, if you're risk-averse, you may prefer to stick with safer investments, such as bonds, even over a longer time horizon.

Your investment horizon is just one factor to consider when building an investment portfolio. It's also crucial to keep your financial goals and risk appetite in mind, as these will influence the types of investments that are suitable for you.

Retirement Investments: Best Places for Your Savings

You may want to see also

Emergency funds

When it comes to investing your emergency fund, there are a few things to keep in mind. Firstly, liquidity and safety are paramount. You want to be able to access your funds quickly and easily in an emergency, without worrying about penalties or loss of value. Therefore, it's generally recommended to keep your emergency fund in a low-risk, highly liquid account, such as a savings account or money market fund. This ensures your money is safe and accessible when you need it.

However, with inflation, even high-yield savings accounts may not keep up, and you could still lose money in real terms. As such, some people choose to invest their emergency funds in a well-diversified portfolio of stocks, bonds, and other assets. This approach carries more risk but can offer the potential for growth over time. If you decide to invest your emergency fund, it's crucial to ensure it is overfunded to account for any potential losses, and you may want to consider a mix of investments and liquid assets to balance risk and return.

- Money Market Accounts: These accounts, offered by banks or credit unions, provide a mix between checking and savings. They are low-risk and can offer APYs of around 3-4%. Many come with debit cards or check-writing privileges, giving you instant access to funds. They are also often insured by the Federal Deposit Insurance Corporation (FDIC) or National Credit Union Association (NCUA) up to $250,000 per account.

- High-Yield Savings Accounts: These accounts, often found at online banks, offer higher interest rates than traditional savings accounts, typically in the range of 3-4% APY. Your money is easily accessible through online transfers or other methods, and it is also FDIC-insured.

- Certificates of Deposit (CDs): CDs offer higher interest rates than regular savings accounts, especially for longer maturities (e.g., five years). However, the trade-off is that you usually have to pay a penalty to withdraw your money before the maturity date, making it less ideal for emergency funds.

- Stocks and Other Investments: While financial advisors generally recommend against investing emergency funds in stocks due to their volatility, some people choose to do so if they have a significant amount saved. If you decide to invest in stocks, keep in mind that you may have to sell at a loss in an emergency, and it can take several days to access the cash. Therefore, it's wise to pair stock investments with more liquid assets.

Betterment: Savings or Investment?

You may want to see also

Research and analysis

Risk Tolerance

Understanding your risk tolerance is crucial in defining an ideal investment portfolio. Risk tolerance refers to your ability to accept potential losses in pursuit of higher investment returns. It is influenced by both the time horizon of your financial goals and your psychological comfort with market volatility. Younger investors with longer investment horizons may have a higher risk tolerance, as they have more time to recover from potential losses. It's important to assess your risk appetite and capacity before constructing your portfolio.

Financial Goals

Clearly defining your financial goals is essential. These goals can vary widely, from saving for a down payment on a house to funding retirement or specific milestones like a child's education or marriage. Your financial goals will guide the types of investments you make and the level of risk you're willing to take. For example, if you're nearing retirement, you may opt for lower-risk investments like bonds, whereas if you're saving for retirement and can tolerate more risk, you might consider higher-risk assets like stocks.

Investment Horizon

Your investment horizon refers to the period over which you plan to invest. It can be short-term (1-2 years) or long-term (5-10 years or more). This timeframe influences the types of investments you choose. For instance, if you have a short-term goal, such as buying a house, you might opt for more conservative investments, while a long-term goal like saving for college tuition could involve taking on more risk.

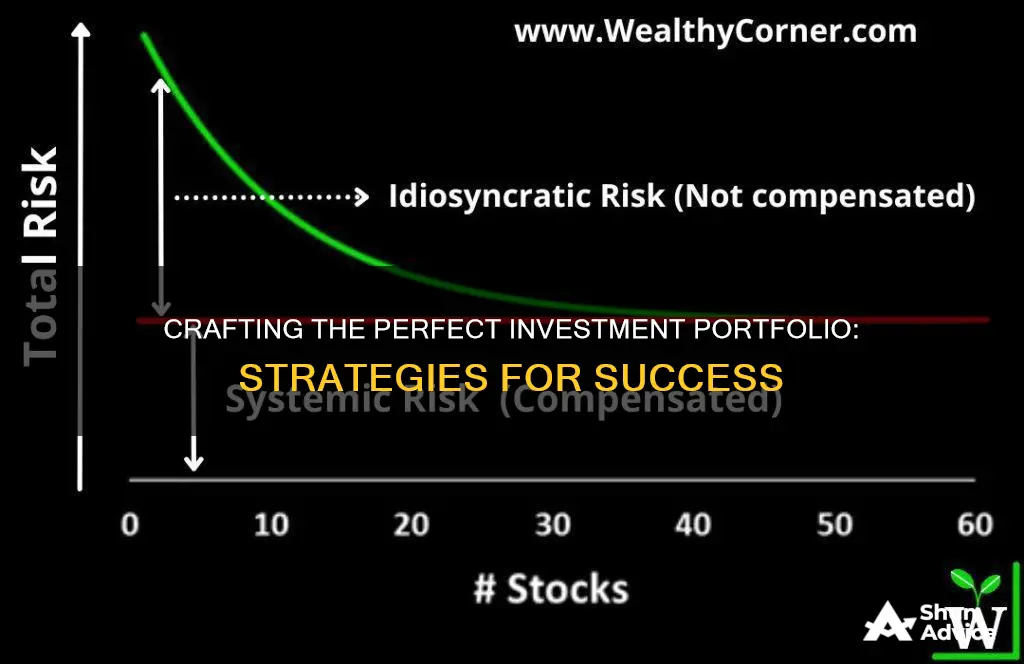

Diversification

Diversifying your portfolio across different asset classes is a fundamental strategy. By investing in a range of stocks, bonds, mutual funds, exchange-traded funds (ETFs), or other vehicles, you reduce the risk of significant losses if one particular investment performs poorly. Diversification ensures that your portfolio is not overly exposed to the ups and downs of a single stock or class of securities.

Regular Review and Rebalancing

An ideal investment portfolio is not a static entity. It requires regular review and rebalancing to ensure it remains aligned with your financial goals and risk tolerance. Market conditions, economic trends, and your personal circumstances can all impact your portfolio's performance. Therefore, it's essential to conduct periodic assessments, make adjustments as needed, and rebalance your portfolio to maintain the desired asset allocation.

Return Analysis

Conducting thorough research and return analysis is vital before making any investments. This involves evaluating the potential returns and risk profiles of different investment options. It helps you determine which stocks or companies are better suited for long-term growth and which ones might be better off selling. Return analysis ensures that your investments align with your risk tolerance, financial goals, and overall investment strategy.

Adding Cash to Your Investment Portfolio: Strategies for Success

You may want to see also

Frequently asked questions

An investment portfolio is a collection of invested assets such as stocks, bonds, funds, and other securities.

An ideal investment portfolio should include different types of securities linked to specific goals. For example, stocks, bonds, mutual funds, exchange-traded funds, and real estate. The exact composition will depend on your financial goals, risk tolerance, and investment horizon.

The best asset allocation for your investment portfolio depends on your financial goals, risk tolerance, and investment horizon. Generally, a portfolio should be reviewed and adjusted regularly to ensure it aligns with your changing needs and goals.

Building an investment portfolio involves choosing an account or advisor, selecting investments that align with your preferences and goals, and regularly reviewing and rebalancing your portfolio as needed.