In the world of finance, the term distribution refers to the disbursement of assets from a fund, account, or individual security to an investor. In other words, it is the payment of profits or income earned by a company or fund to its investors. Distributions can take various forms, such as dividends, interest payments, or capital gains, and they are typically paid out on a monthly, quarterly, or annual basis. Understanding the concept of distribution is crucial for investors to make informed decisions when investing in funds or companies that offer such payouts.

| Characteristics | Values |

|---|---|

| Definition | The distribution of investment funds refers to the payment of assets from a fund, account, or individual security to an investor or beneficiary. |

| Types | Dividends, interest payments, retained earnings, capital gains distributions |

| Frequency | Monthly, quarterly, semi-annually, annually, or on a successful exit event |

| Calculation | Net investment income divided by the total number of outstanding shares |

| Reinvestment | Investors can choose to reinvest distributions, purchasing additional investment shares and potentially leading to compound growth |

| Taxation | Distributions are taxed at the investor's personal tax rate; missed distribution payments can have tax implications |

What You'll Learn

Dividends and interest payments

Dividends are the investor's share of a company's profits. The company decides on the amount based on its financial results, and dividends are generally paid quarterly. Dividends may be paid in cash or additional shares. When a company announces a dividend, it also announces the payment date on which the dividend will be deposited into the shareholders' accounts. Dividends are often expected by shareholders as their share of the company's profits, and dividend payments reflect positively on a company, helping to maintain investors' trust.

Interest is the payment to investors for lending money in the form of a bond or other debt instrument. Interest is taxed at the usual income tax rate. "Interest dividends" from funds are taxed like regular interest. Bonds and other fixed-income investments pay interest. If you own bonds or money markets through a mutual fund or ETF, the interest payments will go to the fund and will then be passed on to you as "interest dividends".

Mutual funds that own dividend-paying or interest-bearing securities pass those on to investors in the fund. Mutual funds are required by law to distribute their accumulated dividends at least once a year. Mutual fund investors may take dividend distributions when they are issued or reinvest the money by buying additional fund shares. Mutual funds that receive dividends from their investments are required by law to pass them on to their shareholders. Mutual funds typically distribute dividends on a regular schedule, which can be monthly, quarterly, semi-annually, or annually.

A Beginner's Guide to Investing in Mutual Funds via HDFC Demat

You may want to see also

Reinvesting distributions

In the world of finance, distributions refer to the disbursement of assets from a fund, account, or individual security to an investor. Distributions can come in the form of dividends, interest, capital gains, rents, and royalties.

DRIPs are a set-it-and-forget-it way to ensure your dividends keep growing your portfolio. They are a good way to grow your investments organically and take advantage of the power of compounding. This helps accelerate future gains as new distributions are credited not only to the initial investment but also to the reinvested amounts.

With mutual funds, distributions represent the allocation of capital gains and dividend or interest income generated by the fund for the investors periodically during a calendar year. Mutual funds are required by law to pay out income and realised capital gains to the funds' shareholders. When a fund issues a distribution, the shareholders can either elect to be paid directly—putting the money into their account—or elect to buy more shares of the fund—known as reinvesting.

Mutual Fund Investment: Strategies, Risks, and Rewards

You may want to see also

Tax implications

The tax implications of investment fund distributions depend on the type of fund and the nature of the distribution. Distributions from mutual funds occur for several reasons and are subject to different tax rates. Mutual funds in retirement and college savings accounts are tax-advantaged, meaning taxes are only paid when earnings or pre-tax contributions are withdrawn. On the other hand, distributions from taxable accounts, such as dividends and capital gains, are generally taxable, even if the money is reinvested in additional shares.

For mutual funds, distributions represent the allocation of capital gains, dividend income, or interest generated by the fund for investors periodically during a calendar year. These distributions are typically taxed at the shareholder's personal tax rate. If the distribution is from a tax-free fund, such as a muni bond fund, there is no additional tax burden. However, for funds that are not tax-free, all income received must be included in shareholders' taxable income.

In the case of retirement accounts, distributions are typically mandatory after the account holder reaches a certain age. These required minimum distributions (RMDs) are taxed based on the individual's tax bracket at the time of withdrawal. The only exception to this is the Roth IRA, where contributions are made with after-tax dollars, and no income tax is due on distributions.

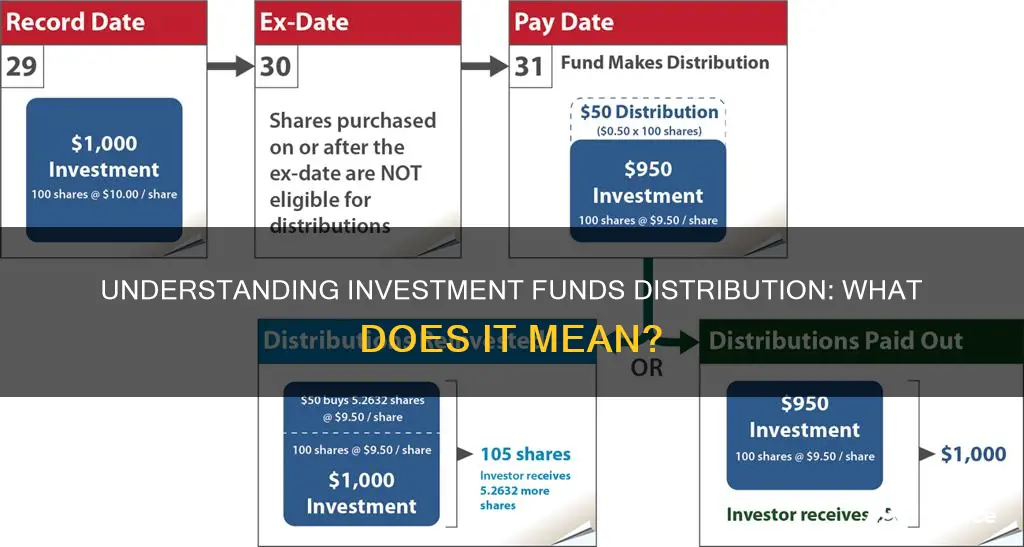

It is important to note that distributions from investment funds can be received in two ways: cash or reinvested units of the fund. If received in cash, the value of an investor's holdings will decline by the amount of the distribution. If reinvested, the purchase of additional units occurs at a lower price, but the total value of the investor's holdings in the fund remains unchanged.

Additionally, the timing of fund purchases and sales relative to distributions can impact tax obligations. Buying shares just before a distribution occurs can result in a significant tax impact, as taxes must be paid on any gains for the entire year, even if the shares were not owned for the full year. Selling shares after a distribution usually results in a smaller gain or larger loss compared to selling before the distribution.

When it comes to tax-efficient strategies, investors concerned about tax exposure may consider investing in tax-efficient equity funds. These funds are managed with the goal of limiting capital gain distributions by keeping holdings turnover low and harvesting losses to offset realised gains. While tax considerations are important, financial planners encourage investors to focus primarily on their long-term financial goals, as decisions based solely on taxes could lead to costly mistakes.

Mutual Fund Investing: A Comprehensive Guide for Beginners

You may want to see also

Distribution calculation

When it comes to investment funds, the term "distribution" generally refers to the disbursement of assets from a fund, account, or individual security to an investor. This can include mutual funds, retirement accounts, stocks, bonds, and investment trusts. Here are some detailed calculations regarding distribution:

- Mutual Fund Distributions: Mutual funds distribute capital gains, dividends, or interest income to fund owners. The calculation for the distribution amount per unit is: Distribution amount per unit = Fixed distribution rate (%) x Last Net Asset Value per Unit (NAVPU) for the previous calendar year / Number of periods. This yields the distribution amount that investors will receive per unit owned.

- Retirement Account Distributions: Retirement accounts, such as traditional Individual Retirement Accounts (IRAs), often have age restrictions for withdrawals. For example, distributions before the age of 59 and a half are subject to an IRS penalty and ordinary income tax. After this age, distributions incur no penalty, but taxpayers pay tax according to their current tax bracket.

- Stock and Bond Distributions: Distributions from securities like stocks or bonds are payments of interest, principal, or dividends to shareholders or bondholders. The distribution amount is calculated by multiplying the number of units by the per-unit distribution amount.

- Investment Trust Distributions: Investment trusts typically distribute income monthly or quarterly, offering higher yields that can be as high as 10% annually. The distributions lower the trust's taxable income, resulting in minimal or no income tax.

- Calculating Maximum Periodic Distribution: To determine the maximum amount that can be withdrawn from an investment periodically, use the following formula: Maximum Periodic Distribution = Total amount invested x Annual rate of return expected. This calculation helps investors understand the sustainable withdrawal rate without depleting their investment.

- Calculating Years of Distribution: To find out how long a specific withdrawal amount will last, use the following formula: Years of Distribution = Total amount invested / (Amount of distribution x Expected annual inflation rate). This calculation helps investors plan for the longevity of their investments.

HDFC Capital Builder Fund: Worth Your Investment?

You may want to see also

Distribution frequency

The distribution date is typically the next business day after the record date, which is the date that determines who is eligible to receive the distribution. The distribution amount is set as a dollar value per unit, based on the number of units owned by each investor.

Investors can choose to receive distributions in cash or as reinvested units of the fund. If they opt for cash, the value of their holdings will decrease by the amount of the cash distribution. If they choose to reinvest, they will purchase additional units at a lower net asset value per unit (NAVPU), resulting in more units at a lower value.

It is important to note that distributions are not necessarily a negative event. While taxes are never enjoyable to pay, distributions reduce the taxes paid by the fund. This is because distributions to investors are taxed at each investor's personal tax rate, which is typically lower than the fund's tax rate.

Small-Cap Funds: Invest Now or Miss Out?

You may want to see also

Frequently asked questions

Distribution of investment funds refers to the payment of profits or income generated by a fund to its investors. These distributions can be made in the form of dividends, interest payments, or capital gains.

The two main types of distributions are retained earnings and capital gains. Retained earnings are profits that a company has reinvested in its business instead of distributing as dividends. Capital gains represent the increase in the value of an asset, typically stock, over time.

Distributions are calculated by first determining the income generated by the fund, including sources such as dividends, interest payments, and option fees. Then, any deductible expenses, such as management fees, are subtracted. Finally, the remaining amount is divided by the total number of units or shares in the fund to determine the distribution per unit or share.

Distributions can be paid out at different frequencies, including monthly, quarterly, semi-annually, or annually. The frequency depends on factors such as the type of security, investment strategy, and the discretion of the investment manager.