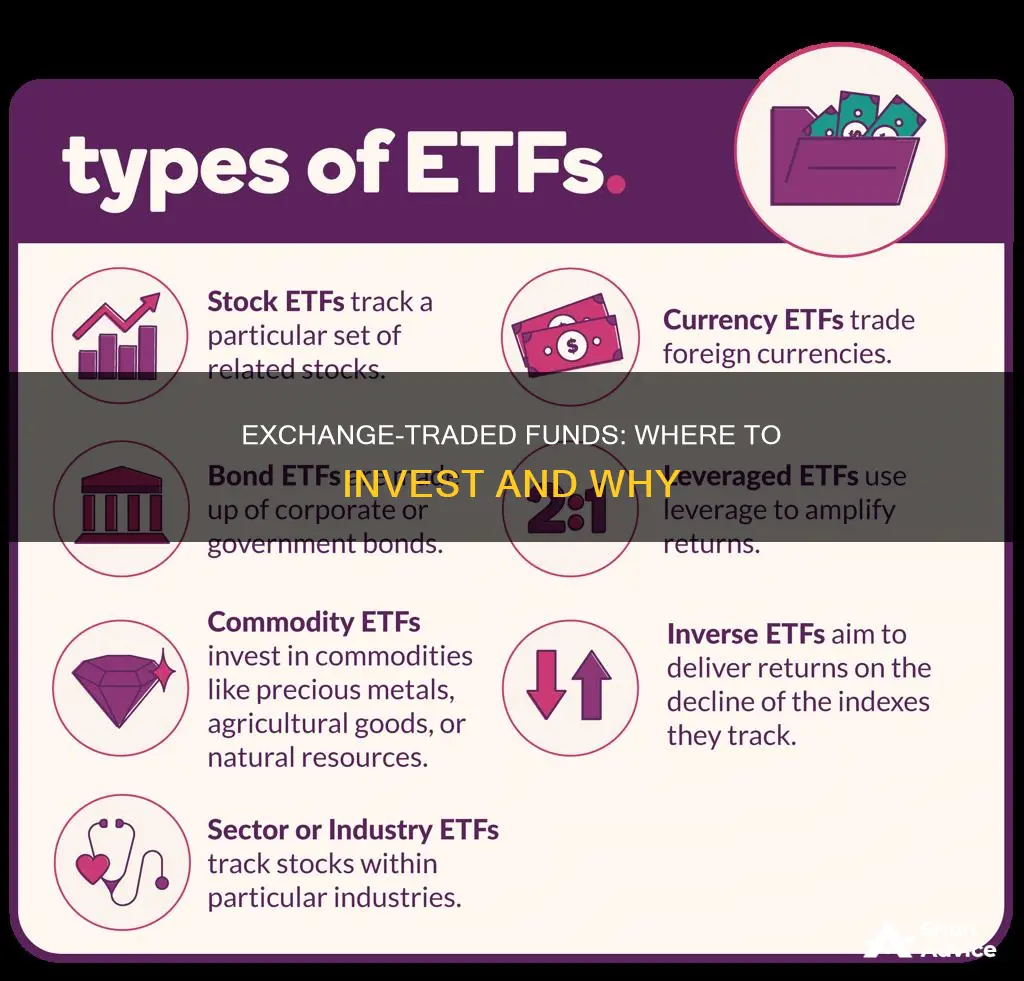

Exchange-traded funds (ETFs) are a popular investment vehicle for both active and passive investors. They are similar to mutual funds but trade like stocks, providing low-cost access to a variety of asset classes, industry sectors, and international markets. ETFs are a collection of hundreds or thousands of stocks or bonds, managed by experts, in a single fund that trades on major stock exchanges. They offer benefits such as diversification, low costs, and the ability to trade shares live during the trading day. However, it's important to be aware of the potential disadvantages, such as commissions, expenses, underlying fluctuations, and reduced taxable income flexibility. When considering investing in ETFs, it is crucial to evaluate them based on management costs, commission fees, liquidity, investment quality, and how they fit into your existing portfolio.

| Characteristics | Values |

|---|---|

| Type of investment fund | Combines the best attributes of stocks and mutual funds |

| Basket of investments | Stocks, bonds, commodities or currencies |

| Instant diversification | Yes |

| Lower fees | Yes |

| Traded more easily | Yes |

| Management costs | Vary |

| Commission fees | Vary |

| Fit into existing portfolio | Yes |

| Investment quality | Vary |

| Share price | Depends on the fund |

| Minimum investment | Depends on the fund |

What You'll Learn

ETFs vs. mutual funds

Exchange-traded funds (ETFs) and mutual funds are similar in that they are both professionally managed collections or "baskets" of individual stocks or bonds. They are both less risky than investing in individual stocks and bonds and come with built-in diversification. They also offer a wide variety of investment options and are overseen by professional portfolio managers.

However, there are some key differences between the two. Here are some of the most important ones to consider:

- Investment minimums: ETFs typically have lower investment minimums than mutual funds. With ETFs, you can buy as little as one share, whereas mutual funds usually have a flat dollar amount as their minimum investment, which can range from $500 to $5,000 or more.

- Control over trade price: ETFs give you more control over the price of your trade. They provide real-time pricing and allow you to use more sophisticated order types to get the best price. Mutual funds, on the other hand, provide the same price to everyone who buys or sells that day, calculated after the trading day is over.

- Automatic transactions: Mutual funds allow you to set up automatic investments and withdrawals based on your preferences. ETFs do not offer this feature.

- Index funds: Most ETFs are index funds, which are passively managed and aim to match the performance of a particular market index. Mutual funds can be actively or passively managed, but actively managed funds tend to have higher fees and expense ratios.

- Trading: ETFs can be bought and sold just like stocks on major exchanges, such as the NYSE and Nasdaq. Mutual funds, on the other hand, are typically purchased through a brokerage or directly from the issuer, and transactions are not instantaneous.

- Tax efficiency: ETFs are generally considered more tax-efficient than mutual funds. Mutual funds can trigger capital gains tax liabilities when shares are sold or when there is turnover within the fund. ETFs, on the other hand, are traded on an exchange, which keeps tax costs lower.

- Liquidity: ETFs are more liquid than mutual funds, meaning they are easier to buy and sell. Online brokers make it simple to buy or sell ETFs with just a click of the mouse.

In summary, ETFs are often a good choice for investors who want the diversification benefits of mutual funds but with lower fees and more flexibility in buying and selling. They are also a good option for those who want to invest in a particular index or sector. Mutual funds, on the other hand, may be preferable for those who want more hands-on management of their investments and are willing to pay higher fees for it. They are also a good option for those who want to set up automatic investments or withdrawals.

Fidelity No-Fee Funds: A Smart Investment Strategy?

You may want to see also

ETF expense ratios

When considering investing in an ETF, it's important to understand the costs involved. ETFs charge fees, known as the expense ratio, which covers the fund's operational expenses and annual fees. The expense ratio is typically expressed as a percentage of a fund's average net assets. For example, a 1% expense ratio means you'll pay $10 in fees for every $1,000 invested.

The expense ratio of an ETF is an important consideration when choosing which fund to invest in, as high costs can erode portfolio returns. The average expense ratio for index ETFs is typically lower than that of index mutual funds, historically 0.52% for ETFs versus 0.85% for mutual funds. Actively managed ETFs tend to have higher expense ratios than passive, index-tracking funds.

The expense ratio doesn't include brokerage commissions, transaction fees, and other fees to financial intermediaries for purchases and sales of ETF shares on the secondary market. These fees are paid directly by the investor and can add to the overall cost of investing in ETFs.

When evaluating the cost of an ETF, it's important to consider not only the expense ratio but also the total cost of ownership (TCO), which includes trading and holding costs. Depending on your rebalancing size and frequency, trading costs can accumulate and have a more significant impact on TCO than the expense ratio.

- Understand what the expense ratio covers: The expense ratio reflects the cost of portfolio management, administration, marketing, distribution, and other operational expenses of the fund.

- Compare expense ratios: Use ETF screener tools available on fund company websites and online brokerage platforms to compare expense ratios across different ETFs.

- Evaluate the total cost of ownership: Consider not only the expense ratio but also the trading and holding costs associated with the ETF.

- Consider the impact on investment returns: As the value of your investment grows, the amount you pay in fees will also increase. A fund with a lower expense ratio can help maximize your investment returns over time.

- Be mindful of additional fees: Remember that the expense ratio doesn't include certain fees like brokerage commissions and transaction fees, which you may need to pay separately when buying and selling ETF shares.

- Analyze fund performance: While minimizing costs is important, don't make your investment decision based on expense ratios alone. Consider the fund's performance, investment strategy, and how it fits into your overall portfolio.

By carefully evaluating expense ratios and the total cost of ownership, you can make more informed decisions when investing in ETFs and maximize your potential returns.

IRA and Mutual Funds: A Smart Investment Strategy?

You may want to see also

ETF taxes

The tax efficiency of exchange-traded funds (ETFs) is one of their key selling points, especially when compared to mutual funds. However, the tax implications for ETFs can be complex and depend on the fund's structure, the type of assets held, and the jurisdiction. Here's a detailed look at ETF taxes.

Tax Efficiency of ETFs

ETFs generally have a reputation for being tax-efficient, primarily due to passively managed equity ETFs, which tend not to distribute significant capital gains. This is because most ETFs passively track an index, leading to lower turnover and fewer taxable events than actively managed mutual funds. As a result, ETFs can help investors defer taxes until the fund is sold.

Capital Gains Taxes

When you sell an ETF, any gains are typically taxed based on how long you held the fund and your income. In the US, if you hold an ETF for more than a year, it is usually considered a long-term capital gain and taxed at a lower rate than short-term capital gains, which are held for a year or less. High-income earners may also be subject to an additional Net Investment Income Tax (NIIT) on ETF sales.

Dividends and Interest Taxes

Dividends and interest payments from ETFs are generally taxed as income from the underlying stocks or bonds they hold. Dividends can be classified as ordinary (taxable) or qualified (taxed at lower capital gains rates). The type of dividend received will depend on the ETF's holdings. For example, if an ETF holds Apple stock and Apple pays a qualified dividend, the ETF investor will receive a qualified dividend. Interest payments from bond ETFs are typically considered ordinary dividends.

Exceptions and Special Cases

The tax rules for ETFs can vary depending on the types of assets they hold. Here are some exceptions to the general tax rules:

- Commodity ETFs: These ETFs invest in commodities like oil, corn, or metals through futures contracts. Gains and losses on these futures contracts are often treated as 60% long-term and 40% short-term capital gains or losses, regardless of how long the ETF holds the contracts.

- Currency ETFs: Many currency ETFs are structured as grantor trusts, and profits from these trusts are taxed as ordinary income, even if held for several years.

- Precious Metals ETFs: ETFs that invest in physical precious metals like gold or silver are often treated as "collectibles" for tax purposes. Short-term gains are taxed as ordinary income, while long-term gains are taxed at a special capital gains rate for collectibles.

- Crypto ETFs: Spot crypto ETFs structured as grantor trusts are taxed similarly to commodity ETFs. Crypto futures ETFs are subject to the 60/40 rule, with 60% of gains or losses treated as long-term and 40% as short-term.

- Leveraged and Inverse ETFs: These ETFs can be tax-inefficient due to their use of derivatives, which are taxed using the 60/40 rule.

- International ETFs: Some international ETFs, especially those focused on emerging markets, may be less tax-efficient due to restrictions on in-kind deliveries of securities, leading to taxable events.

Tax Strategies

ETFs can be used for tax planning purposes. One common strategy is to sell ETFs with losses before holding them for a year to take advantage of short-term capital loss treatment. Conversely, holding ETFs with gains past the one-year mark allows you to benefit from lower long-term capital gains tax rates. Additionally, you can sell an ETF with a loss and immediately buy a similar but different ETF to maintain exposure to the same sector while still claiming the tax loss.

Sector Fund Investment: Strategies for Success

You may want to see also

How to start investing in ETFs

Exchange-traded funds (ETFs) are a great way for beginners to start investing. They are fairly simple to understand and can generate impressive returns without much expense or effort. Here is a step-by-step guide on how to start investing in ETFs:

Step 1: Open a brokerage account

You need a brokerage account to buy and sell securities like ETFs. Many brokers offer commission-free stock and ETF trades, so cost isn’t a major consideration. Compare each broker’s features and platform. If you’re a new investor, it might be a good idea to choose a broker that offers an extensive range of educational features.

Step 2: Choose your first ETFs

For beginners, passive index funds are generally the best way to go. Index funds are cheaper than their actively managed counterparts, and most actively managed funds don’t beat their benchmark index over time. Some of the best ETFs for beginners include:

- Vanguard S&P 500 ETF (VOO) -- Large U.S. companies

- Schwab U.S. Mid-Cap ETF (SCHM) -- Midsize U.S. companies

- Vanguard Russell 2000 ETF (VTWO) -- Smaller U.S. companies

- Schwab International Equity ETF (SCHF) -- Larger non-U.S. companies

- Schwab Emerging Markets Equity ETF (SCHE) -- Companies from countries with developing economies

Step 3: Let your ETFs do the hard work for you

ETFs are generally designed to be maintenance-free investments. Newer investors tend to have a bad habit of checking their portfolios too often and making emotional, knee-jerk reactions to major market moves. The best advice is to leave them alone and let them do what they’re intended to do: produce excellent investment growth over long periods.

Index Funds: Short-Term Investment Strategy or Long-Term Gain?

You may want to see also

ETF diversification

Exchange-Traded Funds (ETFs) are an excellent investment vehicle for beginners and experienced investors alike. One of the key benefits of ETFs is the diversification they offer.

Diversification is a risk management strategy that involves investing in a variety of assets to reduce the impact of any single investment loss on your portfolio. By spreading your investments across various asset classes, sectors, or industries, you lower the risk of losing a significant portion of your investment due to an event that affects a specific market or industry.

ETFs are inherently diversified because they are a basket of investments, such as stocks or bonds. When you buy shares of an ETF, you are investing in multiple securities at once. This instant diversification is a significant advantage over investing in individual stocks, where your risk is concentrated in the performance of a single company.

For example, the Vanguard Australian Shares Index ETF (ASX: VAS) provides exposure to 200 or 300 of the largest businesses on the ASX. Similarly, the BetaShares Australia 200 ETF (ASX: A200) offers a diverse portfolio of Australian companies.

Sector-Specific ETFs

While ETFs inherently provide diversification within a specific market or asset class, some ETFs are designed to provide exposure to various sectors or industries. This type of ETF can be useful for investors who want to gain access to a particular sector without investing in individual stocks.

For instance, the VanEck Australian Equal Weight ETF (ASX: MVW) invests in a diverse range of Australian companies across sectors, reducing the concentration in any one industry. This ETF has holdings in companies such as Evolution Mining Ltd (ASX: EVN), Qantas Airways Limited (ASX: QAN), and Medibank Private Ltd (ASX: MPL), ensuring a well-diversified portfolio.

International Diversification with ETFs

ETFs also provide an easy way to gain international diversification. International ETFs invest in foreign stocks or specific country blocs, allowing investors to access global markets with a single investment.

Crypto and Commodity ETFs

For investors interested in alternative assets, there are commodity ETFs that invest in raw goods like gold, coffee, or crude oil. Cryptocurrency ETFs, which provide exposure to Bitcoin or other cryptocurrencies, are also available and have gained popularity in recent years.

Final Thoughts

ETFs are an excellent tool for investors seeking diversification. They offer instant diversification by investing in a basket of securities and can provide exposure to various sectors, countries, and alternative assets. However, it is important to remember that while ETFs provide diversification within a specific market or asset class, investing in a single ETF may not provide adequate diversification for your entire portfolio. It is essential to assess your risk tolerance and investment goals when constructing a well-diversified portfolio using ETFs.

American Funds: Which Investment Companies to Look For?

You may want to see also

Frequently asked questions

Exchange-traded funds (ETFs) are a great investment vehicle for small and large investors. They are similar to mutual funds but trade like stocks, broadening the diversity of an investor's portfolio without increasing the time and effort spent on managing and allocating investments. ETFs provide low-cost access to a variety of asset classes, industry sectors, and international markets. They are also more liquid and have lower expense ratios than mutual funds.

ETFs carry some unique risks. Investors need to be aware of trading fees, which can quickly add up and reduce investment performance. Every ETF will also come with an expense ratio, which affects total returns. ETFs are not immune to volatility, and certain classes of ETFs, such as leveraged ETFs, are significantly riskier investments. ETFs also have less flexibility when it comes to taxable income and controlling tax-loss harvesting.

Some examples of popular ETFs on the market include:

- SPDR S&P 500 (SPY)

- iShares Russell 2000 (IWM)

- Invesco QQQ (QQQ)

- SPDR Dow Jones Industrial Average (DIA)

- Vanguard S&P 500 ETF (VOO)

- Schwab U.S. Mid-Cap ETF (SCHM)

- Vanguard Russell 2000 ETF (VTWO)

When choosing an ETF, evaluate it on its own merits, including management costs, commission fees, how easily you can buy or sell it, how it fits into your existing portfolio, and its investment quality. Ensure that the ETF aligns with your investment goals, risk tolerance, and desired asset mix.