Investing can be a great way to grow your money, but it comes with risks. When evaluating investments, consider when you need the money you plan to invest. If you're investing for the long term, the stock market is the best investment. However, if you need your money within the next five years, you might prefer a savings account or CD options. Here are some of the best funds to invest in now:

- High-yield savings accounts: Online savings accounts and cash management accounts provide higher rates of return than a traditional bank savings or checking account.

- Certificates of deposit (CDs): CDs are federally insured savings accounts that offer a fixed interest rate for a defined period. Now may be a good time to lock in that fixed rate, as interest rates are expected to continue to go down.

- Bonds: Lower-risk bonds, such as government or corporate bonds, tend to pay lower interest than higher-risk bonds. Government bonds are virtually risk-free but offer lower returns. Corporate bonds are riskier but offer higher yields.

- Money market mutual funds: Money market funds are an investment product that buys a collection of high-quality, short-term government, bank, or corporate debt. They are best for money you may need soon that you're willing to expose to market risk.

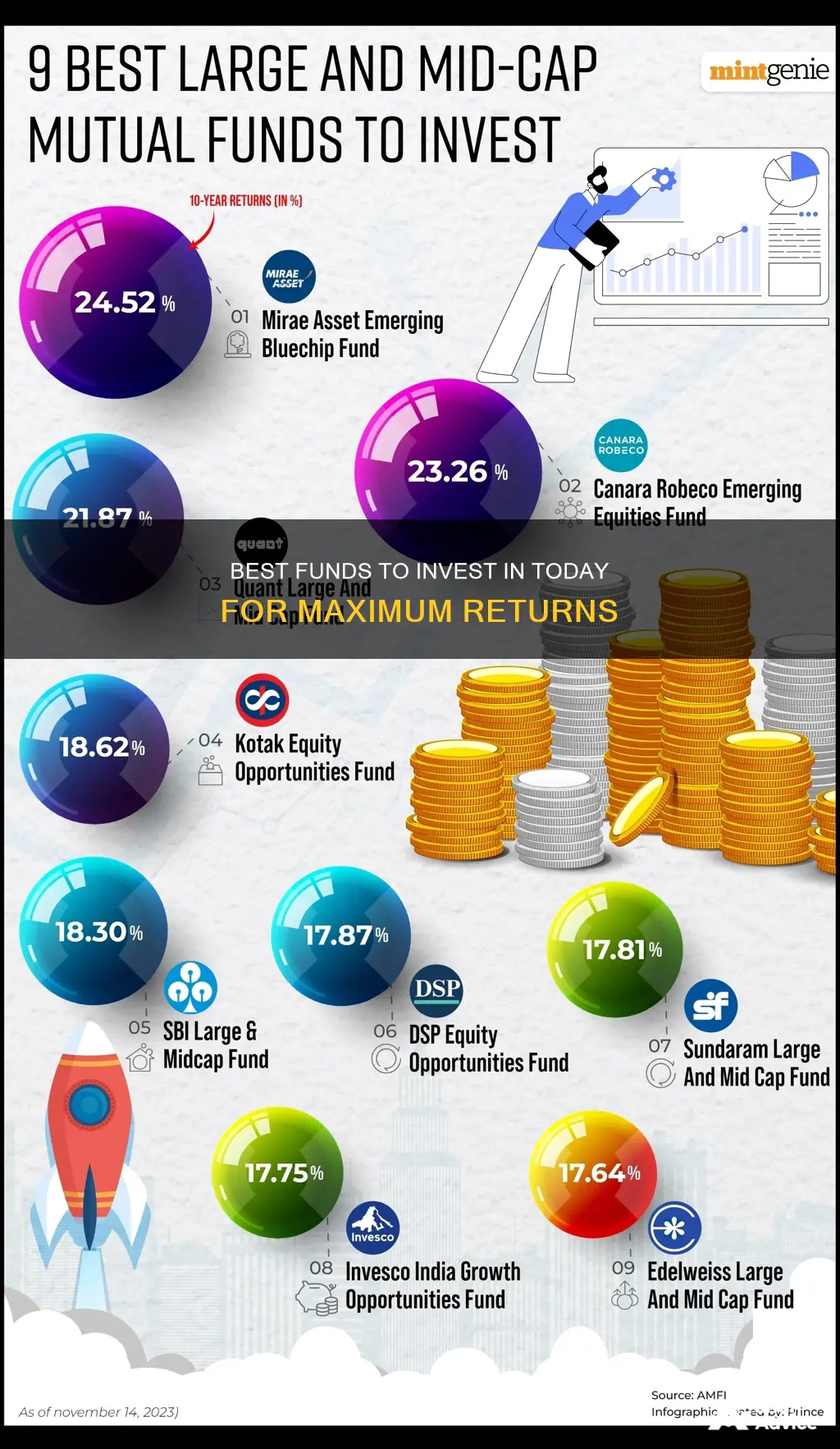

- Mutual funds: Mutual funds are an inexpensive way to diversify your investments. They pool cash from investors to buy stocks, bonds, or other assets. Some funds limit the scope of their investments to companies that fit certain criteria.

- Index funds: Index funds are a type of mutual fund that aims to provide investment returns equal to the underlying index's performance. They are more cost-effective and less volatile than actively managed funds.

- Exchange-traded funds (ETFs): ETFs are like mutual funds but trade more like stocks. They pool investor money to buy a collection of securities and provide a single diversified investment. ETFs are ideal for investors who don't have enough money to meet the minimum investment requirements for a mutual fund.

- Stocks: Stocks generally offer a larger potential return on your investment than lower-risk investments but may expose your money to higher levels of volatility.

- Dividend stocks: Dividend stocks can provide the fixed income of bonds and the growth of individual stocks and stock funds. They are attractive to investors because of the dividends and stability they provide.

| Characteristics | Values |

|---|---|

| Type | Mutual funds, exchange-traded funds (ETFs), stocks, bonds, cash management accounts, certificates of deposit (CDs), money market funds, index funds |

| Risk level | Low, medium, high |

| Investment focus | Tech, pharma, small-cap, growth, international, Nasdaq-100, S&P 500, Dow Jones Industrial Average, Russell 2000, Russell 3000, CRSP US Small Cap, biotech, dividend, large-cap |

| Provider | Vanguard, Fidelity, Shelton, Invesco, iShares, Schwab, SPDR, Goldman Sachs, JPMorgan, BlackRock, American Funds, Morgan Stanley, Dodge & Cox, Nuveen, Manning & Napier |

| Fees | Sales load, expense ratio, investment minimum, trading costs, sales loads |

| Returns | 4% (trailing 12-month yield), 8% (trailing 12-month yield), 9.4% (5-year annualized return), 11.7% (5-year annualized return), 15.2% (5-year annualized return), 15.9% (5-year annualized return), 16% (5-year annualized return), 21.8% (5-year annualized return), 21.9% (5-year annualized return), 37.7% (1-year return), 11% (10-year return) |

What You'll Learn

Mutual funds

- Goals and risk tolerance: Before investing in any fund, you must first identify your goals for the investment and your personal risk tolerance. Are you investing for the long term or do you need current income? Can you accept dramatic swings in portfolio value or do you require a more conservative investment?

- Time horizon: How long do you plan to hold the investment? Mutual funds have sales charges, which can eat into returns in the short run, so an investment horizon of at least five years is ideal.

- Management style: Do you want an actively or passively managed mutual fund? Actively managed funds are managed by professionals who research what's out there and buy with an eye toward beating the market. Passive funds, on the other hand, are a more hands-off approach and often carry lower fees.

- Fund history: The fund's history provides a record of the fund's performance over time, including during market corrections. This shows the fund's resilience during volatile market conditions.

- Expense ratio: The fund house charges fund management fees along with other charges, expressed as a percentage of the cash you invest. This is known as the expense ratio and will impact your net returns.

- Fund manager's performance: It's crucial to look at the fund manager's track record. An investor should monitor the fund's performance during times of rise and corrections in the market.

- Vanguard Wellington Fund: One of the oldest mutual funds, this fund invests about two-thirds of its portfolio in stocks and one-third in bonds. It aims to provide investors with exposure to all economic sectors and has a five-star rating from Morningstar.

- Fidelity 500 Index: With a 0.015% expense ratio and a $0 investment minimum, this fund is hard to beat. It invests at least 80% of its assets in the S&P 500, giving you exposure to the largest names on Wall Street.

- Fidelity ZERO International Index: This fund has a zero-minimum, zero-expense-ratio and provides international stock exposure, making it a great addition to a U.S.-heavy portfolio.

- Fidelity Select Pharmaceuticals Portfolio: This fund invests mostly in companies that research, develop, manufacture, sell or distribute drugs. It has returned an impressive 37.7% over the past year and nearly 11% over the past 10 years.

- Vanguard Total Stock Market Index Fund: This fund offers exposure to the totality of the U.S. stock market and is one of the largest mutual funds on Wall Street. It's deceptively simple and has low fees.

- Vanguard Small-Cap Index Fund Admiral Shares: This fund is a well-diversified, low-turnover portfolio with rock-bottom fees, making it one of the most compelling strategies in the small-blend category.

- Nuveen Quant Small/Mid Cap Equity Premier: This fund uses quantitative models to select stocks from the Russell 2500 index, which holds the smallest companies in the Russell 3000 index. It has outperformed the Russell 2500 index every year since 2017 except for 2020.

- Dodge & Cox Income Fund: This fixed-income mutual fund aims to provide a stable source of income for investors while preserving long-term capital. It has a diversified portfolio of mostly investment-grade and government bonds, as well as mortgage- and asset-backed securities.

- Manning & Napier High Yield Bond: While this is a high-yield bond fund, it still manages to be below-average risk relative to its category peers. It provides among the highest returns, including a trailing 12-month yield of nearly 8%.

- Fidelity Select Semiconductors: This fund has been identified as one of the best-performing U.S. equity mutual funds, with a five-year return of 16.0%.

- Vanguard 500 Index Fund Admiral: This fund is the

Pension Funds: Choosing the Right Investment for Your Future

You may want to see also

Index funds

Fidelity 500 Index (FXAIX)

Fidelity's version of an S&P 500 mutual fund, FXAIX invests at least 80% of its assets in the S&P 500, giving investors exposure to some of the largest companies on Wall Street, including Apple, Microsoft, and Nvidia. With a 0.015% expense ratio and a $0 investment minimum, it's a low-cost option for those seeking broad market exposure.

Vanguard S&P 500 ETF (VOO)

Backed by Vanguard, one of the powerhouses of the fund industry, the Vanguard S&P 500 ETF has been trading since 2010 and tracks the S&P 500 index. With hundreds of billions in the fund and an expense ratio of 0.03%, it is a widely held and low-cost option for investors seeking diversification.

SPDR S&P 500 ETF Trust (SPY)

The SPDR S&P 500 ETF is one of the oldest ETFs, having been founded in 1993. It tracks the S&P 500 index and is sponsored by State Street Global Advisors. With hundreds of billions in the fund and an expense ratio of 0.095%, it is a popular and established option for investors.

IShares Core S&P 500 ETF (IVV)

Sponsored by BlackRock, one of the largest fund companies, the iShares Core S&P 500 ETF is a large ETF that has been tracking the S&P 500 since 2000. With an expense ratio of 0.03%, it is a low-cost option for investors seeking to replicate the performance of the S&P 500.

Schwab S&P 500 Index Fund (SWPPX)

Sponsored by Charles Schwab, a well-respected name in the industry, the Schwab S&P 500 Index Fund has been trading since 1997. With tens of billions in assets and an ultra-low expense ratio of 0.02%, it offers investors broad market exposure at a low cost.

Vanguard Total Stock Market ETF (VTI)

The Vanguard Total Stock Market ETF offers exposure to the entire U.S. stock market, including small, medium, and large companies across all sectors. With Vanguard as the sponsor, the fund has low fees (expense ratio of 0.03%) and has been trading since 2001, making it a reliable and cost-effective option.

Trust Fund Investment: Legit or Scam?

You may want to see also

Exchange-traded funds (ETFs)

ETFs are best suited for investors with a long time horizon. They are also a good option for those who want to benefit from diversification and lower fees compared to actively managed mutual funds. Since ETFs are traded on an exchange, they are more tax-efficient than mutual funds, as there are no capital gains distributions at the end of the year.

- Vanguard Growth ETF (VUG): This ETF tracks the CRSP US Large Cap Growth Index and has a low expense ratio of 0.04%. However, it has a heavy tilt towards the technology sector.

- Fidelity Blue Chip Growth Fund (FBGRX): FBGRX is an actively managed ETF that focuses on blue-chip growth stocks. It has outperformed its benchmark, the Russell 1000 Growth Index, over the past 10 years and charges a 0.47% expense ratio with no minimum investment.

- IShares Russell 1000 Growth ETF (IWF): This ETF tracks the Russell 1000 Growth Index, which is a market-capitalization-weighted benchmark of large- and mid-cap companies selected based on higher price-to-book ratios and historical growth. It has a 0.19% expense ratio and a five-star rating from Morningstar.

- Invesco Nasdaq 100 ETF (QQQM): QQQM provides exposure to the 100 largest non-financial companies listed on the Nasdaq exchange, including Apple, Nvidia, Microsoft, Meta, Amazon, Tesla, and Alphabet. It has a 0.15% expense ratio and is tax-efficient.

- Invesco S&P 500 GARP ETF (SPGP): This ETF implements a "growth at a reasonable price" strategy by tracking the S&P 500 Growth at a Reasonable Price Index. It has a 0.36% expense ratio and focuses on companies with strong growth potential while also considering valuation measures.

Mutual Fund Investment: Benefits and Your Financial Growth

You may want to see also

Stocks

When it comes to stocks, there are several factors to consider before investing. Here are some detailed and direct tips to help you decide where to invest:

Fundamentals

Start by researching the company's financial statements, such as revenue, earnings, profit margins and debt-to-equity ratio. These figures will help you assess the company's financial health and determine if the stock is a worthwhile investment.

Industry Trends

Understanding the trends in the company's industry is crucial. Study research reports, news and analyst predictions to gain a better sense of the industry's trajectory. This will help you make more informed investment decisions.

Management

The experience and track record of a company's management team are important factors that can impact its success. Evaluate their history of decision-making, leadership and overall strategy when considering an investment.

Competitive Advantage

Look for companies with a competitive edge over their peers, such as strong brand recognition or unique intellectual property. This can give them a market advantage and help sustain stock appreciation and dividend payouts over time.

Valuation

Assess the stock's value compared to similar companies in its industry. Utilise metrics like the price-to-earnings ratio, price-to-sales ratio and price-to-book ratio to determine if the stock is overvalued or undervalued.

Dividend Yield

Consider stocks that offer attractive dividend yields. Over time, dividend payments can contribute significantly to your overall return on investment.

Risks

Every investment carries risks, so it's essential to evaluate the potential downsides. Consider factors such as the company's debt level, industry volatility and geopolitical risks that could affect its performance.

- Taiwan Semiconductor (TSM)

- Netflix (NFLX)

- Broadcom (AVGO)

- Nvidia (NVDA)

- Advanced Micro Devices (AMD)

- Apple (AAPL)

- Spotify Technology (SPOT)

- The Progressive Corporation (PGR)

- Alphabet, Inc. (GOOG, GOOGL)

- Intuitive Surgical, Inc. (ISRG)

- Tapestry, Inc. (TPR)

- TopBuild Corp. (BLD)

- The Kraft Heinz Company (KHC)

- Fidelity National Information Services, Inc. (FIS)

- M/I Homes (MHO)

- Freshpet (FRPT)

- Cboe Global Markets (CBOE)

Investment Funds: Understanding the Different Types and Their Benefits

You may want to see also

Bonds

Government bonds are considered a risk-free investment as they are backed by the full faith and credit of the US government. However, in exchange for this safety, investors won't see as high a return as they might with other investments.

Corporate bonds operate in the same way as government bonds, but the loan is made to a company rather than a government entity. These loans are not backed by the government, making them a riskier option. High-yield bonds, or junk bonds, are substantially riskier, taking on a risk/return profile that more closely resembles stocks than bonds.

When buying bonds, investors can choose between individual bonds or bond funds, which hold a variety of bonds to provide diversification. Bonds can be purchased from a broker or directly from the underwriting investment bank or the US government.

Maximizing EIDL Funds: Strategies for Savvy Business Investments

You may want to see also

Frequently asked questions

Some of the best funds to invest in right now include high-yield savings accounts, certificates of deposit (CDs), government and corporate bonds, money market mutual funds, mutual funds, index funds, exchange-traded funds (ETFs), and stocks.

Mutual funds are a type of investment that pools money from multiple investors to purchase stocks, bonds, or other assets. They offer a diversified collection of assets in one fund, often at a low cost.

Mutual funds offer easy diversification, portfolio management, and potentially low costs. However, they may have high initial investment requirements, fees, sales charges, tax implications, and limited trading flexibility.

When selecting a mutual fund, consider your risk tolerance, time horizon, and existing portfolio allocation. Evaluate the fund's long-term track record, expense ratio, and whether it aligns with your investment goals and risk profile.

Some top-performing mutual funds for 2024 include Fidelity Blue Chip Growth (FBGRX), Shelton Nasdaq-100 Index Investor (NASDX), Victory Nasdaq-100 Index (USNQX), Fidelity Large Cap Growth Index (FSPGX), and Fidelity Contrafund (FCNTX).