Exchange-traded funds (ETFs) are a great way to begin investing. They are fairly simple to understand and can generate impressive returns without much expense or effort. ETFs allow investors to buy multiple stocks or bonds at once, offering simplicity and broad market exposure. ETFs trade on a major exchange such as the NYSE and Nasdaq, and their prices fluctuate like stocks. They are also more liquid and easier to buy and sell than mutual funds.

ETFs can be structured to track anything from the price of a commodity to a large and diverse collection of securities. For example, the Vanguard S&P 500 ETF (VOO) is a fund that tracks the performance of the S&P 500 index, which includes 500 of the top companies in the U.S. stock market.

ETFs have become an increasingly popular investment vehicle due to their low costs, tax efficiency, and convenience. They are also a great option for investors who want to take a more passive approach to investing, as they are designed to track a particular index or benchmark rather than trying to beat the market.

When choosing an ETF to invest in, it is important to consider the fund's expense ratio, diversification, performance, and investment minimums. It is also crucial to have a clear investment goal and do thorough research to ensure the ETF aligns with your risk tolerance and investment objectives.

| Characteristics | Values |

|---|---|

| Type | Exchange-traded fund (ETF) |

| Investment Vehicle | A pooled investment security |

| Trading | Traded like an individual stock on an exchange |

| Registration | Must be registered with the Securities and Exchange Commission |

| Structure | Can be structured to track the price of a commodity or a large and diverse collection of securities |

| Design | Designed to track specific investment strategies |

| Purpose | Income generation, speculation, price increases, and to hedge or partly offset risk in an investor’s portfolio |

| First ETF | SPDR S&P 500 ETF (SPY) |

| Share Prices | Fluctuate all day as the ETF is bought and sold |

| Expense Ratios | Low |

| Broker Commissions | Fewer |

| Risk Management | Through diversification |

| Focus | Targeted industries |

| Management | Actively managed ETFs have portfolio managers making decisions about which securities to include in the portfolio |

What You'll Learn

What is an index ETF?

An exchange-traded fund (ETF) is a basket of securities that trades on an exchange just like a stock does. An index ETF is a type of ETF that tracks a particular stock market index, such as the S&P 500 or the Nasdaq Composite. By investing in an index ETF, you gain exposure to a diverse range of stocks within that index.

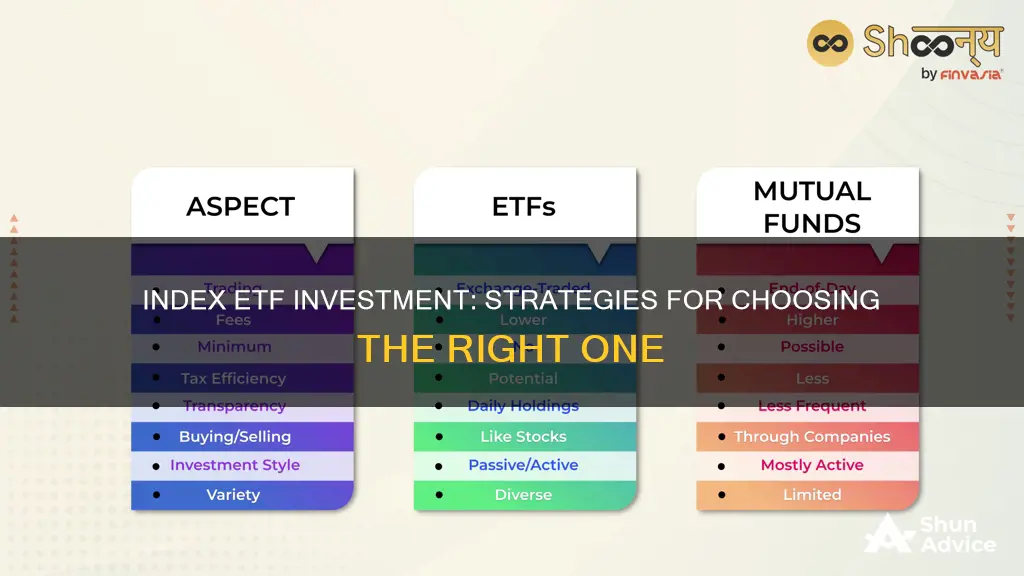

Index ETFs are a popular investment choice due to their low costs, broad diversification, and ease of trading. They are traded on major exchanges such as the NYSE and Nasdaq, and their prices fluctuate throughout the trading day, just like stocks. This makes them more liquid than mutual funds, which are priced only once per day.

When choosing an index ETF to invest in, it is important to consider the expense ratio, which represents the fund's operating expenses as a percentage of your investment. Lower expense ratios are generally preferable, as they result in lower costs for investors. Additionally, you may want to consider the index ETF's performance, investment objectives, and the level of diversification it offers.

Some popular index ETFs include the Vanguard S&P 500 ETF (VOO), SPDR S&P 500 ETF Trust (SPY), and iShares Core S&P 500 ETF (IVV). These ETFs track the performance of the S&P 500 index and have relatively low expense ratios.

A Beginner's Guide to iShares ETF Investing

You may want to see also

How do index ETFs work?

Index ETFs are a type of exchange-traded fund (ETF) that can be bought and sold like an individual stock on an exchange. They are a basket of securities that trade on an exchange and are designed to track a particular stock market index, such as the S&P 500 or the Nasdaq-100. ETFs offer investors a simple, low-cost way to gain exposure to a diverse range of stocks or assets, making them a popular choice for beginners and experienced investors alike.

Here's how index ETFs work:

How Index ETFs Work

- Index Tracking: Index ETFs are designed to track a specific stock market index, such as the S&P 500, Nasdaq-100, or Dow Jones Industrial Average. The ETF will hold the same stocks or assets as the index it tracks, in the same proportions. This means that the performance of the ETF will closely mirror that of the underlying index.

- Passive Investment Strategy: Index ETFs are considered a passive investment strategy because they aim to replicate the performance of an index rather than trying to beat the market. This means that the fund managers do not actively select stocks or time the market. Instead, they simply adjust the ETF's holdings to match the index's composition.

- Low Costs: Index ETFs are known for their low costs, which is one of their main advantages over other types of investments. They have low expense ratios, and investors do not need to pay for the services of an active fund manager. Additionally, ETFs generally have lower broker commissions compared to buying the underlying stocks individually.

- Diversification: Index ETFs provide instant diversification across a wide range of stocks or assets. This helps to reduce risk for investors, as their returns are less dependent on the performance of individual stocks.

- Trading Flexibility: ETFs can be bought and sold throughout the trading day, just like stocks. This gives investors more flexibility and control over their investments compared to mutual funds, which can only be traded once a day after the market closes.

- Tax Efficiency: Index ETFs are generally more tax-efficient than mutual funds because they typically have lower turnover, resulting in fewer capital gains distributions to shareholders.

- Accessibility: Index ETFs are easily accessible to individual investors, as they can be purchased through online brokers, traditional broker-dealers, or even retirement accounts. Many platforms offer commission-free trading for ETFs.

Water ETF: A Smart Investment for the Future

You may want to see also

What are the pros and cons of investing in index ETFs?

Index ETFs, or Exchange-Traded Funds, are an increasingly popular investment vehicle, with over $8 trillion invested in them as of the end of 2023. They are similar to mutual funds in that they allow investors to buy a basket of stocks or other securities, but they trade like stocks on major exchanges. This means that investors can buy and sell ETFs throughout the trading day, and the price of an ETF is updated continuously.

Pros of Investing in Index ETFs

Index ETFs have several advantages over other investment options:

- Lower costs: ETFs generally have lower expense ratios than actively managed funds, as they are passively managed and do not require a fund manager. This makes them a more cost-effective option for investors.

- Diversification: ETFs provide investors with exposure to a diverse range of stocks, bonds, and other assets, helping to reduce the risk of loss from the poor performance of a single investment.

- Trading flexibility: ETFs offer more flexibility than mutual funds, as they can be bought and sold during market hours, and the price is known immediately.

- Transparency: ETFs provide investors with transparency into what they are investing in, as they typically disclose their full portfolios daily.

- Tax efficiency: ETFs are structured in a way that can reduce the annual taxes investors face on their shares. They also tend to generate fewer capital gains than actively managed funds, further improving tax efficiency.

- Simplicity: ETFs are fairly simple to understand and can generate impressive returns without much effort or expense. This makes them an attractive option for beginner investors.

Cons of Investing in Index ETFs

Despite their many advantages, there are also some potential drawbacks to investing in index ETFs:

- Limited control: When investing in an ETF, investors buy a basket of stocks aligned with the fund's objectives, which may not match their own investment preferences. This means they have less control over their investments compared to buying and selling individual stocks and bonds.

- Potentially lower returns: While ETFs provide diversification, they may also dilute potentially high returns. Individual stocks may provide higher returns than an ETF tracking a specific sector, commodity, or index.

- Management fees: Some ETFs are actively managed, which means they have higher fees as they require a fund manager. These fees can offset returns over time, especially if the ETF underperforms.

- Trading costs: Some financial institutions may charge commissions or fees for buying or selling ETFs, which can impact overall returns.

- Lack of customization: ETFs are premade funds, so investors cannot personalize them to their specific investment goals and preferences.

Invest in Land: The ETF Way

You may want to see also

How do I start investing in index ETFs?

Investing in index ETFs is a great way to build wealth over time. Here are the steps to get started:

Open a brokerage account

You will need a brokerage account to buy or sell ETFs. Most online brokers offer commission-free ETF trades, so cost need not be a major consideration. Instead, compare each broker's features and platform. If you are a new investor, consider choosing a broker that offers an extensive range of educational features.

Choose your first ETFs

For beginners, passive index funds are generally the best option. Index funds are cheaper than actively managed funds, and most actively managed funds do not beat their benchmark index over time. When choosing an ETF, consider the following:

- Investment objective: Ensure the ETF's objective aligns with your investment goals. For example, if you want to invest in large U.S. companies, consider the Vanguard S&P 500 ETF.

- Expense ratios: ETFs charge fees known as expense ratios, which are listed as an annual percentage. A lower expense ratio will save you money.

- Dividends: Most ETFs pay dividends, which can be paid to you as cash or automatically reinvested through a dividend reinvestment plan (DRIP).

Let your ETFs do the work

ETFs are generally designed to be maintenance-free investments. Avoid the temptation to frequently check your portfolio and make emotional, knee-jerk reactions to market moves. Instead, let your ETFs produce excellent investment growth over long periods.

Investing in Graphene: The Ultimate Guide to Graphene ETFs

You may want to see also

What are some popular index ETFs?

Exchange-traded funds (ETFs) are a type of index fund that can be bought and sold like individual stocks on an exchange. They are a popular investment vehicle as they offer investors a low-cost, diversified way to gain exposure to a broad basket of securities. Here are some of the most popular index ETFs:

- SPDR S&P 500 ETF (SPY): This is the oldest and most widely known ETF, tracking the S&P 500 index. It is also one of the largest ETFs in the world.

- IShares Russell 2000 (IWM): This ETF tracks the Russell 2000 small-cap index.

- Invesco QQQ (QQQ) ("cubes"): This ETF tracks the Nasdaq 100 Index, which typically includes technology stocks.

- SPDR Dow Jones Industrial Average (DIA) ("diamonds"): This ETF represents the 30 stocks of the Dow Jones Industrial Average.

- Vanguard S&P 500 ETF (VOO): This ETF tracks the S&P 500 index and is one of the largest funds on the market, backed by Vanguard, a powerhouse in the fund industry.

- Fidelity ZERO Large Cap Index (FNILX): This mutual fund from Fidelity tracks the Fidelity U.S. Large Cap Index, which is very similar to the S&P 500. It stands out for its zero expense ratio.

- Vanguard Russell 2000 ETF (VTWO): This Vanguard ETF tracks the Russell 2000 Index, which consists of about 2,000 small-cap companies in the U.S.

- Vanguard Total Stock Market ETF (VTI): This Vanguard ETF covers the entire universe of publicly traded stocks in the U.S., including small, medium, and large companies across all sectors.

- SPDR Dow Jones Industrial Average ETF Trust (DIA): This ETF from State Street Global Advisors tracks the 30-stock index of large-cap stocks in the Dow Jones Industrial Average.

- Shelton NASDAQ-100 Index Direct (NASDX): This mutual fund from Shelton tracks the performance of the largest non-financial companies in the Nasdaq-100 Index, which primarily includes tech companies.

- Invesco QQQ Trust ETF (QQQ): This ETF from Invesco tracks the performance of the largest non-financial companies in the Nasdaq-100 Index.

A Beginner's Guide to ETF Investing on Robinhood

You may want to see also

Frequently asked questions

An index ETF is an investment vehicle that pools a group of securities into a fund. It can be traded like an individual stock on an exchange. ETFs are available on most online investing platforms, retirement account provider sites, and investing apps like Robinhood.

Index ETFs are a great way for most people to invest because they are a low-cost, easy way to build wealth. They are also a good investment for beginners because they are diversified and have lower risk than individual stocks.

When choosing an index ETF to invest in, it is important to research and analyze the fund's performance, expenses, taxes, investment minimums, trading costs, fund options, and convenience. It is also crucial to consider the geographic location, business sector, and market opportunity of the investments included in the fund.