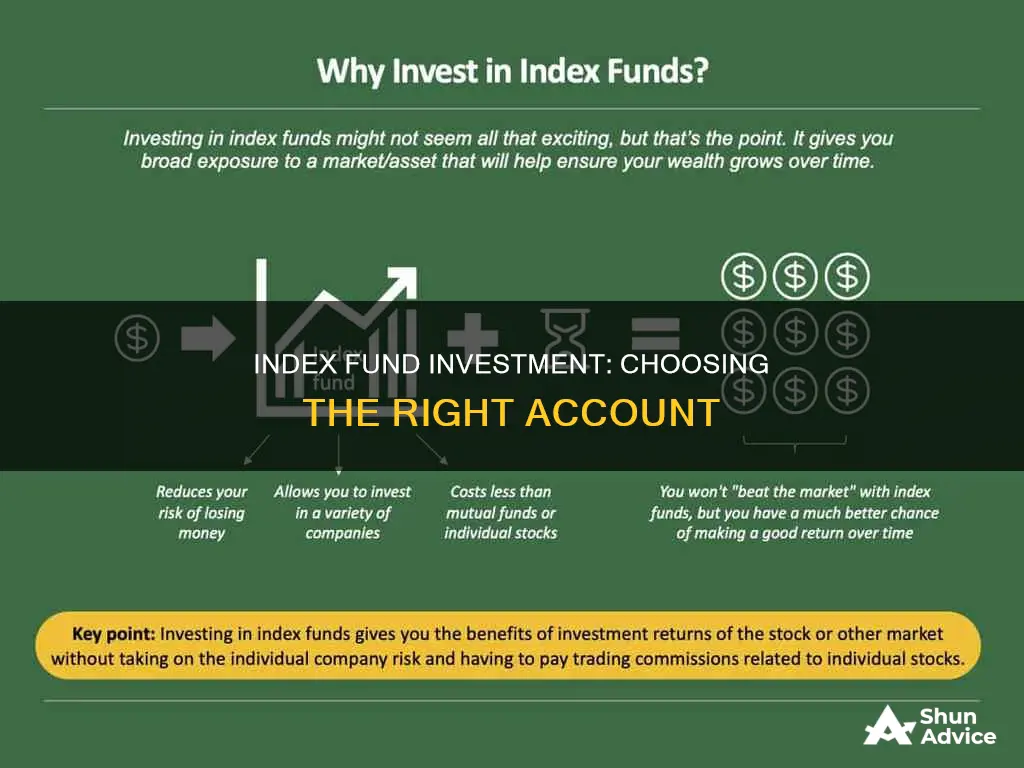

Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. They are a passive investment strategy that aims to mirror the performance of a specific index. Index funds are popular among investors due to their low costs, diversification benefits, and long-term solid returns. When considering which investment account to use for purchasing an index fund, there are a few options to choose from.

One option is to open a taxable brokerage account, which is suitable for financial goals other than retirement, such as saving for a home down payment. Another option is to use a retirement account like an IRA or 401(k), which offers tax benefits for long-term investing. For educational expenses, 529 plans can provide tax advantages. Custodial accounts, or UTMA/UGMA accounts, are also an option for investing on behalf of a child.

When deciding on an investment account for purchasing an index fund, it is important to consider the fees and expenses associated with each account type. Additionally, the level of risk and the investment horizon should be considered to ensure the account aligns with the investor's goals and risk tolerance. Consulting with a financial advisor can help determine the best account type and index fund strategy based on individual circumstances.

| Characteristics | Values |

|---|---|

| Investment account types | Brokerage account, Individual Retirement Account (IRA), Roth IRA |

| Investment goals | Short-term, Long-term |

| Investment research | Company size and capitalization, Geography, Business sector or industry, Asset type, Market opportunities |

| Investment selection criteria | Fund selection, Convenience, Trading costs, Impact investing, Commission-free options |

| Investment timing | Market performance, Investor's budget |

What You'll Learn

Investment accounts for index funds

Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. Index funds are defined as investments that mirror the performance of benchmarks like the S&P 500 by mimicking their makeup.

Index funds are a popular choice for investors seeking low-cost, diversified, and passive investments that happen to outperform many higher-fee, actively traded funds. They are designed to replicate the performance of financial market indexes, like the S&P 500, and are ideal for long-term investing, such as retirement accounts.

- Open an investment account: Different kinds of investment accounts are best suited for different types of goals. For financial goals other than retirement, a taxable brokerage account is a great way to build wealth. For retirement, accounts like an IRA or a 401(k) provide tax benefits. Educational expenses can be covered by 529 plans, and custodial accounts, also known as UTMA/UGMA accounts, let you invest on behalf of a child.

- Decide on your investment strategy: Your index fund investment strategy takes into account your overall financial goals, risk tolerance, and timeline. If you're working with a financial advisor, they can help you determine the best mix of funds for your situation. Robo-advisors will also suggest a strategy based on your answers to specific questions.

- Research your index funds: Pick an index or more than one index to start your search. The S&P 500 is probably the most well-known index, but there are also indexes based on company size, business sector, and market opportunity, such as emerging markets. Once you've settled on an index or indexes, research individual funds by comparing expense ratios, fees, and investment minimums.

- Buy the index funds: Once you have a brokerage account, you can buy shares of the index funds you've settled on. Generally, you'll search for or type in the ticker symbol of the fund you want to purchase and the dollar amount you want to invest.

- Set up your purchase plan: Investing is typically an ongoing practice, so set up automatic investments that happen on a schedule (such as once a month or every payday) with your brokerage.

- Decide on your exit strategy: Although buying and holding is a solid investment strategy, you should also think about when and how you'll sell your shares, especially when it comes to tax implications. A financial advisor or tax professional can help you figure out the best strategies for managing withdrawals from any type of investment account.

Index funds are a popular investment choice for their low-cost, diversified nature, and strong performance over time. By following these steps, you can get started on building your own index fund portfolio.

Trust Fund Investment: A Guide to Getting Started

You may want to see also

Index funds vs. individual stocks

Index funds are a type of investment fund that pools money from investors and invests it in securities that make up a particular market index, such as the S&P 500. The goal of an index fund is to mirror the performance of the underlying index, aiming to match its returns. Index funds are passively managed, meaning the fund managers do not actively decide which investments to buy or sell. Instead, they simply buy and hold the securities that make up the index. This passive management strategy helps to keep costs low, as there is no need to pay for active fund management.

On the other hand, investing in individual stocks involves purchasing shares of a single company. This approach can be more risky than investing in index funds, as your capital is tied to the fortunes of a single company. If that company performs well, you may see higher returns than you would with an index fund. However, if the company struggles, you could lose a significant portion of your investment.

One of the main advantages of index funds is their diversification. By investing in an index fund, you automatically gain exposure to a broad range of companies, reducing the risk associated with putting all your eggs in one basket. Index funds are also generally associated with lower fees and better tax efficiency compared to actively managed funds.

However, one potential downside of index funds is that they may not provide the opportunity to beat the market. Since index funds are designed to match the performance of a particular index, they will never outperform it. If you're confident in your stock-picking abilities and want the potential for higher returns, investing in individual stocks may be more appealing.

When deciding between index funds and individual stocks, it's important to consider your investment goals, risk tolerance, and the amount of time and effort you're willing to put into researching and managing your investments. Index funds are often recommended for beginners or those seeking a more hands-off approach, while investing in individual stocks may be more suitable for those with a higher risk tolerance and a strong understanding of the stock market.

In conclusion, both index funds and individual stocks have their own advantages and disadvantages. Index funds offer diversification, lower fees, and passive management, while investing in individual stocks may provide the potential for higher returns but with increased risk. Ultimately, the best choice depends on your personal investment strategy and preferences.

Asia's 1997 Financial Crisis: Why Foreign Investment Poured In

You may want to see also

Index funds vs. active funds

Index funds are a type of investment fund that tracks a market index, such as the S&P 500 or Nasdaq Composite. They are designed to mirror the performance of a specific market index as closely as possible, and they generally invest in all the components of the index they track. Index funds are passively managed, meaning they don't require active decision-making about which investments to buy or sell. This passive management strategy helps to balance the risk in an investor's portfolio, as market swings tend to be less volatile across an index compared to individual stocks.

On the other hand, active funds are mutual funds or exchange-traded funds (ETFs) that aim to beat the market returns. Active funds try to outperform the market by investing in hand-picked stocks or bonds chosen by professional money managers based on their research and expertise.

Differences between Index Funds and Active Funds:

Costs

Index funds have lower costs compared to active funds. They are cheaper to run because they are automated to follow the shifts in value in an index. However, index funds still carry administrative costs, which are subtracted from each fund shareholder's returns as a percentage of their overall investment.

Active funds, on the other hand, incur higher costs due to the need for professional fund management, research, and investment strategies. The total expense ratios (TERs) of active funds are typically higher than those of index funds.

Risk

Index funds are exposed to systematic risk, also known as market risk, which is associated with overall market sentiment and movements. They aim to minimise unsystematic risk, which is the risk associated with individual stocks or sectors, by investing in a diversified portfolio of securities that replicate the benchmark index they are tracking.

Active funds, in their attempt to beat the market, take on additional unsystematic risk. They aim to be overweight or underweight on certain stocks or sectors relative to the market benchmark index, which can lead to higher potential returns but also increases the risk of losses.

Performance

Index funds aim to match the performance of the market or a specific benchmark index. While they may not offer the potential for outsized gains, they have consistently performed well over the long term and tend to outperform actively managed funds.

Active funds, on the other hand, aim to beat the market returns and provide higher returns than the market index. However, it is challenging for active fund managers to consistently outperform the market, and their performance can be volatile.

The choice between index funds and active funds depends on your investment goals, risk tolerance, and preferences. Index funds offer a low-cost, passive investment strategy that mirrors the performance of the market. They are suitable for investors seeking long-term wealth accumulation and diversification. On the other hand, active funds offer the potential for higher returns but come with higher costs and increased risk.

Understanding SBP Fund Investment: Withdrawal Impact Explained

You may want to see also

Index funds for beginners

Index funds are a great way for beginners to start investing. They are a simple, cost-effective way to hold a broad range of stocks or bonds that mimic a specific benchmark index, meaning they are diversified.

Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. They are defined as investments that mirror the performance of benchmarks like the S&P 500 by mimicking their makeup.

Index funds seek to match the performance of an underlying index they're tracking. For example, an S&P 500 index fund will hold the stocks that make up the S&P 500 index in an effort to match its performance. Because these funds don't have teams of analysts and portfolio managers trying to beat the market, their costs are low, leaving more of the return for the fund's investors.

How to invest in Index Funds:

- Open an investment account: You'll need an investment account to buy index funds. Different kinds of investment accounts are best suited for different types of goals. For example, taxable brokerage accounts are great for building wealth, while retirement accounts like an IRA or 401(k) provide tax benefits for long-term investing.

- Decide on your investment strategy: Your index fund investment strategy takes into account your overall financial goals, risk tolerance, and timeline. If you're working with a financial advisor, they can help you determine the best mix of funds for your situation.

- Research your Index Funds: It's important to know what you're getting into, so research is key. First, pick an index or more than one index. The S&P 500 is probably the most well-known, but there are also indexes based on company size, business sector, and market opportunity, such as emerging markets.

- Buy the Index Funds: Once you have a brokerage account, you can buy shares of the index funds you've settled on. Generally, you'll search for or type in the ticker symbol of the fund you want to purchase and the dollar amount you want to invest.

- Set up your purchase plan: Investing is typically an ongoing practice, so you'll need to think about your plan for buying index funds over time. Financial advisors often recommend dollar-cost averaging—the practice of putting a certain amount of money into your investments at set intervals.

- Decide on your exit strategy: Although buying and holding is a solid investment strategy, you should also think about when and how you'll sell your shares, especially when it comes to tax implications.

Benefits of Index Funds:

- Lower fees: Index funds typically have lower expense ratios because they are passively managed.

- Market representation: Index funds aim to mirror the performance of a specific index, offering broad market exposure.

- Transparency: The holdings of an index fund are well-known and available on almost any investing platform.

- Historical performance: Over the long term, many index funds have outperformed actively managed funds, especially after accounting for fees and expenses.

- Tax efficiency: Lower turnover rates in index funds usually result in fewer capital gains distributions, making them more tax-efficient than actively managed funds.

Drawbacks of Index Funds:

- Lack of flexibility: Because they are designed to mirror a specific market, they decline in value when the market does and can't pivot away when the market shifts.

- Inclusion of all securities in an index: This means they may invest in companies that are overvalued or fundamentally weak.

- Market-cap weighting: Companies with higher market capitalizations have a more significant influence on the fund's performance, which can lead to being too tied to the fate of a few large companies.

Index funds can be an excellent option for beginners stepping into the investment world. They are a simple, cost-effective way to hold a broad range of stocks or bonds, are diversified, have lower expense ratios than most actively managed funds, and often outperform them.

Where to buy Index Funds:

You can purchase an index fund directly from a mutual fund company or a brokerage. Same goes for exchange-traded funds (ETFs). These are like mini mutual funds that trade like stocks throughout the day. When choosing where to buy an index fund, consider fund selection, convenience, trading costs, impact investing, and commission-free options.

Launching Your First Investment Fund: A Beginner's Guide

You may want to see also

Index funds for retirement

Index funds are a great investment option for those looking to build wealth over time, especially for retirement. They are a type of mutual fund or exchange-traded fund (ETF) that tracks a specific market index, such as the S&P 500, and aims to mirror its performance. Here are some key points about index funds for retirement:

Benefits of Index Funds for Retirement:

- Low Costs and Fees: Index funds are known for their low costs, which is one of their biggest advantages. They have lower expense ratios compared to actively managed funds because they are passively managed and don't require active trading or a large team of analysts. This means more of your money goes towards your investment rather than fees.

- Diversification: Index funds provide instant diversification, reducing your risk. By investing in an index fund, you immediately gain exposure to a wide range of stocks or bonds, which means you're not dependent on the performance of just a few individual stocks. This diversification can help minimize losses during market downturns.

- Tax Efficiency: Index funds tend to be more tax-efficient than actively managed funds because they buy and sell securities less frequently. This results in lower capital gains distributions, which can reduce your tax bill.

- Solid Long-Term Returns: Index funds have historically delivered solid long-term returns. For example, the S&P 500 has averaged an annual return of about 10% over the long term. While past performance doesn't guarantee future results, index funds have consistently outperformed actively managed funds over time.

- Simplicity and Accessibility: Index funds are relatively simple to invest in and are accessible to beginner investors. They don't require extensive knowledge of the financial markets or individual stocks. By investing in an index fund, you can gain exposure to a diverse range of stocks or bonds with a single investment.

Considerations for Retirement:

When using index funds for retirement, there are a few things to keep in mind:

- Risk and Volatility: While index funds offer lower risk compared to individual stocks due to diversification, they are still subject to market risk and volatility. During market downturns, your index fund will also lose value. It's important to remember that investing in index funds is a long-term strategy, and short-term fluctuations should be expected.

- Average Returns: Index funds tend to deliver average market returns. This means that while you may not see extremely high returns, you also avoid the potential for significant losses that can come with more aggressive investments.

- Limited Flexibility: Index funds are designed to mirror a specific market index, so they may not offer the same flexibility as actively managed funds. The fund's performance is tied to the index it tracks, and the fund manager has less discretion to make changes or pivot during market shifts.

- Expense Ratios and Costs: While index funds are known for their low costs, it's important to compare expense ratios and other fees across different funds. Even small differences in expense ratios can impact your returns over time, so it's crucial to choose funds with competitive fees.

Examples of Index Funds for Retirement:

When selecting index funds for retirement, consider funds with a strong track record, low costs, and broad diversification. Here are a few examples:

- Vanguard S&P 500 ETF (VOO): This ETF tracks the S&P 500, offering broad diversification across 500 large U.S. companies. It has a low expense ratio of 0.03%.

- Fidelity ZERO Large Cap Index (FNILX): This mutual fund is similar to the S&P 500 but has a 0% expense ratio, making it a very cost-effective option.

- Vanguard Total Stock Market ETF (VTI): This ETF covers the entire universe of publicly traded stocks in the U.S., providing exposure to small, medium, and large companies across all sectors. It has a low expense ratio of 0.03%.

- Vanguard Total Bond Market ETF (BND): This ETF tracks an index of various bonds, offering diversification within the fixed-income market. It has a low expense ratio of 0.03%.

- Vanguard Russell 2000 ETF (VTWO): This ETF focuses on small-cap companies, providing exposure to about 2,000 of the smallest publicly traded companies in the U.S. It has an expense ratio of 0.10%.

Remember, it's important to do your own research and consider your investment goals, risk tolerance, and time horizon before investing in any index funds or other financial products. Consulting with a financial advisor can also help you make informed decisions about index funds for retirement.

HDFC Balanced Advantage Fund: Safe Investment Option?

You may want to see also

Frequently asked questions

You can buy an index fund through a brokerage account, an individual retirement account (IRA), or a Roth IRA.

Brokerage accounts offer a wide range of investment options and tools, and they can also hold multiple types of investments, making it easier to manage your portfolio.

Retirement accounts offer tax advantages that can help your investments grow over time. Additionally, these accounts are designed for long-term investing, which aligns with the passive nature of index funds.