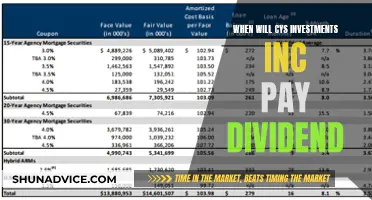

There are many investment options that can yield a 10% return. Here are some of the most common ones:

- Paying off high-interest debt

- Starting your own business

- Investing in farmland

- Foreign currency investments

- Peer-to-peer lending

- Initial public offerings

- Real estate

- Art and collectibles

- Precious metals

- Junk bonds

- Master limited partnerships

- Short-term stock trading

- Long-term stock investments

What You'll Learn

Paying off high-interest debt

Ask for a Lower Interest Rate:

Creditors may be willing to lower interest rates, especially if you have a good history of making timely payments. Contact your credit card company and negotiate a better rate. Having offers from other credit card companies with lower rates can also be used as leverage in your negotiation.

Transfer the Balance:

Consider transferring your balance to a low-interest or 0% APR credit card, especially if you have good credit. This strategy can give you a few months without interest, helping you get on top of your debt. However, be mindful of the fine print, as these offers usually have a time limit, after which you may start accumulating interest again.

Pay More Than the Minimum:

Paying only the minimum required amount will keep you in debt for longer. To accelerate debt repayment, commit to paying more than the minimum each month. Focus on paying off the debt with the highest interest rate first, which is known as the "avalanche method." This approach ensures you tackle the debt that is growing the fastest due to interest charges.

Lower Your Expenses:

Evaluate your budget and look for areas where you can cut back on spending. For example, you can reduce entertainment costs by disconnecting cable, lowering streaming subscriptions, or cutting back on dining out. You can also reduce utility costs by adjusting your thermostat settings or unplugging unused appliances.

Increase Your Income:

In addition to reducing expenses, focus on increasing your income. This can be done by asking for a raise, finding a higher-paying job, selling unused items, taking on freelance work, or leveraging your skills for consulting opportunities.

Cancel or Pause Subscriptions:

Review your subscriptions and cancel or pause any that you don't truly need or fully utilize. Be sure to cancel any subscriptions that automatically renew after a free trial, and keep an eye on price increases.

Snowball Method:

This approach focuses on paying off smaller balances first to gain a sense of accomplishment and stay motivated. While it may take longer and result in more interest paid overall, seeing quick wins can boost your determination to continue eliminating debt.

Credit Counseling:

Consider seeking help from a certified credit counselor at a nonprofit credit counseling agency. They can assess your debt situation and may be able to enroll you in a debt management plan (DMP) to reduce your interest rates and monthly payments.

Remember, paying off high-interest debt is a wise financial decision, as it is challenging to find an investment that pays off as well as, or with less risk than, eliminating high-interest debt.

Depression-Era Investments: Where Money Went

You may want to see also

Starting your own business

Starting a business can be a great way to generate a 10% return on your investment. Here are some tips and ideas to help you get started:

- Market Research: Before launching your business, conduct thorough market research to identify potential customers, understand your competitors, and find your unique selling point. This will help you develop a strong business plan and attract investors.

- Choose a Niche: Identify a specific industry or target market that you are passionate about and have expertise in. This could be anything from childcare to business consulting, artisan manufacturing, or personal shopping. By specialising in a particular area, you can differentiate yourself from competitors and attract a dedicated customer base.

- Low Setup Costs: Keep your initial costs low by starting small and working from home or a shared workspace. You may only need to purchase a website domain, basic equipment, and supplies to get started.

- Offer Services: Consider offering services that utilise your existing skills and knowledge. For example, if you have experience in human resources or administration, you could offer resume writing and career coaching services. Alternatively, if you are handy with repairs and renovations, you could start a handyman business.

- Online Businesses: Take advantage of the internet to reach a wider audience and keep costs low. You can create an online presence through a website, social media, and online marketplaces. This is especially useful for businesses such as dropshipping, ecommerce, or content creation.

- Freelancing: Consider freelancing in a skilled field such as web development, graphic design, writing, or photography. These skills are in high demand, and you can easily connect with clients online or through freelance platforms.

- Product-Based Businesses: If you prefer creating physical products, there are numerous options to explore. You can design and sell fashion accessories, toys, pet products, or even essential oils and soaps. You can sell these products online, at craft fairs, or through local retailers.

- Food Businesses: If you have a passion for food, consider starting a catering business, food truck, bakery, or specialty food store. You can also offer services such as personal cheffing or meal prep for busy individuals.

- Consulting: If you have expertise in a specific field, consider becoming a consultant. This could include marketing, sales, small business coaching, or even gardening or urban farming consulting. Share your knowledge and help others succeed while building a profitable business.

- Franchising: Franchising allows you to own a business with an established brand and business model. While it may require a larger initial investment, it can provide a clear path to success and higher returns. Examples include Jazzercise, Anytime Fitness, and Planet Fitness franchises.

- Patience and Persistence: Building a successful business takes time and dedication. It may take a while to turn a profit, so be patient and focus on providing value to your customers. Continuously learn, adapt, and improve your offerings to meet their needs and stay ahead of the competition.

Investing: Wealth and Security

You may want to see also

Investing in farmland

Farmland is a lower-risk opportunity that has outpaced inflation and offers the potential for double-digit returns.

There are a few reasons why investors are turning to farmland:

- It has a long history of solid returns, with the value of American farmland rising by about 6.1% per year over the last 50 years.

- Farmland returns have historically had less volatility than most other asset classes, including the 10-year U.S. Treasury Bond, S&P 500, gold, and Dow Jones REIT Index.

- Farmland returns typically don't move in the same direction as the stock market.

- Farmland is a real asset that produces commodities like corn and grain and benefits from inflation.

How to Invest in Farmland

- Directly purchase usable cropland or pastureland and rent it out to a farmer or rancher. This method has a sizable upfront cost since an investor would likely need to purchase a large plot of land.

- Purchase an existing farm via a sale-leaseback transaction. This is likely the least risky and most passive way of investing in farmland, but the investor might need to pay a higher price for the land and therefore earn a lower cash yield.

- Buy an existing farm or agricultural land and lease it to a new tenant. This option could generate a higher return but would require more work upfront to find the right tenant.

- Acquire land that's not currently used for agriculture and convert it to cropland, pastureland, or an urban farm. This option has the potential to produce the highest return since an investor would likely be able to purchase land for a lower price and benefit from higher land value appreciation. However, it requires the most work since an investor would need to transform the land for farm use and find the right crops and tenants.

- Purchase shares of specialty REITs focused on farmland, such as Farmland Partners and Gladstone Land Corporation.

- Invest through a crowdfunding platform focused on farming, such as AcreTrader, FarmFundr, FarmTogether, Farmland LP, Harvest Returns, and Steward.

Risks and Returns

When investing in farmland, it's important to understand the risks, which include interest rates, weather, platform risk, and producer concentration. Wildfires, for example, can consume valuable land and crops.

The return on farmland investments depends on where we are in the commodities cycle and the starting point of land prices. A mid-to-high single-digit return is reasonable, with the potential for double-digit returns depending on the particular parcel, crop, and whether debt was used to magnify the return. Permanent crops such as almonds, pistachios, and wine grapes have generally outperformed annual crops with returns of 9% or more over the past decade.

Investments: What's the Return?

You may want to see also

Foreign currency investments

Foreign currency investing involves buying the currency of one country and selling that of another. This is done through the foreign exchange market, or forex, which is managed by banks and other financial institutions. Forex trading always happens in pairs. For a transaction to be complete, one currency has to be exchanged for another. For example, you might buy US dollars and sell British pounds or vice versa.

Pros of Foreign Currency Investments

Convenience and Accessibility

Stock market exchanges operate during set hours, whereas forex trades can be made at any time of the day or night.

Diversification

Diversifying your portfolio can help manage risk. Foreign currency is an alternative asset class to the traditional mix of stocks, bonds, and mutual funds.

Lower Costs

Unlike trading stocks, there may be fewer commissions associated with trading foreign currencies, allowing you to hold on to more of your returns.

Cons of Foreign Currency Investments

Potential Volatility

While forex trading can be lucrative, there may be more ups and downs than the stock market, creating a steep learning curve for beginners. The risks may also be higher compared to other investment strategies, so it’s important to assess your risk tolerance carefully before jumping in.

How to Invest in Foreign Currency

There are several ways to invest in foreign currency:

- Standard Forex Trading Account: Investors can open an account with a forex broker and trade currencies from around the world.

- CDs and Savings Accounts: Some banks offer certificates of deposit (CDs) and savings accounts that earn interest at local rates in specific countries, allowing you to take advantage of higher interest rates in other countries.

- Foreign Bond Funds: You can invest in a mutual fund that buys foreign government bonds, which earn interest denominated in foreign currency. If the foreign currency goes up in value relative to your local currency, the earned interest increases when converted back.

- Multinational Corporations: Investing in the stocks of multinational corporations with significant overseas operations can be a way to indirectly participate in the foreign currency markets. The revenues and profits derived from overseas operations are boosted if the foreign currency appreciates versus the dollar.

- Exchange-Traded Funds (ETFs) and Exchange-Traded Notes (ETNs): These are traded like stocks and can be a way to invest in currencies without needing to trade forex directly.

Risks of Foreign Currency Investments

Exchange-Rate Risk

Exchange-rate risk, or currency risk, occurs when the price of one currency changes relative to another. Transaction risk is the loss that can occur due to delays between the transaction and the settlement of trades.

Political Risk

The political climate of foreign countries creates portfolio risks because governments and political systems are constantly in flux, which can impact the economic and business sectors.

Taxation

Foreign investors are subject to taxes on foreign-based securities, which can be withheld at the source country before an investor can realize any gains, and then taxed again when the investor repatriates the funds.

Adani Power: Invest Now?

You may want to see also

Peer-to-peer lending

The process is simple: those who want to lend money open an account with a peer-to-peer platform as a lender, and those who require a loan register as a borrower. The platforms then evaluate borrowers on various aspects, including but not limited to credit scores, employment, income, and credit history. Borrowers are then assigned to different risk buckets, which serve as the basis for their interest rates. The better the creditworthiness of a borrower, the lower the interest rate they will pay, and vice versa.

Lenders can then check this assessment and choose who they want to lend their money to, depending on the risk they want to take and the return they want to earn. Similarly, borrowers can also view the profiles of lenders and reach out to them.

The platforms do not keep a margin from the transactions but instead charge a fee for their services. As per RBI regulations, if a P2P platform decides to shut down, the company's board will follow a pre-decided Business Continuity Plan to keep the information of lenders and borrowers safe and continue servicing loans.

While there is no market-related risk in P2P lending, the primary risk is the borrower defaulting on their loan. If this happens, the platform can assist lenders in recovery and file a legal notice. To mitigate this risk, investors can diversify their investments across various high-creditworthy borrowers.

In terms of returns, P2P lending platforms Faircent and LenDenClub have reported average portfolio returns for lenders of 12-14% and 13.47% respectively for a holding period of one year. However, it's important to note that these returns can be reduced by default rates and platform fees.

When investing in P2P lending, it is critical to understand who you are lending to, as each platform uses different criteria to select borrowers. It is also important to remember that the interest rate offered by a P2P platform is not guaranteed and is directly impacted by the non-performing assets of the portfolio. Therefore, it is recommended to check the profile of borrowers and their non-performing assets when choosing a platform.

Some other things to consider before investing in P2P lending include:

- The timeline of payout offered by the platform, i.e. whether interest is credited daily, monthly, or at the end of the tenure.

- The option of auto-renewal, which will automatically reinvest your money for another year if you do not opt out.

- The track record and reputation of the platform, including disclosures of borrower information, fees, charges, and potential risks.

- The risks involved, which include fraud, platform failure, and a lack of liquidity, in addition to the risk of default.

Overall, P2P lending can be a good investment option for those seeking higher returns than traditional bank deposits, but it is important to understand the risks involved and diversify your portfolio accordingly.

Euro: A Smart Investment Move?

You may want to see also

Frequently asked questions

There are several safe investments that can yield a 10% return, including high-yield savings accounts, long-term certificates of deposit, long-term corporate bond funds, dividend stock funds, and value stock funds.

Riskier investments that can yield a 10% return include small-cap stock funds, rental housing, and Nasdaq-100 index funds.

Some alternative investments that can yield a 10% return include starting your own business, investing in farmland, foreign currency investments, and peer-to-peer lending.

Here are some tips to get a 10% return on your investments:

- Invest consistently for the long term.

- Invest in different assets.

- Buy assets when they are on sale.

- Pay off high-interest debt.

- Consider investing in art, antiques, or collectibles.

- Look into master limited partnerships (MLPs).

- Invest in precious metals like silver.

- Explore peer-to-peer lending platforms.