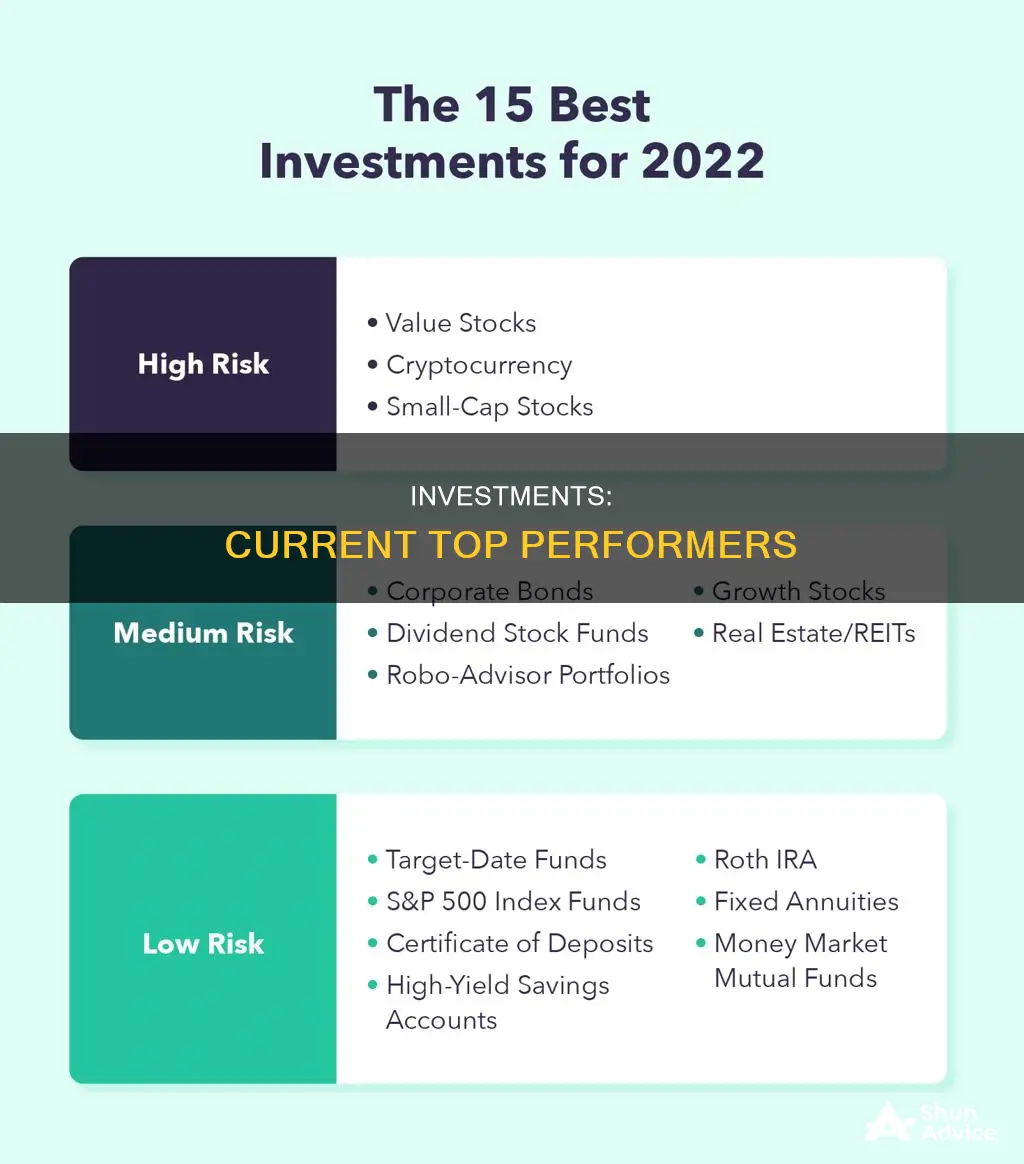

There are several investments that are doing well right now.

According to sources, the best investments in 2024 include high-yield savings accounts, long-term certificates of deposit, long-term corporate bond funds, dividend stock funds, value stock funds, small-cap stock funds, real estate investment trusts (REITs), S&P 500 index funds, Nasdaq-100 index funds, rental housing, and stocks.

Some of the safest investments with high returns include high-yield savings accounts, certificates of deposit (CDs), money market accounts, Treasury Inflation-Protected Securities (TIPS), and the S&P 500 index fund/ETF.

It's important to note that the best investments depend on various factors, including risk tolerance, investment goals, time horizon, knowledge of investing, and financial situation. Diversification is also key to reducing risk and maximizing returns.

What You'll Learn

Exchange-Traded Funds (ETFs)

ETFs are a good investment because they offer benefits such as the ability to buy multiple assets in one fund, the risk-reducing benefits of diversification, and generally low costs to manage the fund. The cheapest funds are usually passively managed and may cost just a few dollars annually for every $10,000 invested.

- IShares MSCI Russia ETF (ERUS): This ETF provides exposure to Russian stocks, which have been performing well recently due to the country's large exports of natural resources.

- Grayscale Solana Trust (GSOL) and Osprey Solana Trust (OSOL): These ETFs provide exposure to the Solana blockchain and its native cryptocurrency, SOL. Solana is a fast-growing blockchain platform for decentralised applications and has seen significant price appreciation in recent months.

- GraniteShares 2x Long NVDA Daily ETF (NVDL) and GraniteShares 2x Long COIN Daily ETF (CONL): These leveraged ETFs seek to provide 200% of the daily performance of NVIDIA and Coinbase stocks, respectively. Leveraged ETFs are high-risk but can be profitable for short-term traders.

- IShares ESG Screened S&P 500 ETF (XVV) and iShares Morningstar U.S. Equity ETF (ILCB): These ETFs provide exposure to large-blend stocks, focusing on environmental, social, and governance (ESG) criteria. They are ranked highly by U.S. News for long-term asset allocation plans.

- Vanguard S&P 500 ETF (VOO), SPDR S&P 500 ETF Trust (SPY), iShares Core S&P 500 ETF (IVV), and Invesco QQQ Trust (QQQ): These ETFs track the S&P 500 index, providing broad exposure to the top publicly traded companies listed in the U.S. They are recommended by Warren Buffett and have low expense ratios.

- Vanguard FTSE Developed Markets ETF (VEA), iShares Core MSCI EAFE ETF (IEFA), Vanguard FTSE Emerging Markets ETF (VWO), and Vanguard Total International Stock ETF (VXUS): These ETFs provide targeted exposure to international publicly traded companies, either broadly or by specific geographic areas such as Asia, Europe, or emerging markets.

- Vanguard Dividend Appreciation ETF (VIG), Vanguard High Dividend Yield Index ETF (VYM), and Schwab U.S. Dividend Equity ETF (SCHD): These dividend ETFs offer higher returns and low costs, making them attractive to investors seeking income, such as retirees.

- SPDR Gold Shares (GLD) and iShares Silver Trust (SLV): These commodity ETFs provide exposure to precious metals, offering portfolio diversification and a store of value.

- IShares Bitcoin Trust (IBIT), Fidelity Wise Origin Bitcoin Fund (FBTC), and Franklin Bitcoin ETF (EZBC): These Bitcoin ETFs allow investors to buy a stake in Bitcoin through a share in the fund, making it easier and more accessible than setting up an account with a crypto exchange.

Remember, when investing in ETFs, it is important to understand the underlying holdings of the fund and assess if it aligns with your investment goals and risk tolerance.

Investments: Where People Put Their Money Now

You may want to see also

Dividend stocks

When choosing dividend stocks, it's important to look for companies with robust fundamentals and long-term profitability. Investors should also look for a sustainable dividend yield that has been consistently increasing for some years. Dividend payout ratios and dividend coverage ratios can help investors evaluate the stability and long-term earnings growth potential of a company.

- Diversified Energy Company (DEC)

- Ecopetrol (EC)

- BW LPG Ltd. (BWLP)

- Euronav (EURN)

- Pennymac Mortgage Investment Trust (PMT)

- Franklin BSP Realty Trust Inc. (FBRT)

- International Seaways Inc (INSW)

- Angel Oak Mortgage REIT Inc (AOMR)

- Civitas Resources Inc (CIVI)

- CVR Energy Inc (CVI)

Additionally, investors can choose to reinvest dividends if they don't need the income. This can greatly enhance your return on investment.

Dividend ETFs or index funds are another way to invest in dividend stocks. These funds offer instant diversification and provide access to a selection of dividend stocks within a single investment.

Robinhood: Still Relevant?

You may want to see also

High-yield savings accounts

With fewer overhead costs, you can typically earn much higher interest rates at online banks than you would at a traditional brick-and-mortar bank. Plus, you'll likely have easy access to the money by quickly transferring it to your primary bank or via an ATM.

- UFB Direct: 5.25% APY

- Credit Karma Money Save: 5.10% APY

- Varo: 5.00% APY

- My Banking Direct: 5.55% APY

- Cloudbank 24/7: 5.22% APY

- SoFi Checking & Savings: 4.60% APY

Investment Scams: Why the Fall?

You may want to see also

Real estate

There are two main ways to invest in real estate:

- Individual properties: This option requires a large amount of capital and hands-on management.

- Real estate crowdfunding platforms: This is a simpler way to invest, and it fits better within a portfolio. These platforms allow you to invest in property while getting the benefit of professional property management.

- Purpose of investment: Are you investing to occupy or rent out the property? If you plan to occupy the property, consider whether it makes more financial sense to buy rather than rent. On the other hand, if you're buying to rent out, you need to understand the rental market and the expenses involved in maintaining the property.

- Mortgage rates: Mortgage rates have been rising since 2023, and while they are currently at elevated levels, they are not particularly high relative to history. If rates are expected to rise further, it may be wise to lock in a lower-rate mortgage now.

- Home prices: Low mortgage rates initially made property more affordable, but this quickly led to surging home prices. Now, with rising rates and higher home prices, many buyers are finding themselves priced out of the market.

- Long-term focus: Real estate is typically viewed as a long-term investment, not a short-term trade. It is important to look at long-term trends rather than whether the market is hot or not at the moment.

- Financial situation: Assess your financial situation and ability to make payments. Ensure you have job security and find a property that fits within your budget.

- Passive investments: Instead of investing in physical properties, consider becoming a passive investor in real estate through real estate investment trusts (REITs) or crowdfunding platforms. REITs offer attractive returns, including regular dividend payments, and allow for diversification across multiple properties.

- Risk and return: Investing in real estate, especially individual properties, requires a large amount of capital and comes with certain risks. These include the potential for negative cash flow, time constraints, and the need for an exit strategy. It is important to weigh the risks and returns before investing.

Overall, real estate can be a wise investment decision, but it is important to consider your financial situation, risk tolerance, and investment goals before making any decisions.

Food Startups: Invest in Your People

You may want to see also

S&P 500 index funds

The S&P 500 index is one of the most widely quoted American indexes, and it is considered one of the best gauges of large U.S. stocks and the overall equities market. The index includes companies from a range of sectors, such as technology, software, banking, and manufacturing, and it focuses on the large-cap sector.

- Instant Diversification: By investing in an S&P 500 index fund, you instantly gain exposure to hundreds of the largest U.S. companies, providing diversification across many industries and sectors.

- Long-Term Returns: The S&P 500 has consistently performed well over the long term, with an average annual return of about 10%.

- Passive Investment Strategy: S&P 500 index funds are passive investments that aim to mirror the performance of the S&P 500 index. This means you don't need to actively select stocks or time the market.

- Accessibility: S&P 500 index funds are widely accessible through various investment vehicles, such as mutual funds, exchange-traded funds (ETFs), and brokerage accounts.

- Low Costs: Index funds are known for their low expense ratios, making them a cost-effective option for investors.

- Taxable Brokerage Accounts: You can invest in S&P 500 index funds through taxable brokerage accounts, 401(k) plans, or Individual Retirement Accounts (IRAs).

- Volatility and Risk: Like any stock investment, the S&P 500 index funds carry the inherent risks of equity investing, including volatility and downside risk.

- Large-Cap Dominance: The S&P 500 index is dominated by large-cap companies, which make up a significant portion of the index. This means there is limited exposure to small-cap and mid-cap stocks, which may have higher growth potential.

- U.S.-Focused: The S&P 500 index only includes U.S. companies, so it may not provide exposure to international markets.

- Vanguard 500 Index Fund - Admiral Shares (VFIAX)

- Schwab S&P 500 Index Fund (SWPPX)

- Fidelity 500 Index Fund (FXAIX)

- Fidelity Zero Large Cap Index (FNILX)

- T. Rowe Price Equity Index 500 Fund (PREIX)

Retirement Planning: Invest More, Worry Less

You may want to see also

Frequently asked questions

Short-term investment vehicles are a good choice for those who want to prioritise stability and accessibility over the highest returns. Some of the best options include high-yield savings accounts, money market accounts, and government bonds. These investments offer flexibility, liquidity, and diversification, and your money will be safe and accessible when you need to withdraw it.

The best long-term investments for 2024 include exchange-traded funds (ETFs), dividend stocks, and real estate. ETFs are one of the most popular investments as they enable you to invest in a diversified portfolio of securities. Dividend stocks are also a good option as they have a history of weathering stormy markets better than other stocks. Real estate is another popular long-term investment vehicle, and you can invest in it through real estate crowdfunding platforms or REITs.

Some of the best stocks to buy now include Meta Platforms (META), Goldman Sachs (GS), Granite Construction (GVA), Universal Health Services (UHS), and Booking (BKNG). These stocks have impressive relative strength and strong overall performance.