Active investment managers are professionals who handle and make important decisions related to a portfolio. Active management is an approach to investing where the investor selects the investments that make up the portfolio. Active managers use analytical research, personal judgment, and forecasts to make decisions on what securities to buy, hold, or sell. They rely on various strategies and mathematical techniques to make decisions regarding portfolio management. Active management is often compared to passive management, where investors try to replicate an index. Active management is used in all aspects of investing, including security selection, asset allocation, and sustainability analysis. The goal of active management is to outperform the benchmark index by investing in stocks that are undervalued or have higher potential for growth.

| Characteristics | Values |

|---|---|

| Definition | An approach to investing where the investor selects the investments that make up the portfolio |

| Comparison to Passive Management | Active management is often compared to passive management, where investors try to replicate an index |

| Techniques | Fundamental research, quantitative investing |

| Use Cases | Security selection, asset allocation, sustainability analysis |

| Benefits | Superior returns, customisation, risk management, dividend or interest income, tax planning, mission-based goals |

| Disadvantages | Higher fees, potential for underperformance, human error, excessive trading, turnover risk |

| Strategies | Fundamental analysis, technical analysis, quantitative analysis |

What You'll Learn

Active vs. passive management

Active investment management is an approach to investing where the investor selects the investments that make up the portfolio. Active managers use various techniques to choose investments, including fundamental research and quantitative investing. Active management is used in all aspects of investing, including security selection, asset allocation, and sustainability analysis. It requires a hands-on approach and constant attention, with the goal of outperforming the market or industry benchmarks.

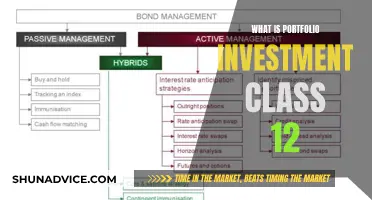

Passive investment management, on the other hand, involves investors selecting investments that are included in a specific index. Passive management is also known as index fund management, as a passive portfolio typically parallels the returns of a particular market index or benchmark. Passive investors tend to buy and hold investments over a long period, limiting the amount of buying and selling within their portfolios. This results in lower fees and costs for the investor.

Active management offers several benefits, including flexibility in investment selection, hedging capabilities, and tax management strategies. However, it also comes with higher fees and may not consistently generate superior returns. On the other hand, passive management offers the advantage of low fees, good transparency, and tax efficiency.

The choice between active and passive management depends on various factors, including the investor's risk tolerance, investment objectives, and personal priorities. Some investors may prefer a blended strategy that combines the benefits of both approaches. Ultimately, the decision should be based on the investor's financial goals and risk appetite.

In summary, active management involves a more hands-on approach with frequent buying and selling, while passive management focuses on replicating the performance of a specific index. Active management aims to outperform the market, while passive management seeks to match the market's performance. Both strategies have their advantages and disadvantages, and the best approach may depend on the investor's specific needs and market conditions.

Understanding Passive Portfolio Investment Vehicles: Strategies and Benefits

You may want to see also

Active management process

Active management is an approach to investing where the investor or a team of professionals actively tracks the performance of an investment portfolio and makes decisions about the assets in it. The active management process can be broken down into four steps:

- Planning: This step involves identifying the investor's objectives, such as risk tolerance, return expectations, liquidity needs, time horizon, tax considerations, and regulatory requirements. Based on these factors, an investment policy statement (IPS) is created, outlining reporting requirements, rebalancing guidelines, investment communication, manager fees, and investment strategy.

- Capital Market Expectation: Active managers need to form expectations about the capital market and make forecasts for the risk-and-return profile of the securities that will form the basis of the portfolio. This step involves analytical research, personal judgment, and forecasts to determine which securities to buy, hold, or sell.

- Execution: In this step, active managers integrate their investment strategies with capital market expectations to select specific securities for the overall portfolio. They optimise the portfolio by combining assets efficiently to achieve the desired return and risk objectives.

- Feedback: This step involves managing exposures to investments by rebalancing the portfolio to ensure it aligns with the IPS. Investors periodically evaluate the portfolio's performance to ensure that investment objectives are met.

Active management is often compared to passive management or index investing. While active management involves actively selecting investments and making buy-sell decisions, passive management follows a more passive approach by replicating a specific market index. Active management aims to generate returns that exceed the overall market performance, while passive management seeks to match the returns of the index.

Understanding Investment Portfolio Activity: A Beginner's Guide

You may want to see also

Advantages of active management

Active management is an approach to investing where the investor selects the investments that make up their portfolio. Active investors aim to generate additional returns by buying and selling investments advantageously. Here are some advantages of active management:

Expertise and Experience

Investors in an actively managed fund benefit from a fund manager's expertise, experience, and judgment. For example, an active manager with extensive experience in the automotive industry might invest in a select group of auto-related stocks that they conclude are undervalued.

Flexibility

Active fund managers have more flexibility in the selection process than index funds, which must closely match the selection and weighting of investments in a specific index. This flexibility allows active investors to tailor the risk of their investments to match their risk tolerance and adjust their portfolios as their personal circumstances change.

Tax Management Benefits

The flexibility of active management allows managers to offset losers with winners, providing benefits in tax management. Additionally, active investors can time the sale of investments with capital gains for tax-planning purposes.

Risk Management

Active fund managers can more nimbly manage risks. For example, during the 2008 financial crisis, active investment managers could have reduced their clients' risk by adjusting their portfolio exposure to the financial sector. Active managers can also use various hedging strategies, such as short selling and derivatives, to mitigate risk.

Tactical Asset Allocation

Active management is beneficial for tactical asset allocation, which involves dynamically adjusting portfolio allocations to capture short-term opportunities and protect investors' capital against risks based on changing market conditions.

Uncovering Hidden Opportunities

Active managers can find opportunities that are likely to outperform the market, especially in volatile and irrational market conditions. They have the flexibility to adapt to changing market conditions, unlike passive managers who must strictly follow a benchmark.

Long-Term Thinking

Active managers can take a long-term view, minimising trading costs and recognising that triggers for share price appreciation may occur over time. Patience can be key to maximising returns.

Building a Million-Dollar Investment Portfolio: Strategies for Success

You may want to see also

Disadvantages of active management

Active investment management is a strategy where investment managers actively make investment decisions, aiming to outperform the market or a specific benchmark. While this approach has its advantages, there are several disadvantages to consider:

Higher Costs

Actively managed funds generally have higher fees than passively managed funds. This is because investors pay for the sustained efforts of investment advisors who specialise in active investment strategies and for the potential for higher returns. Active management fees can range from 0.10% to over 2% of assets under management (AUM). Active money managers may also charge a performance fee between 10% and 20% of the profit they generate. The higher costs of active management can eat into overall investment returns.

Lower Returns

There is no guarantee that active management will always result in higher returns. In fact, active management returns may be lower than those of passive management strategies. Studies comparing active and passive management have shown mixed results, indicating that there is no consensus on which strategy yields better results.

Tax Inefficiency

Active management may be less tax-efficient than passive management due to the frequent buying and selling of investments, which can generate capital gains. However, it is important to note that active managers can employ strategies to mitigate the tax impact, such as offsetting losses with gains.

Minimum Investment Amounts

Active funds often set minimum investment thresholds for prospective investors. For example, a hedge fund might require new investors to make a substantial starting investment, which may not be suitable for all investors.

Inappropriate for Retail Investors

Some active investment strategies may not be appropriate for retail investors. Retail investors typically have different risk tolerances, investment goals, and financial circumstances compared to institutional investors.

Overly Active Trading

Active management involves frequent trading, which can impact overall returns. The costs associated with numerous transactions can accumulate, reducing the net returns for investors.

In conclusion, while active investment management offers potential advantages such as higher returns and flexibility, it is important to carefully consider the disadvantages before deciding on an investment strategy.

Invest Wisely to Secure Grandkids' College Education

You may want to see also

Active management strategies

Active investors use various techniques to identify mispriced investments. Two common techniques are fundamental analysis and quantitative analysis. Fundamental analysis involves analysing the characteristics of individual investments to evaluate their risk and potential return. Quantitative analysis establishes a systematic process for buying and selling investments using data about individual investments.

Active management may be used in all aspects of investing, including security selection, asset allocation, and sustainable investing. Security selection involves choosing individual stocks, bonds, or other investments. Asset allocation determines the allocation of investment among asset classes, such as stocks, bonds, and cash. Sustainable investing involves analysing the impact of environmental, social, and governance (ESG) factors on investments.

Active management provides investors with the potential for higher returns and is more flexible than passive management. It allows investors to tailor the risk of their investments to match their risk tolerance and adjust exposures to reflect existing exposures. Active management also enables investors to emphasise income generation over capital appreciation and time the sale of investments for tax-planning purposes.

The active management process usually involves three steps: planning, execution, and feedback. During the planning step, the investor's objectives and constraints are identified, and an investment policy statement (IPS) is created. The execution step involves forming a capital market expectation and making forecasts for the risk-and-return profile of the securities that will form the basis of the portfolio. The strategic asset allocation is then determined with asset class weights. The feedback step involves managing exposures to investments and periodically evaluating the portfolio's performance to ensure that investment objectives are being met.

Strategies for Joining Investment Firm Portfolios: A Guide

You may want to see also

Frequently asked questions

An active investment manager is a professional who uses an active management approach to handle and make important decisions related to a portfolio of funds. Active managers rely on analytical research, personal judgment, and forecasts to make decisions on what securities to buy, hold, or sell.

Active investment management involves managing an investor’s portfolio by considering all the parameters that could affect an investment, industry, or market. Active managers constantly watch the market and its surroundings, enabling them to make quick buying or selling decisions to give their clients better profits.

Active investment management offers the potential for higher returns, better risk management, quick and accurate decision-making, high responsiveness to the market, and flexibility in investment selection.