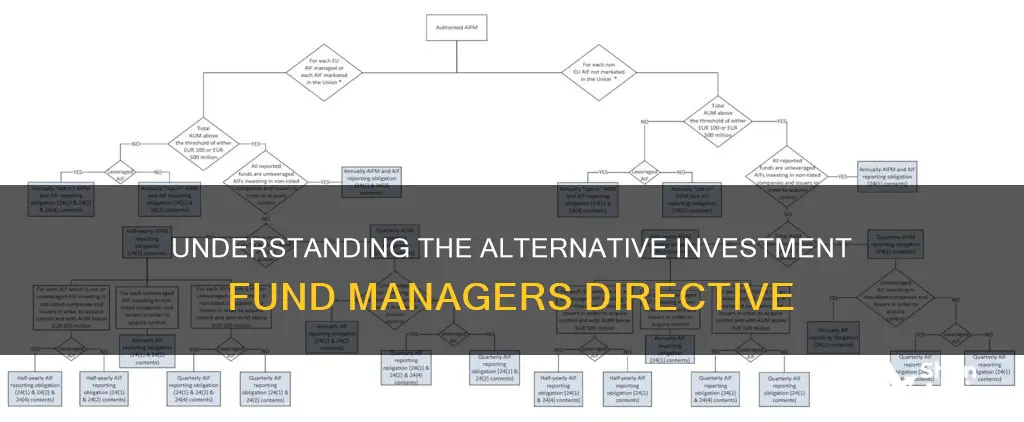

The Alternative Investment Fund Managers Directive (AIFMD) is a regulatory framework that came into force in 2011 and applies to managers of alternative investment funds (AIFMs) in the European Union (EU). The directive aims to protect investors and reduce the systemic risk posed by these funds to the EU economy. It sets standards for marketing, remuneration policies, risk monitoring, reporting, and overall accountability.

The AIFMD was implemented to better regulate alternative investments that were largely unchecked before the 2008-09 global financial crisis. Any manager that operates an alternative investment fund in the EU is subject to AIFMD regulation, regardless of whether the fund is set up within or outside the EU's borders.

The AIFMD has two major objectives:

1. To protect investors by introducing stricter compliance around how and what information is disclosed, including conflicts of interest, liquidity profiles, and independent valuation of assets.

2. To reduce systemic risk by mandating that remuneration policies do not encourage excessive risk-taking, that financial leverage is reported to the European Systemic Risk Board (ERSB), and that funds have robust risk management systems that take liquidity into account.

| Characteristics | Values |

|---|---|

| Type of Directive | European Union (EU) regulation |

| Focus | Alternative investments |

| Goal | Protect investors and reduce systemic risk to the EU and its economy |

| Implementation Date | 22 July 2013 |

| Scope | EU-registered hedge funds, private equity funds, and real estate investment funds |

| Compliance Requirements | Business conduct, minimum capital requirements, marketing efforts, and safeguarding investments |

| Reporting | Reports to be generated, reviewed, and filed by specified deadlines |

What You'll Learn

- The AIFMD regulates alternative investment fund managers and the distribution of alternative investment funds

- The AIFMD aims to protect investors and reduce systemic risk

- The AIFMD requires fund managers to be authorised and transparent

- The AIFMD covers portfolio and risk management, and other functions like depositary, valuation, administration, reporting, and marketing

- The AIFMD applies to EU-registered hedge funds, private equity funds, and real estate investment funds

The AIFMD regulates alternative investment fund managers and the distribution of alternative investment funds

The Alternative Investment Fund Managers Directive (AIFMD) is a European Union (EU) regulation that applies to alternative investments, many of which were left largely unchecked before the 2008-09 global financial crisis. The directive sets standards for marketing around raising private capital, remuneration policies, risk monitoring and reporting, as well as overall accountability.

The AIFMD has two major objectives:

- To protect investors by introducing stricter compliance around how and what information is disclosed. This includes conflicts of interest, liquidity profiles, and an independent valuation of assets.

- To remove some of the systemic risks posed to the EU economy by these types of funds. To do this, the AIFMD mandates that remuneration policies be structured in a way that does not encourage excessive risk-taking, that financial leverage is reported to the European Systemic Risk Board (ERSB), and that the funds have robust risk management systems that take liquidity into account.

The AIFMD was implemented in the EU in 2013. Any manager that operates a fund in the EU is subject to AIFMD regulation, regardless of whether it is set up within or outside the union's borders.

The AIFMD contains many technical requirements, some of which may require significant modifications to operating structures and organisation.

DSP Blackrock Tax Saver Fund: Worth Investing?

You may want to see also

The AIFMD aims to protect investors and reduce systemic risk

The Alternative Investment Fund Managers Directive (AIFMD) is a European Union (EU) regulation that applies to alternative investments, many of which were left largely unchecked before the 2008-09 global financial crisis. The directive sets standards for marketing around raising private capital, remuneration policies, risk monitoring and reporting, as well as overall accountability.

The AIFMD was implemented to better regulate alternative investments that were previously largely unchecked. The directive regulates fund managers rather than the funds themselves. Any manager that operates a fund in the EU is subject to AIFMD regulation, regardless of whether it is set up within or outside the union's borders. The institutional funds that fall under the AIFMD were previously outside of EU financial regulations for disclosure and transparency, including the Markets in Financial Instruments Directive (MIFID), which aimed to boost transparency across the union's financial markets.

The AIFMD has two major objectives:

- To protect investors by introducing stricter compliance around how and what information is disclosed.

- To reduce systemic risk by mandating that remuneration policies be structured in a way that does not encourage excessive risk-taking, that financial leverage is reported to the European Systemic Risk Board (ERSB), and that the funds have robust risk management systems that take liquidity into account.

Investing in a Davis Fund: A Comprehensive Guide

You may want to see also

The AIFMD requires fund managers to be authorised and transparent

The Alternative Investment Fund Managers Directive (AIFMD) is a European Union (EU) regulation that applies to alternative investments, many of which were left largely unchecked before the 2008-09 global financial crisis. The directive sets standards for marketing around raising private capital, remuneration policies, risk monitoring and reporting, as well as overall accountability.

The AIFMD has two major objectives. Firstly, it seeks to protect investors by introducing stricter compliance around how and what information is disclosed. Secondly, it aims to remove some of the systemic risks these funds can pose to the EU economy.

The AIFMD was implemented in the EU in 2013. Any manager that operates a fund in the EU is subject to AIFMD regulation, regardless of whether it is set up within or outside the union's borders. The institutional funds that fall under the AIFMD were previously outside of EU financial regulations for disclosure and transparency, including the Markets in Financial Instruments Directive (MIFID), which aimed to boost transparency across the union's financial markets.

The AIFMD contains many technical requirements, some of which may require significant modifications to operating structures and organisation. Understanding the regulation and its impact can be challenging, especially when there is a lack of detailed guidance.

Researching Investment Funds: A Guide to Getting Started

You may want to see also

The AIFMD covers portfolio and risk management, and other functions like depositary, valuation, administration, reporting, and marketing

The Alternative Investment Fund Managers Directive (AIFMD) covers portfolio and risk management, and other functions like depositary, valuation, administration, reporting, and marketing.

Portfolio and Risk Management

The AIFMD requires the separation of the risk management and portfolio management functions. This means that the AIFM must ensure that these two functions are independent of one another. This is to ensure that the risk management function is performed adequately and that there are no conflicts of interest.

The AIFMD also requires the implementation of a robust risk management framework. This includes establishing a risk management policy, using risk management tools, and identifying and monitoring all risks relevant to each AIF's investment strategy. The AIFM must also ensure that the risk profile of each AIF corresponds to the size, portfolio structure, and investment strategies and objectives of the AIF.

Depositary

The AIFMD requires private funds to appoint a "depositary". The depositary acts as a custodian and a monitor/auditor of the fund. They ensure that the fund's assets are held independently of the investment manager, that the fund's accounting records are reconciled, and that investors' entitlements are correctly calculated. The depositary also ensures the proper monitoring of the AIF's cash flows and the safe-keeping of assets.

Valuation, Administration, and Reporting

The AIFMD requires AIFMs to ensure that a proper and independent valuation of the assets of the AIF is performed. This includes establishing appropriate and consistent procedures for valuation, as well as calculating and disclosing the net asset value per unit or share of the AIF to investors.

The AIFMD also requires AIFMs to use adequate and appropriate human and technical resources for the proper management of AIFs. This includes having sound administrative and accounting procedures, control and safeguard arrangements for electronic data processing, and adequate internal control mechanisms.

Additionally, the AIFMD imposes several reporting and disclosure requirements on AIFMs. They must provide an annual report for each financial year and comply with various transparency requirements.

Marketing

The AIFMD provides conditions under which AIFMs may market the units or shares of AIFs to professional investors in the EU. This includes obtaining authorization from the competent authorities and complying with the AIFMD.

ICICI Prudential Bluechip Fund: Is It Worth Your Investment?

You may want to see also

The AIFMD applies to EU-registered hedge funds, private equity funds, and real estate investment funds

The Alternative Investment Fund Managers Directive (AIFMD) is a European Union (EU) regulation that applies to alternative investments, many of which were largely unregulated before the 2008-2009 global financial crisis. The AIFMD was implemented in 2013 to regulate the fund managers of alternative investment funds, including EU-registered hedge funds, private equity funds, and real estate investment funds.

The AIFMD has two primary objectives. Firstly, it aims to protect investors by introducing stricter compliance around how and what information is disclosed. This includes conflicts of interest, liquidity profiles, and an independent valuation of assets. The directive points out that alternative investment funds are only intended for professional investors, although some member states can choose to make these funds available to retail investors as long as additional safeguards are applied at a national level. Secondly, the directive seeks to reduce some of the systemic risks these funds can pose to the EU economy. To achieve this, the AIFMD mandates that remuneration policies be structured in a way that does not encourage excessive risk-taking, that financial leverage is reported to the European Systemic Risk Board (ERSB), and that the funds have robust risk management systems that take liquidity into account.

Any manager that operates an alternative investment fund in the EU is subject to AIFMD regulation, regardless of whether the fund is set up within or outside the EU's borders. The institutional funds that fall under the AIFMD were previously outside of EU financial regulations for disclosure and transparency, including the Markets in Financial Instruments Directive (MIFID). Compliance with the AIFMD is required to obtain an EU Financial Services Passport (or the UK equivalent).

The AIFMD imposes strict compliance requirements on alternative investment fund managers, including:

- Business conduct, including identifying conflicts of interest, fairness toward investors, full and complete disclosure, risk management, and remuneration

- Minimum capital requirements, including initial capital and total assets under management (AUM)

- Marketing efforts directed solely at investors within the EU

- How investments are safeguarded—through custodians and depositaries

Exploring Commodity Funds: Investment Strategies and Opportunities

You may want to see also

Frequently asked questions

The Alternative Investment Fund Managers Directive (AIFMD) is a European Union (EU) regulation that applies to alternative investments, many of which were left largely unchecked prior to the 2008-09 global financial crisis. The directive sets standards for marketing around raising private capital, remuneration policies, risk monitoring and reporting, as well as overall accountability.

The primary goal of the AIFMD is to protect investors and reduce some of the systemic risk that alternative investment funds can pose to the EU and its economy.

The AIFMD is a regulatory framework that applies to EU-registered hedge funds, private equity funds, and real estate investment funds. The directive regulates the fund managers, rather than the funds themselves.

The first objective is to protect investors by introducing stricter compliance around how and what information is disclosed. The second objective is to remove some of the systemic risks these funds can pose to the EU economy.

Some of the requirements of the AIFMD include business conduct, minimum capital requirements, marketing efforts directed solely at investors within the EU, and how investments are safeguarded.