Financial planning and investment management are both crucial aspects of managing money and achieving financial goals. Financial planning involves assessing an individual's financial situation, providing advice, and creating a comprehensive plan to help them reach their short- and long-term monetary objectives. This can include saving for education, planning for retirement, managing taxes, and insurance. On the other hand, investment management focuses on handling an individual's investment portfolio and involves buying and selling assets, creating short- and long-term investment strategies, tax planning, and managing asset allocation. While financial planning provides a roadmap for an individual's financial journey, investment management executes and monitors the specific investment strategies within that roadmap. Both financial planning and investment management aim to optimize an individual's financial well-being and help them achieve their desired financial milestones.

What You'll Learn

- Investment management is about growing wealth by investing in stocks, bonds and other securities

- Financial planning is about creating a comprehensive plan to achieve short- and long-term goals

- Investment managers make decisions about buying and selling assets to achieve a target return

- Financial planners help individuals and businesses to secure their future and build wealth

- Financial planning is about managing investor behaviour and creating strategies to achieve financial goals

Investment management is about growing wealth by investing in stocks, bonds and other securities

Investment management is a service provided by investment firms or brokers. It involves managing investment portfolios to achieve financial goals. This includes buying, selling, and/or trading securities on behalf of clients. These securities can include stocks, bonds, mutual funds, exchange-traded funds (ETFs), and alternative investments such as hedge funds, private equity, and venture capital.

Investment managers make decisions about where and when to invest their clients' money, with the aim of growing their wealth over time. They consider various factors such as risk level, long-term growth potential, and market volatility to select appropriate investment vehicles.

While investment management focuses specifically on managing investments, it is an essential component of the broader financial planning process. Financial planning involves creating a comprehensive roadmap that aligns an individual's or household's financial choices with their goals and priorities. This includes aspects such as expenses, assets, liabilities, taxes, insurance needs, retirement planning, and estate planning.

Financial planning helps individuals define their financial goals and create a strategy to achieve them. It offers a holistic approach to managing one's financial life, where investments are just one part of the bigger picture. Financial planning is typically done in conjunction with investment management to ensure that the investment strategy aligns with the individual's financial goals and risk tolerance.

In summary, investment management is about growing wealth by investing in stocks, bonds, and other securities, while financial planning provides the framework and direction for those investment decisions. Both work hand in hand to help individuals achieve their financial aspirations.

Car Savings: Invest or Keep?

You may want to see also

Financial planning is about creating a comprehensive plan to achieve short- and long-term goals

Financial planning is a comprehensive process that involves creating a detailed roadmap to help individuals or households achieve their financial goals and objectives. It is a broader concept than investment management, encompassing various aspects of personal finance beyond just investments.

Financial planning typically begins with gathering relevant information and analysing one's overall financial situation, including expenses, assets, liabilities, taxes, insurance needs, and retirement and estate planning. It involves defining short- and long-term financial goals and creating a strategy to reach them. This strategy includes determining how much of one's assets to invest, when, and in what type of investment account.

A comprehensive financial plan is highly customised and tailored to the individual's or household's specific needs, goals, and priorities. It takes into account all areas of one's financial life, such as cash flow planning, debt repayment, saving for a home or education, and retirement planning.

Financial planning also involves regular reviews and adjustments to ensure the plan remains up-to-date and aligned with the individual's or household's evolving financial situation and life changes. It is a dynamic process that guides financial decisions through different life stages.

By creating a comprehensive financial plan, individuals or households can make more informed decisions, gain a sense of confidence in their financial choices, and work towards achieving their short- and long-term financial goals.

Fisher Investments: Understanding the Half-Million Portfolio Strategy

You may want to see also

Investment managers make decisions about buying and selling assets to achieve a target return

Investment managers play a crucial role in helping individuals, trusts, and legal entities grow their wealth. They make well-informed decisions about buying and selling assets to achieve a target return, and this process is known as investment management.

Investment managers are responsible for managing investment portfolios on behalf of their clients. They are well-versed in selecting appropriate investment vehicles, such as stocks, bonds, mutual funds, and alternative investments. Their expertise lies in making strategic decisions about when to buy or sell assets to meet the financial goals of their clients.

When making these decisions, investment managers consider various factors, including asset allocation, diversification, and risk management. They aim to achieve a target rate of return within a given portfolio while managing the inherent risks associated with investing. This involves monitoring market trends, economic conditions, and the performance of different assets to make timely and profitable investment choices.

The role of an investment manager is crucial in helping clients grow their wealth over time. They provide expert guidance and make strategic decisions to ensure that their clients' investments are optimized for growth and aligned with their financial objectives. By actively managing portfolios, investment managers aim to maximize returns while also considering the level of risk their clients are comfortable with.

It is important to note that investment management is just one aspect of an individual's financial strategy. Financial planning, on the other hand, takes a broader approach by addressing various aspects of an individual's financial life, including expenses, taxes, insurance, retirement planning, and estate planning. While investment managers focus on the day-to-day management of investment portfolios, financial planners work with clients to create comprehensive financial plans that incorporate investment strategies as a means to achieve their clients' short-term and long-term financial goals.

Answering Relationship Manager Questions: Investment Management Edition

You may want to see also

Financial planners help individuals and businesses to secure their future and build wealth

Financial planning is a crucial step towards securing your future and building wealth. It is a comprehensive, goal-based process that involves creating and managing a financial plan tailored to your personal or business objectives. This plan takes into account various aspects of your financial life, such as cash flow, tax strategy, risk management, and estate planning.

Financial planners help individuals and businesses secure their future and build wealth in several ways. Firstly, they assist in defining and refining financial goals, whether that be saving for a comfortable retirement, funding a child's education, or purchasing a home. They also help to create a comprehensive roadmap that aligns financial choices with these goals and priorities. This involves determining how much to save or invest and when and where to invest to meet future spending needs.

For businesses, financial planners can offer guidance on complex issues such as advanced charitable planning, multigenerational estate planning, business succession, and family governance. They can also assist in developing strategies to manage risk and protect wealth during significant life or market volatility.

Additionally, financial planners provide investment advice, helping individuals and businesses decide on an investment strategy that suits their risk tolerance and financial objectives. They can also collaborate with investment managers to ensure the chosen strategy is effectively implemented and monitored.

Financial planners offer ongoing support, regularly reviewing and adjusting financial plans as life circumstances and the financial situation evolve. This ensures that individuals and businesses stay on track to achieve their short-term and long-term financial goals, ultimately helping them to secure their future and build wealth over time.

Robinhood Investing: Diversifying Your Portfolio for Beginners

You may want to see also

Financial planning is about managing investor behaviour and creating strategies to achieve financial goals

Financial planning and investment management are often used interchangeably, but they are distinct services with important differences. Financial planning is a comprehensive process that involves gathering information and analysing an individual's or household's overall financial situation, including expenses, assets, liabilities, taxes, insurance needs, retirement planning, and estate planning. It is about managing investor behaviour and creating strategies to achieve financial goals. It is a broader process that goes beyond investments and aims to create a comprehensive roadmap that aligns financial choices with goals and priorities.

Financial planning helps individuals define their goals, dreams, desires, and fears, and create short- and long-term financial goals. It involves developing strategies to help individuals survive significant life volatility and make big life decisions with their money. Financial planning is typically performed by a fiduciary, a financial planner who is legally and ethically bound to put their clients' best interests first.

Financial planning professionals can help individuals create a comprehensive financial plan and stay on track with their financial goals. They can provide guidance on investment strategies, tax planning, college savings, and trust and estate planning. Financial planning is about understanding an individual's economy and creating strategies to achieve financial goals within that context. It is a long-term process that guides financial decisions through different life stages.

In summary, financial planning is a holistic process that focuses on managing investor behaviour and creating strategies to achieve financial goals. It involves understanding an individual's financial situation, goals, and priorities, and developing a comprehensive plan to guide financial decisions and achieve those goals. Financial planning professionals work with individuals to navigate the complexities of their financial journey and make informed decisions to secure their future and build wealth.

Why Service Management is a Smart Investment Strategy

You may want to see also

Frequently asked questions

Financial planning is a comprehensive process that involves creating a financial plan for an individual or business to help them achieve their financial goals. It covers various aspects of personal finance, including expenses, assets, liabilities, taxes, insurance needs, retirement planning, and estate planning.

Investment management involves managing investment portfolios on behalf of individuals, trusts, and other legal entities. Investment managers make decisions about buying, selling, and trading securities to grow the funds of their clients through financial markets.

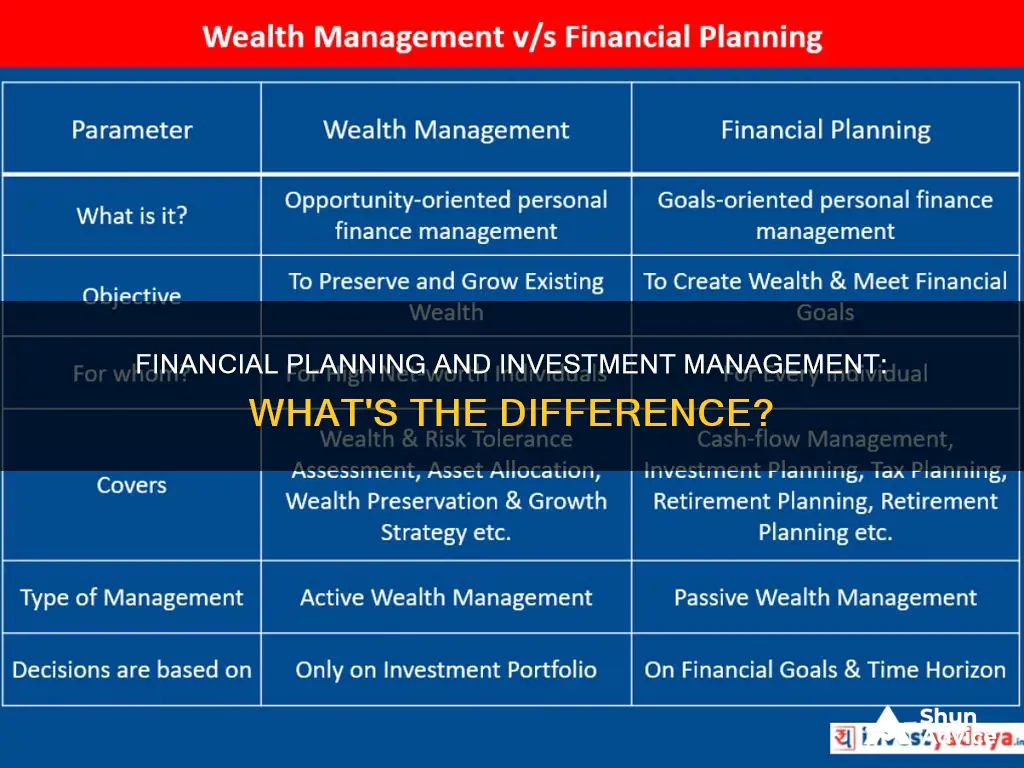

Financial planning is broader in scope and focuses on creating a comprehensive financial plan, whereas investment management specifically focuses on managing investment portfolios and growing funds through various investment vehicles.

Both financial planning and investment management are important for achieving financial goals. Financial planning helps create a roadmap for your financial decisions, while investment management involves executing investment strategies to grow your wealth. The choice depends on your specific needs, goals, and risk tolerance.