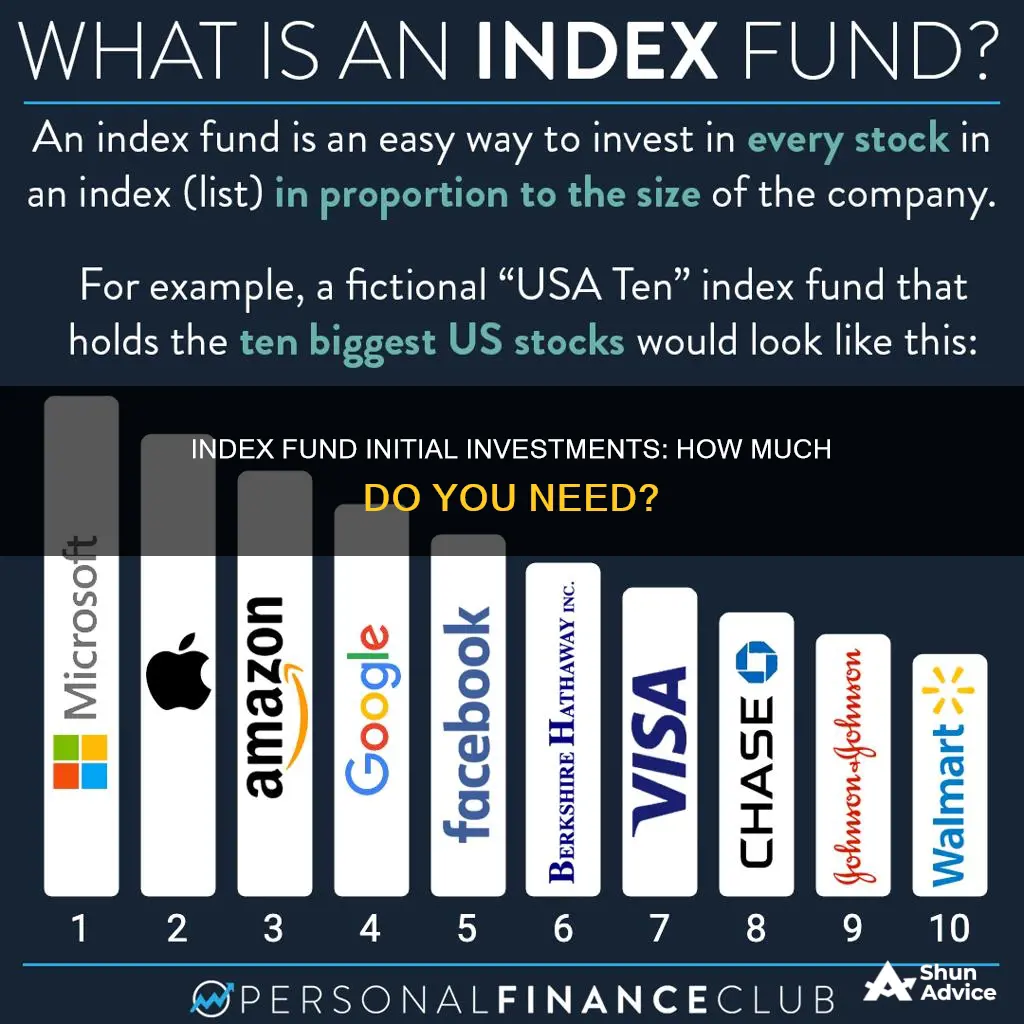

Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. Index funds are defined as investments that mirror the performance of benchmarks like the S&P 500 by mimicking their makeup. They are passively managed and have lower fees than actively managed funds. Index funds are a low-cost, easy way to build wealth and are popular with retirement investors.

| Characteristics | Values |

|---|---|

| Definition | A type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. |

| Benefits | Low fees, tax advantages, low risk, outperforming other types of mutual funds, broad diversification, low transaction costs, tax efficiency, simple, time-tested way to invest, good for beginners |

| Drawbacks | Lack of flexibility, lack of downside protection, lack of control over investment holdings, tracking errors, higher fees than robo-advisors |

| How to invest | Choose your investment platform, open and fund an account, select an index fund, buy shares, monitor and adjust as needed |

| Types | Equity index funds, bond index funds, international index funds, sector-specific index funds |

What You'll Learn

Index funds vs. individual stocks

Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. Index funds are passive investments, meaning they do not involve actively picking securities or timing the market. Instead, they aim to mirror the performance of a specific market index, such as the S&P 500, the Dow Jones Industrial Average, or the Nasdaq Composite Index.

On the other hand, investing in individual stocks involves actively selecting specific stocks or companies to invest in, rather than tracking a market index. This approach can be more risky and requires more research and effort to identify companies with strong fundamentals and growth potential.

When comparing index funds vs. individual stocks, there are several key considerations:

Diversification

Index funds offer built-in diversification by design, as they aim to replicate a market index, which typically includes a broad range of stocks or bonds. This diversification helps to reduce risk, as the performance of the fund is not dependent on the success of a single company. In contrast, investing in individual stocks may provide more concentrated exposure to specific companies or sectors, which can increase risk.

Costs and Fees

Index funds are known for their low costs and expense ratios. Since they are passively managed, they tend to have lower fees compared to actively managed funds. On the other hand, investing in individual stocks may involve higher trading commissions and brokerage fees, especially if you are buying and selling stocks frequently.

Performance

While index funds aim to match the performance of a specific market index, individual stocks can offer the potential for higher returns if you pick the right companies. However, it is important to note that picking stocks that consistently outperform the market is extremely difficult, even for professional investors. According to SPIVA, only 40% of actively managed funds beat or matched the returns of the S&P 500 in 2023.

Control and Flexibility

With index funds, you have less control over the specific stocks or bonds you are investing in, as the fund aims to replicate a predefined market index. In contrast, investing in individual stocks gives you more flexibility to choose the companies and sectors you want to invest in. However, this also requires more time and expertise to make informed investment decisions.

Suitability for Different Investors

Index funds are often recommended for beginner investors or those who prefer a passive investment approach. They are a straightforward and cost-effective way to gain exposure to a diversified portfolio of stocks or bonds. On the other hand, investing in individual stocks may be more suitable for experienced investors who have the time and expertise to research and select individual companies.

In conclusion, the choice between index funds and individual stocks depends on various factors, including your investment goals, risk tolerance, and the amount of time and effort you are willing to dedicate to investing. Index funds offer diversification, low costs, and a passive investment approach, while investing in individual stocks may offer the potential for higher returns but also carries more risk and requires more active management.

Mutual Funds: Invest Now or Later?

You may want to see also

Index funds' pros and cons

Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. They are defined as investments that mirror the performance of benchmarks like the S&P 500 by mimicking their makeup.

Pros

- Lower fees and expenses: Index funds typically have lower expense ratios because they are passively managed. Actively managed funds have large staffs and conduct trades with more complications and volume, driving up costs.

- Market representation: Index funds aim to mirror the performance of a specific index, offering broad market exposure. This is ideal for those looking for a diversified investment that tracks overall market trends.

- Predictable long-term returns: Index funds promise stable returns in the long term. For example, the S&P 500 earned approximately 10% in average annual returns over 90 years.

- Simplicity and convenience: Index funds are readily available at major custodians and workplace retirement plans. They are also a simple, time-tested way to invest and can be a nice backbone to any stock portfolio.

- Tax efficiency: Lower turnover rates in index funds usually result in fewer capital gains distributions, making them more tax-efficient than actively managed funds.

- Historical performance: Over the long term, many index funds have outperformed actively managed funds, especially after accounting for fees and expenses.

- Broad market exposure and diversification: Index funds provide broad market exposure and diversification across various sectors and asset classes according to their underlying index.

Cons

- Lack of flexibility: Index funds are designed to mirror a specific market, so they decline in value when the market does, and they can't pivot away when the market shifts.

- Inability to choose companies in the fund: You might have a say in the types of businesses and industries you invest in, but you cannot pick the companies in the fund.

- High investment minimums: Some index funds demand sizable starting investments. You might have to pay between $1,000 and $10,000 to access the market's best shares.

- Poor risk management: Index funds, by their very nature, track with the market. As such, it’s not possible to fully align your true personal risk tolerance with the risk an index fund introduces.

- Lack of downside protection: In prolonged downtrends, these funds can perform poorly in line with the broader market.

Maximizing HSA Funds for FI: Where to Invest Wisely

You may want to see also

Index funds' fees

Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. They are passively managed, meaning they do not actively pick securities or time the market. This passive management strategy means they are often subject to lower fees than actively managed funds.

Index Fund Fees

Index funds are considered a low-cost investment option, but there are still some fees to be aware of. Here are some of the most common fees associated with index funds:

- Expense ratio: This is one of the main costs of an index fund. It is a percentage of assets under management used to pay advisors and managers and cover transaction fees, taxes, and accounting costs. Expense ratios for index funds are typically low, ranging from 0.03% to 0.05% on average.

- Sales load: This is a commission charged by some funds when buying or selling the fund. It can be avoided by choosing investor-friendly fund companies such as Vanguard, Charles Schwab, or Fidelity.

- Account minimum: This refers to the minimum amount required to open an investment account, such as a brokerage account, IRA, or Roth IRA. This is separate from the investment minimum required by the index fund itself.

- Trading costs: Some brokers charge a commission or transaction fee for buying or selling index funds, especially for mutual funds. However, many brokers now offer commission-free trading for ETFs.

- Capital gains taxes: If held outside of tax-advantaged accounts such as a 401(k) or IRA, index funds may trigger capital gains taxes.

When investing in index funds, it is important to consider the fees and expenses associated with the fund. Lower fees can result in higher returns over time. It is also essential to understand the different types of fees that may be charged and how they can impact your investment returns.

A Beginner's Guide to Mutual Funds in Pakistan

You may want to see also

Index funds' risks

Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. While index funds are a popular investment strategy, they are associated with certain risks that investors should be aware of. Here are some key risks associated with index funds:

- Lack of Downside Protection: Index funds provide exposure to the upside of the market but also leave investors vulnerable to downturns. During market corrections or crashes, investors with heavy exposure to stock index funds can face significant losses.

- Lack of Reactive Ability: Index funds do not allow for proactive adjustments when certain stocks become overvalued. In such cases, astute investors would typically want to reduce their portfolios' exposure, but index funds lack the flexibility to make such timely changes.

- No Control Over Holdings: Index funds are set portfolios, and investors have no control over the individual holdings. This lack of control may be undesirable for investors who want to invest in specific companies they believe in or avoid companies that conflict with their values or principles.

- Limited Exposure to Different Strategies: Index funds primarily focus on market indexes and may not provide access to other successful investment strategies. Investors who conduct their own research may be able to identify better investment opportunities beyond the scope of the index fund.

- Dampened Personal Satisfaction: Investing in index funds can still be stressful during market volatility. Investors may constantly monitor the market's performance and worry about economic conditions without the satisfaction of making their own investment decisions.

- Tracking Error: An index fund may not perfectly track its target index, especially if it only invests in a sample of the securities in the index. This discrepancy can lead to the fund's performance deviating from the expected returns of the index.

- Underperformance: Index funds may underperform their target indexes due to fees, expenses, trading costs, and tracking errors. Over time, these factors can impact the overall returns of the fund.

- Limited Flexibility: Index funds are designed to mirror the performance of a specific market index, and they lack the flexibility to pivot away from underperforming sectors or companies. This inherent lack of flexibility can result in declines in the value of the fund during market downturns.

Best Vanguard Funds for Your First Investment

You may want to see also

How to invest in index funds

Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. They are a low-cost, easy way to build wealth and are ideal for long-term investing, such as retirement accounts.

- Have a goal: Before investing in index funds, it is important to know what you want to achieve with your money. Index funds are suitable if you are looking to grow your money slowly over time, especially if you are saving for retirement.

- Research index funds: There are various types of index funds, so it is important to understand their differences before investing. Some common types include broad market, sector, domestic, international, bond, dividend, socially responsible, growth, and value index funds.

- Pick your index funds: When choosing an index fund, consider factors such as company size and capitalization, geography, business sector or industry, asset type, and market opportunities. Compare the costs and investment minimums of different funds, as these can vary significantly.

- Decide where to buy your index funds: You can purchase index funds directly from a mutual fund company or a brokerage, or through a robo-advisor. Consider factors such as fund selection, convenience, trading costs, impact investing, and commission-free options when choosing a provider.

- Open an investment account: To purchase shares of an index fund, you will need an investment account such as a brokerage account, individual retirement account (IRA), or Roth IRA. Compare different brokers based on the number of index funds available, their overall fees, and the user-friendliness of their platform.

- Fund your account and buy shares: Transfer money into your investment account and use it to buy shares of your chosen index fund(s).

- Monitor your index funds: While index funds are passive investments, it is important to periodically review their performance to ensure they are meeting your financial goals. Check that your index fund is mirroring the performance of its underlying index and be mindful of any fees that may accumulate over time.

By following these steps, you can effectively invest in index funds and take advantage of their benefits, which include low fees, diversification, tax efficiency, and solid long-term returns.

Understanding AIFMD's Alternative Investment Fund Definition

You may want to see also

Frequently asked questions

An index fund is a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them.

Index funds are a low-cost, easy way to build wealth. They are passively managed, which means they don't need to actively decide which investments to buy or sell. They are also well-diversified, reducing the risk of losing money.

One drawback of index funds is that they rise and fall with the market. If you have a fund that tracks the S&P 500, for example, you will be vulnerable when the market drops. Index funds also lack the flexibility to pivot away from a declining market.