A model portfolio is a combination of managed investment funds that are grouped together to achieve an expected return with a corresponding risk based on extensive research. These portfolios blend asset classes, investment managers, and investment strategies to achieve diversification.

Model portfolios are a great option for investors who may not understand the industry very well and have little idea of which funds to invest in. They allow investors to diversify their assets and use simple and effective investment methods that require minimal management effort.

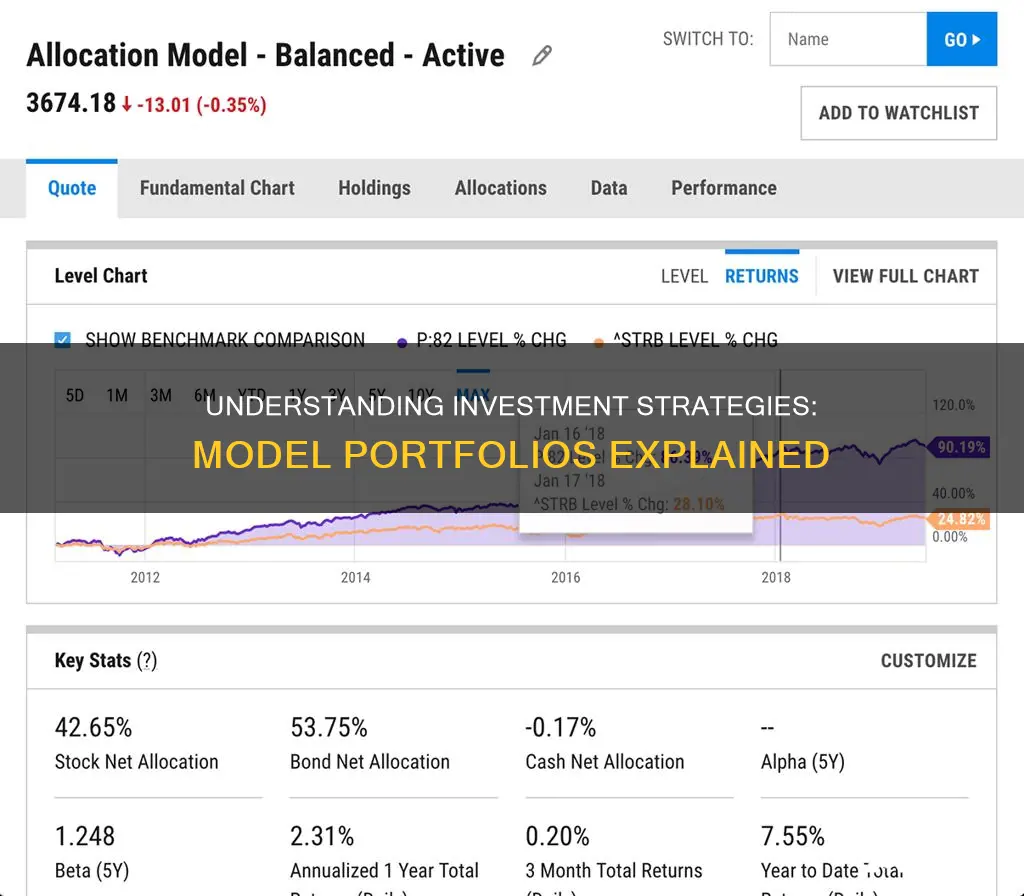

Financial advisors or investment managers offer a variety of model portfolios to correspond with an individual's financial goals and objectives.

| Characteristics | Values |

|---|---|

| Definition | A series of predefined asset allocation pie charts in which a recommended mix of different asset classes are proposed based on a client’s risk tolerance. |

| Management | The funds within the model portfolio are held by the investor directly and invested via an investment platform but managed and rebalanced by the financial advisor on behalf of the investor. |

| Advantages | Efficient management, diversification, tracking performance, rebalancing |

| Disadvantages | The investor has no control, performance is not guaranteed, additional costs |

| Benefits for the advisor | Easier to manage, ability to act fast, a solution for every client |

| Considerations | Client's needs and risk appetite, type of investment |

What You'll Learn

- Model portfolios are a combination of managed investment funds that aim to achieve an expected return with a corresponding risk

- Model portfolios are designed to help investors streamline and scale their practice, allowing them to focus on other activities like planning and client engagement

- Model portfolios are beneficial for investors who may not understand the industry well and have little idea about which funds to invest in

- Model portfolios can be adapted to the needs of the investor, for example, a conservative model for those averse to risk

- Model portfolios can be used to achieve different financial goals, such as income generation or enhanced total return

Model portfolios are a combination of managed investment funds that aim to achieve an expected return with a corresponding risk

One of the key advantages of model portfolios is efficient management. Financial advisors can quickly implement changes across all their clients' accounts, making it easier to adapt to market conditions. This also simplifies performance tracking for investment advisory firms, as analysts only need to track a smaller number of funds. Model portfolios also offer diversification by blending different asset classes and fund managers, reducing overall portfolio risk.

When considering a model portfolio, it's important to evaluate the client's needs and risk appetite. Financial advisors typically offer a range of model portfolios, from conservative to aggressive, to match different risk tolerances and financial goals. For example, a conservative model portfolio might be suitable for someone averse to risk, while an aggressive model portfolio might be aimed at investors with a higher risk tolerance.

While model portfolios provide a simplified investment approach, it's important to remember that investors lose a degree of control over their asset management decisions. The performance of a model portfolio is also not guaranteed, and additional fees may be incurred for the financial advisor's services.

Savings vs Investments: When Does Saving Trump Spending?

You may want to see also

Model portfolios are designed to help investors streamline and scale their practice, allowing them to focus on other activities like planning and client engagement

Model portfolios are a series of predefined asset allocation strategies, where a recommended mix of different asset classes is proposed based on a client's risk tolerance. These portfolios are automatically rebalanced according to changing market conditions or client circumstances.

Additionally, model portfolios offer the advantage of diversification. They blend various asset classes, investment managers, and investment strategies to reduce overall portfolio risk. This diversification not only applies to asset classes but also to fund managers, further lowering risk.

The use of model portfolios also simplifies the process of tracking performance and analysing investments. With a model portfolio, analysts only need to track a smaller number of funds, as most investors are exposed to the same funds. This allows analysts to spend more time on in-depth analysis, potentially contributing to improved client investment performance.

Furthermore, model portfolios enable investors to make changes and adjustments more efficiently. If a particular investment is underperforming, investors can quickly switch it out by advising the investment platform to activate the change within the model. This streamlined process enhances the overall management of client investment accounts.

In conclusion, model portfolios provide investors with a powerful tool to streamline their practices, increase efficiency, and focus on client-centric activities. By utilising model portfolios, investors can better serve their clients while also having the flexibility to customise investment strategies to meet individual needs and goals.

Private Savings: Excluding Investments for a Secure Future

You may want to see also

Model portfolios are beneficial for investors who may not understand the industry well and have little idea about which funds to invest in

Model portfolios are a great option for investors who are new to investing and don't fully understand the industry. They are a diversified group of assets designed to achieve an expected return with a corresponding risk. They are based on extensive research and are managed by financial advisors or investment managers.

Model portfolios can be beneficial for investors who don't understand the industry well because they:

- Allow for efficient management: Model portfolios allow financial advisors to manage their clients' investment accounts more efficiently. They can implement changes quickly if market conditions change, and they only need to issue a single instruction to a Link Investment Service Platform when a fund switch is required, rather than submitting a separate instruction for each client account. This makes the process simpler and reduces the risk of errors.

- Provide diversification: Model portfolios blend different asset classes, investment managers, and investment strategies to achieve diversification, which helps to reduce overall portfolio risk. Diversification is a strategy that involves distributing funds across multiple financial vehicles, asset categories, and industries to reduce the risk of loss. By investing in a variety of securities in different industries, investors can avoid a large loss if a particular event occurs that affects one industry.

- Simplify performance tracking: Model portfolios make it simpler for investment advisory firms to analyse and track the performance of the underlying funds. Analysts only need to track a smaller number of funds because most investors are exposed to the same funds. This allows analysts to spend more time analysing the funds and contribute to the overall performance of the client's investment.

- Offer a range of options: Financial advisors typically offer a variety of model portfolios to meet the different financial needs and risk appetites of their clients. For example, they may offer conservative, moderate, and aggressive model portfolios. This allows investors to choose an option that aligns with their risk tolerance and financial goals.

- Save time and effort: Model portfolios streamline the investment process for both investors and financial advisors. Investors can use simple and effective investment methods that require minimal management effort, while financial advisors can save time by not having to build each client portfolio from scratch. This frees up time for more meaningful conversations and allows advisors to focus on client relationships and retention strategies.

- Provide access to expert knowledge: Model portfolios are usually designed by knowledgeable experts in the industry, such as financial advisors and investment managers. These professionals use their professional analysis and extensive research to create detailed investment strategies and select the assets for each portfolio. They also monitor and review the portfolios regularly to ensure they are meeting benchmarks and performing at an acceptable level.

Investment-Led Growth: Impact on National Savings and Economy

You may want to see also

Model portfolios can be adapted to the needs of the investor, for example, a conservative model for those averse to risk

Model portfolios are designed to help investors achieve their financial goals. They are a collection of investments held by an individual or institution, with the aim of generating returns over time while managing risk. The benefit of model portfolios is that they can be adapted to the needs of the investor.

For example, an investor who is averse to risk may prefer a conservative model portfolio with a larger share of safer fixed-income assets, such as bonds and money market funds, to protect against losses. This type of portfolio is more suitable for those with short-term financial goals, such as buying a house in the next year, and for those who are nearing retirement.

On the other hand, an investor with a higher risk tolerance and a long-term investment time horizon may opt for a growth portfolio, which consists mostly of stocks that are expected to appreciate over the long term. This type of portfolio has the potential for higher returns but also comes with greater risk.

The flexibility of model portfolios allows investors to choose a strategy that aligns with their financial goals, risk tolerance, and time horizon. By understanding their investment objectives and preferences, investors can select a model portfolio that best suits their needs.

Rajiv Gandhi Equity Savings Scheme: A Smart Investment Move

You may want to see also

Model portfolios can be used to achieve different financial goals, such as income generation or enhanced total return

Model portfolios are designed to help investors achieve their financial goals. They are like templates that aim to deliver a set return for a given risk profile. These portfolios can be used to achieve different financial goals, such as income generation or enhanced total return.

Income generation is a key goal for many investors, especially those in or nearing retirement. Model portfolios can help generate a steady stream of income through dividend-paying stocks and coupon-yielding bonds. These investments provide regular payouts to investors, ensuring a consistent income stream.

For investors seeking enhanced total return, model portfolios can offer a mix of growth and income-generating assets. Growth-oriented portfolios typically include a larger proportion of high-risk, high-earning growth stocks, which aim for capital appreciation over the long term. On the other hand, income-oriented portfolios may have a larger share of dividend-paying stocks and bonds, providing a balance between income generation and capital preservation.

Additionally, model portfolios can be tailored to an investor's specific needs and risk tolerance. They can incorporate various asset classes, such as stocks, bonds, real estate, and commodities, and can be managed according to set rules by a professional management team. This diversification helps to lower the overall risk of the portfolio while still pursuing the desired financial goals.

By utilising model portfolios, investors can benefit from the expertise of professional investment managers, who make investment decisions based on extensive research and analysis. This can lead to better investment outcomes and help investors stay on track to achieve their financial objectives.

Savings Glut: When Saving Outpaces Investment

You may want to see also

Frequently asked questions

A model portfolio is a combination of managed investment funds that are grouped together to achieve an expected return with a corresponding risk based on extensive research. These portfolios blend asset classes, investment managers, and investment strategies to achieve diversification. The funds within a model portfolio are held by the investor directly and are invested via an investment platform but managed and rebalanced by a financial advisor on behalf of the investor.

There are several advantages to investing in a model portfolio, including efficient management, diversification, and simplified performance tracking. Model portfolios allow for better management of investor accounts by advisory practices, as they can implement changes quickly in response to changing market conditions. Additionally, model portfolios can include different asset classes and fund managers, reducing overall portfolio risk. They also simplify the process of tracking performance, as analysts only need to track a smaller number of funds since most investors are exposed to the same funds.

One significant disadvantage of model portfolios is the loss of control over asset management. When investing in a model portfolio, investors hand over control of their money to a financial advisor, which may be uncomfortable for some. Additionally, model portfolios may include additional fees for the financial advisor's time, expertise, and investment selection. Lastly, there is no guarantee of performance, even with professional management.