Mutual funds are a great way to get started with investing. They are a collection of investment assets packaged as a single investment, allowing investors to pool their money to invest in a diverse portfolio of stocks, bonds, or other assets.

When investing in mutual funds, it is important to understand the difference between actively and passively managed funds. Actively managed funds employ managers who select investments for the fund, while passively managed funds track a benchmark index, such as the S&P 500.

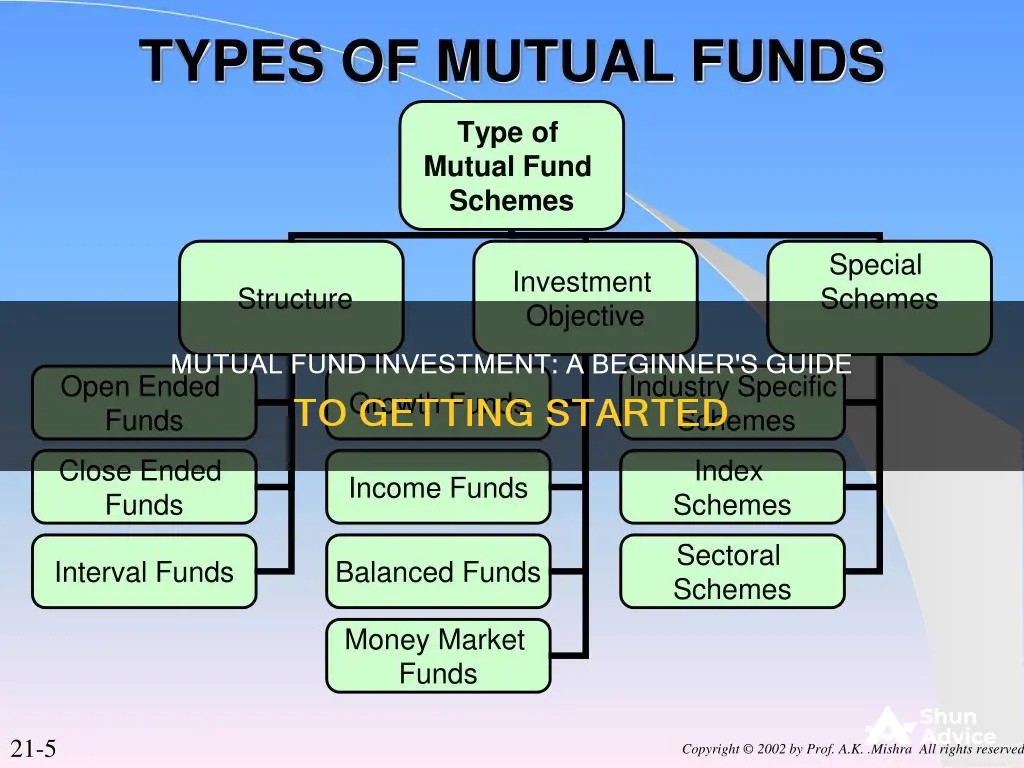

There are also different types of funds, such as open-ended and closed-ended funds. Open-ended funds have no limit on the number of shares that can be issued, while closed-ended funds have a set number of shares, usually determined during the initial public offering (IPO).

When choosing a mutual fund, it is essential to consider your financial goals, time frame, and risk tolerance. Diversified equity funds, equity-linked savings schemes, and sector funds are some options available to investors.

Additionally, mutual funds have fees and costs associated with them, such as expense ratios and sales loads, which are important to understand as they can impact your investment performance.

By understanding the basics of mutual funds, you can make informed decisions about your investments and work towards achieving your financial goals.

| Characteristics | Values |

|---|---|

| Type of fund | Open-ended or closed-ended |

| Investment strategy | Actively or passively managed |

| Investment assets | Stocks, bonds, commodities, real estate, tax-free government or municipal bonds, etc. |

| Investment goals | Wealth creation, tax savings, achieving financial goals, retirement, child's education, current income, etc. |

| Risk tolerance | Depends on age, occupation, number of dependents in the family, etc. |

| Investment amount | Minimum investments of $1,000 to $5,000 |

| Investment frequency | Systematic investment plans (SIPs) or automated monthly investments |

| Diversification | Different stocks, debt, gold, etc. |

| Fund selection | Based on investment philosophy, consistency in returns, financial goals, time frame, risk tolerance, etc. |

| Fund analysis | No-load funds with low expense ratios |

| Fund management | Actively or passively managed |

What You'll Learn

Active vs. passive funds

Passive investing is a long-term strategy that involves buying and holding investments with minimal portfolio turnover. It is a more hands-off approach where investors buy a basket of stocks and continue to buy or sell regularly, regardless of market performance. This strategy is often employed by those who cannot devote a lot of time to research and trading. Passive investors tend to rely on fund managers to ensure their investments are performing well and expect them to replace declining holdings.

Passive funds are usually indexed funds that track a major index like the S&P 500 or Dow Jones Industrial Average (DJIA). These funds automatically adjust their holdings whenever the indices they follow change their constituents. Passive funds offer benefits such as ultra-low fees, good transparency, and are tax-efficient due to their buy-and-hold strategy. However, they may offer limited investment options, small returns, and investors have less control over their specific investments.

On the other hand, active investing takes a more hands-on approach, requiring investors to actively monitor and adjust their portfolios based on market performance. Active investors research and closely follow companies, buying and selling stocks based on their predictions about future performance. This strategy is more suitable for professionals or those with the time and resources to devote to research and trading.

Active funds are managed by portfolio managers who aim to beat the market's average returns and take advantage of short-term price fluctuations. They have the flexibility to buy any investment that meets their criteria and can use hedging strategies to manage risk. However, active funds tend to be more expensive due to higher transaction costs and analyst team salaries. Additionally, active funds are subject to management risk, as fund managers can make costly mistakes.

Historically, passive funds have outperformed active funds and have attracted more investment inflows. However, during market upheavals, active funds may become more attractive to investors. Ultimately, the decision to choose between active and passive funds depends on an investor's risk tolerance, investment goals, and the time and resources they can devote to managing their portfolio.

IRA and Mutual Funds: A Smart Investment Strategy

You may want to see also

Expense ratios and other costs

Expense ratios are a key consideration when investing in mutual funds. These are the ongoing fees and expenses for the fund, expressed as a percentage of the fund's assets. For example, a 1% expense ratio means you pay $100 in annual fees for every $10,000 invested. Passive mutual funds or index funds tend to have lower expense ratios, typically ranging from 0.03% to 0.25%, as they are not actively managed and do not have to compensate fund managers. On the other hand, active mutual funds tend to have higher expense ratios, usually ranging from 0.5% to 1.25%, as they incur higher costs for investment managers' expertise and active trading.

It is important to note that load fees, a type of commission, can also impact your investment. Front-end loads are charged when you initially buy shares in the fund, while back-end loads are charged if you sell your shares within a certain timeframe after purchasing them. These loads can be quite costly, ranging from 4% to 8% of your investment, so it is generally advisable to avoid mutual funds with sales loads. Instead, consider no-load funds, which do not charge broker commissions and sales charges, potentially resulting in higher returns over time.

When investing in mutual funds, it is crucial to understand all the associated fees and charges. These fees can vary significantly and have a substantial impact on the performance of your investment. By opting for funds with lower expense ratios and avoiding unnecessary load fees, you can maximize your returns and minimize the drag on your investment performance.

Financial Sector Funds: Invest or Avoid?

You may want to see also

Sales load

A sales load is a type of commission or sales charge paid by investors when buying or redeeming shares in a mutual fund. These fees are paid to brokers or agents who sell the fund to the investor.

There are two main types of sales load: front-end loads and back-end loads. Front-end loads are incurred at the time of purchase, with fees ranging from 4% to 8% of the amount invested in the fund. Back-end loads are incurred when investors sell their fund shares and may taper off over time, eventually reaching zero after a certain period, often 10 years or more.

It is important for investors to understand the fees and charges associated with mutual funds, as they can have a significant impact on the performance of their investment.

Climate Change Mitigation: Investing for a Sustainable Future

You may want to see also

Asset allocation

There are three types of asset allocation mutual funds:

- Balanced funds: These funds invest in a fairly even split of equity and fixed-income securities, usually 60% equity and 40% fixed income. They typically aim to generate income while preserving capital.

- Aggressive asset allocation funds: These funds generally invest more in equities than fixed-income securities and are aimed at capital appreciation or growth. They are more suited to investors with a higher risk tolerance.

- Conservative asset allocation funds: These funds hold more in fixed-income securities than equities and may also invest in dividend-paying equities. They often aim to achieve a high level of income.

When selecting an asset allocation mutual fund, investors should consider the amount of risk they are willing to take. Funds allocating a higher percentage to equities typically carry more risk than those with a higher allocation of fixed-income securities.

Hedge Funds: Investment Pool or Something More?

You may want to see also

Risk tolerance

When assessing risk tolerance, it is important to consider factors such as age, financial position, and investment goals. Younger investors tend to have a higher risk tolerance as they can afford to take on more risk in the pursuit of superior returns. However, older investors or those nearing retirement may have a lower risk tolerance and prefer more stable investments.

Additionally, it is crucial to understand the impact of risk tolerance on investment choices. For instance, investors with a low-risk tolerance may opt for bond funds that invest in highly-rated government or corporate bonds, or money market funds. On the other hand, investors with a higher-risk tolerance may seek higher returns by investing in high-yield stock and bond funds.

It is worth noting that risk tolerance is a personal assessment, and each individual's tolerance for risk may vary based on their unique circumstances. Therefore, it is essential to carefully consider one's financial goals, time horizon, and comfort level with market volatility when determining their risk tolerance.

Mutual Fund Value Investing: Where Does Your Money Go?

You may want to see also

Frequently asked questions

A mutual fund is a collection of investment assets packaged as a single investment. Money from many investors is pooled together and invested in stocks, bonds, commodities, or real estate. An investor buys shares in the mutual fund, representing an ownership interest in a portion of the fund's assets.

In the US, there are three popular ways to buy shares in a mutual fund: through a broker, a mutual fund company, or a retirement plan (from an employer or a 401(k)).

A sales load is a type of commission charged by some mutual funds. There are front-end loads (paid when you buy), back-end loads (paid when you sell), deferred loads, and declining loads.

You should consider your risk tolerance, expense ratio, and investment philosophy. It's also important to know your financial goals and time frame. Diversified equity funds, equity-linked savings schemes, and balanced funds are a good choice for beginners.