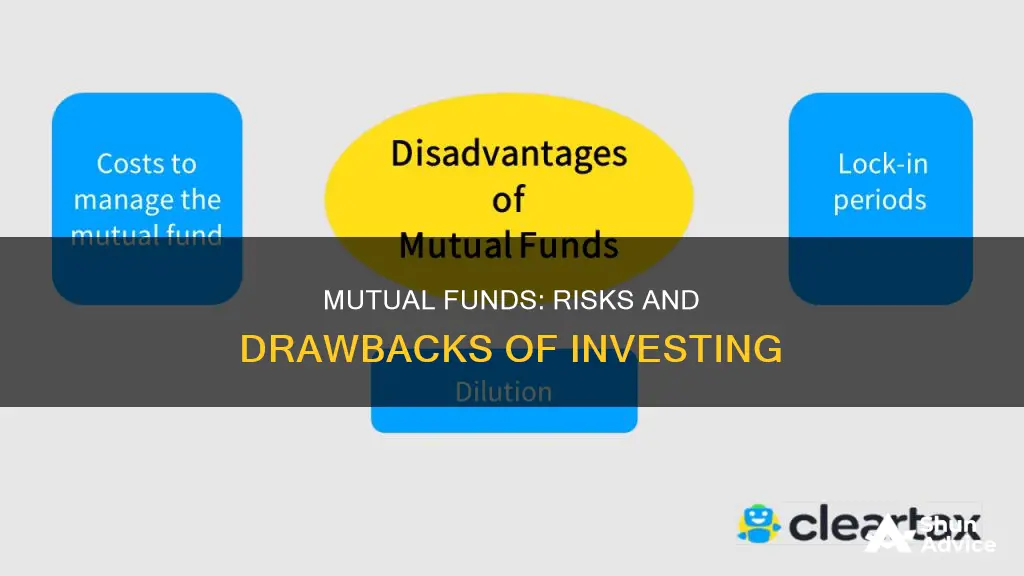

Mutual funds are a popular investment choice, allowing investors to pool their money and have it professionally managed. They offer many advantages, such as advanced portfolio management, risk reduction, and convenience. However, there are also disadvantages to investing in mutual funds. One of the main disadvantages is the fees associated with these investments, including high expense ratios, sales charges, and management fees. These fees can eat into overall investment returns and should be carefully considered before investing. Additionally, mutual funds may also have tax inefficiencies, poor trade execution, and the potential for management abuses. It is important for investors to understand the specifics of their budget, timeline, and profit goals when deciding if mutual funds are the right choice for them.

| Characteristics | Values |

|---|---|

| High fees | High expense ratios and sales charges |

| Tax inefficiency | Uncontrollable tax events |

| Poor trade execution | Traded only once per day |

| Management abuses | Churning, turnover, window dressing |

High fees

In addition to expense ratios, mutual funds may also charge sales loads or commissions, further increasing the cost of investing. These fees can vary depending on the fund and the method of purchase, such as through a financial advisor or stockbroker. It is important for investors to carefully review and compare the fees associated with different mutual funds before making investment decisions.

Another fee to consider is the operating expense ratio, which covers the fund's operational costs and is based on a percentage of the fund's assets. According to financial services company Morningstar, the average expense ratio for actively managed mutual funds in 2022 was 0.59%, or $59 for every $10,000 managed. This is significantly higher than the average expense ratio for passively managed funds, which was 0.12%.

Additionally, mutual funds may charge 12b-1 fees, which are annual fees used for sales, marketing, employee bonuses, or shareholder services. These fees can be up to 1% of the fund's assets.

Venture Funds That Invested in Theranos: A Comprehensive List

You may want to see also

Poor trade execution

Mutual funds are executed by the fund company rather than traded on the secondary market. An investor can enter a trade order through a broker, a brokerage, an advisor, or directly through the mutual fund. The trade order will then be executed at the next available NAV, which is determined after the market closes each trading day. The NAV is the fund's market value on a per-share basis and is calculated by adding up the cash and the closing prices of each security in the fund's portfolio, subtracting any liabilities, and then dividing the result by the total number of outstanding shares.

The settlement period for mutual fund transactions varies from one to three days, depending on the type of fund. Money that a customer owes must be available in their account to cover the shares purchased by the trade settlement date. Mutual fund trades may be subject to various fees, including loads (paid to a broker or advisor), transaction fees, and expense ratios.

Index Funds: Utopia or Dystopia for Investors?

You may want to see also

Tax inefficiency

Mutual funds are a popular investment choice, especially in the US, where they allow investors to pool capital into a professionally managed investment vehicle. However, one of the disadvantages of investing in mutual funds is tax inefficiency.

Mutual funds are considered one of the least tax-efficient investment tools, and with over half of American households owning mutual funds, investors need to be cautious of the potential tax issues.

Mutual funds are required to distribute all their net gains to shareholders at least once a year, and these distributions fall into two categories: dividend distributions and capital gains distributions.

Dividend Distributions

Dividend distributions occur when a fund receives a payoff from dividend-bearing stocks and interest-bearing bonds. These distributions are typically taxed at the higher ordinary income tax rate, increasing an investor's tax bill.

Capital Gains Distributions

Capital gains distributions are generated when a fund manager sells fund assets for a net gain. For example, if a fund invested $100,000 in a stock and then sold all its shares for $110,000, the 10% profit is considered a capital gain.

The tax rate applied to capital gains depends on the length of time the fund has held the assets. Only gains from assets held for a year or more are taxed at the capital gains rate, which is lower than the ordinary income tax rate.

Turnover Ratio

The turnover ratio of a mutual fund refers to the frequency with which it buys and sells securities. Funds with high turnover ratios generate mostly short-term gains, which are taxed at the ordinary income tax rate.

Mutual funds with lower turnover ratios and assets at least one year old are taxed at the lower capital gains rate.

Taxable Events

Mutual funds have more "taxable events" than other investment vehicles like ETFs. Mutual fund managers need to constantly rebalance the fund by selling securities to accommodate shareholder redemptions or reallocate assets, creating capital gains for shareholders.

Tax Mitigation Strategies

Mutual fund managers can employ strategies such as carrying forward capital losses from previous years and tax-loss harvesting to reduce the impact of annual capital gains taxes. Additionally, index mutual funds are more tax-efficient than actively managed funds due to their lower turnover.

Tax-Free Funds

To optimise tax efficiency, investors can choose mutual funds that include investments in government or municipal bonds, which generate interest not subject to federal income tax. These funds are often referred to as tax-free funds.

Tax Complexity

The taxation of mutual funds can be complex, and it's important for investors to understand the potential tax implications before investing. Consulting a financial advisor or tax professional can help investors make informed decisions and navigate the complexities of mutual fund taxation.

Investment Funds: Exploring Their Investment Boundaries

You may want to see also

Management abuse

One form of management abuse is excessive trading, also known as churning. This occurs when the fund manager engages in unnecessary or excessive buying and selling of securities, generating higher transaction costs and potentially reducing the fund's performance. This practice can be detrimental to investors, as it increases expenses and may not always lead to better returns.

Another form of management abuse is turnover, where fund managers excessively replace securities in the portfolio. This can be done to improve the appearance of the fund's performance, as it allows managers to sell underperforming investments and replace them with more promising ones. However, it can also lead to increased costs and may not always result in better returns for investors.

Window dressing is another tactic that fund managers may employ to enhance the appearance of the fund's performance. This involves selling underperforming securities before the end of a quarter or reporting period and replacing them with more successful investments. While this can make the fund's portfolio look more attractive to potential investors, it does not accurately reflect the fund's actual performance over the entire period.

Additionally, fund managers may engage in poor trade execution, which can negatively impact investors. This occurs when the timing of trades is not optimal, resulting in lower returns. For example, if a fund manager places trades too early or too late in the day, investors may receive a different price than expected, potentially impacting their profits.

It's important for investors to be aware of these potential abuses and to carefully research and monitor the activities of fund managers to ensure their investments are being managed responsibly and in their best interests. While mutual funds offer the advantage of professional management, it's crucial to remember that the performance of the fund depends on the manager's skill and integrity.

Mutual Fund Investment Objectives: Strategies and Goals

You may want to see also

High expense ratios

Expense ratios can significantly impact your returns. A fund with a high expense ratio could cost you 10 times what you might otherwise pay, or more. Generally, any expense ratio higher than 1% is considered high and should be avoided. Over an investing career, a low expense ratio could easily save you tens of thousands of dollars.

However, many investors choose to invest in funds with high expense ratios if it's worth it for them in the long run. It's important to note that expense ratios have been declining for years, with many passive funds offering expense ratios below 0.10%.

When comparing expense ratios, it's important to compare funds of the same type and investment approach. Actively managed funds will always be more expensive than passively managed funds.

While expense ratios are an important consideration, there are other costs to take into account, such as administrative fees, mutual fund sales loads, and commissions on stock trades.

Tips Funds: A Guide to Smart Investing

You may want to see also

Frequently asked questions

High fees are not an advantage of investing in mutual funds. Mutual funds can have high expense ratios, sales charges, and management fees. These fees can eat into your overall investment returns.

Uncontrollable tax events are not an advantage of investing in mutual funds. When a mutual fund sells securities from its portfolio, it may trigger taxable investment income for investors. This can result in a higher-than-expected tax bill at the end of the year.

Lack of control is not an advantage of investing in mutual funds. Some investors prefer to be involved in trades and investment decisions. With a mutual fund, a fund manager makes these decisions on your behalf, and you may not have voting rights.