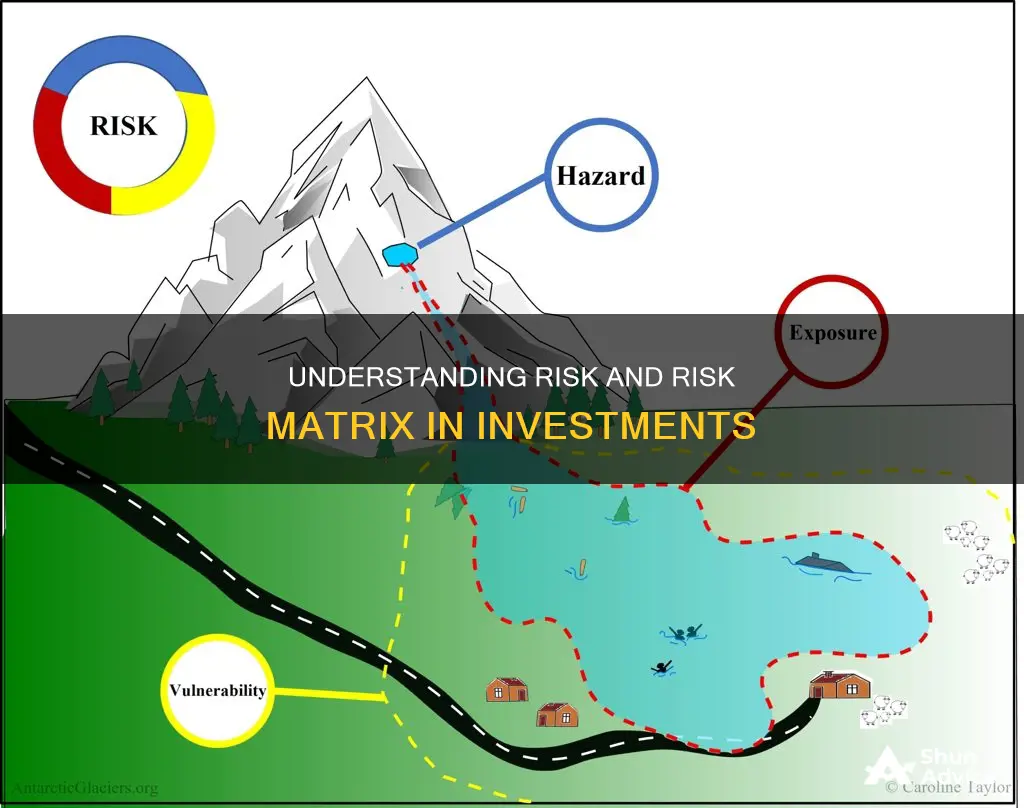

Risk is the lack of certainty about the outcome of making a particular choice. A risk matrix is a tool used during risk assessment to define the level of risk by considering the category of likelihood against the category of consequence severity. In other words, it helps visualise the probability versus the severity of a potential risk. Risk matrices are used by organisations to assess and prioritise risks inherent in their operations, and to facilitate informed decision-making by quantifying and qualifying these risks. In the investment world, higher investment risk indicates an opportunity for higher returns on an investment.

| Characteristics | Values |

|---|---|

| Definition of risk | Lack of certainty about the outcome of making a particular choice |

| Calculation of risk | Probability of harm occurring multiplied by severity of harm |

| Risk matrix | A tool to define the level of risk by considering the category of likelihood against the category of consequence severity |

| Risk matrix axes | Likelihood (or probability) and impact (or severity) |

| Risk types | Financial, operational, IT, fraud, regulatory, or reputational |

| Risk categorisation | High, moderate, or low |

| Risk matrix purpose | To assess and prioritise risks, and facilitate informed decision-making |

What You'll Learn

Risk and Control Matrix (RACM)

Risk is the lack of certainty about the outcome of making a particular choice. In the investment world, higher investment risk indicates an opportunity for higher returns on an investment.

A Risk and Control Matrix (RACM) is a powerful tool that measures the potential risks you face against the control measures in place to mitigate their impact. The matrix typically has two axes: likelihood (or probability) and consequence severity. Likelihood rates how likely a particular risk is to occur. Consequence severity considers the potential impact the risk event will have. Common risk types include financial, operational, IT, fraud, regulatory, or reputational risk.

A RACM is a visual tool that helps you understand the probability versus the severity of a potential risk. It is a simple mechanism to increase visibility of risks and assist management decision-making. By plotting risks on this matrix, decision-makers can swiftly identify which risks warrant immediate attention and allocation of resources, thus enabling proactive risk mitigation strategies.

Risk and Reward: Schedule C Investments

You may want to see also

Probability and Severity

Risk is the lack of certainty about the outcome of making a particular choice. A risk matrix is a tool used during risk assessment to define the level of risk by considering the category of likelihood (probability) against the category of consequence severity.

The level of downside risk can be calculated as the product of the probability that harm occurs (e.g., that an accident happens) multiplied by the severity of that harm (i.e., the average amount of harm or more conservatively the maximum credible amount of harm). The risk matrix is a visual tool that juxtaposes the likelihood of an event occurring against the potential impact it could have on organisational objectives.

The matrix typically has two axes: likelihood (or probability) and consequence severity. Likelihood rates how likely a particular risk is to occur. The potential impact of the risk event is the severity. Depending on likelihood and severity, risks can be categorised as high, moderate, or low.

In the investment world, “higher investment risk indicates an opportunity for higher returns on an investment”.

Maximizing Salary Investments: India's Best Options

You may want to see also

Likelihood and Impact

Risk is the lack of certainty about the outcome of making a particular choice. A risk matrix is a tool used during risk assessment to define the level of risk by considering the category of likelihood against the category of consequence severity.

The risk matrix is based on two intersecting factors: the likelihood a risk event will occur and the potential impact the risk event will have. In other words, it’s a tool that helps you visualise the probability versus the severity of a potential risk. The likelihood of a risk occurring can be rated as high, moderate, or low. The impact of a risk occurring can also be rated as high, moderate, or low. The level of downside risk can be calculated as the product of the probability that harm occurs multiplied by the severity of that harm.

A Risk and Control Matrix (RACM) is a powerful tool that measures the potential risks you face against the control measures in place to mitigate their impact. Common risk types include financial, operational, IT, fraud, regulatory, or reputational risk. The matrix typically has two axes: Likelihood (or probability): This rates how likely a particular risk is to occur.

In the investment world, “higher investment risk indicates an opportunity for higher returns on an investment”. A risk matrix serves as a fundamental tool in the arsenal of risk management, offering organizations a structured approach to assess and prioritize risks inherent in their operations.

Doyne Farmer's 5-Million-Dollar Investing Strategies Revealed

You may want to see also

Risk assessment

Risk is the lack of certainty about the outcome of making a particular choice. In the investment world, higher investment risk indicates an opportunity for higher returns on an investment.

A risk matrix is a fundamental tool in the arsenal of risk management, offering organisations a structured approach to assess and prioritise risks inherent in their operations. It is a visual representation that juxtaposes the likelihood of an event occurring against the potential impact it could have on organisational objectives. The matrix typically has two axes: likelihood (or probability) and consequence severity.

The primary purpose of a risk matrix is twofold: first, to provide a systematic framework for understanding the spectrum of risks faced by an organisation, and second, to facilitate informed decision-making by quantifying and qualifying these risks. By plotting risks on this matrix, decision-makers can swiftly identify which risks warrant immediate attention and allocation of resources, thus enabling proactive risk mitigation strategies.

A Risk and Control Matrix (RACM) is a powerful tool that measures the potential risks faced against the control measures in place to mitigate their impact. Common risk types include financial, operational, IT, fraud, regulatory, or reputational risk.

Saving Precedes Investing: The Foundation of Financial Planning

You may want to see also

Risk management

Risk is the lack of certainty about the outcome of making a particular choice. A risk matrix is a tool used during risk assessment to define the level of risk by considering the category of likelihood against the category of consequence severity. The level of downside risk can be calculated as the product of the probability that harm occurs multiplied by the severity of that harm.

The first step in effective risk management is identifying and assessing the potential risks associated with an investment opportunity. This involves analysing the likelihood of various risk events occurring and evaluating the potential impact on investment returns. Risks can be categorised as financial, operational, IT, fraud, regulatory, or reputational.

Once the risks have been identified and assessed, the next step is to develop strategies to mitigate those risks. This may involve implementing control measures to reduce the likelihood of risk events occurring or minimising their potential impact. It is important to prioritise risks based on their likelihood and severity, focusing on those that pose the greatest threat to investment objectives.

Regular monitoring and review of risks is essential to effective risk management. As investment environments can be dynamic and subject to change, risks may evolve or new risks may emerge over time. By conducting periodic risk assessments, investors can identify any changes in the risk landscape and adjust their strategies accordingly.

Finally, effective risk management requires a proactive approach. This involves staying informed about market trends, industry developments, and potential external factors that could impact investment opportunities. By being proactive, investors can anticipate potential risks and take appropriate actions to minimise their impact.

Equity Securities: Understanding Your Investment Options

You may want to see also

Frequently asked questions

A risk matrix is a tool used to assess the level of risk by considering the likelihood of an event occurring and the potential impact it could have. It is a visual tool that helps to increase the visibility of risks and assist management decision-making.

A risk matrix can help investors understand the spectrum of risks associated with an investment and facilitate informed decision-making by quantifying and qualifying these risks. It can also help investors identify which risks warrant immediate attention and allocation of resources, enabling proactive risk mitigation strategies.

Common types of risk include financial, operational, IT, fraud, regulatory, and reputational risk.