Bitcoin has gained popularity as an alternative investment due to its potential for high returns and its lack of correlation with traditional asset classes such as stocks and bonds. However, determining the average investment size in Bitcoin is challenging due to the difficulty in estimating the number of Bitcoin users and the uneven distribution of Bitcoin wealth. While Bitcoin's market capitalization was around $45 billion at one point, with a Bitcoin valued at around $2,600, the average investment per wallet is estimated to be less than $100. Experts generally recommend that cryptocurrencies should comprise no more than 5% of an investment portfolio, given their high volatility and riskiness.

| Characteristics | Values |

|---|---|

| Current Market Capitalization | $45 billion |

| Current Value of One Bitcoin | $2,600 |

| Number of Bitcoin Users | 7 million |

| Average Investment Per Wallet | $100 |

| Top 1% Bitcoin Wallet Holders | 99% of Supply |

| Top 10% Bitcoin Wallet Holders | $260+ |

| Top 1% Bitcoin Investors | 10 Bitcoins |

| Top 10% Bitcoin Investors | $260+ |

| Recommended Portfolio Allocation | 0.5% - 5% |

What You'll Learn

Bitcoin's high-risk, high-reward nature

Bitcoin and other cryptocurrencies are considered high-risk, high-reward investments due to their extreme volatility and uncertain regulatory future.

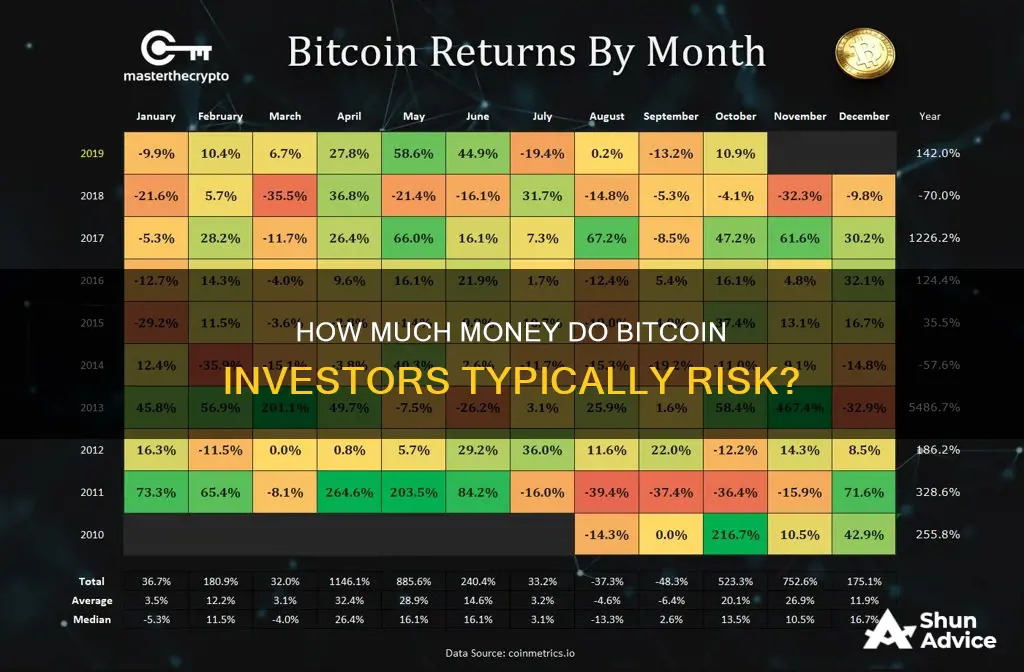

Bitcoin's price has fluctuated wildly since its inception in 2009, when it was worth less than a penny. In February 2011, its price passed $1, and in March 2024, it hit an all-time high of $73,750. However, it has also experienced significant drops, including an 80% decline in 2018. This volatility is due in part to Bitcoin's decentralised nature and lack of oversight by traditional central institutions like governments or banks.

The anonymous nature of Bitcoin transactions also poses regulatory challenges for governments and tax agencies. While some countries, like El Salvador and the Central African Republic, have embraced Bitcoin as legal tender, others, such as China, Qatar, and Saudi Arabia, have banned it outright. The regulatory landscape for Bitcoin is still evolving, and the potential for increased scrutiny or restrictions poses a risk for investors.

Additionally, Bitcoin's energy consumption and environmental impact have come under scrutiny. Bitcoin mining consumes a significant amount of electricity, contributing to carbon emissions. This has led to concerns about the sustainability and social responsibility of investing in Bitcoin.

Despite these risks, Bitcoin offers the potential for high returns. Its decentralised nature and lack of correlation to traditional asset classes like stocks and bonds make it an attractive alternative investment. For example, a $300 investment in Bitcoin four years ago would be worth over $7,500 today.

The high-risk, high-reward nature of Bitcoin is further illustrated by its wealth distribution. A small number of investors, the top 1%, hold around 99% of Bitcoin's supply, while the majority of Bitcoin users hold small amounts as a speculative investment.

In summary, Bitcoin's volatility, regulatory uncertainty, environmental impact, and concentrated wealth distribution characterise it as a high-risk, high-reward investment. Its potential for substantial returns, however, continues to attract investors despite the associated risks.

Study Crypto Index: Key Steps Before Investing

You may want to see also

Difficulty in determining the number of bitcoin holders

Determining the number of bitcoin holders is challenging due to the decentralised nature of cryptocurrencies. While estimates exist, there is no precise figure available. The most common approach to estimating the number of bitcoin owners is to examine the amount of bitcoin held in various addresses or wallets. However, this method has several limitations, including the fact that a single person can have multiple addresses and wallets, and that a single address or wallet can hold bitcoins belonging to numerous people.

Another way to estimate the number of bitcoin owners is to look at cryptocurrency exchanges and check the number of accounts. However, this method also has drawbacks, such as inactive accounts, multiple accounts, and faked accounts.

According to a Crypto.com study, there were approximately 219 million bitcoin holders as of late 2022. However, it is important to note that the number of bitcoin holders can vary depending on how "owning" bitcoin is defined. If it is defined as storing at least $1 worth of bitcoin in a wallet, the maximum number of owners is around 30.5 million.

Coinbase, a popular cryptocurrency exchange, claims to have more than 68 million accounts, while Blockchain.com reports approximately 76 million wallets, for a combined total of at least 144 million wallets. It is estimated that there have been over 200 million, and possibly billions, of wallets created during Bitcoin's existence. However, it is believed that there cannot be more than 64 million active wallets due to the number of unspent bitcoins.

While it is challenging to determine the exact number of bitcoin holders, various studies and estimates provide valuable insights into the growing adoption of cryptocurrencies.

Drip Investment Strategies for Bitcoin: Is it Possible?

You may want to see also

Bitcoin wealth distribution

Bitcoin's wealth distribution is unequal, with a small number of investors owning a large proportion of the currency. This inequality is similar to that of the non-digital economy, where a small number of individuals and companies hold the majority of wealth.

Bitcoin's wealth distribution is difficult to determine accurately due to the anonymity of its users and the use of multiple wallets. However, an analysis of publicly available bitcoin wallet data from 2015 revealed that the top 1% of bitcoin wallets held 99% of the supply of bitcoin, while the vast majority of bitcoin wallets hold little to no wealth.

As of 2024, there are only 1,580 bitcoin wallets that hold over 1,000 bitcoins, amounting to 39% of the total current bitcoin supply. Only around 10% of bitcoin wallets hold more than $250 worth of bitcoins. The average bitcoin investment per wallet is less than $100.

The National Bureau of Economic Research conducted a study that found that the top 10,000 bitcoin accounts hold 5 million bitcoins, equivalent to approximately $232 billion. This means that the top 0.01% of bitcoin holders control 27% of the currency in circulation.

Bitcoin was created to bridge the global wealth gap and provide greater access to financial services. It has been argued that bitcoin can address various aspects of inequality due to its characteristics of decentralisation and transparency. Bitcoin allows users to access financial tools that are more secure, affordable, and user-friendly, and it is not dependent on social standing, gender, or economic stability.

Despite its potential benefits, bitcoin has been criticised for its environmental impact. Bitcoin mining consumes a significant amount of electricity and contributes to carbon emissions.

The Ultimate Guide to Investing in Bitcoin Vault

You may want to see also

How much to invest

Bitcoin is a risky investment, so it's important to think carefully about your goals and your strategy before you decide how much to invest. One common rule of thumb is to invest no more than 10% of your portfolio in individual stocks or risky assets like Bitcoin.

If you're not ready to put a large amount of money at risk, you can start small. Many crypto exchanges have minimum purchases of $10 or less, and Coinbase allows a minimum Bitcoin investment of $2. However, it's worth noting that exchange platforms charge fees for buying, selling and transferring cryptocurrencies, so these fees can quickly eat into a very small investment.

How much you invest in Bitcoin depends on your risk tolerance and the amount of money you can afford to lose. If you're thinking about investing, it's a good idea to consider the following:

- Risk tolerance: The crypto market is very volatile, so it's important to only invest an amount that you feel comfortable losing entirely.

- Profit tolerance: If you invest an amount that makes you highly emotional when you lose it, you may also become highly emotional when you see large profits. This can lead to poor decision-making.

- Market cycles: The crypto market is made up of repeated market cycles, which often last for 1-2 years. Prices surge, creating big bubbles, and then these bubbles burst. So, timing is crucial.

- Change of mind: It's natural to change your mind when confronted with an ever-evolving market, so leave room to do so in the future. Divide your investment over time (e.g. 3, 6 or 12 months).

- Diversification: Don't put all your eggs in one basket. Invest in a range of different vehicles, such as real estate, stocks and gold.

Ultimately, the decision is yours, but it's important to remember that Bitcoin and other cryptocurrencies are risky and highly volatile assets.

Understanding Bitcoin, Blockchain, and Crypto Investing

You may want to see also

Volatility of bitcoin

Bitcoin is considered a volatile asset. Its volatility is measured by how much its price fluctuates relative to its average price over a period of time. Volatility is a measure of how much the price of a financial asset varies over time, and it indicates the level of risk associated with holding the asset. The more volatile an asset, the more people will want to limit their exposure to it.

There are several reasons for Bitcoin's volatility:

- Speculation: Crypto investors bet on Bitcoin's price going up or down to make profits, which causes sudden price increases or decreases.

- Supply and demand: As with most commodities, Bitcoin's price is heavily influenced by supply and demand. The closer the circulating supply gets to the limit of 21 million coins, the higher the prices are likely to climb.

- Investor actions: Bitcoin whales (investors with large holdings) can influence the market. If they were to liquidate their holdings suddenly, prices would drop as other investors panic and follow suit.

- Fear and greed: These are primary drivers of Bitcoin's volatility and prices. Investors fear missing out on big upswings or falling victim to large downswings, leading them to panic buy or sell, influencing demand and prices.

- Media and news outlets: Media attention and publicity can influence Bitcoin's price, often to benefit people who hold large numbers of coins.

- Regulations: Rumours and changes in government regulations and tax policies can impact Bitcoin's price in the short and long term.

- Relative infancy: Bitcoin is still relatively new and in the price discovery phase. Prices will continue to fluctuate as investors, users, and governments work through the initial concerns and uncertainties.

The volatility of Bitcoin makes it difficult to determine the average investment in Bitcoin. However, as a highly volatile asset, it is essential to carefully consider your risk tolerance and financial goals before investing in Bitcoin.

A Beginner's Guide: Investing in Bitcoin Cash in the UK

You may want to see also

Frequently asked questions

The average investment size in Bitcoin is difficult to determine due to the anonymous nature of Bitcoin wallets and the uneven distribution of wealth among holders. However, estimates suggest that the average investment per wallet is less than $100.

It is important to carefully consider your financial situation and risk tolerance before investing in Bitcoin. Key factors to consider include your discretionary income, your risk appetite, and the volatile nature of Bitcoin's market cycles.

Most experts recommend that Bitcoin and other cryptocurrencies make up no more than 5% of your investment portfolio. This allows for a balance between potential gains and risk management. However, some experts suggest allocations of up to 20%, depending on your risk tolerance.

Dollar-cost averaging (DCA) is a popular strategy where investors gradually invest a fixed amount at regular intervals, rather than investing a lump sum. This helps to reduce the impact of market volatility and removes the need to time the market.

Bitcoin is considered a high-risk asset due to its volatility and the potential for significant losses. It is crucial to understand these risks before investing. There is a chance that you may lose some or all of your investment, so only invest what you can afford to lose.