A balanced portfolio strategy is an investment approach that combines different asset classes, typically stocks, bonds, and cash, to balance risk and return. The goal is to create a portfolio that aligns with an investor's risk tolerance, financial goals, and time horizon. For example, a balanced portfolio for a young investor with a high-risk tolerance might include a larger proportion of stocks, while an older investor with a low-risk tolerance might favour bonds and cash. The key to a successful balanced portfolio strategy is diversification across asset classes, which helps to reduce risk and maximise returns. Regular rebalancing is also important to maintain the desired level of risk and ensure the portfolio remains aligned with the investor's goals over time.

| Characteristics | Values |

|---|---|

| Risk | Balanced investment strategies aim to balance risk and return. |

| Investment type | Typically, balanced portfolios are divided between stocks and bonds, with a small cash or money market component for liquidity purposes. |

| Investment percentage | For example, 60% in stocks and 40% in bonds. |

| Investor type | Investors with moderate risk tolerance. |

| Returns | Modest returns on capital, along with a high likelihood of capital preservation. |

| Rebalancing | It is recommended to rebalance your portfolio annually or after significant life events. |

Stocks, bonds and cash

A balanced portfolio strategy is an investment approach that combines asset classes to balance risk and return. The three main asset classes are stocks, bonds, and cash.

Stocks, or equities, are considered high-risk, high-reward investments. They represent ownership in a company and are typically more volatile, offering greater growth potential over time.

Bonds, on the other hand, are generally considered lower-risk investments. They represent debt, or loans, made by investors to governments or corporations. Bonds often have fixed interest rates and are a source of fixed income, making them more stable than stocks.

Cash, the third component of a balanced portfolio, includes liquid assets such as money in a savings account or money market instruments. While cash provides the lowest returns compared to stocks and bonds, it is essential for maintaining liquidity and preserving capital.

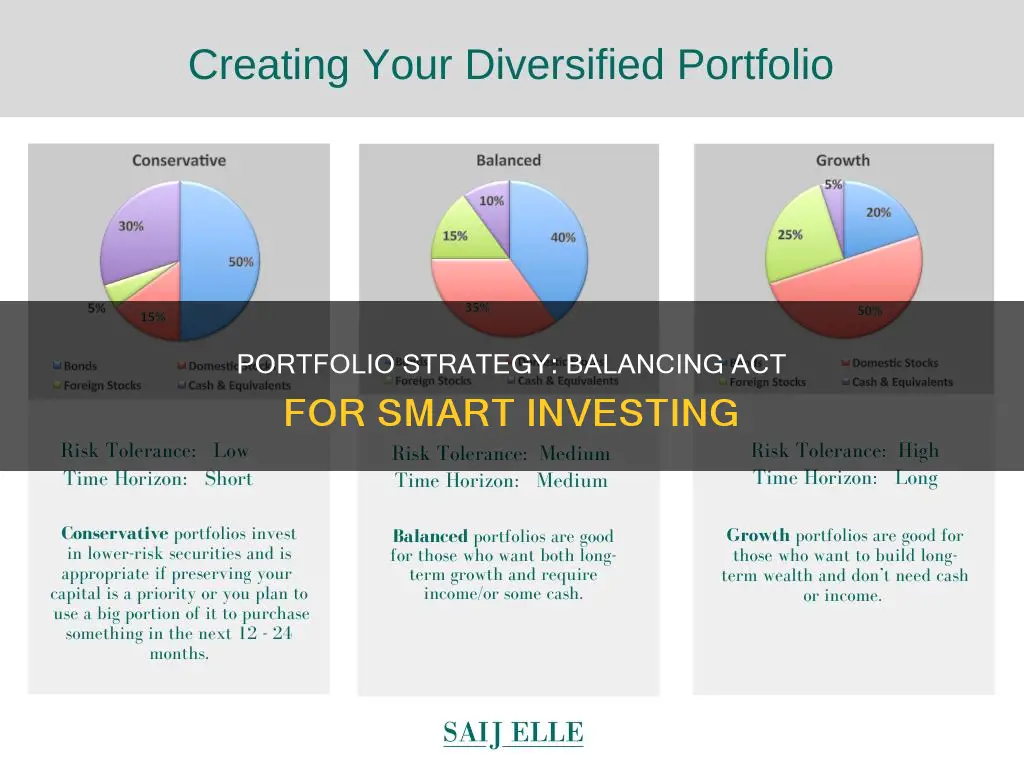

When constructing a balanced portfolio, investors typically divide their investments between stocks and bonds, with a small portion allocated to cash. A common allocation is the 60/40 split, with 60% in stocks and 40% in bonds. However, the exact allocation depends on the investor's risk tolerance, financial goals, and time horizon. For example, younger investors with a higher risk tolerance may opt for a higher percentage of stocks, while older investors approaching retirement may favour a more conservative approach with a larger allocation of bonds and cash.

It is important to note that a balanced portfolio requires regular monitoring and rebalancing. Over time, the value of stocks and bonds can fluctuate, causing the original allocation to shift. To maintain the desired level of risk, investors may need to periodically sell certain investments or allocate additional funds to specific asset classes.

By combining stocks, bonds, and cash, a balanced portfolio strategy offers investors a way to pursue their financial goals while managing risk.

Equity Linked Savings Schemes: A Smart Investment Guide

You may want to see also

Risk tolerance

When assessing risk tolerance, it is important to understand an individual's investment goals and time horizon. For instance, a retired investor may prioritize stability and capital preservation, whereas a younger investor may seek higher returns and be willing to tolerate greater risk.

Additionally, risk tolerance plays a role in the diversification of a portfolio. Diversification involves spreading investments across different asset classes, sectors, and geographies to reduce risk. Investors with a higher risk tolerance may diversify their stock holdings across various sectors and company sizes, while those with a lower risk tolerance may opt for more stable investments such as government or investment-grade bonds.

It is important to note that risk tolerance is subjective and can change over time. Therefore, it is crucial to regularly review and rebalance a portfolio to ensure it aligns with an individual's current risk tolerance and investment goals.

Exploring the Impact of Excess Savings on Planned Investments

You may want to see also

Diversification

When diversifying your portfolio, it is important to consider your risk tolerance, financial goals, and investment timeline. For example, younger investors with a higher risk tolerance and a longer investment horizon may choose to allocate a larger portion of their portfolio to stocks, while older investors approaching retirement may favour more stable assets like bonds and cash.

It is also important to diversify across different types of assets. For instance, if you invest in stocks, you can diversify across different sectors, company sizes, and geographies. If you invest in bonds, you can diversify across various maturities and qualities, such as government and corporate bonds.

Additionally, diversification can be achieved by investing in mutual funds, exchange-traded funds (ETFs), or index funds, which are typically diversified across multiple securities. This provides instant diversification and reduces the risk associated with investing in individual stocks.

It is worth noting that diversification does not guarantee against losses and that the level of diversification will depend on your specific circumstances and goals. Regular portfolio reviews and rebalancing are essential to ensure that your investments remain aligned with your risk tolerance and financial objectives.

Building an Investment Portfolio: Teaching Kids About Money

You may want to see also

Asset allocation

When determining your asset allocation, it's important to consider your financial goals, investment timeframe, and risk tolerance. For instance, if you're investing for retirement, you need to decide when you plan to retire and how much money you'll need. Your risk tolerance will influence whether you favour a more conservative approach with a larger percentage of your portfolio in bonds and cash, or a more aggressive strategy with a higher percentage in stocks.

As a general rule, younger investors with longer investment horizons can take on more risk, allocating 70-80% of their portfolio to stocks. As you get closer to retirement, it's advisable to reduce your stock allocation and increase your holdings in more stable assets like bonds and cash.

- Real Estate: Allocate 5-10% of your portfolio to real estate investments.

- Diversify your stock portfolio: Start with broad stock index funds tracking major market segments, then add funds focused on styles, market caps, sectors, and geographies.

- Select your bonds: Consider shorter-term or longer-term bonds based on your needs. For lower risk, opt for US Treasury bonds, or choose corporate or municipal bonds for potentially higher returns.

- Rebalance regularly: At least once a year, rebalance your portfolio to maintain your desired asset allocation. If certain assets have outperformed, consider selling some to invest in underperforming assets.

Crafting an Effective Investment Portfolio Presentation

You may want to see also

Rebalancing

Even after you've determined your ideal portfolio mix, your work isn't done. As the prices of individual investments fluctuate over time, portfolios naturally get out of balance. For example, if stock prices rise rapidly, the percentage of your portfolio in stocks can increase, throwing off your desired level of risk. This is where rebalancing comes in.

There are two general ways to approach rebalancing. You can either rebalance your portfolio at a specific time interval (say, yearly), or you can rebalance only when your portfolio becomes clearly unbalanced. There is no one-size-fits-all approach, but unless your portfolio's value is extremely volatile, rebalancing once or twice a year should be sufficient.

It's worth noting that if you invest through a robo-advisory service or an employer-sponsored retirement plan such as a 401(k), your portfolio may rebalance automatically.

When rebalancing, you can either sell existing investments and buy others to increase your allocation, or allocate new money strategically. For instance, if one stock has become overweighted in your portfolio, you can invest new deposits into other stocks until your portfolio is balanced again. While the former option is more traditional, the latter is often preferred as it allows you to leave your highest-performing assets alone. However, this might not always be practical, especially if your IRA is out of balance and you're limited by the annual contribution limit.

Additionally, remember to factor in the tax consequences of rebalancing. For example, if a security you're selling is subject to capital gains, it may be more prudent to cease investing in that asset class and direct those funds toward an underweighted asset class.

Gross Saving and Investment: Understanding the Basics

You may want to see also

Frequently asked questions

A balanced portfolio strategy is an investment approach that combines different asset classes, typically stocks, bonds, and cash, to balance risk and return. The specific mix of assets depends on an investor's risk tolerance, financial goals, and investment horizon.

Creating a balanced portfolio involves understanding your risk tolerance, setting financial goals, and diversifying your investments across different asset classes. You can use the Rule of 110 to determine your stock and bond allocation based on your age. It's also important to regularly review and rebalance your portfolio to maintain your desired risk and return levels.

A balanced portfolio strategy helps investors manage market risk, maximize return potential, and achieve their long-term financial goals. It provides a mix of stable, low-risk investments and higher-growth assets, allowing investors to sleep well at night while pursuing their investment objectives.